Original Title: Tokens are the new Herbalife. Parallelisms between crypto and Multi Level Marketing schemes

Original Author: @VannaCharmer

Original Translation: Ismay, BlockBeats

Editor's Note:

In the ongoing narrative of the expanding cryptocurrency market, tokens have long ceased to be mere carriers of technological or financial innovation, instead becoming chips in a structural game. From exchanges, VCs, KOLs, to communities, airdrop players, and retail investors, everyone is caught up in a game of "who is the last buyer." This article does not attempt to deny the potential of cryptocurrency technology itself, but rather reveals the hidden truths in the current token issuance and circulation mechanisms: how it operates like a multi-level marketing scheme and systematically concentrates benefits upwards. It is hoped that this article will provide you with a clearer perspective, helping you discern narrative from reality in a market interwoven with illusion and hope.

The following is the original content:

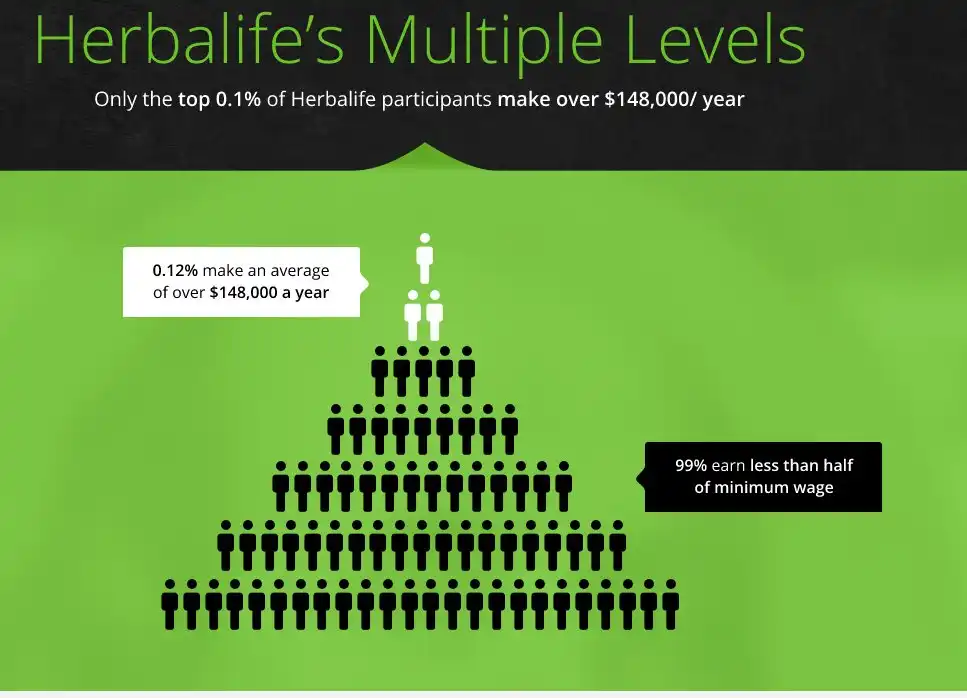

Cryptocurrency reenacts the worst aspects of multi-level marketing—only this time it’s an internet-native version, with higher marketing efficiency but lower transparency. Most tokens have evolved into a sophisticated pyramid scheme: those at the top extract maximum profits, while retail investors are left with a pile of worthless "air tokens."

This is not a coincidence, but a structural issue.

In traditional multi-level marketing schemes, such as Herbalife or Mary Kay, products are often overpriced and less effective than alternatives on the market. The core difference lies not in the product, but in the sales method: instead of through retail stores, individual agents purchase products first and then seek customers willing to buy from them.

The result quickly shifts from "selling products" to "recruiting others." The motivation for everyone to buy products is not for personal use, but to sell them at a higher price later. Ultimately, when the market is left with only "speculators" and no real users, the pyramid cannot sustain itself. Those at the top take all the asymmetric profits, while those at the bottom can only stare blankly at a pile of unsold inventory.

Token Pyramid

The operational logic of crypto tokens is strikingly similar to multi-level marketing. Tokens themselves are the "products"—overpriced digital assets with almost no utility beyond speculation. Just like distributors in a multi-level marketing system, token holders do not buy tokens for use, but to sell them at a higher price to the next person later.

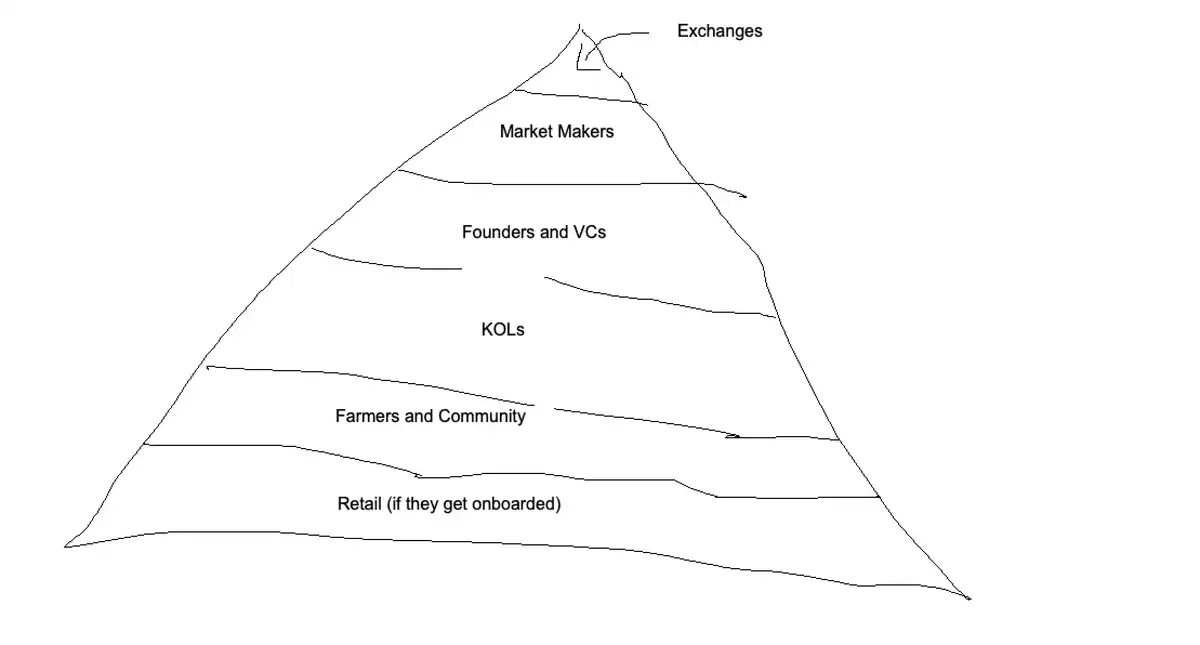

This pyramid structure is akin to traditional multi-level marketing, but cryptocurrency has its own unique ecosystem of participants, forming different tiers. Compared to traditional MLM products, tokens are a more ideal vehicle: they can leverage the internet and social networks more efficiently, are easier to trade and acquire, spread faster, and have a wider reach. The operational logic is roughly as follows:

In traditional multi-level marketing, if you develop downlines, you profit when they sell products or continue to purchase. The play with tokens is the same: you get others to take your "goods," and then recruit newcomers who enter the market later than you. This benefits both you and those above you, as newcomers provide "exit liquidity," driving prices up. Meanwhile, newcomers, having also acquired tokens, will start promoting actively (now they have "goods" too!), while early holders can cash out at higher levels (the returns multiply!). This mechanism is identical to multi-level marketing, only more powerful.

The higher your position in the pyramid, the more motivated you are to continuously issue new tokens and keep pushing this play.

Divine Beings: Exchanges

At the top of the crypto pyramid are the true "deities"—the exchanges. Almost all "successful" tokens are deeply controlled by exchanges and their associated market makers. They control the distribution and liquidity of tokens; if project teams want to access platforms and gain distribution resources, they often must "tribute"—that is, give up a portion of their tokens for free.

If you do not play by their rules, your tokens will not go live, or they will remain in a liquidity-poor "hell," ultimately dying a quiet death. Exchanges can kick market makers out at any time, require project teams to provide tokens for their employees to cash out, and even unilaterally change service terms at the last moment. This hegemony is well understood by all parties, but they can only endure it in silence—because it is the price paid for "liquidity" and "distribution."

For entrepreneurs, exchanges are an insurmountable wall. Whether or not a project can go live on a top exchange often depends on "networks" rather than the quality of the project itself. This explains why so many projects today feature "invisible co-founders" or "former exchange employees" who are responsible for bridging connections and opening channels. Without experience or connections, navigating the process of getting listed is nearly an impossible task.

Demigods: Market Makers

Market makers, theoretically, are roles that provide liquidity to the market, but in practice, they often help project teams secretly offload tokens through OTC while using their information advantage to harvest ordinary users. They typically hold a significant portion of the total token supply (sometimes several percentage points) and use this to manipulate trading, gaining asymmetric arbitrage opportunities. For tokens with a small circulation, this influence is greatly amplified, placing them in an extremely advantageous position in trading.

The money earned from simply "providing liquidity" is extremely limited, but reverse trading against uninformed users can yield substantial profits. Among all market participants, market makers have the clearest understanding of a token's circulation—because they know both the real market fluctuations and hold a large number of tokens. They are at the pinnacle of information advantage.

For project teams, evaluating a market maker's "quote" is also very difficult. Unlike services like haircuts that have clear pricing, the price of market-making services varies from person to person. As a startup project team, you have no idea which terms are reasonable and which prices are inflated, leading to another gray phenomenon: the proliferation of invisible co-founders and "market-making consultants." They act as advisors, bridging connections for you, but further complicate the token issuance process and increase the cost of competition.

Kings: VCs and Project Teams

Beneath the exchanges are project teams and VCs, who capture the vast majority of value during the private placement stage. Before the public has even heard of a project, they acquire tokens at a very low price, then weave narratives to create a "liquidity exit" for offloading.

The business model of crypto VCs has become extremely distorted. Compared to traditional venture capital, obtaining a "liquidity event" in the crypto industry is much easier, so they do not genuinely encourage long-term builders. In fact, the opposite is true—VCs can turn a blind eye to predatory token economic models as long as it benefits them. Many VCs no longer pretend to support sustainable businesses but systematically participate in and support various "pump-and-dump" speculative behaviors.

Tokens have also spawned a peculiar incentive mechanism: VCs have the motivation to artificially inflate the valuations of their portfolios to increase fund management fees (essentially "harvesting" their LPs). This is especially common with low-circulation tokens—they can use FDV to mark the market cap on paper, thus inflating project valuations. This practice is highly unethical, as once the tokens are fully unlocked, it is impossible to exit at those inflated prices. This is also one of the key reasons many VCs will struggle to raise new funds in the future.

While platforms like Echo have slightly improved this reality, behind the scenes in the crypto industry, there are still numerous black-box operations that ordinary investors cannot see.

Opinion Leaders: KOLs

Next down the tier are KOLs, who typically receive tokens for free at the time of a project launch in exchange for promotional content. The "KOL financing round" has become the norm in the industry—KOLs participate in investments and receive full refunds after the TGE. They leverage their communication channels to obtain free tokens, then brainwash their fans, who ultimately become their "exit liquidity."

Soldiers: Community Members and Airdrop Hunters

The "community" and airdrop players form the bottom layer of labor in the pyramid. They undertake the most basic tasks: testing products, generating content, and creating activity in exchange for token distribution. But even these activities have now been "industrialized": rewards are decreasing while the work required is increasing.

Most community members often realize only after working for a project for free for a long time that they are merely outsourced marketing departments for the project team—only to see the project start to dump tokens mercilessly after the TGE. Once they realize this, anger spreads, and they "take up arms." This "angry community" is extremely detrimental to projects that genuinely want to build products, as it creates additional disruption and noise.

Chives: Retail Investors

At the very bottom of the pyramid are the ideal retail investors—the "exit channel" for everyone above. They are fed various narratives and stories, attributing a "meme premium" to an asset, attracting more people to buy in, allowing upper players like foundations to offload smoothly.

However, this cycle is different from before; retail investors have not truly entered the market. Today's retail investors are more cautious and skeptical, leaving community members holding a pile of worthless airdrop tokens, while insiders have already cashed out through OTC transactions. I suspect this is also why you often see people on social media angrily complaining about token crashes or worthless airdrops: because in this cycle, retail investors hardly took the bait, while founders still profited.

Consequences

In the current crypto industry, the core focus is not on building products, but on crafting stories—telling a narrative of "high illusionary returns" to entice others to buy a certain token. Focusing on product development has become an unencouraged behavior (though this is slowly changing).

The entire token valuation system has become completely distorted, no longer based on fundamentals but rather on "market cap comparisons." The core question of a project has shifted from "What problem does this token solve?" to "How much can it rise?" In this environment, projects can hardly be reasonably priced or evaluated. What you are buying is not a company in development, but a lottery ticket; this must be recognized when investing in cryptocurrencies.

The script for selling narratives is very simple: just concoct a story that "sounds reasonable but is actually unpriceable," such as:

"This is a stablecoin project backed by Peter Thiel, and its tokens can be seen as an indirect exposure to Tether equity. The appeal of this token lies in the fact that Circle has a market cap of $27 billion, while Tether's revenue and profits far exceed Circle's, and its operating costs are lower. Currently, there is no product on the market that allows you to invest directly in Tether, and this token perfectly fills that gap! They are also building infrastructure similar to Circle's payment network and plan to introduce privacy features. This is the future of finance, with a projected market cap of $100 billion!"

If you want your friends to buy a token, this kind of narrative is very effective. The key is to tell the story "clearly enough," but also "leave room for imagination," so they can envision a high-valued future.

What to Do Next? Fixing the Market Structure of Tokens

I still believe that the crypto industry is one of the few fields that can bring significant asymmetric returns to ordinary people, but this advantage is gradually disappearing. Speculation is the core product-market fit (PMF) of crypto and was the initial hook that attracted market participants to everything we are building. For this reason, we urgently need to fix the entire market structure.

The second part of this article will explore how platforms like Hyperliquid could potentially change the rules of this game entirely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。