Original Title: "Arthur Hayes: The Bank of Japan's 'Conditional Rate Hike' or Restarting QE: Bitcoin and Risk Assets Will Soar"

Original Author: 0xJigglypuff, BlockTempo

Bank of Japan Governor Kazuo Ueda hinted that inflation has not yet reached the target and insisted on appropriate rate hikes, but BitMEX founder Arthur Hayes expects the central bank to shift towards easing, igniting a rally in global risk assets.

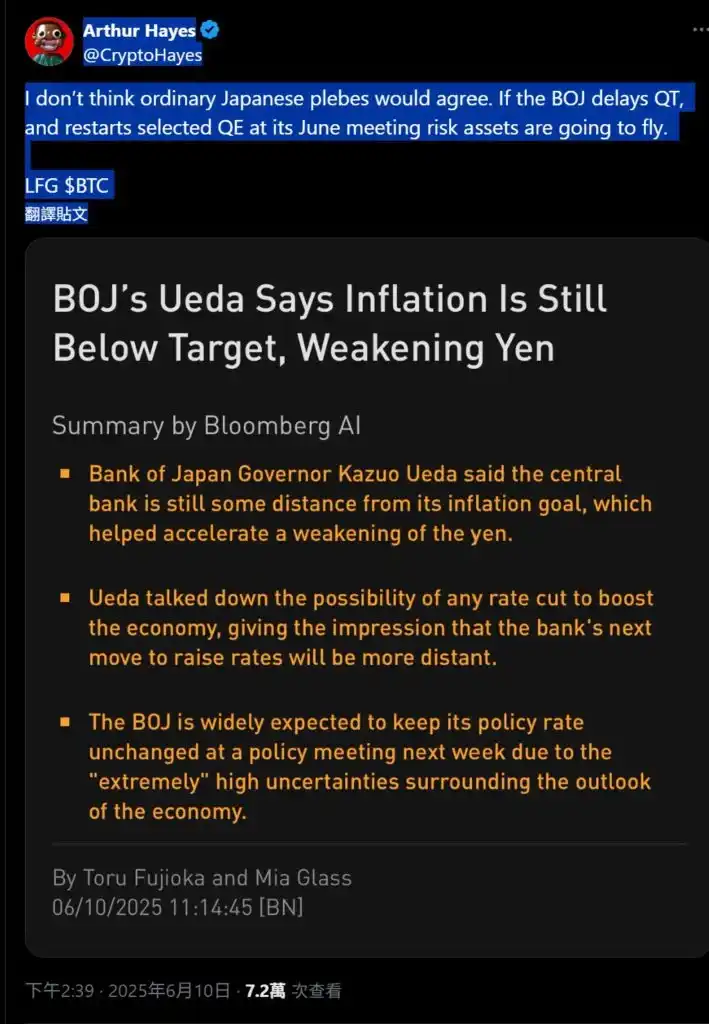

On June 10, 2025, Bank of Japan President Kazuo Ueda's remarks once again drew significant attention from global markets. Ueda stated that if potential inflation continues to accelerate, the Bank of Japan will continue to push for rate hikes. However, BitMEX co-founder Arthur Hayes sees different market signals; he expressed on X that Japan currently exhibits a situation where "inflation is insufficient to trigger" a rate hike. Hayes believes that the Japanese public generally does not welcome the negative impact of rate hikes and predicts that if the Bank of Japan chooses to delay quantitative tightening (QT) in the upcoming June meeting, or even restart some quantitative easing (QE), the global risk asset market will experience a significant surge.

The Implications of the Bank of Japan's Remarks

Ueda's comments come against the backdrop of Japan's long-standing ultra-loose monetary policy to combat deflation, facing rising global inflation pressures and gradually warming domestic inflation in recent years. The Bank of Japan is gradually adjusting its policy direction, and the market remains highly vigilant regarding the specific timing and magnitude of its rate hikes. Traditional views suggest that rate hikes help curb inflation but may also put pressure on economic growth.

Arthur Hayes offers a different interpretation; he has previously questioned the Bank of Japan's plans to reduce bond purchases, warning that the central bank may underestimate the bond market's sensitive response to rising interest rates, potentially triggering market volatility. Hayes pointed out:

"Most Japanese people probably do not welcome rate hikes. I believe that if the Bank of Japan decides to delay quantitative tightening in the upcoming June meeting, or quietly restart some quantitative easing, then the global risk asset market, especially cryptocurrencies, will be ready for a grand party."

Hayes's logic is that if the Bank of Japan restarts QE or delays QT, it will maintain a low-interest-rate environment in the market, prompting investors to seek high-return risk assets like Bitcoin and stocks. He believes that the continued weakness of the yen is also a potential factor driving up global risk asset prices.

The Alarm in Japan's Bond Market and the Potential Effects of Yen Weakness

Recent fluctuations in Japan's bond market, such as rising government bond yields and declining demand, have led some analysts (including Hayes) to believe there is a correlation with the rising prices of cryptocurrencies like Bitcoin. In their view, Bitcoin is seen as a tool to hedge against sovereign credit risk, especially in the context of Japan's high government debt ratio.

Hayes specifically mentioned the case of Norinchukin Bank suffering a paper loss of about $12.6 billion due to holding a large amount of overseas bonds, suggesting this may deter other investors from purchasing similar assets, further impacting the stability of the global bond market. He anticipates that if the Bank of Japan ultimately adopts a dovish stance, it could not only boost risk asset prices but also allow the yen's weak pattern to persist, having far-reaching effects on global asset allocation.

In the context of most major central banks globally raising interest rates to combat inflation, the Bank of Japan's policy stance appears unique. Its decision-making in the June meeting will undoubtedly have a critical impact on Japan's domestic and even global financial markets. Whether Hayes's predictions come true, particularly regarding the uplifting effect on risk assets like Bitcoin and the persistence of yen weakness, will be a focal point for the market in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。