Is it true that we need 3000 more to chase Ethereum?

Written by: Bright, Foresight News

CZ publicly stated on social media: "June 9 will be remembered as DeFi Day." Following the repeal of the "DeFi Broker Rule," U.S. crypto regulation has once again broken a layer of shackles. Subsequently, established DeFi tokens such as AAVE and UNI have entered a vigorous upward trend.

On June 9, U.S. SEC's new chairman Paul Atkins' speech on "DeFi and the American Spirit" marked a fundamental shift in the logic of U.S. crypto regulation. Combined with the strategic adjustments of the Ethereum Foundation (EF) and market capital resonance, DeFi on the ETH chain is ushering in unprecedented structural opportunities. The three core driving forces of regulatory paradigm innovation, institutional capital influx, and technological breakthroughs have jointly constructed the underlying logic for the explosion of DeFi Summer 2.0.

1. Regulatory Easing: The Policy Catalyst for DeFi Summer 2.0

In his June 9 speech, Atkins released three major regulatory signals that completely reversed the "enforcement-first" tone of the Gensler era.

First, the U.S. SEC finally recognized the principle of code neutrality. In his speech, Atkins used the analogy that "developers of self-driving cars should not be held responsible for third-party misuse" to clearly shift the responsibility from tool developers to users, clearing legal obstacles for the "permissionless innovation" of DeFi protocols. This conclusion directly responded to the Tornado Cash developer case that emerged during the previous Democratic administration, lifting the compliance shackles on developers. Within 24 hours of the speech, DeFi blue-chip tokens like AAVE and UNI rose over 13%, while privacy-focused tokens like AZTEC increased by 9%, demonstrating the market's validation of the value reassessment effect from regulatory easing.

Second, there is the return of property rights and the legalization of staking. Atkins emphasized that "the right to self-manage private property" is a core American value, clearly supporting users' direct participation in on-chain financial activities through personal wallets. This statement completely ended the Gensler era's securitization accusations against liquid staking protocols (LSD) like Lido and Rocket Pool. The leading LSD token LDO saw an 11% increase on the same day, and other re-staking projects like EigenLayer also rose, indicating a reconstruction of institutional confidence in the staking ecosystem.

Third, the implementation of an innovation sandbox mechanism was announced. Similar to Dubai's DFSA, the SEC announced the establishment of an "innovation exemption" framework, allowing both registered and unregistered entities to quickly launch on-chain products under compliance conditions. This mechanism provides an officially sanctioned testing ground for the RWA (real-world assets on-chain) sector, accelerating the process of bringing over a trillion dollars of off-chain assets on-chain.

2. Core Efforts: Ethereum Foundation Promotes "Defipunk"

The Ethereum Foundation's 2030 plan clearly states that it will promote the establishment of an evaluation mechanism for "Defipunk" and facilitate the transformation of DeFi projects.

In the plan, the Ethereum Foundation views DeFi as the core vehicle for realizing Ethereum's vision of "permissionless and censorship-resistant," and aims to promote DeFi as "the open financial infrastructure of the digital age" through treasury allocation, technical support, and standard-setting. Its key goal is to have over 30% of treasury (excluding core ETH holdings) allocated to on-chain DeFi by 2026, prioritizing support for privacy and highly composable protocols.

The Ethereum Foundation (EF) is promoting the establishment of a "Defipunk" evaluation framework based on the principles of cypherpunk, focusing on core features such as security, open-source nature, financial sovereignty, prioritization of technical solutions, and privacy protection. The aim is to cultivate a censorship-resistant DeFi ecosystem through research, advocacy, and capital allocation to address current challenges such as high gas fees related to privacy in the DeFi ecosystem and user experience friction, as well as to resolve systemic vulnerabilities that currently rely on centralized backdoors and multi-signature mechanisms.

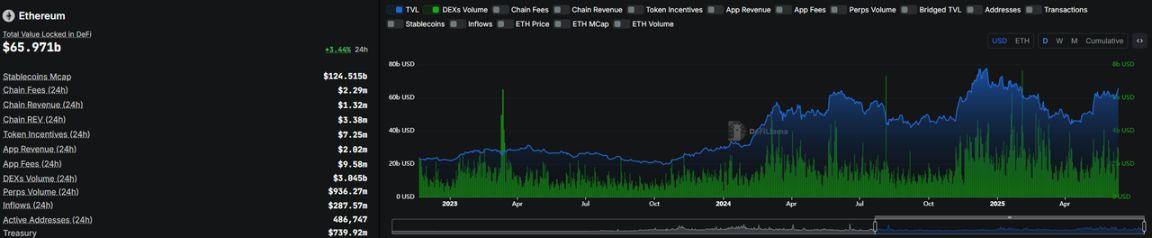

Currently, the TVL on the ETH chain has warmed up to $66 billion compared to the lows in February and March, showing a good expansion momentum, and is expected to exceed the peak in December 2024.

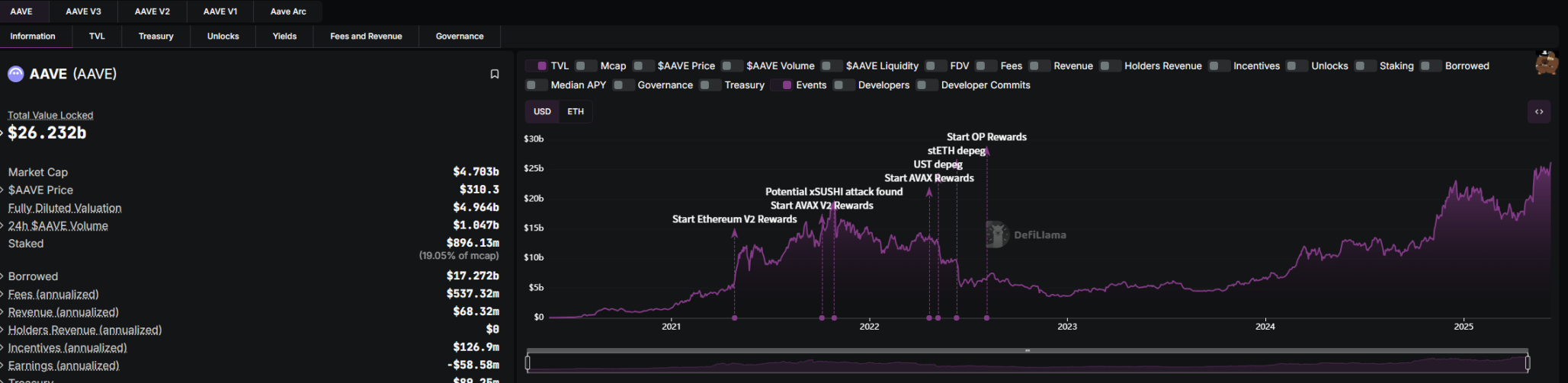

The recently surging AAVE's TVL has reached "new heights," exceeding $26 billion, with staked ETH surpassing 9.3 million.

UNI, which surged 30% in one day, has also shown impressive recent data. Its TVL has rebounded to $5.152 billion, likely to exceed the high point of 2024.

3. Institutional Bullishness: ETH Remains the Preferred Choice in the Context of Crypto Compliance

On June 11, according to monitoring by farside, there was a net inflow of $26.3 million into FETH yesterday, with a net inflow of $9.7 million into Grayscale ETH and $8.4 million into ETHW. At the same time, Ethereum staking has reached a historical high of 34.8 million ETH, accounting for approximately 28.15% of the circulating supply.

The market expects that the U.S. SEC will soon approve Ethereum ETFs that support staking, with REX Shares having submitted relevant applications. Meanwhile, BlackRock's iShares Ethereum Trust has seen no outflows for 23 consecutive trading days.

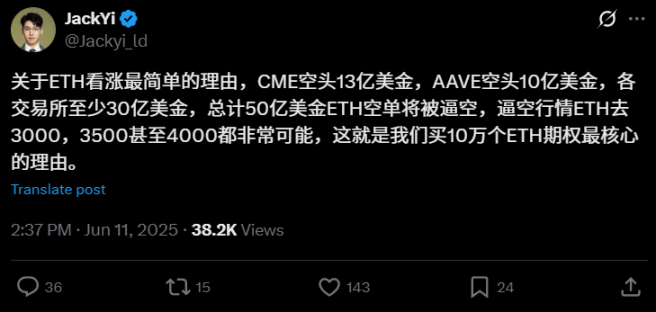

Recently, LD Capital founder Jack Yi reiterated his strong bullish stance on Ethereum and its ecosystem tokens, stating that he currently holds 100,000 ETH call options, believing that the reasons for the undervaluation of the Ethereum ecosystem include: the ETH token itself being undervalued, optimistic about the ETH/BTC exchange rate recovering during a bull market; after the relaxation of crypto policies, projects with real income, users, and products will be the first to benefit from traditional capital inflows; Wall Street funds are currently flowing into Ethereum for accumulation. LD Capital's Trend Research is also clearly bullish on ETH, currently holding 142,000 ETH, with an unrealized profit of $42.35 million.

QCP's research report suggests that Ethereum's implied volatility is rising, with the front-end at-the-money option volatility climbing to around 70%, and the skew in the options market has clearly turned bullish, increasing by 5 to 6 percentage points. The high funding rates of perpetual contracts further reinforce the bullish atmosphere in the market. The inflow of funds into ETFs indicates that institutional interest is returning. This round of capital rotation may suggest that the market narrative is shifting from "Bitcoin is digital gold" to "Ethereum is the infrastructure layer for real-world assets (RWA)."

Looking ahead, macro favorable factors are indeed accumulating momentum for Ethereum. Since the wild growth and regulatory vacuum of DeFi summer in 2020, the crypto industry has completely immersed itself in a compliant context. With the GENIUS Act advancing in the U.S. Senate, Circle launching an IPO, and stablecoins gradually making regulatory progress, Ethereum's core position in tokenization and settlement infrastructure may usher in structurally unexpected upward space. Correspondingly, DeFi based on ETH is also expected to soar again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。