Every upheaval in the stablecoin landscape is an inevitable path toward the maturity of the industry.

The storm in the stablecoin world is rising again. As the position of stablecoins in the cryptocurrency market becomes increasingly solid, mainstream regulatory agencies are introducing new regulations, attempting to find a balance between protecting financial stability and encouraging innovation.

BlockSec, in collaboration with Guofeng Law Firm, focuses on the "Guiding and Establishing National Innovation for U.S. Stablecoins Act" (GENIUS Act), which is being discussed in the U.S. Senate. This analysis delves into the compliance challenges faced by Web3 projects under the backdrop of the GENIUS Act and provides practical solutions.

1 GENIUS Act Legislative Process and Core Content

1.1 Key Legislative Milestones

§ February 4, 2025: Draft Proposal Introduced

Senators Bill Hagerty, Tim Scott, Kirsten Gillibrand, and Cynthia Lummis jointly introduced the draft of the GENIUS Act in the Senate.

§ March 13, 2025: Senate Banking Committee Approval

The Senate Banking Committee passed the GENIUS Act with bipartisan support, voting 18 in favor and 6 against, and officially submitted the bill to the Senate. Starting in March 2025, the GENIUS Act underwent multiple rounds of revisions.

§ May 8, 2025: First Vote to End Debate in the Senate

In the first vote to end debate in the Senate, the motion failed with 48 votes in favor and 49 against, not reaching the 60-vote threshold. The Democrats collectively opposed it, with key points of contention including:

Regulatory loopholes for foreign issuers (e.g., risks of evading sanctions by Iran and North Korea);

No restrictions on the Trump family profiting from USD1 stablecoins;

Ambiguity in access rules for tech giants.

§ May 15-19, 2025: Bill Amendments

Bipartisan negotiations led to urgent amendments, including but not limited to:

Removing direct restrictions on Trump’s cryptocurrency projects, shifting focus to strengthening consumer protection;

Requiring foreign issuers to have the ability to freeze transactions.

§ May 20, 2025: Second Vote to End Debate in the Senate

In the second vote to end debate in the Senate, the motion passed with 66 votes in favor and 32 against. This key development marks that the U.S. is just one step away from establishing the first federal-level stablecoin regulatory framework. Although the GENIUS Act has not completed the final legislative process, this vote has cleared significant obstacles.

§ June 11, 2025: Third Vote to End Debate in the Senate

In the third vote to end debate in the Senate regarding the GENIUS Act and its latest amendments, the motion passed with 68 votes in favor and 30 against. This key development marks that the U.S. is just one step away from establishing the first federal-level stablecoin regulatory framework. Although the GENIUS Act has not completed the final legislative process, this vote has cleared significant obstacles.

§ Subsequent Process: Full Senate Debate and Amendment Procedure

Once the bill enters the full Senate debate and amendment procedure, it only requires a simple majority (51 votes) to pass the final version.

§ Subsequent Process: House of Representatives Review

Afterward, the bill will be submitted to the House of Representatives for review. In the House, the bill only needs to secure a simple majority (218 votes) to pass. Given that the current House has a slight Republican majority (220:215), the GENIUS Act is expected to have a high chance of passing in the House.

§ Subsequent Process: Presidential Approval

After the House passes the bill, it will be submitted for presidential signature and approval. Considering Trump’s previous commitment to establish a stablecoin regulatory framework by August 2025, the likelihood of his direct signature is high. However, if the final version of the bill includes a clause prohibiting the president or his immediate family from holding shares in stablecoin issuers, it cannot be ruled out that Trump may veto or shelve the bill due to political risks or public pressure.

1.2 Key Adjustments in the New Version

Compared to the draft of the GENIUS Act on February 4, 2025, the latest approved version has made the following main adjustments:

In addition to the above details, we recommend focusing on: new regulations for foreign payment-type stablecoin issuers and strengthened anti-money laundering (AML) regulations.

New Regulations for Foreign Payment-Type Stablecoin Issuers

The GENIUS Act establishes a regulatory framework for foreign payment-type stablecoin issuers established overseas or in U.S. territories (such as Puerto Rico, Guam, American Samoa, and the U.S. Virgin Islands). The core of the regulation is the "registration system" and "regulatory equivalence determination." The "registration system" means that foreign payment-type stablecoin issuers must register with the Office of the Comptroller of the Currency and meet strict compliance requirements to provide or sell payment stablecoins in the U.S. through U.S. digital asset service providers. The "regulatory equivalence determination" means that after foreign payment-type stablecoin issuers submit their registration applications to the Office of the Comptroller of the Currency, the office will review the applications based on factors including: the Treasury's assessment of whether the regulatory system of the foreign payment-type stablecoin's home country is equivalent to that of the U.S., the financial and managerial capabilities of the foreign payment-type stablecoin issuer in the U.S., the transparency of the materials submitted for review, the risks posed by the issuance to U.S. financial stability, and the potential for illegal activities related to the issuance.

Additionally, foreign payment-type stablecoin issuers must ensure they hold sufficient reserves to meet redemption demands from U.S. users. If the regulatory system of their home country is deemed equivalent to that of the U.S. by the Treasury, and there are reciprocal provisions between the two countries, they may be exempt from holding reserves in the U.S. but must still possess the technical capabilities for regulation.

Strengthened Anti-Money Laundering (AML) Regulations

The GENIUS Act overall adds two clauses on anti-money laundering protection and anti-money laundering innovation, strengthening AML regulations.

- Anti-Money Laundering Protection

Regarding anti-money laundering protection, compared to the original version, which only briefly mentioned handling the AML compliance requirements of foreign payment-type stablecoin issuers according to international reciprocity principles, the new bill details the AML compliance requirements for foreign payment-type stablecoin issuers, penalizing non-compliant issuers while also establishing an exemption mechanism.

- Compliance Requirements for Foreign Payment-Type Stablecoin Issuers

Foreign payment-type stablecoin issuers wishing to publicly offer, sell, or trade their stablecoins in the U.S. must demonstrate their technical capabilities and willingness to comply with U.S. "lawful orders." These lawful orders may include freezing, seizing, or preventing the transfer of specific stablecoins.

- Determination and Penalties for Non-Compliance

The Treasury has the authority to list non-compliant foreign payment-type stablecoin issuers on a violation list and publish the list, prohibiting digital asset service providers from offering secondary market trading services for the stablecoins of non-compliant foreign payment-type stablecoin issuers. Digital asset service providers violating this regulation may face fines of up to $100,000 per day, while foreign payment-type stablecoin issuers may face fines of up to $1 million per day, or even be banned from conducting financial transactions in the U.S. Additionally, the GENIUS Act grants the Treasury the right to file civil lawsuits against non-compliant foreign payment-type stablecoin issuers to recover the aforementioned fines, seek injunctions to prohibit foreign payment-type stablecoin issuers from participating in U.S. financial transactions, and require digital asset service providers to delist the payment stablecoins of such issuers.

Foreign payment-type stablecoin issuers will need to invest more resources to meet U.S. technical and compliance requirements, which may lead to some smaller issuers exiting the U.S. market; otherwise, they may face hefty fines, potentially prompting industry consolidation where only large compliant platforms can survive.

- Exemptions and Exceptions

The U.S. Treasury may grant exemptions for certain entities or transactions based on special circumstances. Such exemptions may involve factors such as national security, intelligence and law enforcement needs, or if foreign issuers are taking substantial measures to remedy non-compliance.

- Anti-Money Laundering Innovation

The anti-money laundering innovation section focuses on utilizing innovative technologies to enhance the ability to detect and evade illegal activities involving digital assets, including anti-money laundering. Specific measures include:

- Public Opinion Solicitation and Research

The Treasury will initiate a 60-day public opinion solicitation within 30 days of the GENIUS Act's enactment to identify innovative methods, technologies, or strategies that regulated financial institutions are currently using or may adopt to detect and evade illegal activities involving digital assets, including money laundering. These methods may involve application programming interfaces (APIs), artificial intelligence (AI), digital identity verification, and blockchain monitoring technologies.

The adoption of APIs, AI, and blockchain monitoring technologies will drive regulatory agencies from traditional manual reviews to automated regulation, improving the efficiency of AML reviews and oversight.

- Research and Evaluation

After the public opinion solicitation period ends, the Treasury will conduct research based on the public feedback. The Financial Crimes Enforcement Network (FinCEN) will evaluate the innovative methods mentioned in the public feedback, comparing them with existing methods to assess their advancements in regulatory effectiveness, cost, privacy risks, operational efficiency, and cybersecurity impacts. Following the evaluation, FinCEN will establish specific requirements for regulated financial institutions to adopt innovative methods for detecting illegal activities involving digital assets, operational norms for payment-type stablecoin issuers to identify and report illegal activities involving their payment stablecoins, and operational norms for monitoring blockchain transaction systems and practices.

- Risk Assessment and National Strategy

The Treasury must incorporate the national counter-terrorism and illegal financing strategy required by the "Countering America’s Adversaries Through Sanctions Act" into the regulation of illegal activities involving digital assets, focusing on the use of digital assets in money laundering and sanctions evasion, as well as high-risk behaviors that exist in foreign jurisdictions involving the use of digital assets to obtain legal currency for illegal activities.

- Congressional Reports

The Treasury will regularly submit reports to Congress, detailing the research findings on innovative detection technologies and the progress of technical implementation, along with legislative recommendations.

2 Compliance Challenges Faced by Different Types of Projects

The impact of the GENIUS Act is extensive, but the severity of compliance challenges faced by different types of Web3 projects varies significantly. The following analysis categorizes the specific challenges faced by various projects in order of severity from high to low.

2.1 Direct Impact: Stablecoin Issuers

Mainstream stablecoin issuers, as the core regulatory targets of the GENIUS Act, face the strictest compliance requirements and the highest implementation costs. These projects must obtain federal or state licenses within 120 days, establish a 100% reserve support system, implement monthly public disclosures, and possess the technical capability to freeze assets in real-time. For large issuers with a market capitalization exceeding $50 billion, annual audits and enhanced reporting requirements are also necessary. Compliance costs are expected to range from $8 million to $20 million in initial investment, along with ongoing operational costs of $3 million to $10 million per year.

Algorithmic and decentralized stablecoin projects, while not directly bound by traditional reserve requirements, face uncertainties regarding regulatory classification. These projects need to reassess their governance structures, technical architectures, and compliance strategies to determine whether existing models need to be adjusted to meet regulatory requirements. In particular, stablecoin mechanisms involving yield generation may be classified as securities, facing SEC regulation.

2.2 Heavy Impact: Core DeFi Protocols

DeFi lending protocols face fundamental adjustments to their business models, especially the prohibition of yield-bearing stablecoins, which will force these protocols to redesign their product architectures. Protocols need to remove or restructure strategies based on yield-bearing stablecoins, adjust interest rate models, and ensure that all integrated stablecoins come from compliant issuers. These projects will also need to implement enhanced transaction monitoring and reporting mechanisms to comply with AML requirements.

DeFi yield protocols are hit the hardest, as their core business model—providing yields on stablecoins—may be classified as securities issuance. These protocols need to completely redesign their product offerings, remove strategies based on non-compliant stablecoins, or seek new operational models within the regulatory framework.

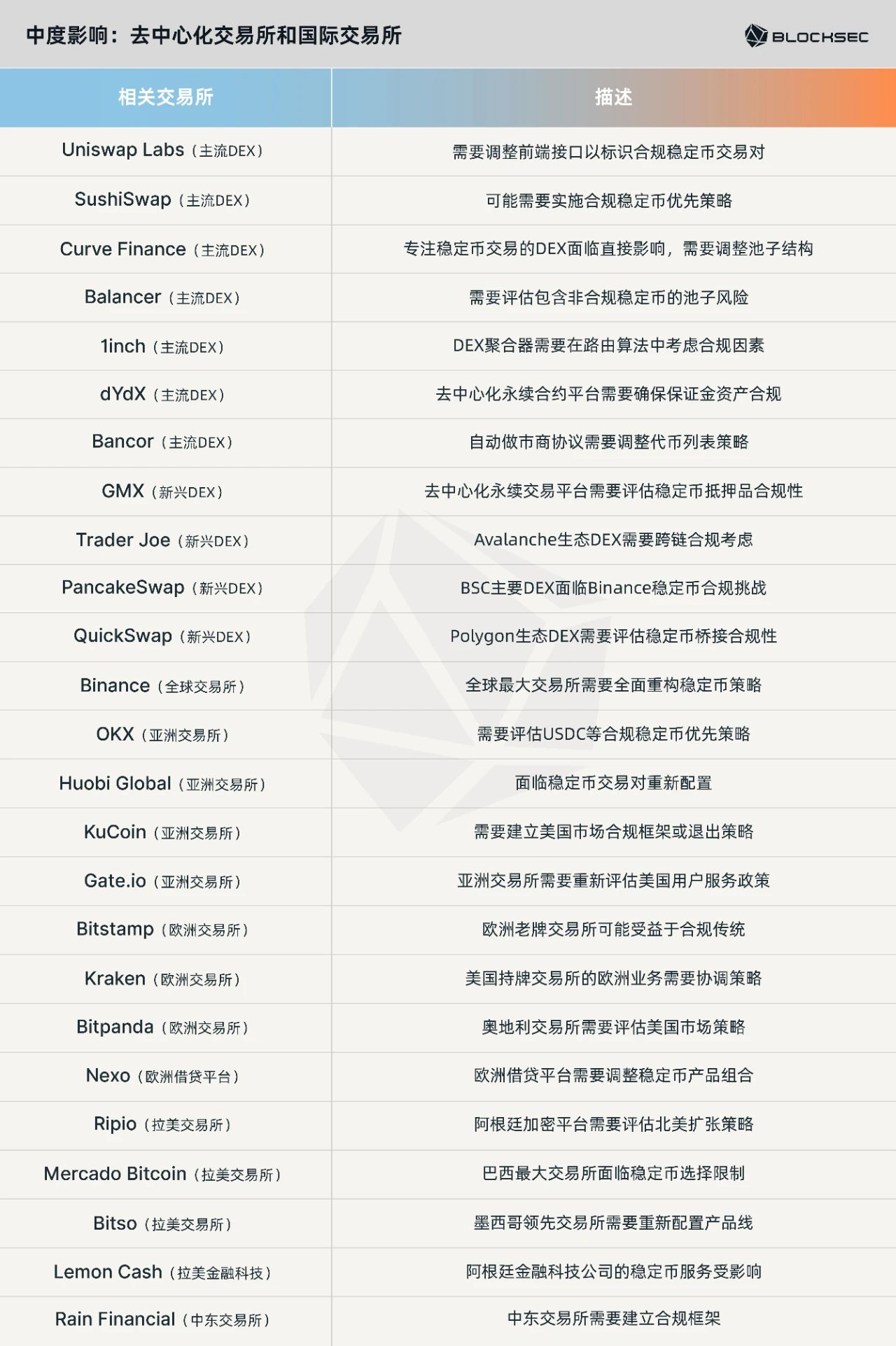

2.3 Moderate Impact: Decentralized Exchanges and International Exchanges

Decentralized exchanges (DEX) benefit relatively from regulatory asymmetry, as the GENIUS Act primarily targets issuers rather than trading platforms. However, these platforms still need to adjust their front-end interfaces to identify compliant stablecoins, potentially implementing a compliant stablecoin priority strategy and considering compliance factors in routing algorithms. DEXs focused on stablecoin trading (such as Curve) face more direct impacts and need to reconfigure liquidity pool structures.

International exchanges face a binary choice: either establish a comprehensive U.S. compliance framework or exit the U.S. market. These platforms need to reconfigure stablecoin trading pairs, prioritize compliant stablecoins, and may need to restrict services to U.S. users. Compliance costs and complexities will drive these platforms to reassess their global market strategies.

2.4 Moderate Impact: Wallet Service Providers

Custodial wallet providers face regulatory requirements similar to those of money transmitters, needing to implement fund segregation measures and enhanced consumer protections. These companies must separate customer funds from operational assets, establish user protection mechanisms in the event of issuer bankruptcy, and may need to obtain relevant financial service licenses.

Self-custody wallet providers remain relatively independent but need to implement features in their user interfaces to display the compliance status of stablecoins, provide user education, and may need to make strategic decisions regarding the handling of compliant and non-compliant stablecoins. This impact is primarily reflected in product functionality adjustments rather than regulatory compliance requirements.

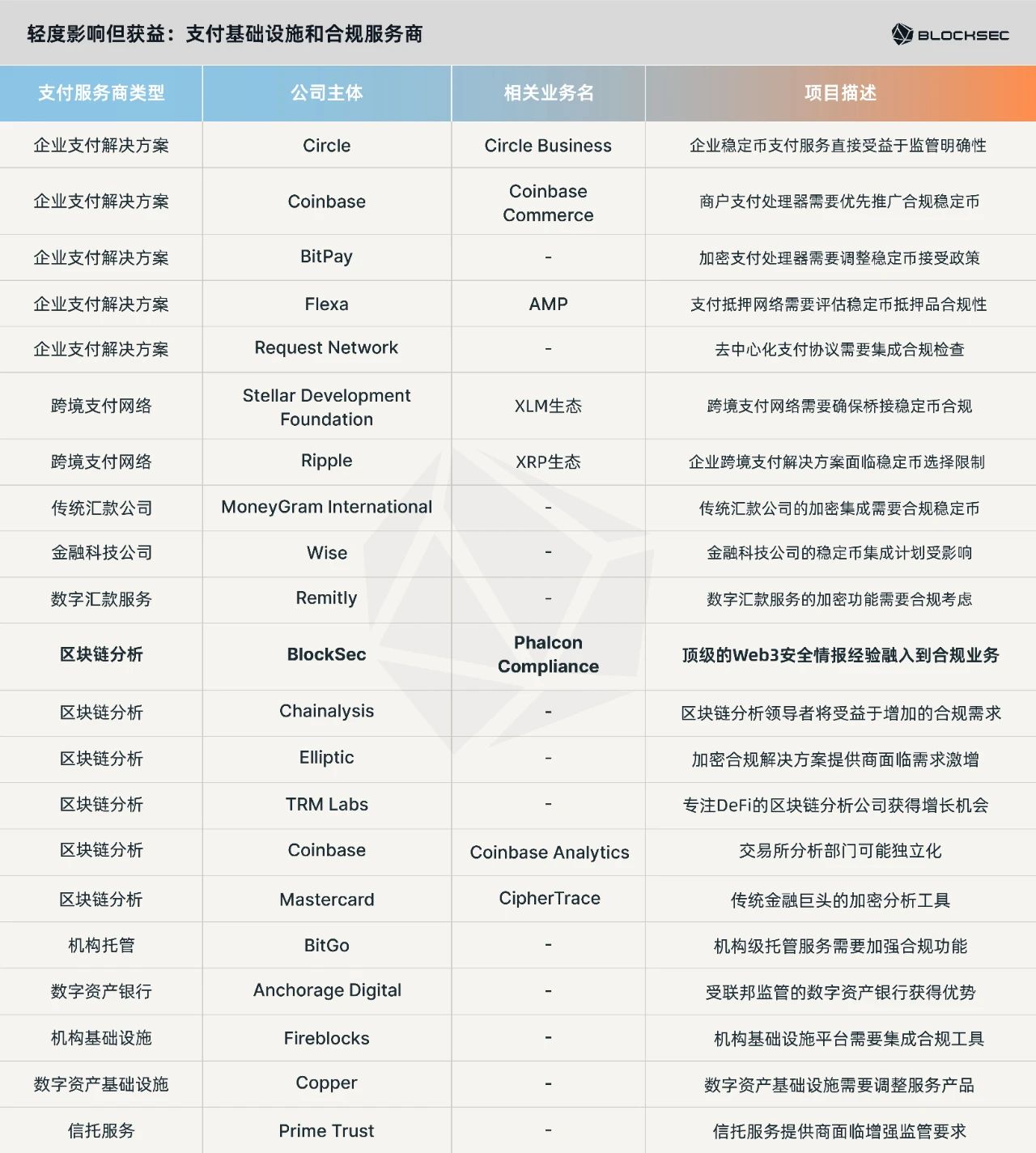

2.5 Light Impact but Benefiting from the Act: Payment Infrastructure and Compliance Service Providers

Payment infrastructure providers are effectively beneficiaries of the GENIUS Act, as regulatory clarity will facilitate collaboration with traditional financial institutions and the adoption of enterprise markets. These companies need to adjust their products to prioritize compliant stablecoins but will generally benefit from enhanced market confidence and an expanded customer base.

Compliance infrastructure service providers face significant market opportunities, as the entire Web3 industry will see a sharp increase in demand for blockchain analysis, transaction monitoring, custodial services, and compliance consulting. These companies need to rapidly expand their service capabilities to meet market demand.

2.6 Common Features of Compliance Challenges

Through the analysis of various Web3 projects above, we summarize several common compliance challenges brought by the GENIUS Act:

2.6.1 Need for Technical Architecture Adjustments

Almost all Web3 projects involving stablecoins in the U.S. market will need to make technical architecture adjustments. Stablecoin issuers need to establish real-time transaction monitoring systems and asset freezing capabilities; DeFi protocols need to redesign smart contracts to distinguish between compliant and non-compliant stablecoins; DEX platforms need to integrate compliance status displays in their front-end interfaces; wallet providers need to implement user education and risk warning features. The complexity and cost of these technical adjustments vary by project type but will require significant development resource investment.

2.6.2 Pressure to Establish Regulatory Relationships

For most Web3 projects, establishing and maintaining regulatory relationships is a new challenge. Directly regulated entities (such as stablecoin issuers and custodial wallet providers) need to establish direct contacts with the OCC, state regulatory agencies, and FinCEN; indirectly affected entities (such as DeFi protocols and DEX) need to establish regulatory compliance frameworks through legal advisors; international projects need to assess whether to establish U.S. subsidiaries or seek regulatory exemptions. Establishing regulatory relationships requires substantial legal and compliance involvement and long-term maintenance investment.

2.6.3 Requirements for Operational Model Reconstruction

The GENIUS Act presents a great opportunity for more Web3 projects to rethink their fundamental operational models. Yield-bearing stablecoin projects need to completely reconstruct their value propositions; decentralized projects need to find a balance between maintaining decentralization and meeting compliance requirements; cross-chain projects need to address compliance complexities across multiple jurisdictions; algorithm-driven projects need to introduce more human oversight and intervention mechanisms. This reconstruction of operational models may require project teams to rethink their core competitiveness and market positioning.

3 BlockSec's Compliance Solutions

The GENIUS Act provides a clear regulatory framework for U.S. stablecoin issuers. Clearer compliance requirements help reduce industry risks, attract more users, and bring new development opportunities to the industry. Increasingly, institutions no longer view regulation as a barrier but actively embrace compliance by implementing KYC, identifying and recording suspicious activities related to money laundering and terrorist financing, tracking sanctioned entities, conducting due diligence on large transactions, timely reporting suspected illegal transactions, and taking measures to block, freeze, or refuse related transactions, continuously enhancing their compliance capabilities.

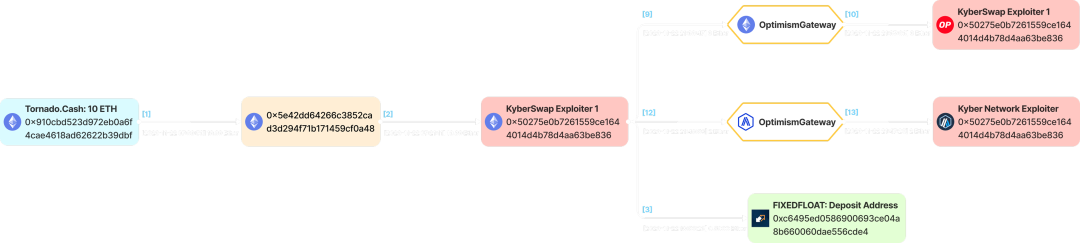

However, the anonymity of blockchain and the complexity of on-chain interactions (especially cross-chain transactions) pose significant challenges for institutions in risk assessment, team collaboration, and responding to compliance reviews. To address this, BlockSec has established deep cooperation with Guofeng Law Firm, combining technology and law to provide comprehensive compliance support for institutions.

3.1 Phalcon Compliance APP: Easily Identify and Manage Compliance Risks

To meet the growing global compliance demands, BlockSec has launched the Phalcon Compliance APP, providing VASPs with efficient tools that comply with anti-money laundering (AML) and counter-terrorist financing (CFT) regulatory standards, helping institutions accurately identify and manage risks related to addresses/funds.

3.1.1 Accurate Identification of Illegal Activities 📍

Risk Exposure Tracking: By covering over 400 million address tags and updating in real-time, accurately locate high-risk entities (such as sanction lists), support unlimited hop transaction tracking, and quickly identify suspicious addresses intersecting with high-risk entities.

Transaction Behavior Analysis: Real-time monitoring of on-chain transactions, combined with an AI-based intelligent behavior analysis engine, processing over 500 transactions per second, comprehensively analyzing behavioral characteristics to accurately identify suspicious activities such as money laundering and fund splitting.

3.1.2 Pre-set + Custom Risk Engine 🌐

Pre-set Risk Engine: Built-in risk engine compliant with FATF standards, covering major risk types such as entity risk, interaction risk, high-frequency transfers, large transfers, and intermediary addresses, helping institutions easily benchmark against international compliance requirements.

Custom Risk Engine: Simultaneously, institutions can customize risk rules based on their jurisdiction and business type to meet personalized compliance needs.

3.1.3 Continuous Screening and Risk Alerts 🚨

Users can choose to regularly screen address risks or trigger a global screening with one click to keep real-time track of address risk status. Once risks or changes in address risk levels are detected, the system will promptly push alerts through seven notification channels, including Telegram, email, and Lark, helping institutions quickly become aware of relevant risks.

3.1.4 Address and Customer Management 👥

Users can view the risk levels and historical alert records of addresses to understand the overall risk situation. The system also supports associating multiple addresses with a single entity, enabling comprehensive risk analysis of customers, thus gaining a more complete understanding of customer risk characteristics and taking more effective risk management measures.

The system includes a fund tracking investigation tool, MetaSleuth.

3.1.5 Efficient Team Collaboration 🤝

The system supports task delegation, comment addition, blacklist settings, and other functions, allowing different roles to collaborate efficiently through the system to promptly address risk alerts. Additionally, BlockSec has introduced Guofeng as an external advisor to provide legal support and consulting advice on specific compliance issues.

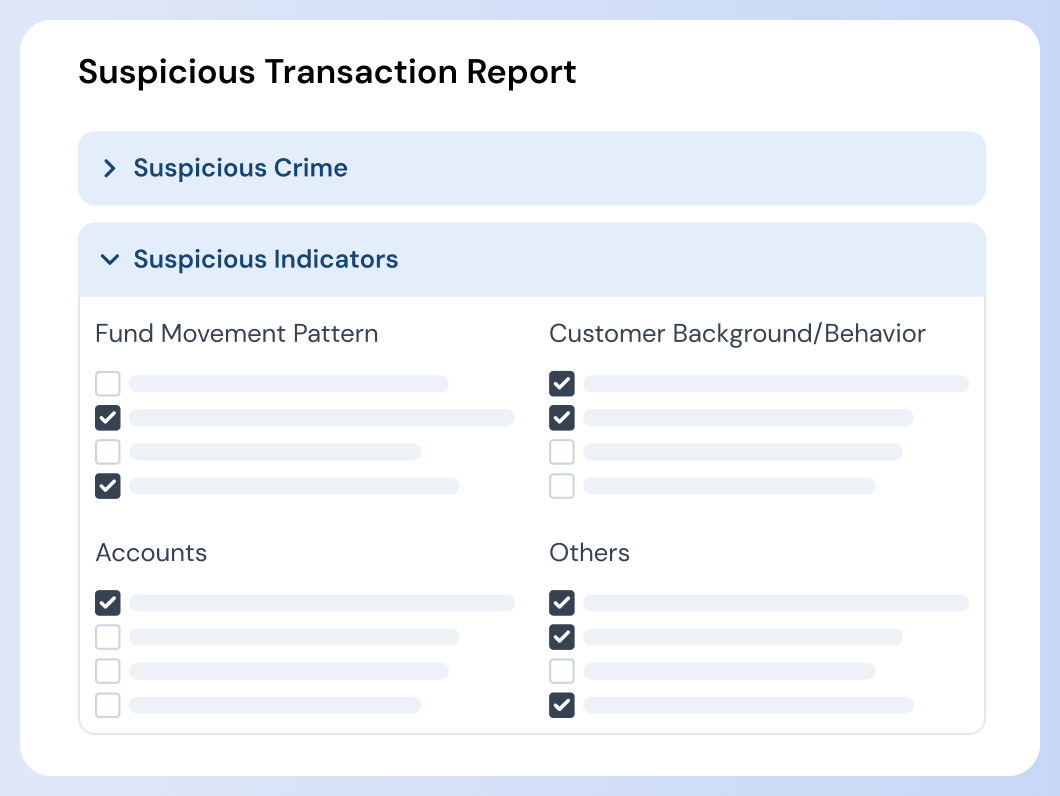

3.1.6 One-Click Export of STR/SAR Reports ✅

Users can select countries or regions such as the U.S., Hong Kong, and Singapore to export corresponding STR/SAR reports with one click based on their needs. Through deep cooperation with Guofeng, BlockSec ensures that the reports' compliance and standardization meet the regulatory requirements of the respective countries or regions, allowing institutions to respond more confidently in complex regulatory environments.

In the face of complex regulations and the upgrading of illicit activities, the Phalcon Compliance APP provides VASPs with a comprehensive compliance solution from real-time monitoring to report generation, building a dynamic risk control barrier to accurately prevent risks such as money laundering and terrorist financing, ensuring efficient regulatory compliance.

3.2 Experience It Now

The launch of the Compliance APP marks the upgrade of BlockSec Phalcon from an attack monitoring and automatic blocking platform to a comprehensive solution that includes two core modules: Security Threat Defense (Security APP) and Compliance Risk Management (Compliance APP), providing users with a one-stop solution for "integrated offense and defense, worry-free regulation."

The platform now supports over 30 mainstream blockchain networks, including Ethereum, BSC, Solana, Base, Tron, Arbitrum, Avalanche, Optimism, Manta, Merlin, Mantle, Sei, Bitlayer, Core, BoB, Story, Sonic, Gnosis, Berachain, and more.

Visit the official website for more information, or click the "Read the original text" button at the bottom left of the article to directly schedule a product demonstration and deeply experience the product features.

🔗 Phalcon Compliance APP:

https://blocksec.com/phalcon/compliance

🔗 Phalcon Security APP:

https://blocksec.com/phalcon/security

🔗 Schedule a Product Demonstration:

https://blocksec.com/book-demo

Conclusion

Every upheaval in the stablecoin landscape is a necessary path toward the maturity of the industry. The advancement of the GENIUS Act, the release of Hong Kong's "Stablecoin Regulation Draft," and the UK's FCA's proposals for stablecoin and crypto asset regulation all indicate that the industry landscape is being comprehensively reshaped. Although the industry will face short-term pains such as surging compliance costs, market reshuffling, limited innovation space, and increased global regulatory friction, in the long run, regulatory measures will lay a sustainable institutional foundation for the Web3 industry. Under the dual reshuffling of the market and rules, only by actively adapting and seeking change can opportunities in the new round of competition be seized. BlockSec and Guofeng will continue to work hand in hand with everyone, assisting every Web3 team that aims for compliance and dares to innovate to navigate the new landscape.

About Guofeng

As a comprehensive law firm, Guofeng's Web3 team has accumulated rich experience in areas such as offshore structuring for Web3 projects, investment and financing for Web3 projects, establishment and operation of Web3 funds, and compliance for Web3 both domestically and internationally.

The team is one of the earliest in China to engage in Web3 legal services, continuously participating since 2013 in a series of legal services related to industrial blockchain applications, blockchain infrastructure projects, crypto asset management, compliance for securitized transactions, DeFi (Decentralized Finance), RWA (Real World Assets), GameFi (Blockchain Gaming), and NFTs (Digital Collectibles), providing legal solutions for leading participants in various sectors under a compliance framework. At the same time, the team remains passionate about blockchain technology and the Web3 industry, closely following industry developments and demands, monitoring changes and challenges in regulatory trends, and continuously exploring opportunities for business development.

Official website: https://www.grandwaylaw.com

About BlockSec

BlockSec is a global leading blockchain security company, co-founded in 2021 by several well-known industry experts. BlockSec is dedicated to enhancing the security and usability of the Web3 world and provides one-stop security services, including security audit services, the security and compliance management platform BlockSec Phalcon, and the fund tracking investigation platform MetaSleuth.

Currently, BlockSec has served over 500 clients globally, including well-known Web3 companies such as Coinbase, Cobo, Uniswap, Compound, MetaMask, Bybit, Mantle, Puffer, FBTC, Manta, Merlin, PancakeSwap, as well as authoritative regulatory and consulting agencies like the United Nations, FBI, SFC, PwC, and FTI Consulting.

Official website: https://blocksec.com

Twitter: https://twitter.com/BlockSecTeam

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。