The crypto ETF market kept its bullish rhythm on Wednesday, June 11, as both bitcoin and ether funds attracted significant investor interest, signaling persistent institutional confidence.

Bitcoin ETFs welcomed their third consecutive day of net inflows, with $164.57 million streaming into four major funds. Blackrock’s IBIT was once again the top destination, amassing $131.01 million, followed by Vaneck’s HODL with $15.39 million.

Fidelity’s FBTC contributed $11.87 million, and Franklin’s EZBC closed the inflow activity with $6.30 million. No funds recorded outflows. Total trading volume stood at $2.41 billion, with total net assets inching up to $131.85 billion.

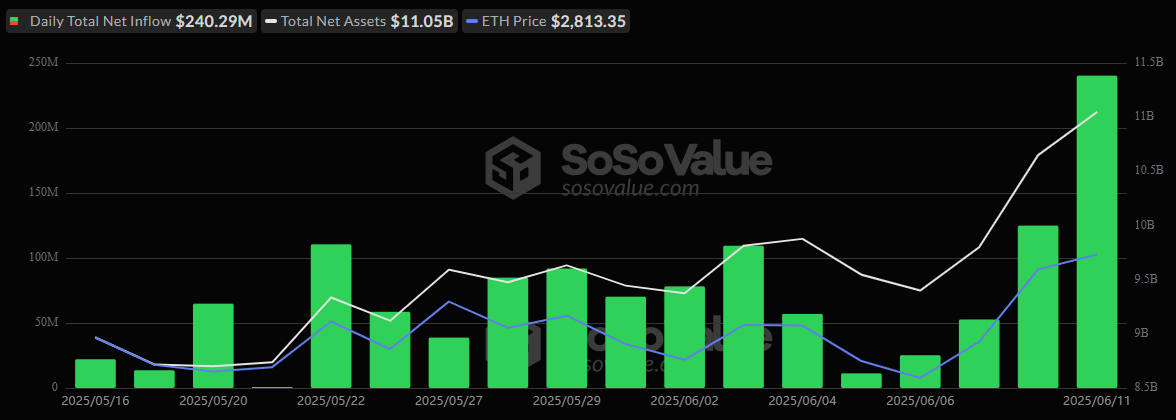

Source: Sosovalue

But the spotlight once again shone brightest on ether ETFs. The segment smashed its record by logging its 18th consecutive day of inflows, this time pulling in a staggering $240.29 million across five funds.

Blackrock’s ETHA led by a wide margin, absorbing $163.64 million. Fidelity’s FETH followed with $37.28 million, while Grayscale’s Ether Mini Trust and its larger sibling ETHE added $19.61 million and $13.30 million, respectively.

Bitwise’s ETHW rounded out the inflows with $6.46 million. Total trading volume in ether ETFs soared to $830.98 million, and net assets rose firmly to $11.05 billion.

As ether ETFs stretch their record run and bitcoin inflows remain steady, market sentiment appears firmly optimistic heading into mid-June.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。