The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and reject any market smoke screens!

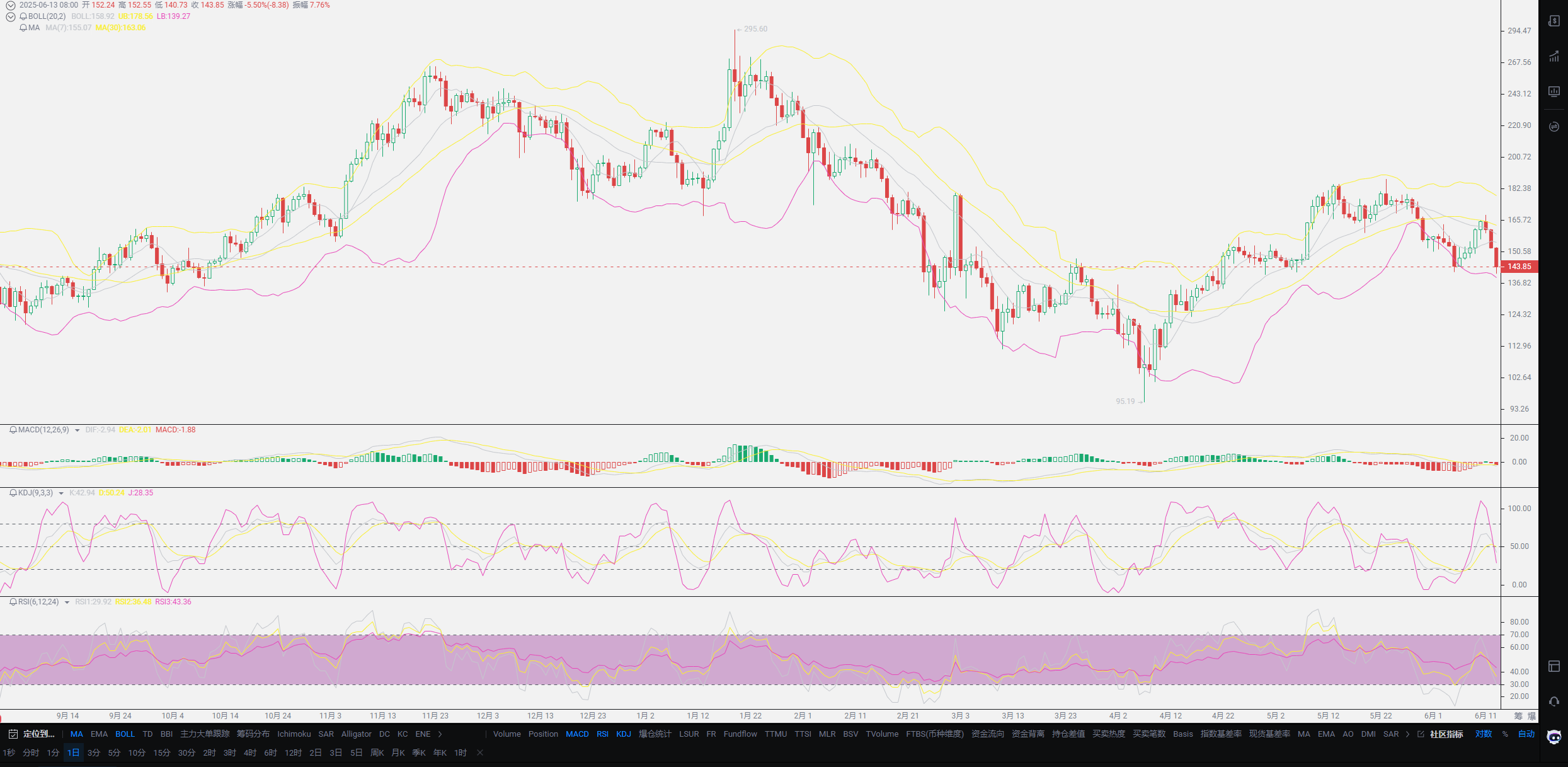

Yesterday's trend once again verified our previous speculation: only when Bitcoin is stable can Ethereum have its day of surge. With the release of the CPI, Ethereum finally broke through previous constraints, and although it reached a high of 2800, the pullback came timely. This has left many friends feeling quite confused about the future trend. Today, I will explain in detail the future trends; the first question is about the CPI data. Many friends do not know much about CPI. Why is it that when CPI data performs well, inflation is below expectations, and the market experiences a brief breakthrough, yet a reversal occurs at the trend level? Conversely, when most CPI data performs poorly, it can even trigger a waterfall in the short term, while at the trend level, it shows a push towards new highs? First, to understand CPI data, one cannot avoid the impact of tariffs. According to normal financial logic, the entire month of May was shrouded in tariffs, and American inflation should have been explosively increasing.

However, the recently released CPI data surprisingly came in below expectations, which is actually easy to explain. Because there are inventories, the normal impact of tariffs, according to previous estimates, should peak in September. But the current tariffs have seen significant improvements, and perhaps the impact at that time will not be too great. This is also a key factor in why the U.S. is eager to negotiate. It is important to understand that the U.S. market is primarily dominated by virtual finance, and physical enterprises are not part of their planning, so daily necessities are overly reliant on foreign imports. Most of the tariff issues are currently borne by enterprises, as can be seen with Walmart. Regarding CPI data, I, Lao Cui, hold a skeptical attitude. First, there is the depreciation of the dollar. With the stablecoin legislation, U.S. Treasury yields will certainly decline. It is impossible to have gray market income flow into the U.S. treasury while also paying them huge interest; this path is inevitable.

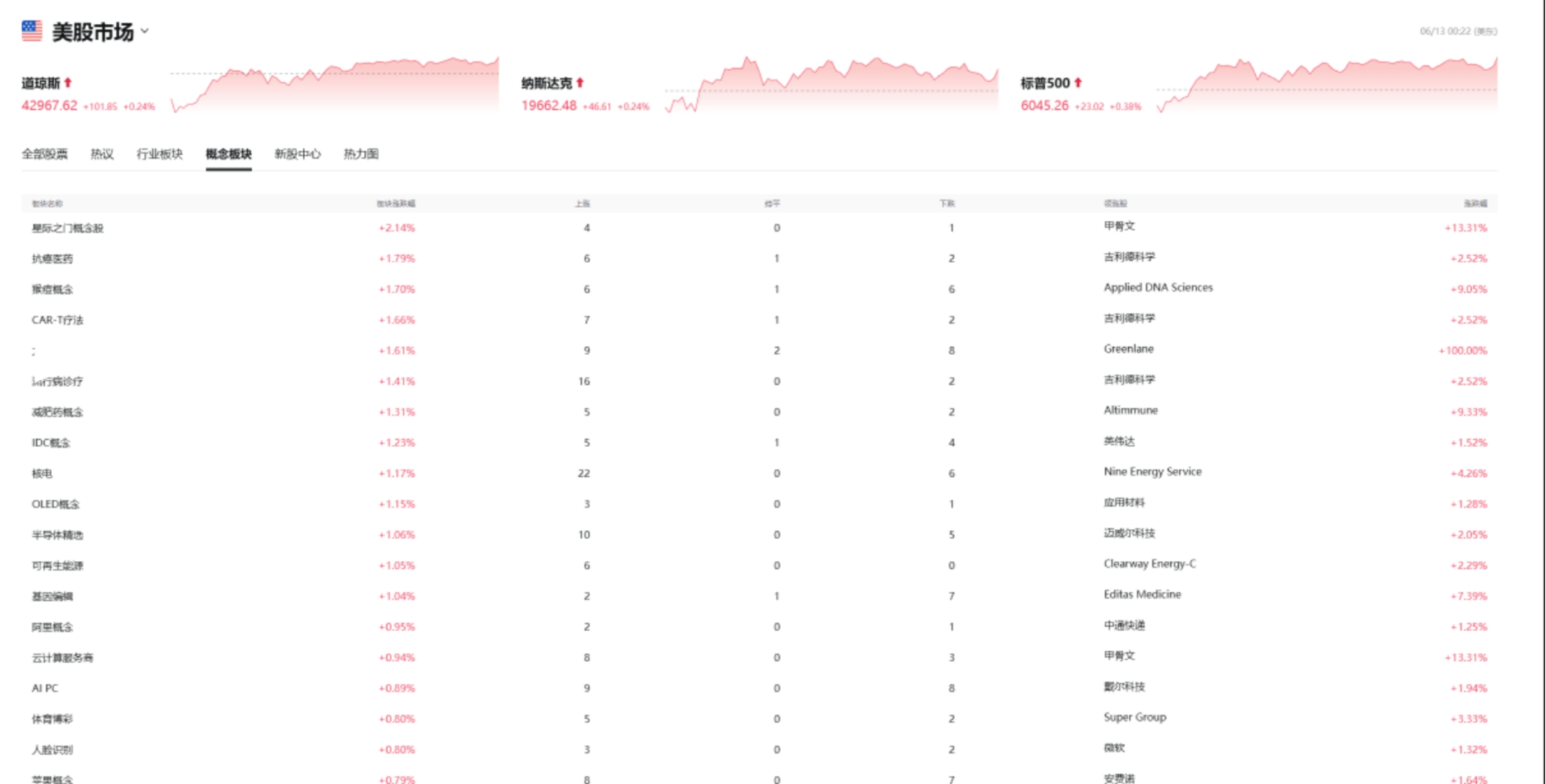

Clarifying this logic will make future market judgments clearer. If CPI performs well, it means that the U.S. financial market is not short of money, and liquidity is relatively good. Therefore, in the short term, some funds will flow into the cryptocurrency market. However, regarding the long-term positive news of interest rate cuts, it means that there will not be a rate cut in the short term. According to basic financial logic, Powell has chosen this data, and at least during the period from June to August, there will be no rate cuts. This rigid influence will directly exacerbate the funding issues in the cryptocurrency market. If there are no rate cuts, it means that the big players will not invest heavily in future-oriented stocks. When the economic situation is poor, the first to be abandoned are the technology stocks with future attributes. At this point, many friends may observe Nvidia and might refute my viewpoint, asking why Nvidia increased by 1.52%? Moreover, the U.S. stock market is still maintaining a growth state?

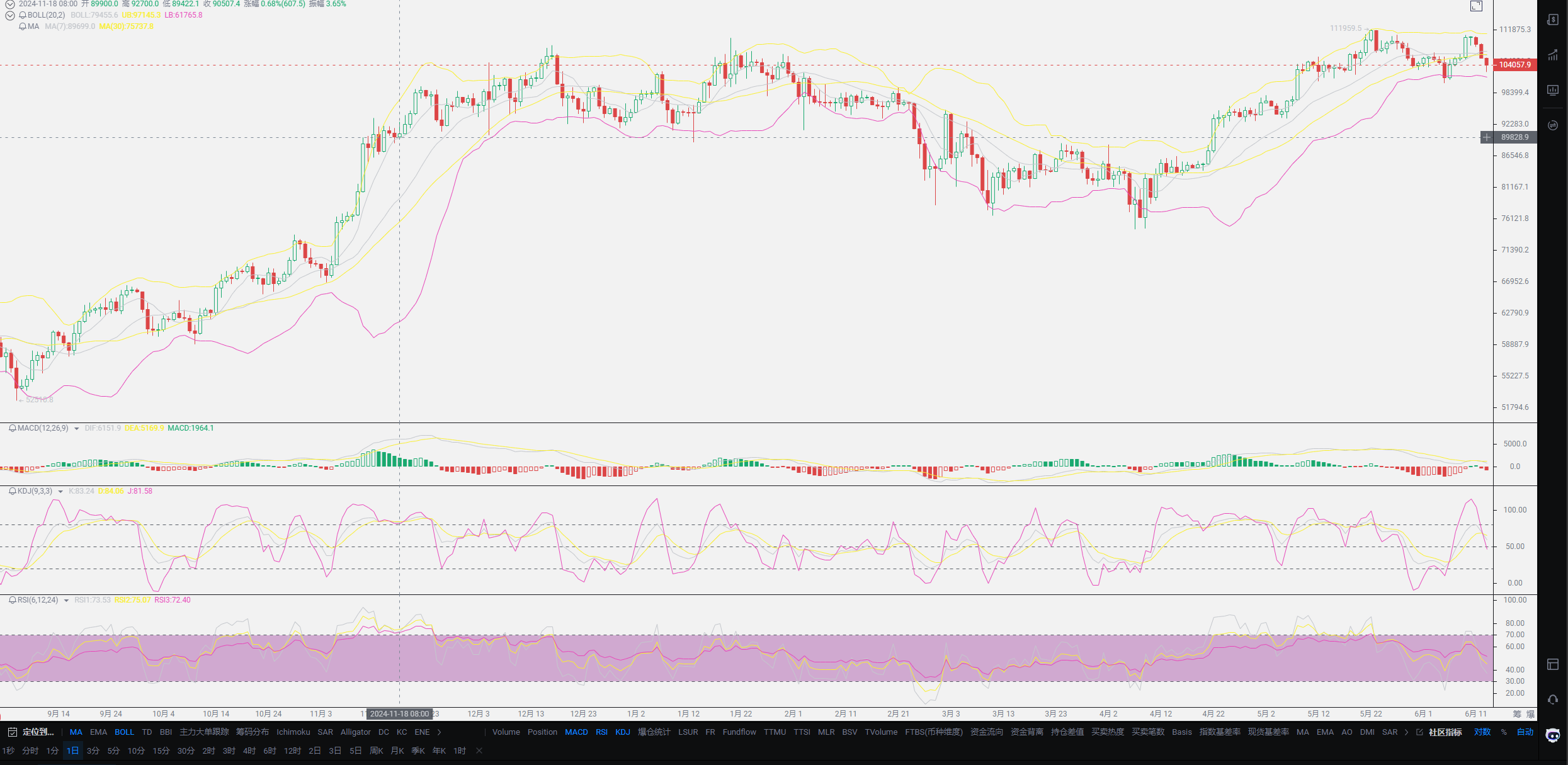

These growing sectors are mostly recovering from previous downward trends, and high-tech concept stocks are offsetting the impact of CPI due to rare earth influences. However, a temporary trend cannot mask the long-term decline, coupled with last night's confrontation between Iran and Israel, which directly catalyzed the decline in cryptocurrency prices. I want to reiterate that the current cryptocurrency market still belongs to risk assets and does not belong to safe-haven assets. Only under specific circumstances can it have the attributes of safe-haven assets. Small country wars do not apply to the attributes of the cryptocurrency market, so a short-term decline is a normal trend. This round of decline has just hit the support levels of both, and today’s Asian market will likely focus on recovery, making stabilization extremely important. According to my estimates, with no rate cut expectations from June to August, it will be difficult to successfully reach the upper high. For three whole months, we must maintain a bearish outlook. In the near future, there will also be meetings regarding interest rate cuts, which will likely focus on pessimism regarding rate cuts. Since they chose to release positive CPI data, it also indicates Powell's determination not to cut rates. The rate cut meetings will likely see another wave of downward movement, so everyone must manage risks well.

The issue of eliminating military-level impacts remains very severe. Under expanded influence, BTC will still face obstacles, as Iran has no inclination for capital outflow. Of course, we need to assess this opportunity from a financial perspective. Iran has abundant oil energy resources, and everyone can pay attention to this sector, which likely still has upward potential. I cannot predict what color flag Iran will raise this time, but everyone just needs to remember one thing: small-scale conflicts are bearish for the cryptocurrency market, while large-scale conflicts are bullish for it. Returning to our main topic, with this year's explosive growth, many friends are also asking me about cryptocurrencies that have not yet been listed on platforms and whether they are worth considering. Regarding this aspect, I hold an open attitude. Cryptocurrencies that are not listed and have not yet been on platforms also include metaverse game coins. As long as they do not require your investment and appear in a way to take advantage of opportunities, you can consider acquiring them. However, due to the influence of Trump Coin, most cryptocurrencies wanting to go on platforms will, even if they allow you to take advantage of opportunities to a certain extent, sign agreements to ensure that you do not sell within a certain time frame. Therefore, the returns on such cryptocurrencies will not be too high. You can see some issues with Trump Coin; although it surged to 79.7, the only party truly profiting is Trump. Moreover, most agreements stipulate that they can only be sold three years later, just as Trump is about to step down, which will allow for another wave of harvesting. Users who have invested in this cryptocurrency must clear their holdings during Trump's term.

Therefore, for any cryptocurrencies you are considering investing in that have not yet been listed on platforms, do not trust them too much, as most are aimed at harvesting your principal. As for game coins, new users can obtain them for free through metaverse games, as long as you do not invest. You can stock up on these types of coins, but abandon any that involve funds. Finally, regarding platform tokens, apart from the top three platform tokens, do not invest in any other tokens. At the same time, the standard for platform tokens is linked to the platform, and small platform tokens are not within your investment scope. Currently, the cryptocurrency market has almost fixed class levels, and it is nearly impossible for other platforms to surpass Binance and Coinbase. These platforms are launched with the strength of a nation and the world, and for individuals to surpass them is akin to dreaming in broad daylight. You can see the trend of OKB; if you can accept the returns of OKB, then you can invest. For small cryptocurrency investments, the first choice is cryptocurrencies that are about to be listed, as the issue of doubling is not significant. Next are those with listing plans; if neither of these two conditions is met, do not invest too much capital.

In summary, the cryptocurrency market from June to August will likely revolve around a large range of fluctuations, not entering a one-sided bear market, nor maintaining strong momentum. Without the influence of rate cuts and listings, the trend will be a downward fluctuation, and this is also the last opportunity for everyone to get on board. The depth may not be too deep, as the market makers are also very aware that new highs will be reached by the end of the year. The recent plan for spot users is to layout during the decline, and the most likely position for Bitcoin to drop below is 98,000. Reaching this position could trigger a liquidation of nearly 2 billion in long positions, and this position is very likely to be achieved this month. For contract users, you can go with the flow; after breaking a new low, wait for recovery to re-enter short positions. Of course, during this period, the risk of liquidation is extremely high, so position control must be strong. The stop-loss position for Bitcoin should be at least above 15,000 points, and for Ethereum, above 500 points, with a bearish outlook as the possibility of new highs is low. As we enter August, preparations for a long-short reversal should begin. The layout for spot trading should conclude in early August, and the CPI and interest rate cut meetings in mid-August are extremely important. It is highly likely that a new round of bull market will begin after the interest rate cut meeting. The explosive point for the cryptocurrency market will also be concentrated around September, with a collective listing of ETFs. The first round of interest rate cuts will at least allow Bitcoin to break through the 120,000 mark and continue to grow, extending to the last interest rate cut of the year, which will be our final battle. If you are unsure about the entry points, you can wait for my signals or directly ask me. I suggest new users abandon the trends of June and July and focus on the trends from August to the end of the year! My estimate for the interest rate cut is that it will be no later than September, not the earliest. The time difference between the interest rate cut and the stablecoin legislation will not exceed one month; this is a set of combined punches!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; experts can see five, seven, or even ten moves ahead, while those with lower skills can only see two or three moves. The skilled consider the overall situation and the larger trend, not focusing on individual pieces or positions, aiming for the ultimate victory. The less skilled, however, fight for every inch, frequently switching between long and short positions, only seeking short-term gains, and often find themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。