Original|Odaily Planet Daily (@OdailyChina_)

_

Author|CryptoLeo (@LeoAndCrypto)

The crypto space is once again affected by the Middle East war, and it's time to withdraw funds from contracts and invest in new projects. Among the new projects recommended by Odaily Planet Daily this time, several have airdrop expectations, and early participation may lead to receiving protocol token airdrops.

1. Felix

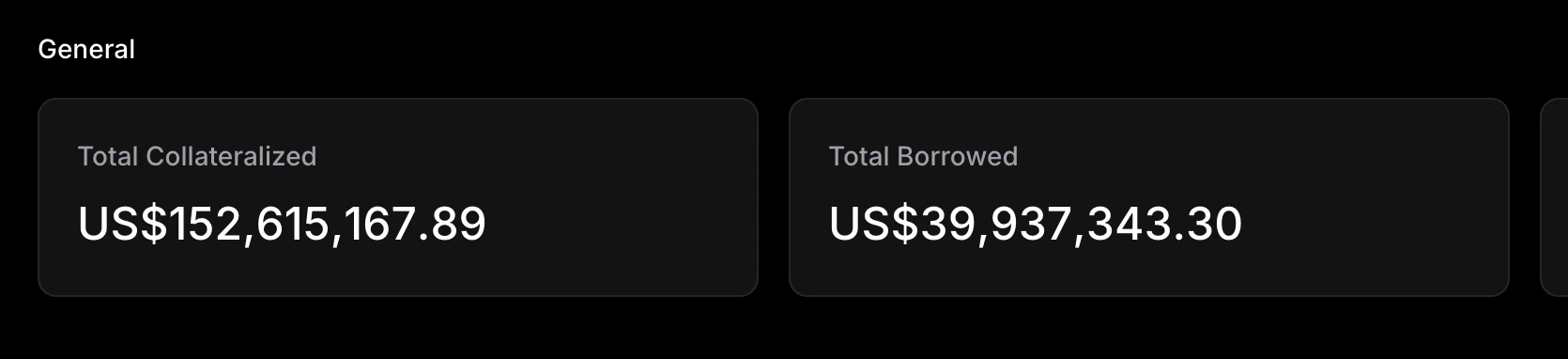

Introduction: Felix is a synthetic dollar stablecoin protocol (feUSD) on Hyperliquid L1, launched on the mainnet on April 8. Users can deposit HYPE, PURR, and cross-bridge versions of BTC, ETH, and SOL as collateral to mint the dollar stablecoin feUSD. feUSD can be used for trading, saving, or payment purposes. Currently, the project's collateral assets amount to $150 million.

How to Participate: Additionally, Felix offers an Earn feature where users can deposit feUSD into its stable pool to earn yields. Each vault corresponds to a specific collateral asset (HYPE, UBTC), and depositors will receive 75% of the interest generated from the supported debt in exchange for participating in automatic liquidation. Therefore, vault deposits can earn feUSD yields and liquidation profits priced in collateral, and further automate the compounding of liquidation gains.

Felix also has a points system where users can earn extra points through trading and inviting others (currently, the points ranking goes up to 1307, indicating that participation is not very high). If interested, you can click my “invitation link” to participate.

2. Resupply

Introduction: Resupply is a decentralized stablecoin supported by collateralized debt positions (CDP), leveraging the liquidity and stability of the lending market to earn yields. It is a sub-DAO protocol supported by Convex Finance and Yearn.

How to Participate: Users can choose crvUSD/frxUSD provided by the Curve Lend/Fraxlend market, deposit it on the Resupply website, and borrow reUSD. They can also perform leveraged operations to cycle borrowing and depositing, ensuring they borrow more reUSD;

Depositing reUSD into the insurance pool maintains protocol security and earns a share of the protocol's revenue as well as RSUP token distribution;

Users can also deposit some tokens into Convex Finance and Yearn to provide liquidity and earn high APY.

3. Meridian

Introduction: Meridian is a DEX and staking protocol built on Movement.

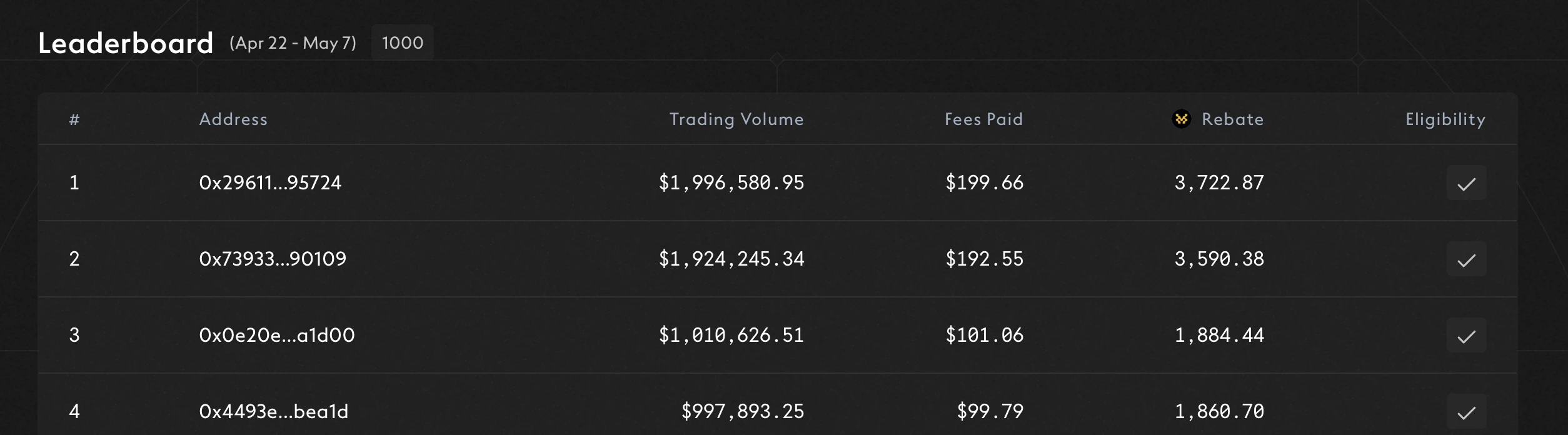

How to Participate: You can increase your ranking by boosting swap trading volume. Currently, the Docs do not have airdrop or token-related information, but its ranking interface has an Eligibility section, which may represent future airdrop reward eligibility.

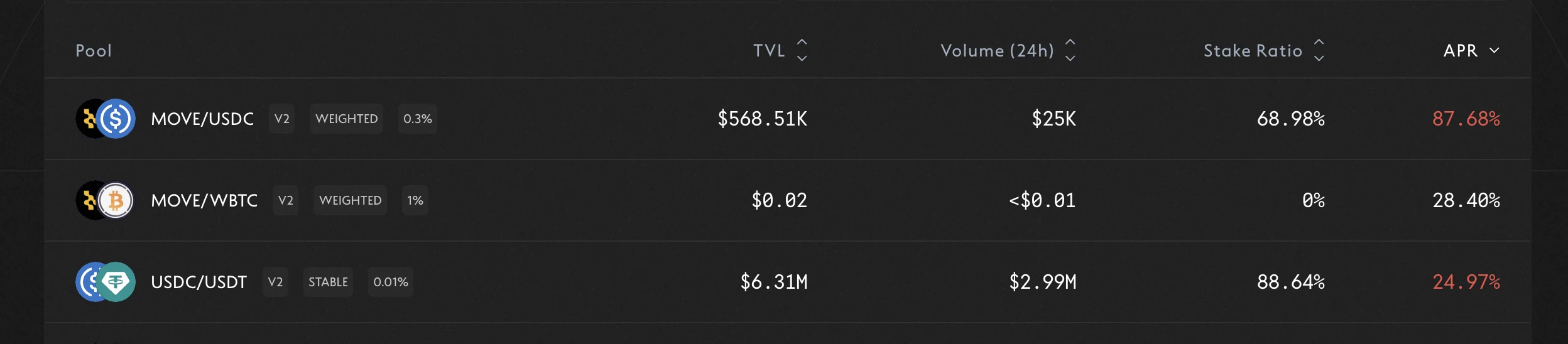

Currently, the APR of the top three pools in this protocol exceeds 20%, as shown in the image below.

4. Vest

Introduction: Vest is an on-chain contract DEX built on the zkRisk pricing engine tool, which continuously monitors individual positions, account balances, and system risks within the Vest ecosystem to dynamically adjust pricing. This helps prevent market manipulation and violations, ensures stable and predictable liquidity, reduces hidden trading costs, and prevents socialized losses and automatic deleveraging, which are extremely important for Perp DEX.

How to Participate: Vest currently supports Arbitrum One, Base, Ethereum, OP mainnet, Polygon, and ZKsync mainnet. Users need to deposit through the network to trade, with a maximum leverage of 50 times. The platform launched the first season of Vest Points activity in March to reward early adopters and active traders, with points distributed based on user trading and LP.

Additionally, users can earn points through referral codes, which can be obtained after depositing with the referral code.

5. Plastic Labs

Introduction: Plastic Labs is an AI identity solution aimed at solving personal identity issues for artificial intelligence. It announced the completion of a $5.35 million pre-seed round of financing in April, led by Variant, White Star Capital, and Betaworks. Currently, Plastic Labs has launched three products:

Honcho: A personalized platform for AI applications, currently in private server phase;

YouSim: An open CLI (text adventure) game, now open-source, allowing users to simulate any identity for gameplay;

Bloom: An AI learning companion based on theory of mind, open-sourced in the form of Tutor-GPT, which will soon be relaunched.

How to Participate: The three projects can only be experienced as ways to interact with AI, and are unlikely to issue tokens or airdrops. However, they can be used to train AI for trading and analysis, or as casual mini-games.

6. Cap

Introduction: Cap is a stablecoin protocol that completed a $11 million seed round of financing in April, co-led by Franklin Templeton and Triton Capital.

Interested readers can check out: “From Human Decision-Making to Code Governance: How Third-Generation Stablecoins Enable Self-Sustaining Yields?”

How to Participate: Cap will launch the stablecoin cUSD and stcUSD (the staked version of cUSD). Users can deposit stablecoins to mint cUSD and stake to receive stcUSD. stUSD can earn automatic compound yields generated by the Cap operating network, which can be redeemed at any time. The website currently has a testnet, but it is not fully functional yet, so keep an eye on it.

7. Wunder

Introduction: Wunder is a social protocol aimed at reshaping social media by using blockchain technology to verify social media users, thereby eliminating bots and sharing advertising revenue with users.

How to Participate: Register on the platform, claim a username and profile, and post frequently to earn token rewards. The platform directly allocates 50% of advertising revenue to users and creators (40% to users). Additionally, users can refer others to earn rewards, and in the future, tokens can also be staked to increase earnings.

Previously, Wunder stated on X that it would launch tokens on Base in May, but currently, there is no reliable WUNDER token pool on Base.

8. Yupp

Introduction: Yupp is an AI blockchain training platform that integrates multiple large AI models. It recently completed a $33 million seed round of financing, led by a16z.

How to Participate: Users can register an account and ask questions, and the platform will provide two filtered best answers. Users choose their preferred answer and provide feedback (e.g., which AI provided a clearer, more logical, faster, or more diverse answer). Feedback can help train the AI model. After the first feedback, users can earn 5000 credits, and each subsequent question will earn a corresponding number of credits. Credits can be withdrawn, with 1000 credits equaling $1 (Chinese users may need KYC). This can serve as a daily AI tool, providing answers while also earning money (it became popular last weekend, and the platform experienced some lag).

Today's recommendations mainly focus on depositing to seek airdrops, which requires a certain amount of funds, so please manage your risk accordingly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。