Investing, like life, is constantly faced with choices. Many times, making the right choice is more important than hard work. If you make the right choice, the path will be smooth; the rest is about sticking to your choice without wavering or giving up halfway. Therefore, the correct choice + persistence in your choice = success.

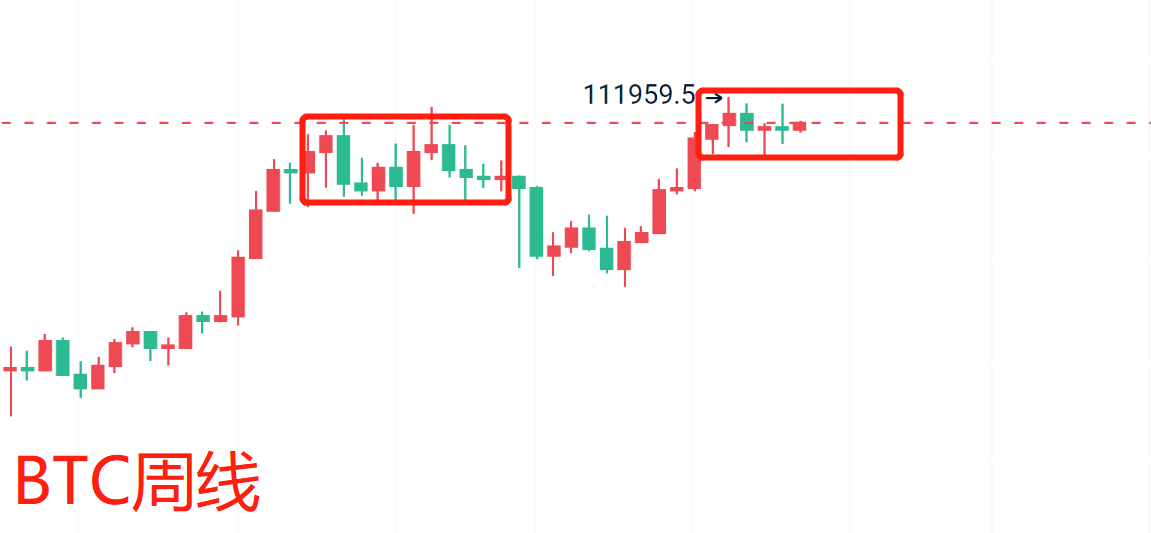

Hello everyone, I am trader Gege. Continuing from the previous article, regarding the predicted trend, the drop of Bitcoin has exceeded expectations. The reason is well known, which is the sudden attack by YI. After two days of digestion and correction, the market has rebounded, and the situation is gradually calming down. Bitcoin's decline has maintained the defense line at 102,000. Today marks the end of the week, and I would like to briefly discuss my views on the weekly chart.

The weekly candlestick for Bitcoin closed as a doji, although it closed above the MA7, the overall structure poses certain risks for bulls, as the previous double top structure still exists. Therefore, in the upcoming week, we need to pay attention to whether the MA7 can stabilize. If it cannot hold, the market will test the 100,000 level again, and if it breaks, it will continue to test near the middle track. This week, bulls should be cautious and observe the situation at key levels before deciding whether to take action.

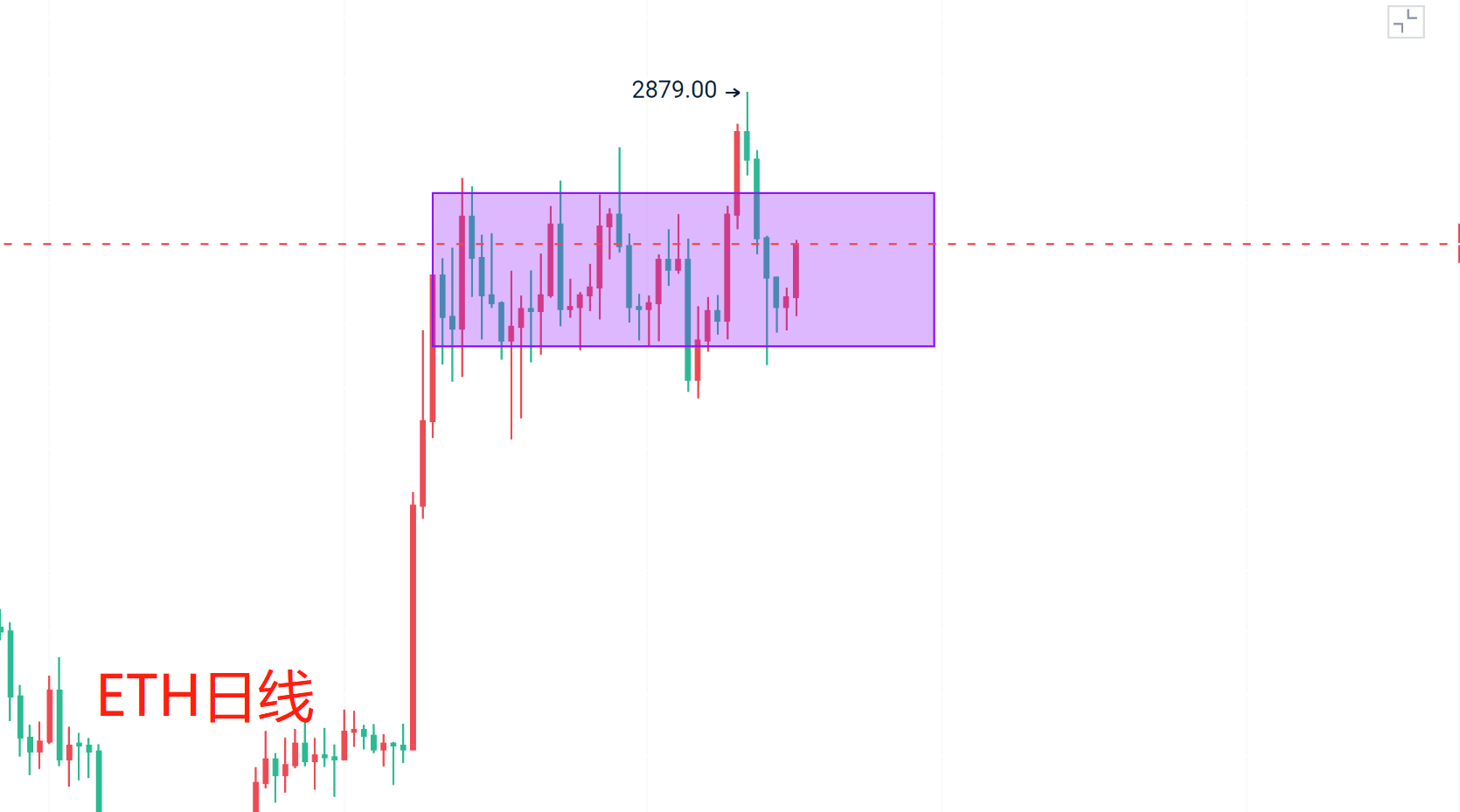

On the daily chart, the market is fluctuating back and forth within the Bollinger Bands, and currently, the Bollinger Bands are in a flat phase without opening up. Therefore, we can temporarily rely on the upper and lower track ranges to intervene. Following the previous thought, due to the respect for the resistance of the previous high, it is advisable not to chase the price upwards. In the short term, maintain a low long and high short trading rhythm until the structure is completely broken before adjusting the strategy.

From the 4-hour chart, the market has tested support near the EMA200 multiple times. Therefore, in the short term, this can still be referenced. If it breaks, we need to look at the support above the 100,000 level. The weekly chart for YI has touched the previously mentioned MA60 but did not break through; instead, it faced resistance and retreated. Thus, the key position on the weekly chart can continue to be monitored. From the perspective of the smaller time frames, the market has returned to the previously mentioned box structure, so in the short term, we can continue to reference the upper and lower edges of the box for intervention. Note that if the upper edge is broken again, we need to pay attention to the resistance of the previous high.

Short-term Bitcoin: Buy at 104,600-103,800, targeting 2,000-3,000 USD. Sell at 108,300-109,300, targeting 4,000-5,000 USD.

Short-term YI: Buy at 2,510-2,470, targeting 80-100 USD. Sell at 2,680-2,720, targeting 100-150 USD.

PS: The strategy is activated for one-time use only.

The suggestions are for reference only. Ensure proper risk control when entering the market, and manage your profit and stop-loss space accordingly. Specific strategies should be consulted in real-time.

Alright, friends, we will say goodbye until next time. I wish everyone continued success and smooth sailing in the cryptocurrency world! More real-time suggestions will be sent internally. Today's brief update ends here. For more real-time suggestions regarding Bitcoin and YI, please reach out to Gege.

Written by: I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。