"I measure a person's worth by how much money they make." This was what Sun Yuchen said during a speech when he returned to China to start his business eight years ago.

He said this and indeed acted on it. Since becoming the legal representative of the "Accompany Me App" in 2014, the pragmatic and almost ruthless Sun Yuchen has always harbored a dream of building a business empire in his heart. He aims to maximize the use of rules, leverage resources, and win the game that belongs to him.

And today, eight years later, Sun Yuchen has truly realized almost every businessman's greatest dream—going public.

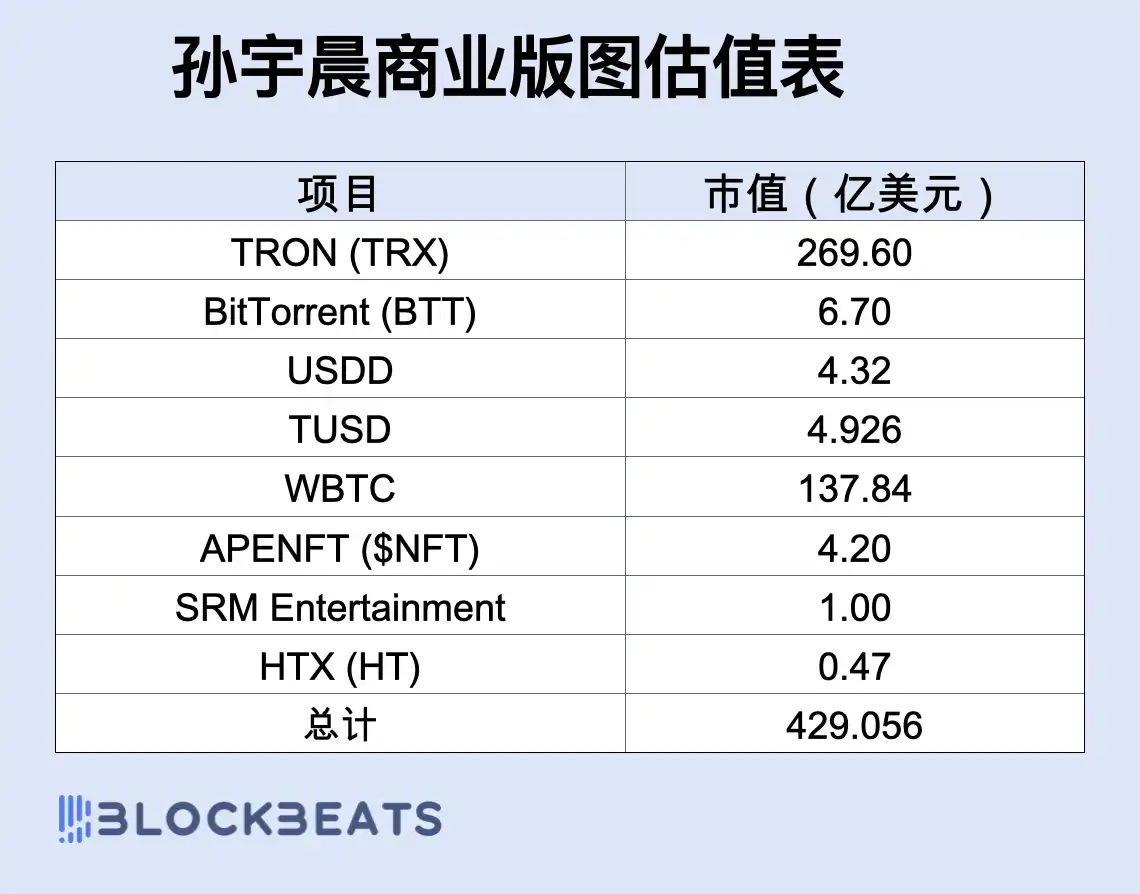

His latest deal is worth $100 million, involving a U.S. listed company named SRM Entertainment, which successfully went public on NASDAQ through a reverse merger with Tron. At 35 years old, Sun Yuchen is now the head of a publicly listed company, and this post-90s entrepreneur also has seven or eight notable enterprises and projects in his hands.

Sun Ge's Blockchain Landscape

Tron: Sun Yuchen's First Big Bet in the Crypto World

Sun Yuchen joined the Ripple China team in 2013, where he accumulated his first pot of gold during his time as an ambassador and built valuable connections in the blockchain circle. With these resources, he quickly developed the idea of starting his own business, intending to make a significant impact in the blockchain sector.

By 2017, Ethereum had already gained fame. Just after his 27th birthday, Sun Yuchen put aside the social app he had been operating, reassembled a few classmates from Peking University, and, backed by capital tycoons, embarked on the entrepreneurial journey of Tron (TRON) with the ambition of "venturing into the crypto world again."

Fortunately, when launching the TRX token and starting the ICO, he successfully raised about $400 million. Unfortunately, the era of the "9.4" ban on ICOs arrived, and Chinese project parties and trading platforms fell silent, quickly fleeing and vowing that neither they nor their descendants would engage in blockchain again.

During those most difficult days, Sun Yuchen refunded the ICO money, and the early core team of Tron nearly disbanded, with partners leaving due to security concerns. Sun Yuchen also admitted, "My six years of entrepreneurship, the first three years were almost all wasted."

A turning point came in April 2019 when Tether decided to issue a TRC-20 version of USDT on the Tron network. From then on, Tron firmly locked its development focus on the promotion and popularization of USDT, a move that almost established 99% of Tron's current market value. "Soon, the USDT issued on the Tron blockchain will become the largest stablecoin in the world," Sun Yuchen's words have indeed come true years later. A considerable amount of USDT on-chain transfers globally is supported by Tron.

Data Source: DefiLama

The latest on-chain data shows that today, the transfer volume and gas consumption of USDT on the Tron network account for over 98% of the total on-chain volume. In other words, the on-chain activity of Tron is almost entirely maintained by USDT "blood transfusions." Users typically pay a transaction fee ranging from $0.3 to $8 for each USDT transfer. According to current statistics, Tron's daily on-chain revenue exceeds $2.1 million, with an annualized income of $770 million, most of which comes from the high-frequency transfer fees of USDT. The daily transaction count exceeds 2.46 million, with an average transaction fee of about $0.85, which is basically consistent with the actual transfer cost of USDT.

As of now, Tron's total market value has reached $26.96 billion, surpassing Mixue Ice City, firmly ranking among the top mainstream public chains globally, and holding a core position in the circulation of stablecoins on-chain.

BitTorrent's "Sentimental Acquisition"

In the summer of 2018, compared to creating Tron, Sun Yuchen did something that seemed even more "out of the box" at the time—he bought the already "outdated" download tool BitTorrent for $140 million.

The name BitTorrent may not be unfamiliar to many people born in the 80s and 90s: it was born in 2001 and is the world's first large-scale application of the P2P file-sharing protocol. At its peak, about 40% of global internet traffic was transmitted via the BitTorrent protocol. In an era before the centralized internet became ubiquitous, BitTorrent almost embodied an entire generation's imagination of "download freedom."

However, for Sun Yuchen, this was not just a "sentimental acquisition." Acquiring the BitTorrent client was just the beginning; what he truly wanted to do was to blockchainize the entire BitTorrent protocol—giving this old P2P network a "rebirth."

Not long after the acquisition was finalized, Sun Yuchen launched the BTT token, adopting the TRC-10 standard, and simultaneously launched the "BitTorrent Speed" project. Users could pay BTT to obtain faster download speeds while uploaders could earn BTT rewards by seeding.

This vision looked promising, but the implementation was not so easy.

As of now, the total circulation of BTT is 986 trillion tokens, priced at about $0.00000068, with a total market value of approximately $670 million, and a 24-hour trading volume stabilizing around $10 million, with an annualized trading volume exceeding $2.6 billion. Although it is still about 78% below its historical peak (reached $0.00000304 in January 2022), in today's meme coin-dominated market, such performance is considered fairly standard.

Poloniex and HTX: Sun Ge's "Cash Flow"

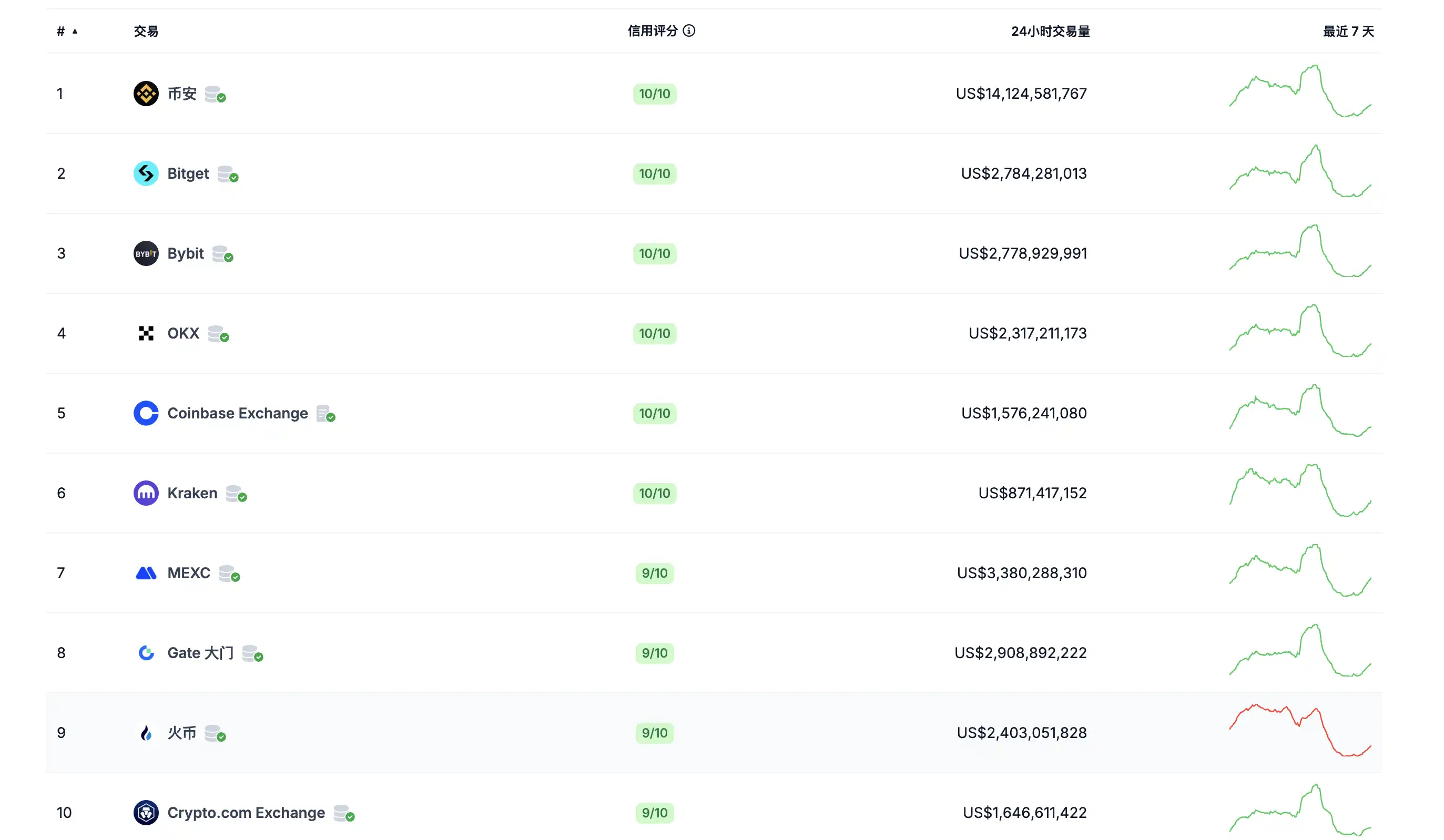

For a long time, Sun Yuchen's second industry in the crypto world has been trading platforms, with two trading platforms in his hands: Poloniex and HTX.

First, let's talk about Poloniex. This veteran trading platform was initially acquired by the crypto startup Circle for $400 million in February 2018. At that time, Circle intended to make it a compliance pioneer, but it didn't last long. In October 2019, Poloniex officially became independent from Circle with the support of an Asian investment consortium and Sun Yuchen, and began deep cooperation with Tron, collaborating in various areas such as TRC20-USDT stablecoin, DeFi, and Tron trading zones.

On June 9, 2022, Sun Yuchen took action again, officially acquiring Poloniex in collaboration with the Wave Federation and several well-known investment institutions, and directly named its Chinese brand "Tron Trading Platform." This acquisition was seen as filling the gap in Tron's ecosystem where there was a lack of a trading platform, marking the official entry of Tron into a new phase of "public chain + trading platform" dual-drive strategy. As of now, Poloniex's daily trading volume is about $500 million.

After acquiring Poloniex, in October of the same year, Sun Yuchen turned his attention to another veteran trading platform—Huobi.

He first joined the Huobi Global Advisory Committee as a global advisor, announcing plans to promote Huobi's internationalization and upgrade the HT ecosystem. Soon, the Huobi executive team underwent a series of changes. Ultimately, Sun Yuchen, through the Hong Kong asset management company About Capital, acquired Huobi's equity for $1 billion, becoming the actual leader of this trading platform. As of now, Huobi still ranks among the top 10 trading platforms in the market, with a daily trading volume of $2.4 billion. The price of Huobi's platform token HTX is currently $0.29, with a market value of $47 million.

Data Source: coingecko

Poloniex was first acquired by the crypto startup Circle for $400 million in February 2018. In October 2019, with the support of an Asian investment group and Sun Yuchen, the trading platform broke away from Circle and began collaborating with Tron in various fields such as TRC20-USDT stablecoin, DeFi decentralized finance, and Tron trading zones, allowing Poloniex to expand from North America to a global presence.

On June 9, 2022, Tron founder Sun Yuchen announced the formal acquisition of the well-known trading platform Poloniex in collaboration with the Wave Federation and several well-known investment institutions, while also launching the Tron Trading Platform as its brand for the Chinese community. With this acquisition, Poloniex will break the situation of Tron's public chain ecosystem lacking a trading platform, marking the official launch of Tron's "public chain + trading platform" dual-drive strategy.

In October 2022, Sun Yuchen joined the Huobi Global Advisory Committee, announcing plans to expand Huobi's global strategy, develop international brand promotion, and focus on the operation of Huobi Token, significantly empowering HT. Subsequently, Huobi's executives gradually left, and Sun Yuchen acquired Huobi's equity for $1 billion through the Hong Kong asset management company About Capital, becoming the actual controller of Huobi.

As of now, Huobi still ranks among the top 10 trading platforms in the market, with a daily trading volume of $2.4 billion.

USDD, TUSD, and WBTC

In addition to public chains and trading platforms, US dollar stablecoins and wrapped Bitcoin are also indispensable parts of Sun Yuchen's business layout in the crypto world.

USDD, TUSD, and WBTC, these three tokens that are highly associated with Sun Yuchen, are his three trump cards in the landscape of stablecoins and cross-chain assets.

First, let's talk about USDD. USDD is a decentralized stablecoin that Sun Yuchen personally led the launch of, issued and managed by Tron DAO Reserve, with an operating mechanism designed by him. To ensure that USDD maintains its peg to the US dollar, Sun Yuchen directly controls the most critical assets in the collateral pool—large reserves of TRX, USDT, Bitcoin, etc. Whenever the market fluctuates and the peg is at risk, he has repeatedly injected funds and reserves to stabilize it, making him the "behind-the-scenes controller" of USDD. According to the latest data, USDD's on-chain market value is approximately $432 million, ranking about 10th among stablecoins.

Data Source: Coinmarketcap

Let's talk about TUSD. Although TUSD does not appear to be an asset directly under Sun Yuchen's name, various on-chain evidence and the flow of funds have essentially confirmed his shadow control position. Since 2023, TUSD has become an important supporting currency for liquidity on TRON and HTX (formerly Huobi). However, this piece on the chessboard is not without risks: TUSD has faced multiple depegging incidents due to custody and audit disputes, and it has also come under scrutiny from the SEC. In 2024, Binance delisted its main trading pairs, and by 2025, it was completely removed from the EU due to the implementation of MiCA regulations, leaving only withdrawal channels. To salvage the situation, Sun Yuchen had to personally invest over $400 million in early 2025 to stabilize TUSD, further tying this stablecoin to his name. Currently, TUSD's market value is $492.6 million.

Data Source: Coinmarketcap

Finally, there's WBTC (Wrapped Bitcoin), which is an ERC20 token issued on the Ethereum network. It was first proposed in 2017 and officially released its white paper in 2019, with its value pegged one-to-one to Bitcoin; each WBTC is backed by an equivalent amount of Bitcoin, managed through custodians (currently Bitgo), ensuring that WBTC holders can redeem it for Bitcoin at any time.

Although WBTC is not a project he directly controls, this heavyweight role in the TRON stablecoin architecture is viewed by some foreign media as a wrapped Bitcoin directly controlled by Sun Yuchen. Related reading: "Why Did the Market React So Strongly to Justin Sun's Involvement in WBTC?"

Tron DAO Reserve holds a significant amount of Bitcoin long-term. To facilitate on-chain collateralization, the team converts some BTC into WBTC to support the stable operation of USDD. It can be said that without WBTC, there would be no safety buffer for USDD on TRON today. According to the latest data from CoinMarketCap, WBTC's market value has reached $13.784 billion, making it one of the largest Bitcoin-mapped assets globally.

Data Source: Coinmarketcap

DLive: Does Sun Ge Also Have a Live Streaming Platform?

Compared to the previous projects, DLive may be somewhat less well-known.

Originally, DLive was a decentralized live streaming platform built on the Lino chain, which was acquired by BitTorrent at the end of 2019, and the entire team and technology stack subsequently migrated into the TRON ecosystem.

Behind this integration is another strategic move by Sun Yuchen in the "content platform + blockchain" direction. DLive introduced BTFS (BitTorrent File System) for decentralized storage, and the BTT token was used for rewarding streamers and incentivizing content distribution, forming a closed loop that runs on-chain from creation, storage to rewards sharing. At the same time, DLive shares a user account system with BitTorrent, uTorrent, Steemit, etc., allowing BTT to gradually become the "universal point system" within this content ecosystem.

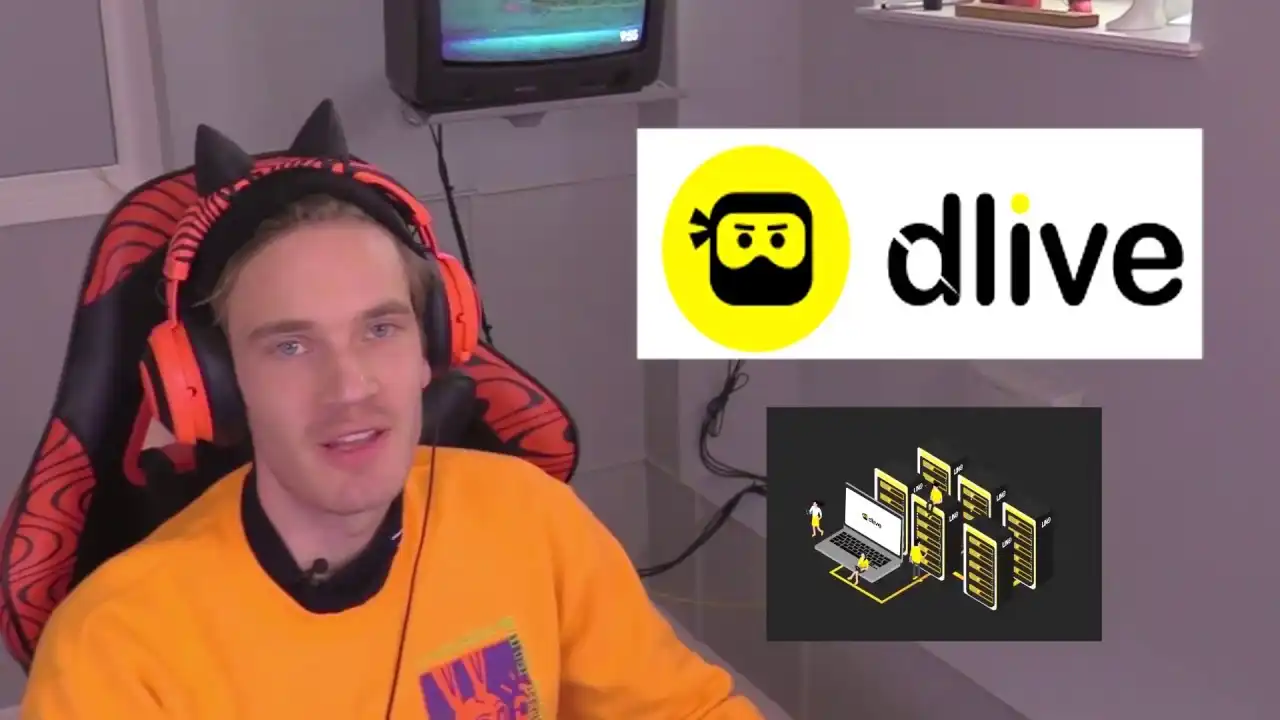

Because of this, DLive once attracted top overseas streamers like PewDiePie to join, and the platform's monthly active users continued to grow, becoming one of the most traffic-rich content windows in the TRON ecosystem. However, the loose community management also laid hidden dangers.

Top overseas streamer PewDiePie live streaming on DLive

In early 2021, DLive faced concentrated criticism from public opinion and regulatory agencies after users streamed the U.S. Capitol riot on the platform, leading to doubts about its content review and risk control mechanisms.

The Collection Arsenal APENFT Marketplace

When it comes to Sun Yuchen's identity, aside from being a businessman, he is perhaps most famously a passionate art collector. He holds a long list of world-class artworks: original pieces by Picasso, Andy Warhol, Alberto Giacometti, and Basquiat are all in his collection. Recently, he made headlines by purchasing "A Banana" for $6.2 million, placing himself at the top of trending topics.

As a top art collector, it is not surprising that Sun Yuchen has an NFT trading platform.

On March 29, 2021, Sun Yuchen officially registered the APENFT Foundation in Singapore, aiming to bridge traditional art with the NFT world through this platform. The core mission of APENFT is straightforward: to buy top traditional artworks and NFT pieces as underlying assets while incubating young NFT artists, paving the way for them; at the same time, it sponsors galleries, organizes exhibitions, sets up awards, and supports art criticism and research, providing a new on-chain path for the global art community.

To ensure that on-chain art is more secure, APENFT chose Ethereum and TRON as dual underlying technologies, using Ethereum to support smart contracts and global recognition while leveraging TRON for high throughput and low gas fees. Sun Yuchen's other early venture, BTFS (BitTorrent File System), was also integrated to provide decentralized storage, ensuring that art files are always accessible, immutable, and not lost due to single points of failure.

In 2021, the APENFT Marketplace officially launched as an NFT trading market based on TRON, specifically responsible for digitizing these top artworks and issuing NFTs, allowing global users to hold "fragmented ownership." In 2022, Sun Yuchen invested tens of millions of dollars to acquire collections such as "Digital Zodiac Beast Heads," "Nose," and "Reclining Nude Woman with Necklace," directly donating them to the APENFT Foundation to further enhance its position in the digital art field.

With the traffic from the TRON community, Sun Yuchen's personal popularity, and the TRON network's on-chain fees being less than $1, the APENFT Marketplace quickly attracted a large number of creators and players. Sun Yuchen also announced that 100% of the transaction fees collected by the platform would be used to buy back and burn platform tokens, along with various racing competitions, hackathons, and other activities, almost bringing a lively atmosphere to the NFT space.

Currently, the market value of the APENFT Marketplace platform token $NFT is $420 million.

From Tron to BitTorrent, from Poloniex to HTX, and then to stablecoins like USDD, TUSD, and WBTC that can easily leverage on-chain liquidity, plus the APENFT Marketplace as an "on-chain art museum."

In less than ten years, Sun Yuchen has polished his business landscape in the crypto world into a complete entity that spans public chains, trading platforms, stablecoins, NFTs, cross-chain, and international politics.

Behind this seemingly decentralized yet tightly interconnected network, based on data from Rhythm BlockBeats, the core assets held by Sun Yuchen are already close to $43 billion.

Now, with the acquisition of SRM Entertainment for $100 million, Sun Yuchen has successfully brought Tron to the NASDAQ stage through a reverse merger, and his greatest confidence may come from the warming relationship with the Trump family behind him.

Sun Ge's Grievances with the United States

Sun Ge's connection with the United States can be traced back to his days studying at the University of Pennsylvania.

In 2011, he pursued a master's degree in East Asian Studies but filled his elective courses with investment studies, entrepreneurship management, and venture capital from the Wharton School. In his spare time, he and his classmates founded "Three People in America," turning the lives of international students into a video program that became popular on Youku, Bilibili, and YouTube, even discussed by CCTV.

It was also during that time that Sun Yuchen was introduced to the concept of Bitcoin through Reddit and campus tech communities. Compared to today's price of $100,000, Bitcoin was quite "cheap" back then, around $10, and he began to experiment with small amounts, gradually increasing his investment.

At the end of 2013, Sun Yuchen gave up the opportunity to further his studies at law school and joined Ripple Labs, becoming one of the first evangelists of the Ripple protocol in China. In 2014, he returned to China, secured investment from IDG, and founded Raybo Technology. Despite experiencing the ICO ban, team disbandment, fleeing overseas, and being ridiculed as the "Jia Yueting of the crypto world," he managed to persevere.

However, in the eyes of the Biden administration, Sun Yuchen has always been seen as "a troublemaker on the blockchain."

Around 2020, due to the extensive use of Tron for black market fund flows, the FBI and the U.S. Department of Justice launched an investigation against him. According to The Wall Street Journal, he has not dared to set foot in the United States for many years because of this.

In 2023, the SEC officially filed a lawsuit against him, accusing him of manipulating the prices of TRX and BTT and illegally selling unregistered securities. Even the celebrities who helped him promote his projects—Akon, Ne-Yo, Soulja Boy, Lindsay Lohan, Jake Paul—were named and fined.

To protect his freedom, he had to seek "amulets," first taking on the title of WTO ambassador for the Caribbean island nation of Grenada in 2021, gaining valuable diplomatic immunity. However, this good fortune did not last long; after the regime change in Grenada in June 2022, Sun Yuchen's diplomatic status gradually became marginalized.

To continue receiving immunity, Sun Yuchen, having lost his Grenadian identity, was appointed as "Speaker" and "Prime Minister" in Liberland. This self-proclaimed liberal micro-nation claims sovereignty over a small area in the floodplain of the Danube River on the border between Serbia and Croatia.

Sun Yuchen is well aware that in the ever-changing power dynamics of the United States, nothing is a permanent defeat, and nothing cannot be turned around. The 2024 election may be his best opportunity for a comeback.

While Wall Street's old financial giants were just beginning to explore cryptocurrencies and American politicians were embroiled in heated debates over crypto regulation, Sun Yuchen had already quietly laid the groundwork. "I believed early on that President Trump would bring many positive impacts to the cryptocurrency space. After his election, the entire crypto world was revitalized," he once told the media.

The Trump family has made a high-profile bet on the cryptocurrency industry and personally participated in the World Liberty Financial project. From the end of last year to this year, Sun Yuchen has invested a total of $75 million in two separate bets, becoming the "top holder," and was thus appointed as a core advisor to the project by the Trump family.

Sun Yuchen's HTX also became the first exchange to list the new stablecoin USD1 from WLFI. With advisors, funding, and connections all in place, he even became the largest holder of Trump Coin ($Trump), owning 1.43 million coins worth about $23 million.

Not long after, the Trump organization announced that it would invite the top 220 holders of $Trump to a dinner. Sun Yuchen quickly tweeted, revealing himself as the largest holder. It is said that Trump attended the dinner for only half an hour, and the latter half was almost a personal showcase for Sun Yuchen, leading many netizens to jokingly refer to it as the "Sun Yuchen Dinner."

Sun Yuchen was awarded a gold watch as the largest holder of Trump Coin at the Trump dinner.

"I am a bridge between the crypto industry and the president, and in some ways, I may also be a bridge for future communication between China and the U.S.," he said in an interview. "My original intention is to establish a good relationship with the Trump family and bring more people from the traditional world into the blockchain world. We will collaborate long-term and continuously with President Trump's cryptocurrency projects to promote the development and progress of our entire industry."

Left: Sun Yuchen; Right: Donald Trump Jr.

For an entrepreneur, aside from the numbers in their accounts, the most important thing is freedom. Compared to CZ, who paid a staggering $4.4 billion in fines for the freedom to enter and exit the U.S., Sun Yuchen's cost was minimal.

Therefore, Sun Yuchen appeared quite pleased about returning to the U.S., not only visiting multiple locations and companies but also tweeting several times to express his "affection" for Trump.

From being a "quasi-suspect" chased by the FBI and SEC to now flaunting a gold watch gifted by the president in the White House, Sun Yuchen has navigated this crypto-political feast in his most adept manner, and the story seems to have reached its climax.

However, the money-driven Sun Ge is likely not planning to stop anytime soon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。