Original Title: Stablecoin Update May 2025

Original Source: Artemis

Original Translation: Bitpush

In the crypto market, stablecoins are no longer just "stable" — they are quietly helping you make money. From U.S. Treasury yields to perpetual contract arbitrage, Yield-Bearing Stablecoins are becoming a new revenue engine for crypto investors. Currently, there are dozens of related projects with a market cap exceeding $20 million, totaling over $10 billion in value. This article will break down the sources of income for mainstream yield-bearing stablecoins and review the most representative projects in the market to see who is truly making your money work for you.

What are Yield-Bearing Stablecoins?

Unlike regular stablecoins (such as USDT or USDC), which serve only as a store of value, yield-bearing stablecoins allow users to earn passive income while holding them. Their core value lies in providing additional returns to holders while maintaining the price peg of the stablecoin.

How is Income Generated?

The sources of income for yield-bearing stablecoins are diverse and can be summarized into the following categories:

· Real World Asset (RWA) Investments: Protocols invest funds in low-risk assets in the real world, such as U.S. Treasury bills (T-bills), money market funds, or corporate bonds, and return the earnings from these investments to holders.

· DeFi Strategies: Protocols deposit stablecoins into decentralized finance (DeFi) liquidity pools, engage in liquidity mining, or employ delta-neutral strategies to extract profits from market inefficiencies.

· Lending: Deposits are lent to borrowers, and the interest paid by borrowers becomes the income for holders.

· Debt Support: Protocols allow users to lock crypto assets as collateral to borrow stablecoins. Income mainly comes from stability fees or interest generated from non-stablecoin collateral.

· Mixed Sources: Income comes from a combination of tokenized RWAs, DeFi protocols, centralized finance (CeFi) platforms, etc., achieving diversified returns.

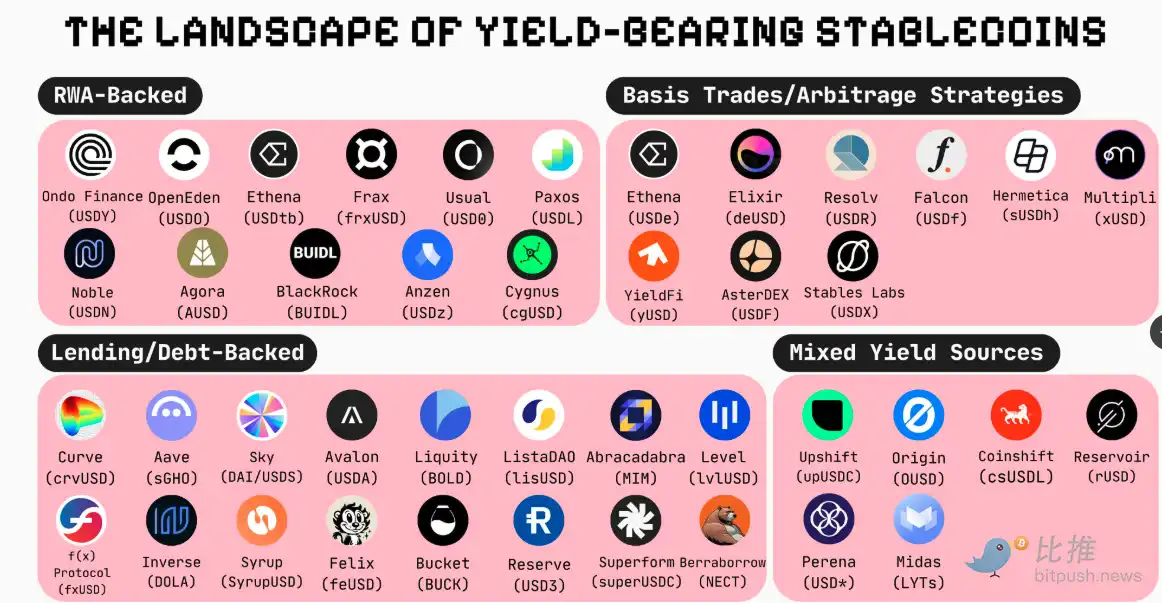

Overview of the Yield-Bearing Stablecoin Market (Projects with Total Supply of Approximately $20 Million and Above)

The following lists some of the currently mainstream yield-bearing stablecoin projects, categorized by their primary income generation strategies. Please note that the data reflects total supply, and this list mainly covers yield-bearing stablecoins with a total supply of $20 million or more.

1. RWA Supported (Primarily through U.S. Treasuries, Corporate Bonds, or Commercial Paper)

These stablecoins generate returns by investing funds in low-risk, income-generating assets in the real world.

· Ethena Labs (USDtb – $1.3 billion): Supported by BlackRock's BUIDL fund.

· Usual (USD0 – $619 million): The liquidity deposit token of the Usual protocol, backed 1:1 by ultra-short-term RWAs (specifically aggregated U.S. Treasury tokens).

· BUIDL ($570 million): A tokenized fund by BlackRock, holding U.S. Treasuries and cash equivalents.

· Ondo Finance (USDY – $560 million): Fully backed by U.S. Treasuries.

· OpenEden (USDO – $280 million): Earnings come from reserves supported by U.S. Treasuries and repurchase agreements.

· Anzen (USDz – $122.8 million): Fully backed by a diversified portfolio of tokenized RWAs, primarily including private credit assets.

· Noble (USDN – $106.9 million): A composable yield-bearing stablecoin, supported by 103% U.S. Treasuries, utilizing M0 infrastructure.

· Lift Dollar (USDL – $94 million): Issued by Paxos, fully backed by U.S. Treasuries and cash equivalents, with daily automatic compounding.

· Agora (AUSD – $89 million): Supported by Agora reserves, including U.S. dollars and cash equivalents, such as overnight reverse repos and short-term U.S. Treasuries.

· Cygnus (cgUSD – $70.9 million): Supported by short-term Treasuries, operating as a rebase-type ERC-20 token on the Base chain, with daily automatic balance adjustments to reflect earnings.

· Frax (frxUSD – $62.9 million): An upgrade from Frax Finance's stablecoin FRAX, it is a multi-chain stablecoin supported by BlackRock's BUIDL and Superstate.

2. Basis Trading/Arbitrage Strategy Type

These stablecoins generate income through market-neutral strategies, such as perpetual contract funding rate arbitrage and cross-exchange arbitrage.

· Ethena Labs (USDe – $6 billion): Supported by a diversified asset pool, maintaining its peg through spot collateral delta hedging.

· Stables Labs (USDX – $671 million): Generates income through delta-neutral arbitrage strategies among various cryptocurrencies.

· Falcon Stable (USDf – $573 million): Supported by a cryptocurrency portfolio, generating income through Falcon's market-neutral strategies (funding rate arbitrage, cross-exchange trading, native staking, and liquidity provision).

· Resolv Labs (USR – $216 million): Fully supported by an ETH collateral pool, with ETH price risk hedged through perpetual futures, and assets managed by off-chain custodians.

· Elixir (deUSD – $172 million): Uses stETH and sDAI as collateral, creating delta-neutral positions by shorting ETH and capturing positive funding rates.

· Aster (USDF – $110 million): Supported by crypto assets and corresponding short futures on AsterDEX.

· Nultipli.fi (xUSD/xUSDT – $65 million): Earns income through market-neutral arbitrage on centralized exchanges (CEXs), including contango arbitrage and funding rate arbitrage.

· YieldFi (yUSD – $23 million): Supported by USDC and other stablecoins, with income derived from delta-neutral strategies, lending platforms, and yield trading protocols.

· Hermetica (USDh – $5.5 million): Supported by delta-hedged Bitcoin, earning funding fees through short perpetual futures on major centralized exchanges.

3. Lending/Debt Support Type

These stablecoins generate returns by lending out deposits, collecting interest, or through stability fees and liquidation profits from collateralized debt positions (CDPs).

· Sky (DAI – $5.3 billion): Based on CDPs (Collateralized Debt Positions). Minted by collateralizing ETH (LSTs), BTC LSTs, and sUSDS on @sparkdotfi. USDS is an upgraded version of DAI, used to earn income through the Sky Savings Rate and SKY rewards.

· Curve Finance (crvUSD – $840 million): Over-collateralized stablecoin, supported by ETH and managed through LLAMMA, maintaining its peg through Curve's liquidity pools and DeFi integrations.

· Syrup (syrupUSDC – $631 million): Supported by fixed-rate loans provided to crypto institutions, with income managed by @maplefinance's credit underwriting and lending infrastructure.

· MIM_Spell (MIM – $241 million): Over-collateralized stablecoin, minted by locking yield-bearing cryptocurrencies into Cauldrons, with income from interest and liquidation fees.

· Aave (GHO – $251 million): Minted through collateral provided in the Aave v3 lending market.

· Inverse (DOLA – $200 million): Debt-supported stablecoin minted through collateralized lending on FiRM, with income generated by staking into sDOLA, which earns from lending income.

· Level (lvlUSD – $184 million): Supported by USDC or USDT deposited into DeFi lending protocols (such as Aave) to generate income.

· Beraborrow (NECT – $169 million): Berachain native CDP stablecoin, supported by iBGT. Income generated through liquidity stability pools, liquidation profits, and PoL incentives for leverage enhancement.

· Avalon Labs (USDa – $193 million): A full-chain stablecoin, minted using assets like BTC through the CeDeFi CDP model, providing fixed-rate lending and generating income through staking in the Avalon treasury.

· Liquity Protocol (BOLD – $95 million): Supported by over-collateralized ETH (LSTs), generating sustainable income through interest payments from borrowers and ETH liquidation profits obtained through its Stability Pools.

· Lista Dao (lisUSD – $62.9 million): Over-collateralized stablecoin on the BNB Chain, minted through CDPs using BNB, ETH (LSTs), and stablecoins as collateral.

· f(x) Protocol (fxUSD – $65 million): Minted through leveraged xPOSITIONS supported by stETH or WBTC, with income derived from stETH staking, opening fees, and stability pool incentives.

· Bucket Protocol (BUCK – $72 million): Over-collateralized CDP-supported stablecoin based on @SuiNetwork, minted by collateralizing SUI.

· Felix (feUSD – $71 million): A Liquity fork CDP on @HyperliquidX. feUSD is an over-collateralized CDP stablecoin, minted using HYPE or UBTC as collateral.

· Superform Labs (superUSDC – $51 million): A USDC-backed treasury that automatically rebalances on Ethereum and Base among top lending protocols (Aave, Fluid, Morpho, Euler), supported by Yearn v3.

· Reserve (USD3 – $49 million): Backed 1:1 by a basket of blue-chip yield-bearing tokens (pyUSD, sDAI, and cUSDC).

4. Mixed Source of Income Type (Combining DeFi, Traditional Finance, and CeFi Returns)

These stablecoins diversify risk and optimize returns by combining multiple strategies.

· Reservoir (rUSD – $230.5 million): An over-collateralized stablecoin supported by a combination of RWAs and dollar-based capital allocators and lending treasuries.

· Coinshift (csUSDL – $126.6 million): Supported by T-Bills and DeFi lending through Morpho, providing regulated low-risk returns via a treasury curated by @SteakhouseFi.

· Midas (mEGDE, mTBILL, mMEV, mBASIS, mRe7YIELD – $110 million): A compliant institutional-grade stablecoin strategy. LYT represents claims on actively managed yield-bearing RWAs and DeFi strategies.

· Upshift (upUSDC – $32.8 million): Yield-bearing and partially supported by lending strategies, but income also comes from LP (liquidity provision) and staking.

· Perena (USD* - $19.9 million): A Solana-native yield-bearing stablecoin, core to the Perena AMM, earning income through swap fees and IBT-driven liquidity pools.

Summary

The above highlights yield-bearing stablecoins with a total supply of around $20 million or more, but keep in mind that all yield-bearing stablecoins come with risks. Returns are not without risk; they may face smart contract risks, protocol risks, market risks, or collateral risks, among others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。