**The US dollar faces the most severe trust crisis in twenty years, while *BTC* ETF has seen significant net inflows over the past two months. Why does it continue to oscillate in the $100,000 to $110,000 range?**

Macro Interpretation: The latest global fund manager survey from Bank of America reveals that investors have a net underweight position in the US dollar of up to 31%, marking the most extreme bearish record in 20 years. This signal resonates with research from the World Gold Council, which indicates that over 70% of central banks expect the dollar's share in global reserves to continue declining over the next five years. When extending the timeline, the dollar's status as the world's core reserve currency is facing systemic challenges, and this trend is creating historic opportunities for crypto assets.

The Federal Reserve's monetary policy has always been a market barometer, but the current environment highlights its decision-making dilemma. The "Fed's megaphone" suggests that if it weren't for the inflation concerns stemming from the Trump administration's tariff policies, interest rate cuts would already be on the agenda. Analysis from the German Central Cooperative Bank further confirms that despite strong economic data, price pressures remain, forcing the Fed to maintain interest rates in the 4.25%-4.50% range while observing. This policy stalemate exacerbates expectations of dollar liquidity contraction, prompting funds to accelerate their search for alternative assets.

Geopolitics has become the biggest gray rhino in the market. Israel's strikes on Iranian nuclear facilities have caused short-term damage, but assessments from US intelligence agencies show that Iran's nuclear weapons development has only regressed by a few months, and the Fordow uranium enrichment facility remains operational. More concerning is the Trump administration's attempt to "completely resolve the Iranian nuclear issue," which could escalate tensions in the Middle East. Historical experience indicates that geopolitical crises often drive capital towards anti-inflation assets, and the performance of Bitcoin and gold may diverge, with potential for increased correlation later.

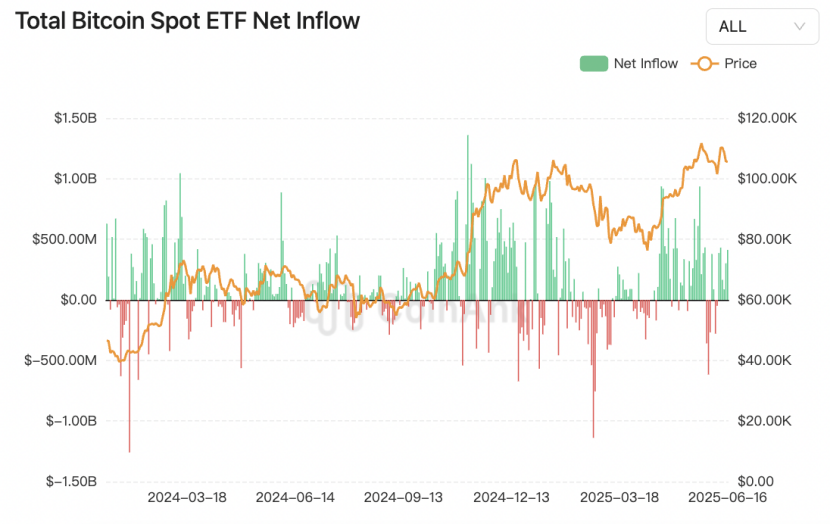

Bitcoin ETFs have become the core vehicle for this round of capital migration. According to CoinAnk data, Bitcoin ETFs recorded a net inflow of $11.2 billion over the past eight weeks, yet the price has only moderately increased by 10%. This seemingly contradictory phenomenon actually hides a mystery: stable institutional buying is building price support at the bottom, while the limited short-term gains reflect tactical operations of "selling on rallies" in the market. Notably, although the pace of accumulation by traditional buyers like Strategy has slowed, the resilience of continued net inflows into ETFs indicates that Bitcoin is transitioning from a fringe speculative asset to a mainstream allocation asset.

The evolution of Bitcoin's underlying network also impacts market logic. Institutional reports warn that Bitcoin mining costs are expected to exceed $70,000 in Q2 2025, a 9.4% jump from $64,000 in Q1. This cost surge primarily stems from two major drivers: the intensifying global competition for computing power pushing the network's hash rate to new highs, and rising energy prices—leading mining company Terawulf's energy expenditures have already doubled year-on-year. The historic rise in mining costs means that Bitcoin's valuation floor will be restructured, with $70,000 potentially becoming a key psychological defense line in the new cycle.

The current crypto market presents a triple contradiction: 1. The weakening of dollar credit and the institutionalization of Bitcoin form a hedging logic; 2. Soaring mining costs force a reevaluation of value, but short-term volatility suppresses price discovery; 3. Geopolitical black swans generate demand for safe-haven assets, yet are constrained by regulatory uncertainties.

In this complex ecology, Bitcoin's "digital gold" attribute is being repriced. The delay in the Fed's policy shift, the loosening of the dollar's reserve status, and the rigid rise in physical mining costs collectively build long-term value support for Bitcoin. For short-term traders, the sustainability of ETF fund inflows will become a key indicator for observing market sentiment—when the $11.2 billion incremental capital only drives a 10% increase, it indicates that the market needs stronger catalysts to break the balance.

Interestingly, the boundaries between the traditional financial system and the crypto world are dissolving. When central banks begin to question the dollar's reserve status, when sovereign funds allocate Bitcoin through ETFs, and when mining costs become a valuation benchmark, the crypto market is no longer an isolated speculative battlefield. In the monetary system upheaval of 2025, Bitcoin may be becoming an important ballast for the new order.

BTC Data Analysis:

CoinAnk data shows that Bitcoin ETFs recorded a net inflow of $11.2 billion within two months, but during the same period, the price only slightly climbed by 10%, maintaining oscillation in the $100,000 to $110,000 range. This phenomenon reveals deep structural changes in the market: stable institutional capital inflow provides solid bottom support for the price, while the limited short-term gains reflect a clear "selling on rallies" strategy in the market, with some investors choosing to take profits when prices rise. Notably, although traditional large buyers have slowed their accumulation pace, the ability of ETFs to continuously attract capital highlights that Bitcoin is transitioning from a high-risk speculative target to a mainstream allocation asset.

From a market impact perspective, this divergence between capital and price underscores the maturation process of the crypto market. On one hand, the sustained inflow into ETFs validates the long-term allocation demand of institutional capital under a regulatory framework, enhancing market stability; on the other hand, short-term selling pressure arises from miners' operational capital needs post-halving and retail investors' sensitivity to high-interest environments, creating a balance of long and short positions. In the medium to long term, the ETF channel allows Bitcoin to gain broader asset recognition, but the market still needs to digest short-term profit-taking and macro policy uncertainties (such as the Fed's interest rate cut pace), which may keep volatility high until new catalytic factors break the balance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。