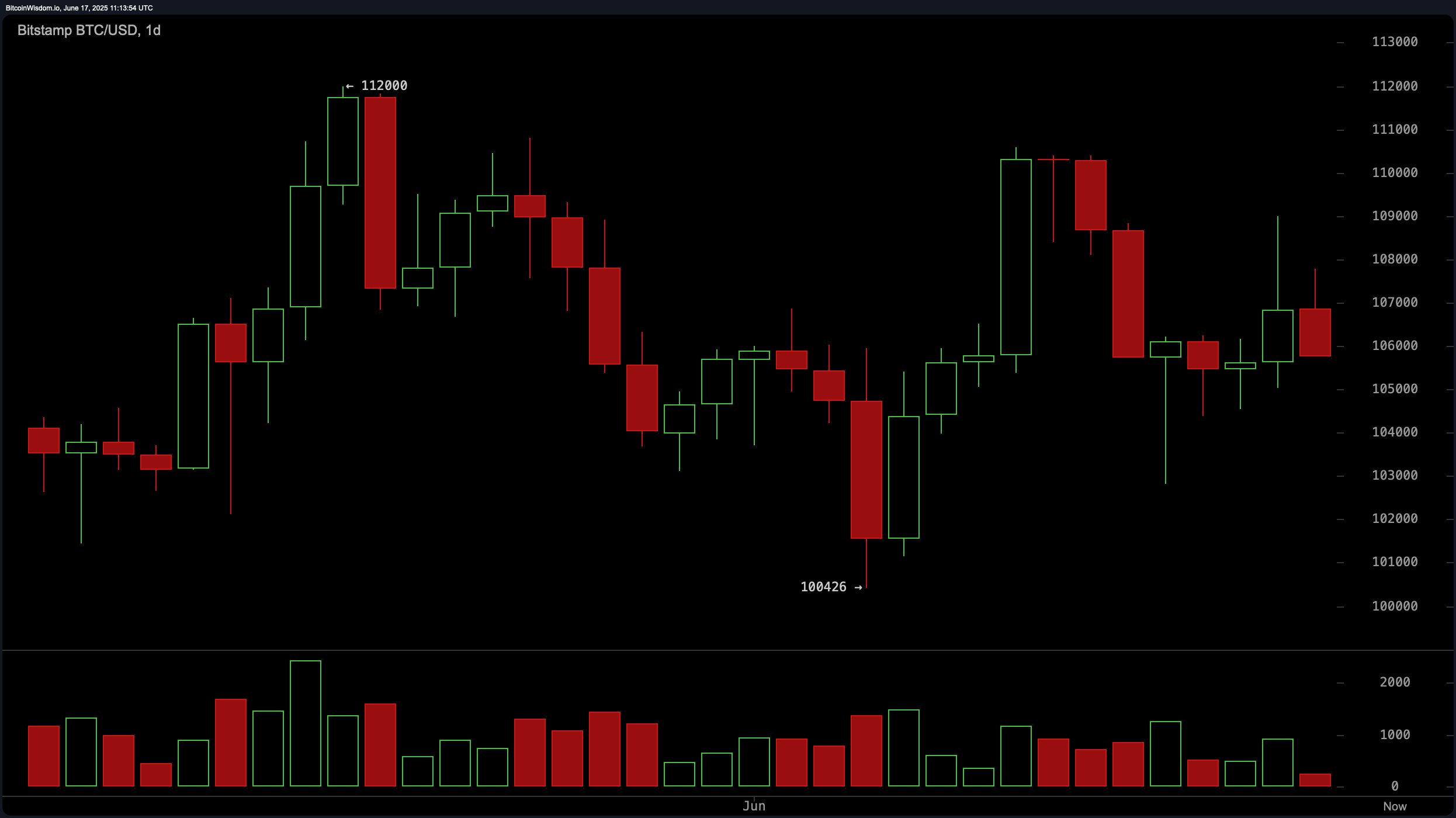

Bitcoin’s daily chart reveals a bearish undertone. After peaking at $112,000, a notable rejection ensued, highlighted by a sharp red candlestick and a shift toward lower highs. Strong buyer defense appears near $100,426, establishing key support. Conversely, the $110,000 to $112,000 resistance band has repeatedly repelled upward movements. Volume surges during sell-offs point to distribution, indicating large players offloading positions.

BTC/USD daily chart via Bitstamp on June 17, 2025.

The 4-hour chart displays a weaker bullish structure transitioning toward bearish sentiment. Bitcoin recently bounced from $102,816 but has been unable to maintain momentum above $109,000. Lower high formations are emerging, a signal of waning bullish strength. Bearish volume near local tops supports the view of distribution. If bitcoin prints a double bottom or bullish divergence between $103,000–$104,000, a bullish opportunity could emerge. On the other hand, a rejection near $108,500–$109,000 would affirm selling pressure.

BTC/USD 4-hour chart via Bitstamp on June 17, 2025.

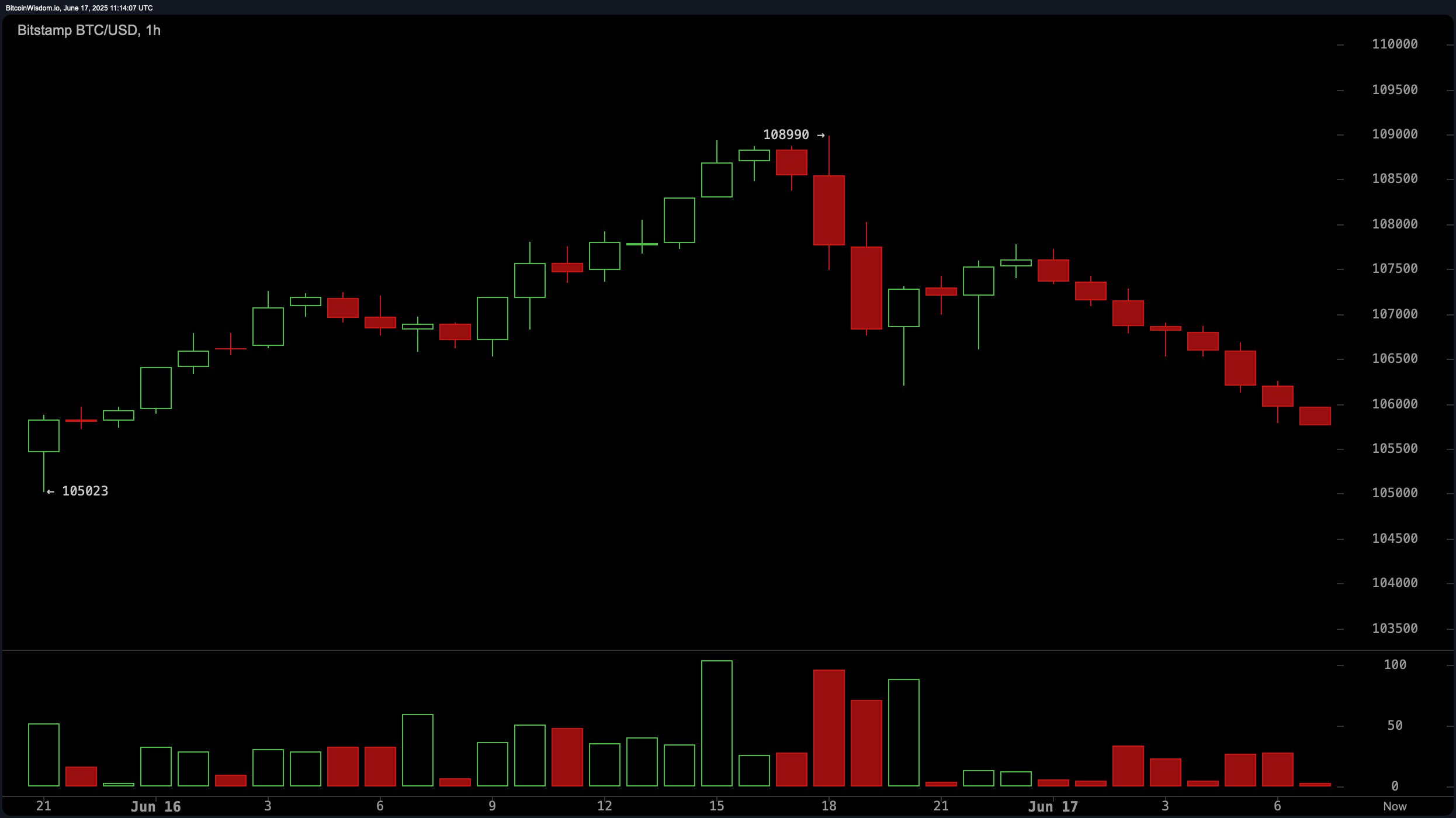

On the hourly chart, bitcoin has entered a short-term downtrend. The local high of $108,990 has been followed by consistently lower highs, and the price has recently tested support around $105,000. Momentum favors sellers, with increasing volume accompanying the sell-offs. Scalp traders might consider buying around $105,000–$105,200 if a strong bounce occurs while shorting could be viable near $107,000–$107,500, especially if price action exhibits bearish reversal patterns such as shooting stars or bearish engulfing candles.

BTC/USD 1-hour chart via Bitstamp on June 17, 2025.

Oscillator data lends additional nuance, showing overall neutrality with a lean toward bearish sentiment. The relative strength index (RSI) stands at 50, the stochastic oscillator at 55, and the commodity channel index (CCI) at 29—all signaling neutral sentiment. However, momentum at 154 and the moving average convergence divergence (MACD) level at 626 both suggest bearish divergence, with corresponding negative signals. The average directional index (ADX) at 16 implies weak trend strength, reinforcing the short-term consolidation narrative.

Moving averages (MAs) offer a mixed outlook. Shorter-term indicators—such as the 10-period exponential moving average (EMA) at $106,327 and simple moving average (SMA) at $107,054—suggest bearish alignment. The 20-period and 30-period EMAs and SMAs are also bearish with the exception of the 30-period EMA. Conversely, longer-term averages, from the 50 to 200-period EMAs and SMAs, are bullish, suggesting structural support remains intact over a wider horizon. This divergence underscores the importance of tactical positioning, with short-term traders favoring downside plays and long-term holders remaining cautiously optimistic.

Bull Verdict:

Despite short-term bearish signals, long-term moving averages continue to support a broader uptrend. If bitcoin can hold above the $105,000 level and attract renewed buying interest near the $103,000–$104,000 range, a sustained bounce toward the $110,000 resistance could pave the way for a retest of the $112,000 peak, maintaining the bullish macrostructure.

Bear Verdict:

Technical indicators on lower timeframes point toward growing seller dominance, with repeated rejections below $109,000 and bearish volume spikes. Should bitcoin fail to defend the $105,000–$104,000 support and momentum remain negative, a drop toward $100,500 or lower becomes likely, confirming a broader distribution phase and the start of a deeper correction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。