Today (June 17 local time), a significant development in American history occurred—the U.S. Senate passed the GENIUS Act. This act will establish a clear federal regulatory framework for U.S. dollar-backed cryptocurrencies (i.e., "stablecoins"). The bill will next be submitted to the House of Representatives and President Trump for approval, and if passed smoothly, it will officially take effect.

Key Provisions of the GENIUS Act

The core content of the act is to establish a federal framework for the issuance of U.S. dollar-backed stablecoins, with the main provisions including:

1:1 Asset Backing: Each stablecoin must be fully backed by high-quality, liquid reserve assets, such as U.S. dollar cash, insured bank deposits, short-term U.S. Treasury securities, or other safe assets. Issuers must hold at least one dollar in compliant reserves for each stablecoin issued. For issuers with a circulation exceeding $50 billion, monthly reserve disclosures and audits are required.

Tiered Regulation for Issuers: The GENIUS Act adopts a tiered regulatory strategy based on the size of the issuer. Large issuers that issue more than $10 billion in stablecoins will be subject to federal regulation; smaller issuers may choose to be regulated by state-level authorities.

Prohibition of Algorithmic Stablecoins: The act explicitly prohibits so-called "algorithmic stablecoins"—tokens that rely on algorithms or internal crypto assets to maintain value rather than physical collateral.

No Yield Payments: Payment stablecoins are not allowed to pay interest, dividends, or any form of yield to holders. Offering yields could blur the lines between stablecoins and savings-type financial products, raising regulatory and financial stability concerns.

Not Securities or Commodities: The act amends existing securities laws to clarify that compliant payment stablecoins do not fall under the categories of securities or commodities. This provision addresses regulatory uncertainty regarding the classification of stablecoins. Stablecoin issuers will be regulated by the Office of the Comptroller of the Currency (OCC), the Federal Reserve, the FDIC, the NCUA, and state regulatory agencies.

Bankruptcy Protection: In the event of bankruptcy, the claims of stablecoin holders will take precedence over those of other creditors.

Why This Matters

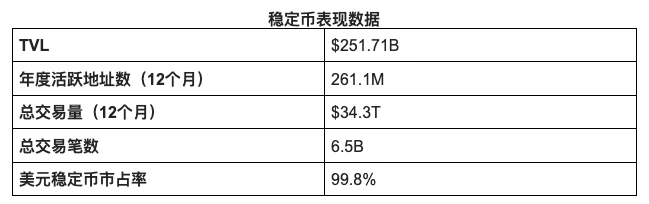

Stablecoins are no longer merely crypto-native assets but are becoming increasingly critical infrastructure in global financial activities. The total market capitalization of stablecoins has surpassed $250 billion, primarily dominated by Tether and Circle. Circle recently went public on the New York Stock Exchange, reaching a market capitalization of $37 billion, with its stock price rising over 400% since the listing, reflecting high market expectations for the mainstream adoption of stablecoins and highlighting the positive impact of clear regulation on issuers like Circle.

Stablecoins are deeply embedded in the global payment ecosystem, with annual transaction volumes exceeding $30 trillion and active addresses reaching 261 million.

Data Source: rwa.xyz, DeFi Llama, Visa On-Chain Analytics

A recent survey by Coinbase showed that 81% of small and medium-sized businesses (SMBs) familiar with cryptocurrencies are interested in using stablecoins. The number of Fortune 500 companies planning to adopt or explore stablecoins has more than tripled compared to 2024.

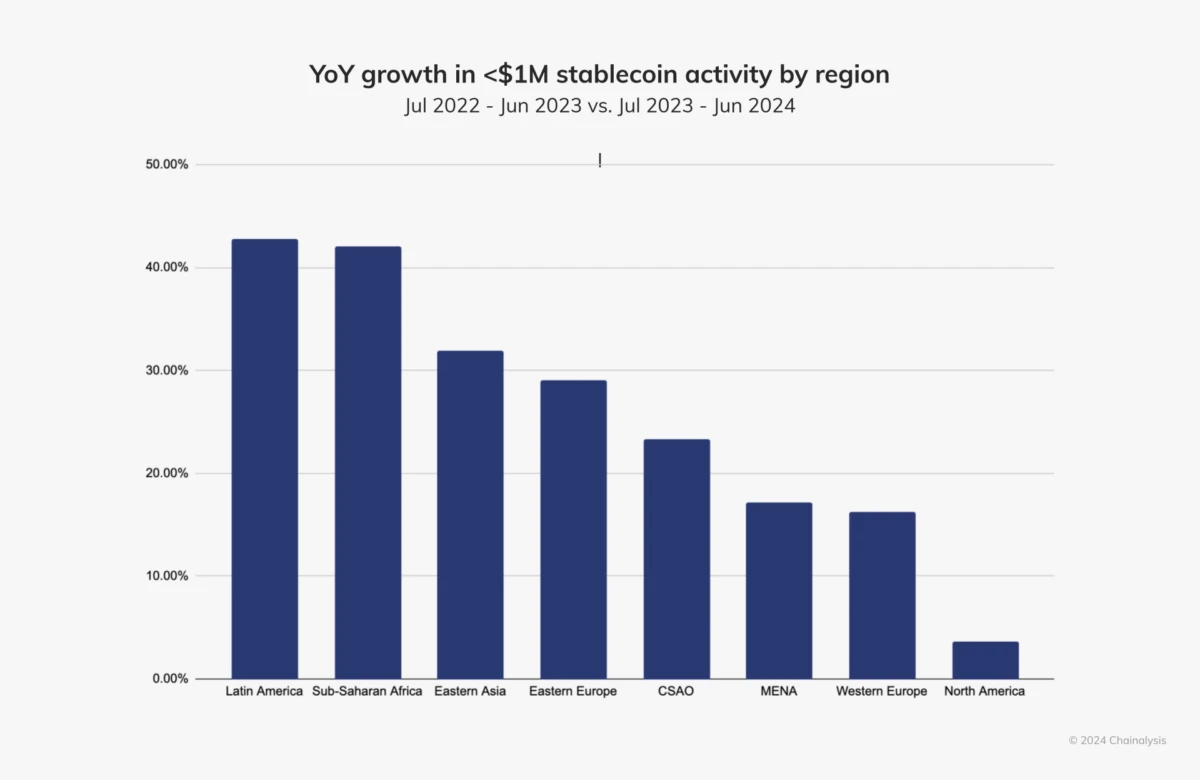

In emerging markets, the adoption of stablecoins is also accelerating. In regions with significant currency volatility, stablecoins provide an alternative means. According to Chainalysis's 2024 stablecoin report, Latin America and Sub-Saharan Africa lead the world in retail and professional-grade stablecoin transfers, with annual growth rates exceeding 40%; East Asia and Eastern Europe follow closely, with growth rates of 32% and 29%, respectively.

Source: Chainalysis

The European Union (through MiCA), Singapore (Payment Services Act), and Hong Kong (Stablecoin Act) have all made clear progress in stablecoin regulation. The U.S. has previously been hindered by political divisions, delaying the establishment of clear policies.

However, the passage of the GENIUS Act in the Senate may break this deadlock.

Impact on Investors, Startups, and the Industry Ecosystem

Regulated Stablecoins: U.S. stablecoin issuers like Circle and Paxos will benefit from regulatory legitimacy, opening the door for compliant institutional funds to flow into on-chain payment sectors. The act requires stablecoins to be backed by cash or U.S. Treasury securities, which will solidify the positions of these mainstream compliant issuers, while unregulated issuers that provide illegal currency backing or promise yields may exit the U.S. market. However, the requirement of "no yield payments" may also force Circle to change its marketing strategy. Currently, Circle shares revenue with Coinbase, which serves as a significant distribution channel for USDC.

Offshore Stablecoins: The era of regulatory arbitrage for offshore stablecoins is coming to an end. The GENIUS Act imposes heavy penalties on unregulated offshore issuers. As the largest stablecoin by market capitalization, Tether (USDT) may face significant challenges in the future if it does not register with the OCC, similar to the situation it encountered in Europe. However, USDT's moat remains strong and is unlikely to be replaced in the short term. Moreover, Tether may seek to re-enter the U.S. market by issuing a new compliant U.S. dollar stablecoin.

Fintech Companies: This act also signifies that U.S. crypto legislation is gradually moving away from a phase of "relying solely on enforcement" to structured policy-making. Stablecoins are on the path to becoming legitimate financial vehicles, which will not only drive retail user adoption but also attract more capital. For example, Stripe is accelerating its layout in the stablecoin sector through acquisitions: it acquired payment infrastructure platform Bridge for $1.1 billion in February and recently acquired wallet service provider Privy. Although tech giants like Meta are not prohibited from issuing stablecoins, they will face strict compliance requirements and special scrutiny, which may actually benefit the development space for startups.

What’s Next?

House Review and Potential Amendments: Although the Senate's passage is crucial, it is just one step in the legislative process. The focus now shifts to the U.S. House of Representatives. Currently, the momentum for stablecoins is strong, but we should pay attention to potential amendments that the House may propose. Any changes could impact the future landscape of stablecoins.

Regulatory Details and Implementation: While the GENIUS Act establishes an overall framework for stablecoin issuance, specific rules regarding capital adequacy, liquidity, risk management, and more still need to be developed by regulatory agencies. We need to observe how the Federal Reserve, OCC, FDIC, FinCEN, and other regulatory bodies will translate this framework into specific rules. Additionally, the actions of states under this regulation will also be another point of interest.

References:

https://www.coinbase.com/en-sg/blog/the-state-of-crypto-the-future-of-money-is-here

https://bitcoinmagazine.com/news/u-s-senate-passes-stablecoin-bill-the-genius-act

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。