Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Previous Records

Lazy Financial Strategy | Huma 2.0 Reopens; BounceBit Launches USD1 Incentive Activity (June 9);

Old Mining Follow-up

Sonic Season 2 Airdrop Starts

The Sonic Season 1 Airdrop will end on June 18, with Season 2 starting on the same day, seamlessly connecting to Season 1.

Regarding the specific mechanism of the Sonic airdrop, we provided a detailed breakdown last week in the article "Detailed Explanation of Sonic Airdrop Mechanism: Can Season 1 Make Up for Missed Opportunities? How to Improve Efficiency in Season 2?." In short, Season 2 cancels the passive points for static asset holding; users will need to actively deploy assets in designated applications within the Sonic ecosystem to earn active points.

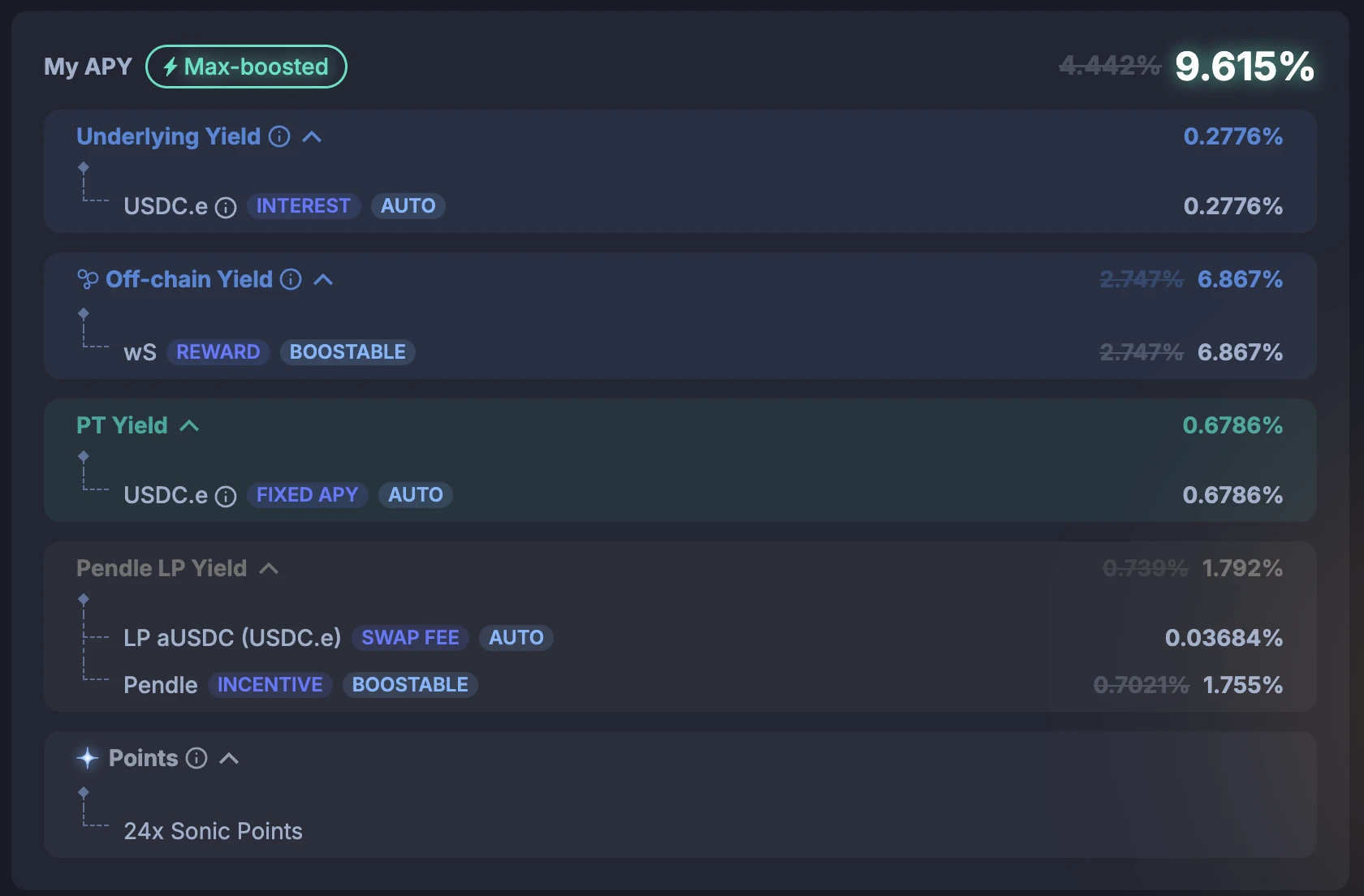

From the perspective of security and efficiency, users can mindlessly choose to use Aave for USDC circular loans (0.31% base yield + 5% additional incentive + 12 times Sonic points), or provide LP in the Pendle aUSDC pool (4.44% base yield, which can be amplified to 9.615% with sufficient PENDLE staking, plus 24 times Sonic).

New Opportunities

Hyperdrive Mining

On June 17, Hyperliquid's stablecoin funding market Hyperdrive officially announced the launch of its first season points program, allowing users to deposit USDT0 (5.89%) or USDe (4.64%) along with HYPE to earn yields while accumulating Hyperdrive points.

In May of this year, Hyperdrive announced the completion of a $6 million Series A financing round, led by Hack VC and Arrington Capital, with participation from Delphi Ventures, Proof Group, SIG, Caladan Group, Amber Group, CMS Holdings, Breed VC, and several angel investors. The project aims to create a stablecoin money market and yield hub on the Hyperliquid blockchain, providing functions such as stablecoin lending and borrowing, liquid staking of HYPE, and one-click yield strategies.

Although Hyperdrive's yield rates may not seem outstanding numerically at present, as one of the few DeFi projects within the Hyperliquid ecosystem backed by well-known institutions, there is still some potential for imagination regarding Hyperdrive's points, leveraging Hyperliquid's momentum.

- Portal: https://app.hyperdrive.fi

infiniFi Integrates Pendle

In the article from June 4, we mentioned that the stablecoin yield protocol infiniFi, which completed a $3 million funding round in February, has officially launched.

Last week, infiniFi announced that it has completed integration with Pendle, allowing users to provide LP for iUSD within Pendle, earning an 8.613% base yield (which can be amplified to 11.43% with sufficient PENDLE staking) while accumulating points at a rate of 4.5 times — significantly improving point efficiency compared to directly staking or locking in the protocol.

- infiniFi Portal: https://app.infinifi.xyz

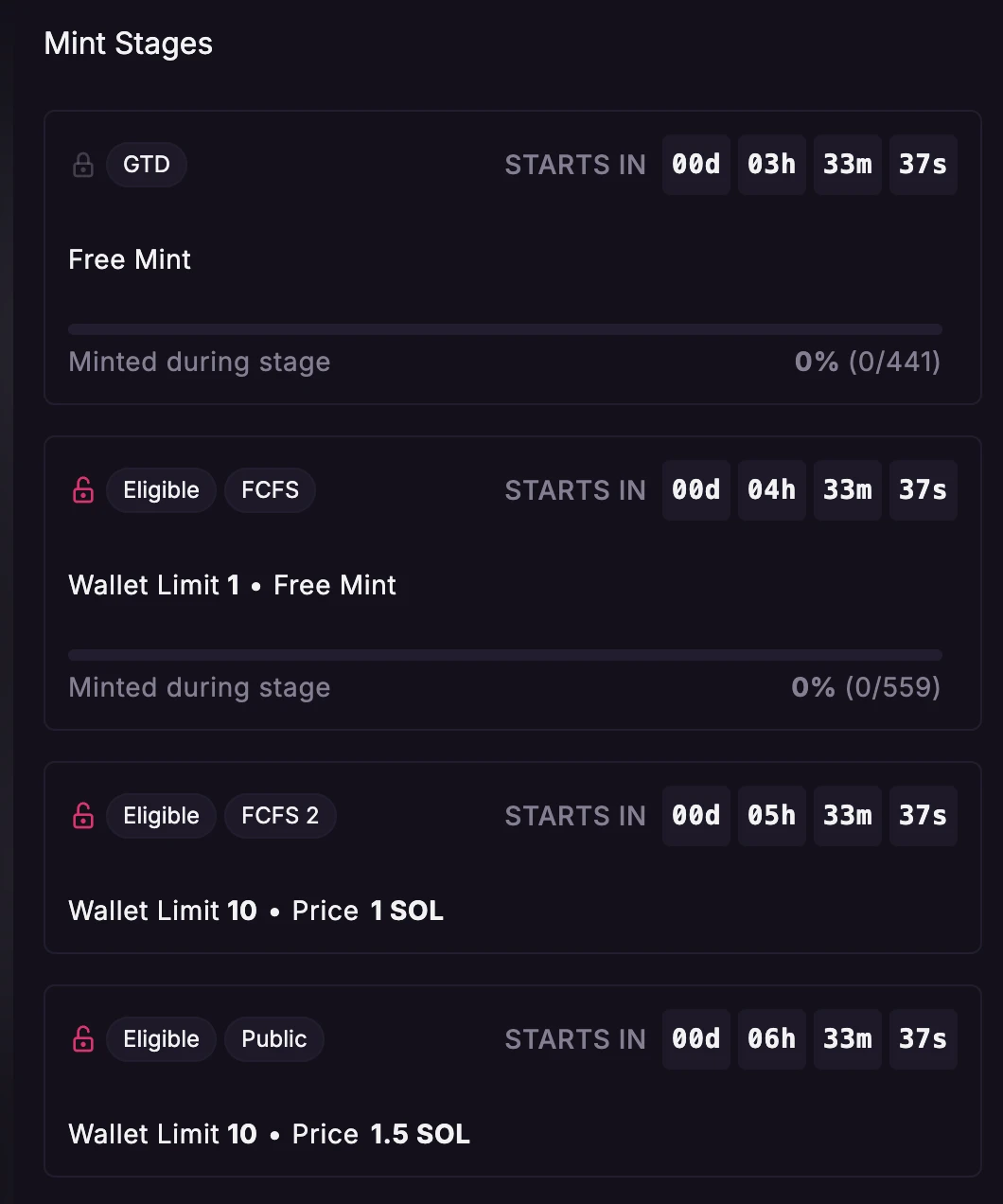

Fragmetric NFT "Freebie" Check

The Solana ecosystem's re-staking project Fragmetric will launch the NFT series TOPU on MagicEden tonight, with a total of 10,000 TOPU, which is expected to yield a 0.75% allocation of Fragmetric tokens based on previous disclosures from the collaborating community.

We have previously recommended several financial and point opportunities on Solana, such as Exponent, Loopscale, RateX, etc. Fragmetric has allocated a certain whitelist share to these collaborating projects, which have distributed the whitelist to the community through point rankings and other methods. After the TOPU development minting tonight, whitelist users will have the opportunity to mint for free.

I checked my main account participating in RateX and Loopscale, and I can access the second phase of the whitelist (qualification not guaranteed, first come first served). Friends who have previously participated in the above projects can also check their eligibility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。