Whether you are a long-term holder looking to make BTC "move" or a DeFi player pursuing high returns, Echo can provide a one-stop experience.

Written by: Deep Tide TechFlow

The global landscape remains uncertain, with various asset speculation methods emerging. As a financial asset that attracts global attention, cryptocurrency has become the current version of a warlord in chaotic times. Not only are diamond-handed players quietly hoarding coins, but large institutions are also entering the market one after another. For publicly listed companies, "buying Bitcoin" has become a wealth code to join the global trend.

As more people gradually realize the value of BTC, it has begun a sustained bull market of its own. Regardless of market fluctuations, BTC holders have once again been rewarded by the market. Of course, the model of hoarding coins is like locking gold bars in a safe—secure, but lacking a bit of vitality. BTC holders also have such a need: how to make BTC generate profits safely without selling it?

The answer lies in the continuously innovating BTC staking protocols. Echo Protocol, as a star protocol in the Aptos ecosystem for BTCFi, injects new vitality into BTC through cross-chain staking and diversified yield mechanisms. It seamlessly integrates BTC into a multi-chain ecosystem while providing users with a low-threshold, high-return DeFi experience through smart design.

In this article, we will take you deep into the core technological strength of Echo Protocol and explore how Echo brings multiple values of BTC staking to "ride the waves."

Outstanding data from the ecosystem, strength is not just "talk"

Echo is a multifunctional BTCFi protocol focused on the Move language ecosystem, primarily providing cross-chain, liquid staking, and re-staking services. Its goal is to bring BTC liquidity into the Move ecosystem and introduce innovative re-staking solutions for BTC assets. At the same time, Echo seamlessly integrates with the BTC ecosystem, supporting all native BTC Layer 2 solutions such as Babylon.

Data: Aptos is getting better, Echo is a backbone of the ecosystem

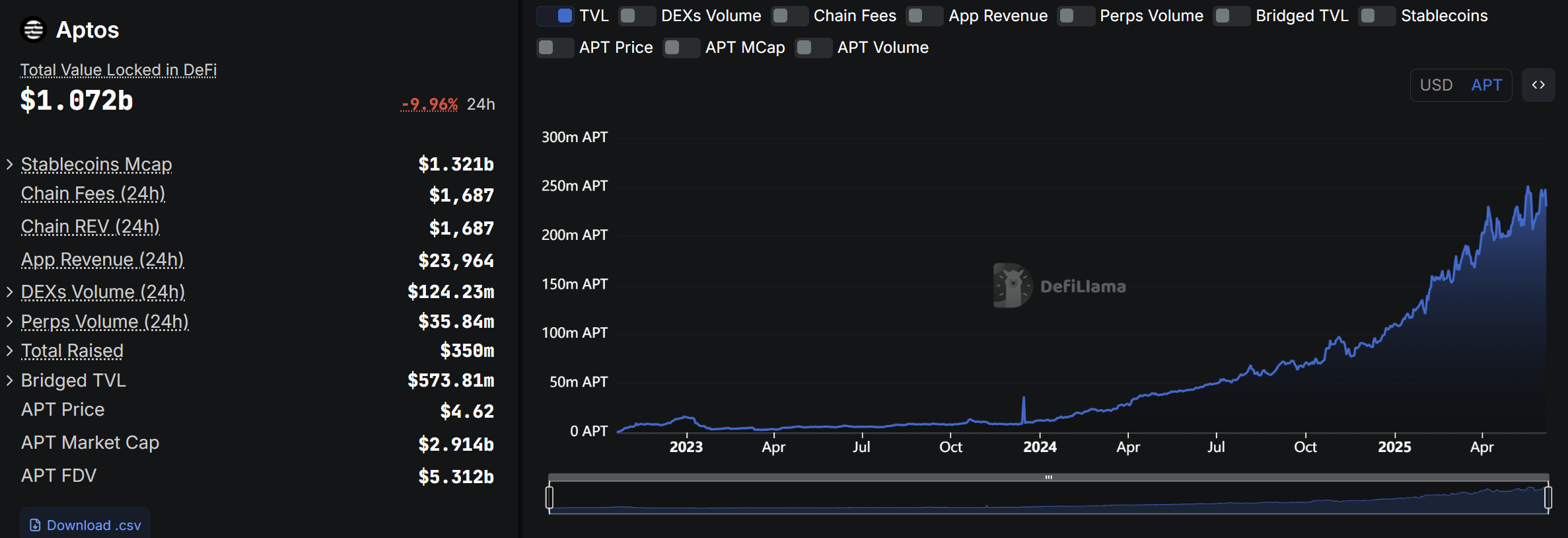

Although the market has always debated the price performance of APT, the data shows that the TVL of the Aptos ecosystem continues to rise, with the current total TVL exceeding $1 billion.

As one of the contributors to the growth of Aptos ecosystem TVL, Echo, which was launched less than a month ago, brought $147 million in TVL to the Aptos ecosystem last year, and now its $375 million TVL accounts for nearly 40% of Aptos's total TVL. Behind the data is the trust users have in Echo's staking mechanism. Whether they are long-term holders seeking stable returns or players wanting to experience DeFi, Echo provides a platform that meets multiple needs. Its success lies not only in technological innovation but also in understanding the hearts of BTC holders: safety and returns are both essential.

Team Background

Behind Echo is a low-profile yet powerful team. Core members have accumulated extensive experience in blockchain technology, DeFi product design, and financial engineering. The team's goal is clear: to ensure that BTC is no longer an "outsider" in the DeFi world. Although specific member information has not been fully disclosed, the team's professional background guarantees Echo's rapid iteration, supported by Spartan Group, ABCDE Capital ecosystem fund, and several top venture capital firms.

Security is the lifeblood of DeFi projects, and Echo has put significant effort into this aspect. It has undergone audits from several top institutions, including Zellic, Cyfrin, OtterSec, and Certik, with Certik having completed part of the audit, giving Echo a Skynet score of 80.47 and awarding the team verification and audit badges. The attitude of prioritizing security also tells users: your BTC is safe with Echo.

With a solid team background and impressive data performance, Echo has already achieved remarkable results in less than a year since its launch. Clearly, Echo is not just about "being a small and beautiful protocol."

However, what truly convinces the market is not superficiality; Echo's innovative technical architecture and flexible yield strategies are the real skills that capture market attention.

Three-layer architecture, making assets "come alive"

Echo Protocol's yield solution is a three-step process that provides BTC holders with efficient and secure staking solutions, standing out in its yield mechanism. It transforms BTC from a static asset into dynamic productivity.

Through the Permissionless Liquidity Layer, Yield Amplifier, and BTC LST Infrastructure Hub, the three-layer architecture is interconnected, allowing BTC holders to easily participate in DeFi activities across the Move ecosystem and other ecosystems while balancing security, liquidity, and yield.

- Permissionless Liquidity Layer

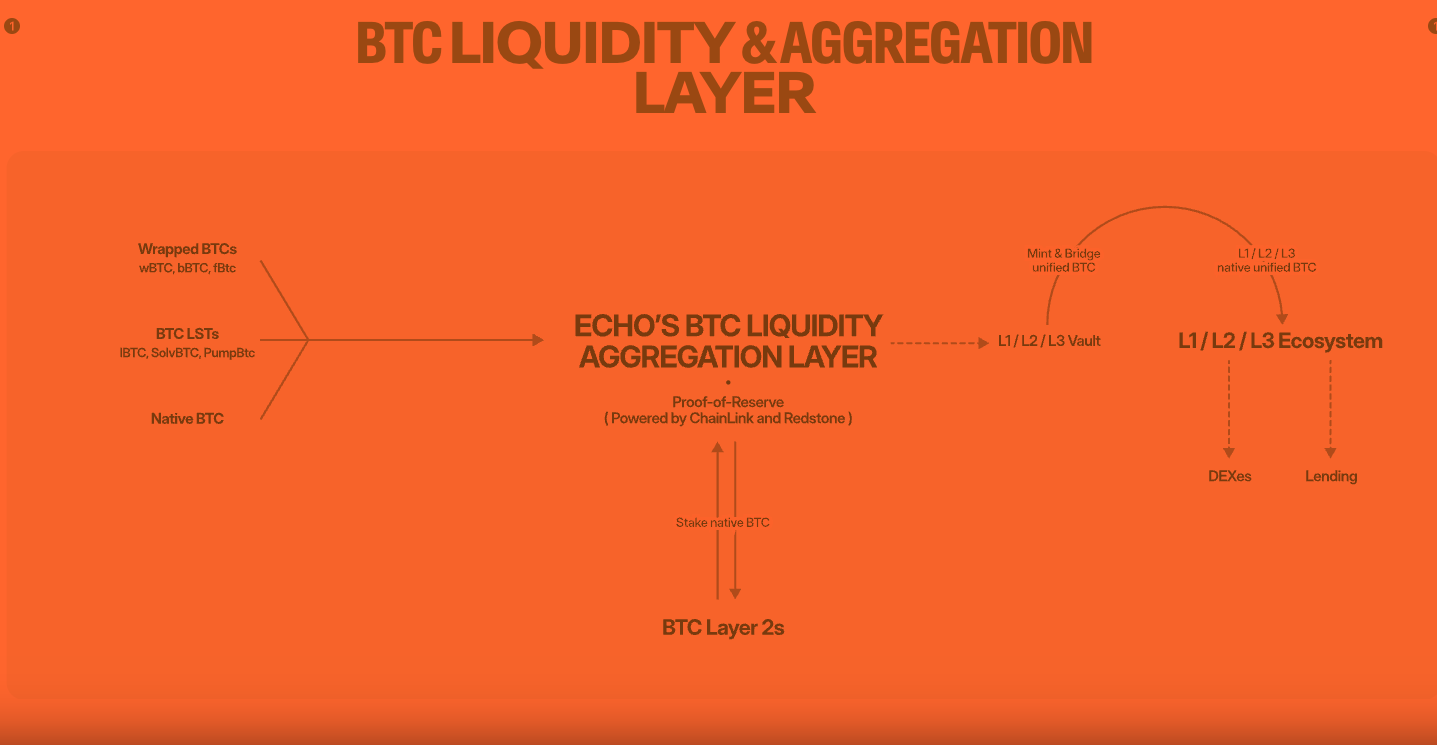

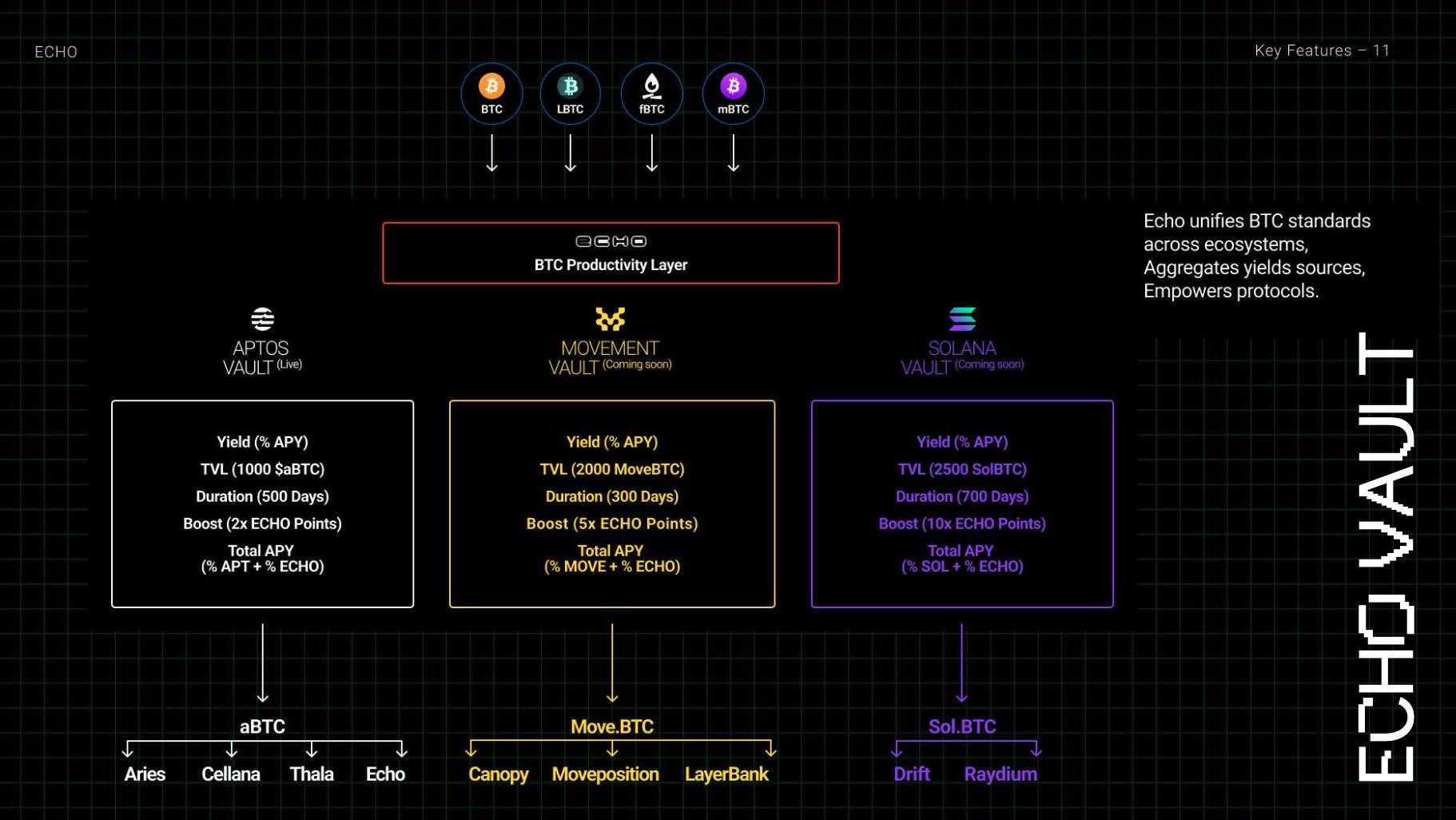

Due to network isolation, BTC has long struggled to directly participate in cross-chain DeFi, and different forms of BTC (LSTs, wBTC, etc.) are incompatible across chains, leading to fragmented liquidity. Echo's Permissionless Liquidity Layer acts like a "universal converter," packaging these BTC assets into a unified standard and achieving efficient cross-chain liquidity on Aptos, benefiting from Aptos's high performance with almost no delay.

In simple terms, Echo can issue a pass for different forms of BTC (native BTC, liquid staking tokens like B²'s uBTC, wrapped BTC like OKX's xBTC, BitGO's wBTC, Mantle's fBTC) assets, standardizing them into "Echo Unified BTC Assets."

Echo's Vault solution allows users to deposit various BTC assets in exchange for unified assets, directly participating in DeFi without relying on traditional BTC staking protocols. At the same time, Echo guides Aptos ecosystem liquidity to the liquidity aggregation layer: users can exchange aBTC for APT or borrow APT on Echo Lend by depositing aBTC. By staking borrowed or exchanged APT on Echo LST, users can earn staking rewards and receive eAPT, which can be used to protect other MoveVM chains or for Move DeFi protocols.

To ensure security, Echo collaborates with PoR (Proof of Reserve) service providers like Chainlink and Redstone, where every BTC asset deposited in the Vault undergoes strict due diligence (DD) and real-time PoR monitoring, ensuring a 1:1 peg and eliminating decoupling risks.

- Yield Amplifier

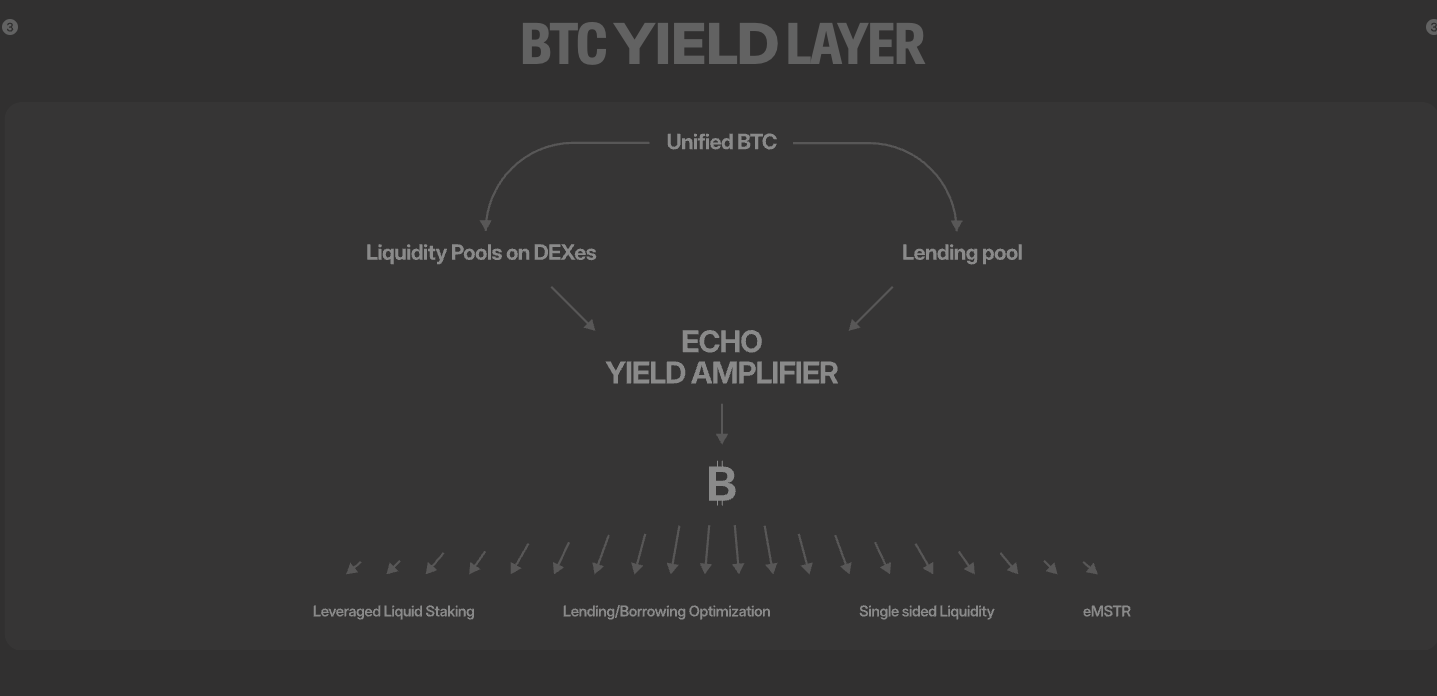

Traditional holding of BTC yields zero additional returns, while DeFi offers a dazzling array of annualized returns. Echo's Yield Amplifier uses smart algorithms and risk management to allocate users' BTC (or aBTC) to optimal yield scenarios, allowing them to enjoy long-term appreciation of BTC while also benefiting from DeFi.

Thus, this layer can be seen as Echo's "money tree," helping users maximize BTC returns through diversified yield strategies. The no-liquidation leverage of eMSTR and the secure custody of CeDeFi cater to a full spectrum of players from conservative to aggressive.

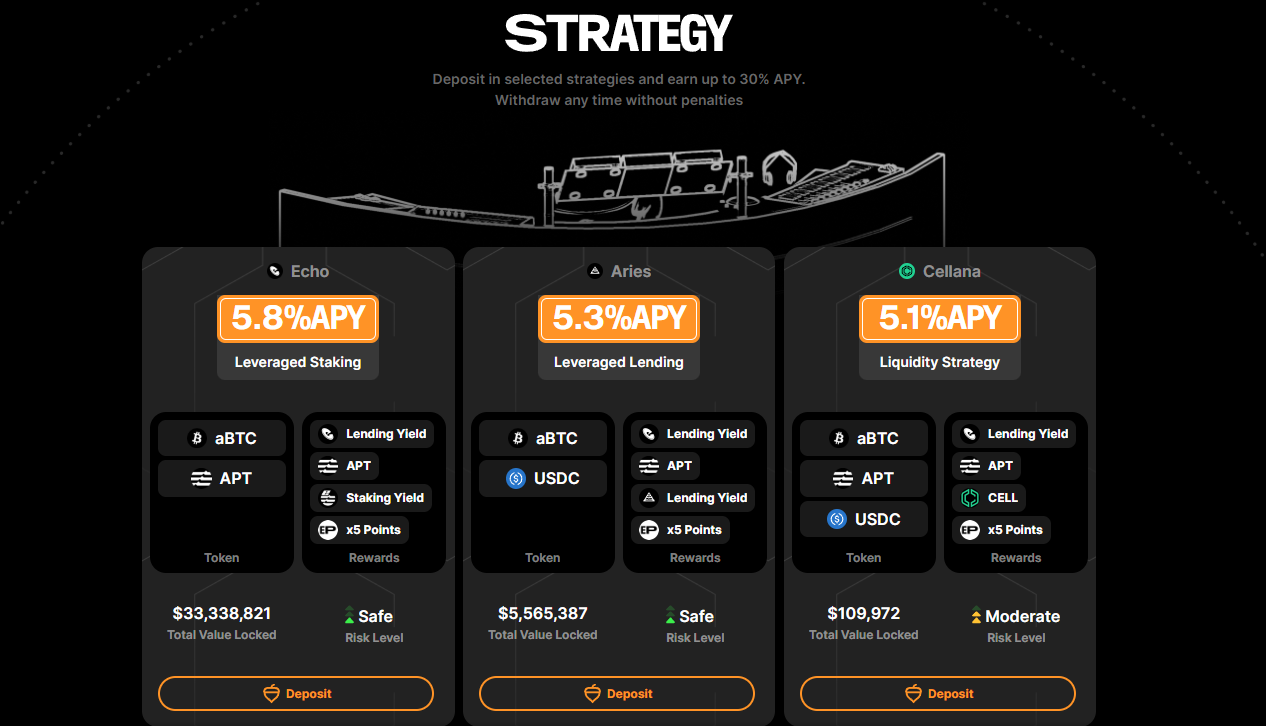

- Echo Strategy: This strategy integrates multiple DeFi protocols (such as lending platforms, liquidity pools), dynamically adjusting asset allocation to provide users with high-yield options like leveraged staking and optimized lending. In simple terms, it automatically invests users' assets into the highest-yielding protocols based on market conditions, acting like a 24/7 investment assistant that helps users earn money effortlessly.

eMSTR: eMSTR allows users to hold BTC exposure with at least 2.5 times leverage through low-cost convertible notes, with no liquidation risk at all. It combines with Web3 lending protocols to reduce capital costs (weighted average cost of capital, WACC), allowing your BTC to amplify returns without selling. In simple terms, eMSTR lets you enjoy the price appreciation of 2.5 BTC with the capital of 1 BTC, without worrying about forced liquidation.

CeDeFi: Utilizing Ceffu's custody infrastructure, it supports neutral trading strategies, balancing security and yield, allowing users to earn more on-chain with unified BTC.

Whether it's stable lending interest or high-risk, high-return vault investments, Echo can provide suitable options, and users can also earn Echo points in the yield layer to exchange for tokens in the future, increasing various forms of "passive income."

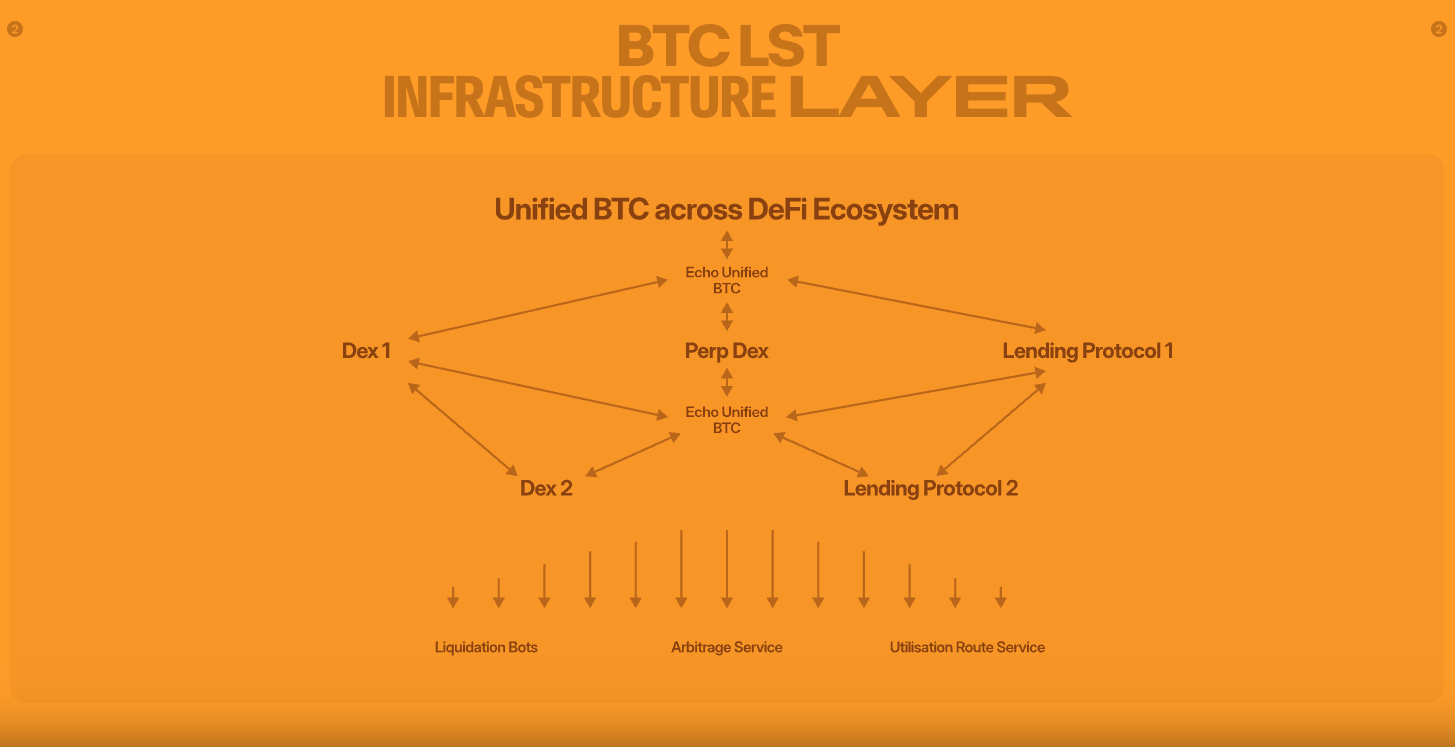

- BTC LST Infrastructure Hub

The charm of DeFi lies in its "composability"—assets and protocols can be combined like Lego blocks. However, if BTC's LST tokens cannot be compatible with other protocols, it means having potential but being unable to exert power.

BTC LST Infrastructure Hub is responsible for integrating liquid staking tokens (LSTs) into various DeFi scenarios. Whether it's lending, trading, or providing liquidity, Echo's hub ensures seamless connectivity between LSTs and protocols.

After staking BTC, the LST token you receive is your "receipt," proving your ownership of BTC while allowing you to use this "receipt" for other activities, such as lending or trading. Echo's hub acts like a DeFi dispatch center, ensuring that your LSTs (like aBTC) can be smoothly utilized across various protocols. The versatility of this infrastructure makes Echo an indispensable connection point between multiple ecosystems.

For example, if a user stakes 1 uBTC through Echo, they receive 1 aBTC. Now, if they want to earn some interest in the Aptos ecosystem, they can deposit aBTC into Echo VAULT to earn a 6% annualized return. A few days later, if there's a liquidity pool on a DEX in Solana with a higher yield, the user can directly exchange aBTC for SolBTC through Solana Vault via Echo, providing liquidity to the Solana DEX and earning a higher APY.

Compared to a simple staking platform, Echo Protocol is more like a ⌈BTC Value Release Layer⌋, and this positioning is not just empty talk. Through its unique three-layer architecture and cross-chain capabilities, it provides comprehensive support for BTC's applications in DeFi.

Looking back at the entire protocol architecture, Echo's cross-chain design is a consistent highlight mechanism. Traditional staking protocols are often limited to a single network, while Echo allows BTC to flow freely across multiple chains. Users can bridge LSTs generated from BTC Layer 2 solutions like Babylon to Echo's Vault, converting them into standardized assets. This process not only supports Aptos but also covers ecosystems like Movement and even extends to Solana.

Taking Aptos as an example, the high performance of the Move language enhances the staking experience on Echo. Transaction confirmation times are just a few seconds, and gas fees are extremely low. On Movement, Echo also leverages the high performance of the Move language to provide low-cost, highly flexible staking options. Users can switch networks freely based on market conditions, directing BTC wherever the yields are highest. This level of freedom makes Echo stand out in the cross-chain staking field.

Diverse yield mechanisms, practicality and variety coexist

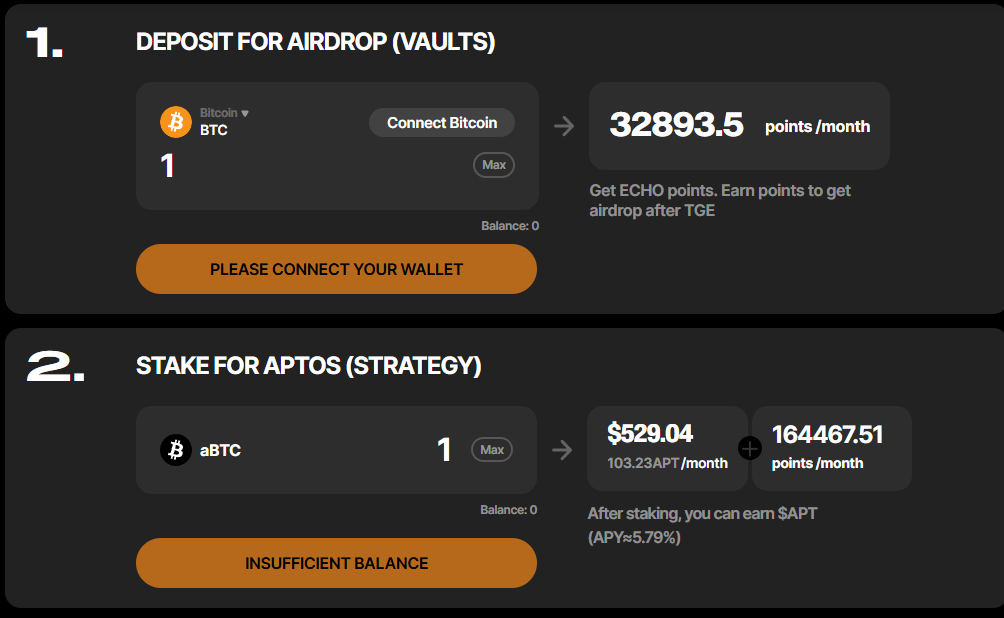

Echo's yield mechanism is designed to be both grounded and rich, fully considering the diverse needs of BTC holders. On Aptos, users can bridge BTC into aBTC, participate in lending or vault investments, and earn multiple returns.

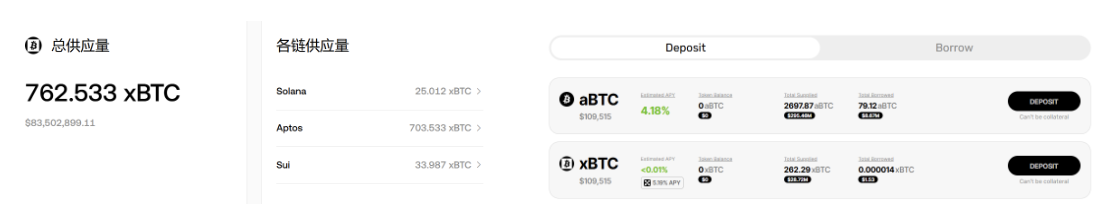

ECHO LENDING is the first choice for conservative players. By lending aBTC or other assets, users can earn an annual interest rate of 5%-8%, providing stable returns with controllable risks.

Multi-chain Vaults are tailored for high-yield enthusiasts, automatically allocating assets to high-quality DeFi protocols with returns of up to 30% APY.

Additionally, users can accumulate points through Echo's Echo Points system by participating in staking, lending, and other operations, which can be exchanged for tokens or other ecosystem benefits in the future.

Ecosystem synergy: many friends, easy paths

As Echo's cross-chain ecosystem continues to expand, its collaborative landscape is becoming increasingly rich.

- Echo x xBTC x Aptos

Rooted in the Aptos ecosystem, Echo's collaboration with xBTC and Aptos is one of its core highlights. xBTC, issued by OKX, is a wrapped BTC pegged 1:1 to BTC. After being integrated into Echo Protocol, it seamlessly connects with Echo's LST mechanism, allowing users to stake and lend xBTC on Aptos. Within three weeks of launch, over $70 million worth of xBTC has been bridged to Aptos, with nearly $30 million of xBTC staked in the Echo protocol, accounting for almost half.

- Solana Vault x Kamino

At the same time, Echo collaborates with Kamino in the Solana ecosystem. Through Solana Vault, Echo bridges BTC to Solana, generating solBTC, allowing users to participate in Solana's DeFi activities. Kamino's optimized yield strategies further enhance the vault's return potential. Cross-chain collaboration not only broadens Echo's application scenarios but also serves as the best proof of Echo's multi-chain expansion capabilities.

Riding the waves, a promising future

With a TVL of $375 million, leading on-chain activity, and an ever-expanding collaborative landscape, the data sufficiently proves that Echo Protocol has firmly established itself in the Move ecosystem, becoming a leader in the BTCFi track.

Although Echo's current focus on the Aptos ecosystem is relatively low-key in the market, its unique advantages in high performance and the continuous growth momentum of Echo indicate that its potential has yet to be fully tapped. Whether you are a long-term holder looking to make BTC "move" or a DeFi player pursuing high returns, Echo can provide a one-stop experience.

The positioning of Echo Protocol is not limited to a single staking platform; it acts more like a preacher for additional pricing of BTC. By making BTC's gameplay more flexible, it tells the market that BTC's potential goes far beyond "digital gold." With the high performance of Aptos and the entire Move ecosystem, BTC can also become a new preferred driving force in DeFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。