🧐 Traffic or Structural Trust | Binance's Market Share Returns to Peak, 45.6% BTC Proportion Behind: User Voting During Market Cooling Period —

The colder the market, the truer the vote.

It's not at the moment when prices rise, but rather when "no one is watching," that we can see users' true affiliations.

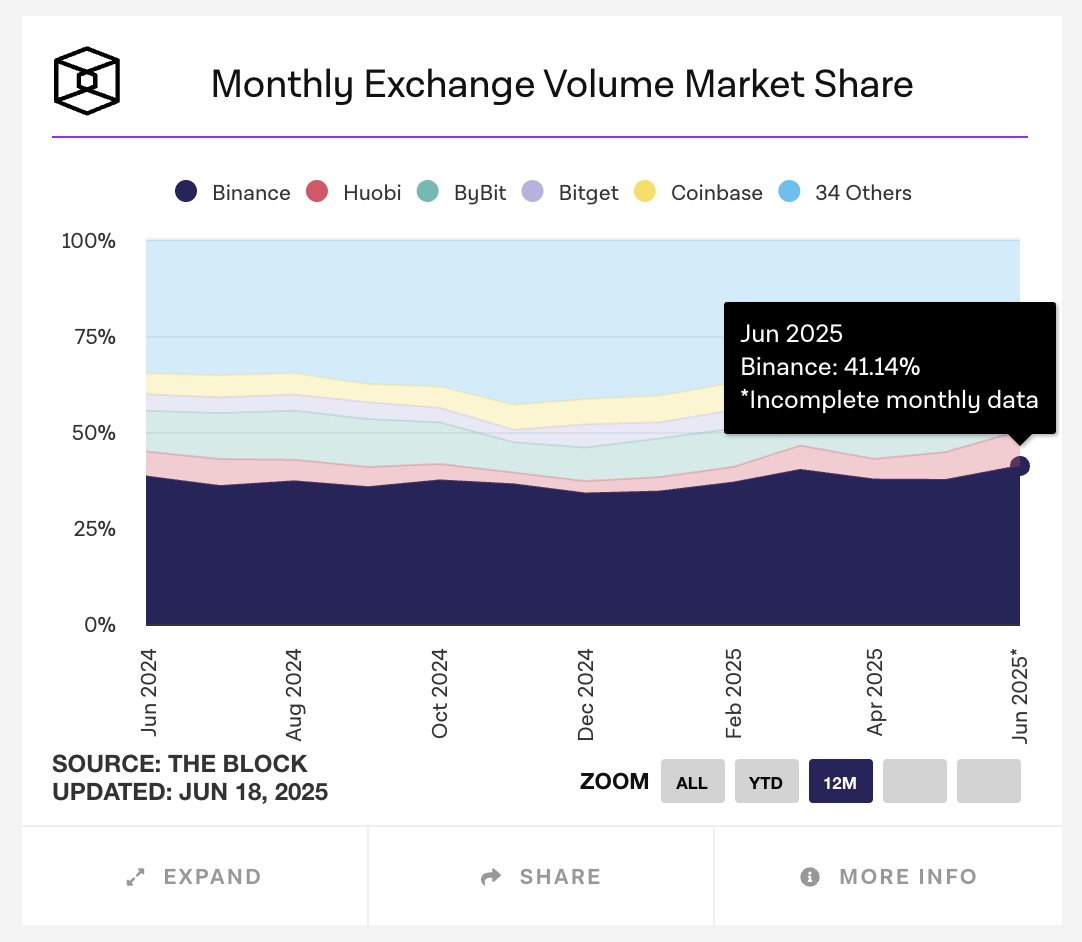

The latest data from The Block shows that in June 2025, Binance's spot market share rebounded to a nearly one-year high, accounting for about 41.14% of the market;

Among them, the proportion of $BTC spot trading is approaching the historical peak of 2024.

This is not a random data point under the frenzy of a bull market, but rather a reflection of users "voting with their feet."

1️⃣ What signals are released by the "counter-cyclical growth" in a flat market?

Against the backdrop of overall trading volume reduction, Binance's share continues to grow.

This indicates that Binance does not rely solely on market enthusiasm to "make a living," but can also attract a stable user base to continue trading when volatility decreases.

This highlights two key points:

Strong user stickiness: Even without airdrops or hot topics, users do not churn;

Structural leadership: The trading liquidity of mainstream assets like BTC and ETH continues to lead, especially with BTC's nearly 45.6% market share, which is indeed rare.

This actually illustrates a core reality: what users truly value is not "competition," but "stability."

2️⃣ The Alpha system's closed loop, the linkage mechanism of trading, wallets, and points begins to take effect —

Many still regard Alpha points as "promotional activities," but what is truly interesting is that it is reconstructing user behavior pathways:

Trading → Wallet → Points → Pricing Simulation → Liquidity Redistribution

Alpha is not about issuing tokens, but about exercising users' attention muscles — binding behavior with points and using behavior to influence the platform's market power in reverse.

To some extent, this partially returns the primary pricing power of VCs back to the platform — and even to the users.

Whoever can mobilize liquidity holds the initial premium for project cold starts.

Whoever can stabilize the preheating rhythm holds the control over primary pricing.

This is why we see that under Alpha incentives, on June 8, Binance wallet's on-chain trading volume reached $12.5 billion, accounting for 92.1% of the total market wallet trading volume —

This structure is no longer a traditional CEX, but a new type of closed loop in CeDeFi.

Alpha is not just a "points system," but more like a playground where the platform and users jointly train their liquidity pricing muscles.

3️⃣ The "safe haven" effect continues to ferment: it's not about who competes, but who wins —

Looking back over the past few months, several trading platforms have experienced security incidents, declines in stablecoin reserves, and even liquidity tensions.

Yet Binance has seen reverse growth, becoming the preferred destination for capital inflows.

According to CryptoQuant data, as of early June, Binance held 59% of the USDT and USDC reserves among CEXs. This not only reflects a sense of security but also indicates that the market is "re-aggregating."

Conclusion —

Many people like to use "traffic" to explain the strength of trading platforms, but the long-term battlefield of the crypto market has never been about traffic, but about trust —

And trust ultimately settles into structural advantages + liquidity control + safety redundancy.

https://www.theblock.co/data/crypto-markets/spot/the-block-legitimate-index-market-share

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。