Listed on DTCC: VanEck Moves Closer to Potential Solana ETF Debut

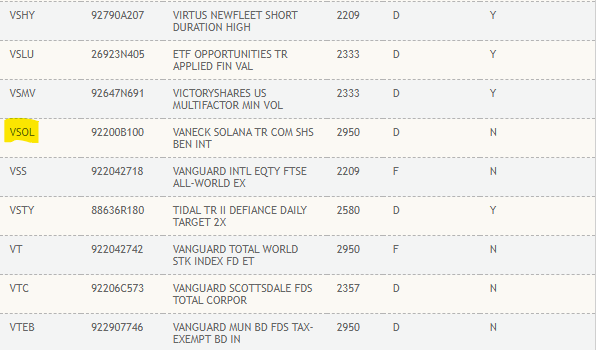

Recently, VanEck Solana ETF has been spotted on the website of Depository Trust & Clearing Corporation (DTCC).VanEck’s ETF, trading under the ticker symbol VSOL, represents a significant move toward bringing Solana exposure into the mainstream for traditional investors.

VanEck’s Solana ETF Nears Regulatory Green Light

According to the DTCC records the fund is labelled as “VANECK SOLANA TR COM SHS BEN INT” and falls under the “D settlement category”. The ETF is listed in this category.

It proposed an ETF for SOL whose ticker is VSOL is reaching the final stage of regulatory review and has the possibility to get the approval to launch.

Source: DTCC

The Securities and Exchange Commission has yet to approve the SOL ; it is an assumption of some analysts that it could happen within months.

What does DTCC do?

It is the backbone of U.S financial service company which oversees the processing of trades, including clearing and settlement, ensuring smooth and secure operations within the financial markets.

The DTCC list includes ETFs marked as active or pre-launch, but these cannot proceed through DTCC’s settlement process until they receive the necessary regulatory approvals.

Why did VanEck choose SOL?

SOL is a high-performance blockchain network known for its low transaction costs and rapid processing speeds, making it ideal for decentralized app development.

It has fast transaction speeds and a growing developer environment. It is considered one of Ethereum’s top rivals. Like others, SOL has become a prime candidate for investment products like Exchange Traded Funds.

VanEck is appearing to have these potential. By pushing forward with Solana Exchange Traded Fund, positioning itself as first movers in what could be a new wave of altcoin based Exchange Traded Fund following the footsteps of Bitcoin and Ethereum spot.

How the Market Is Responding to Solana ETFs?

It is an early move of VanEck to list its SOL Exchange Traded Fund on the DTCC, signalling a broader shift in the landscape of crypto investment.

Conclusion:

This sudden appearance of VSOL on the website of Depository Trust & Clearing Corporation has created buzz within the world of crypto and investment communities.

So, it is very important to understand what this listing truly means. Because being listed on the DTCC does not show that the ETF has received regulatory approval from the US Securities and Exchange Commission (SEC), nor does it ensure a positive outcome in the approval process.

This move is considered a regular part of technical preparation before any official launch of the ETFs.

Also read: Spur Protocol Daily Quiz Answer 19 June 2025: Earn Free Rewards免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。