"This is a topic that people usually don't want to bring up, but currently, humans cannot achieve immortality."

On June 19, Binance founder CZ responded to the emergency contact and inheritance features updated in the latest version of Binance. This is not just a product update; it feels more like a long-overdue coming-of-age ceremony for the industry, forcing the entire crypto world to confront the oldest and most deliberately avoided question: What happens to a crypto holder's digital wealth when he/she unexpectedly passes away?

According to a retrospective analysis report released by Chainalysis on June 15, it is estimated that over 3 million Bitcoins may have permanently gone silent due to the owner's death or loss of private keys, creating a "digital black hole" worth hundreds of billions of dollars.

The "First Ray of Light" from CEX: The Inevitable Compromise of Convenience and Centralization

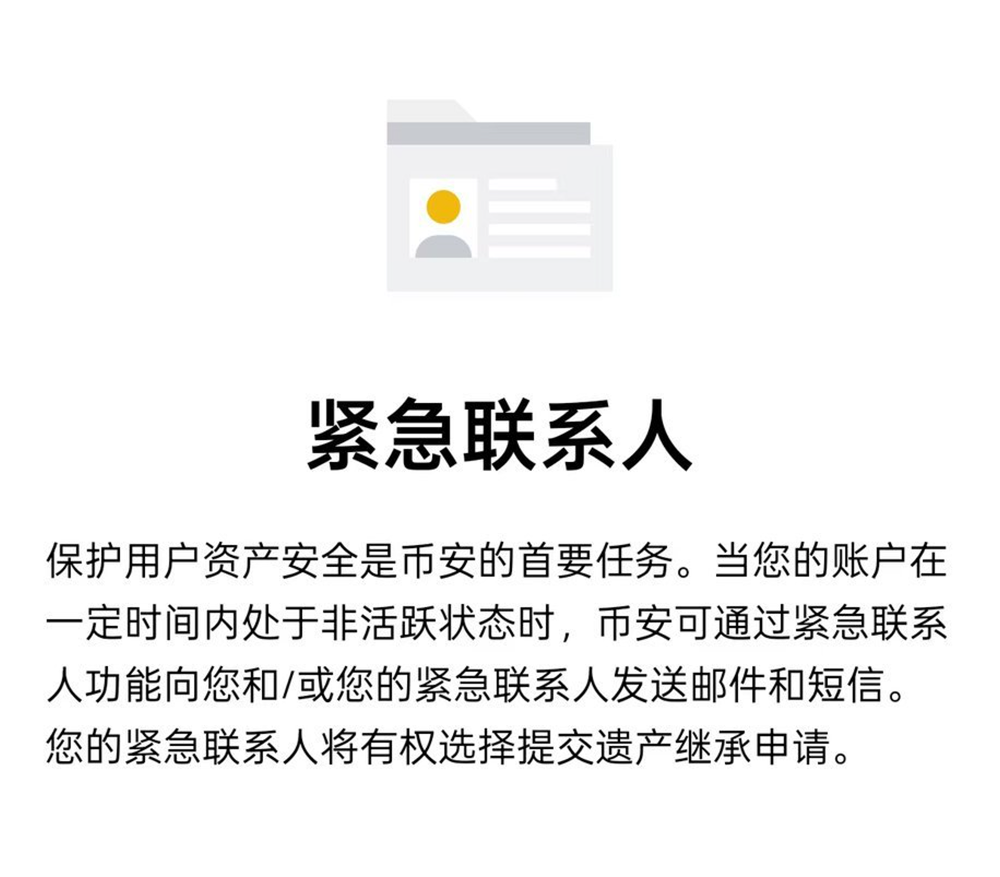

According to the official announcement from Binance and evaluations from several KOLs on the X platform, its "inheritance heir" feature allows users to pre-designate one or more beneficiaries. When the platform confirms through a specific process (such as the user being inactive for a long time and the emergency contact submitting relevant legal documents) that the original account holder has passed away, it can initiate the asset transfer process, distributing the assets to the designated heirs according to the preset ratio.

"This is a necessary evil and a pragmatic advancement," a spokesperson for the crypto asset management platform SafePal told Cointelegraph on June 17. "For the vast majority of users who lack professional technical knowledge, it is unrealistic to expect them to manage complex multi-signature wallets or mnemonic shards. CEX provides a 'one-click' solution, which is the best balance between user education and market reality."

Renowned Bitcoin educator @BTC_Philosopher posted on June 16, stating: "Binance's solution is essentially a form of 'centralized trust.' You are handing over the final disposal rights of your assets, along with the authority to determine your 'death,' to the platform. This goes against the core spirit of 'Not your keys, not your coins.' The risks of the platform running away, being hacked, or making erroneous judgments still exist."

A legal advisor from another leading exchange, Kraken, expressed appreciation for Binance's attempt during an interview with Decrypt on June 18, but also cautiously mentioned: "Any such feature must be built on an extremely strict, transparent, and auditable verification process; otherwise, it could lead to significant legal disputes and ethical risks."

The "Hardcore Path" of Self-Custody: Technological Sovereignty and High Barriers

In contrast to the "trust" route of CEX, the self-custody space has long been exploring technology-driven "hardcore" solutions. The core idea is to shift trust from centralized entities to cryptography and decentralized protocols.

Mainstream solutions include:

Multi-signature (Multi-sig) wallets: For example, setting up a 2/3 multi-signature wallet, where three private keys are given to oneself, family, and a lawyer. Asset transfer requires at least two signatures, effectively preventing single points of failure. Crypto asset security company Casa emphasized in a blog post on June 14 that this remains the "gold standard" for estate planning among institutions and high-net-worth individuals.

Social Recovery: A solution advocated by Ethereum founder Vitalik Buterin for many years. Users can designate a group of "guardians" (which can be friends, family, or professional institutions) who can collectively authorize account access recovery when the user loses the main key. Smart contract wallets like Argent have implemented such functionality.

Time Locks and "Dead Man's Switch": Through smart contracts, if there is no activity in the account within a specified time, specific transactions (such as sending assets to the heir's address) will be automatically triggered.

These solutions maximize user sovereignty and the decentralized nature of assets, but their cognitive and operational barriers are extremely high, posing a daunting challenge for ordinary investors. "We can't expect my 70-year-old mother to understand what Shamir's Secret Sharing (SSS) is," a Reddit user wrote in a discussion in the CryptoCurrency section, "I would rather trust Coinbase or Binance; at least there is a customer service number to call."

Legal Maze: When Platform Designation Meets Legal Wills

CZ's thoughts touch on deeper legal dilemmas: "Legal regulatory provisions should also allow minors to have accounts."

This proposal directly addresses the core of global financial regulation—KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. Allowing minors to have (even if not trading) crypto accounts would require significant revisions to the existing legal framework.

The more fundamental legal conflict lies in which has higher authority: the "designated heir" on the Binance platform or the legal will established by the user in the real world?

Alex Tan, a digital asset legal expert at Hogan Lovells in Singapore, told The Wall Street Journal on June 19: "Currently, this feature from CEX is legally closer to a 'beneficiary designation,' similar to an insurance contract. In some jurisdictions, this designation can bypass complex probate procedures and take effect directly. However, in others, if it conflicts with the contents of a legal will, the court may prioritize the will. It entirely depends on local inheritance laws and digital asset laws."

This means that even if Binance's feature is used, a clear professional legal will that specifies how to handle digital assets remains indispensable. Otherwise, prolonged legal battles may erupt within families or even between heirs and the platform.

Conclusion: A Heavy Step Towards Industry Maturity

The launch of Binance's "inheritance feature" signifies far more than just a product function. It marks that the crypto industry is shedding its early idealism and technological fervor, beginning to seriously take on the social responsibilities of a mainstream asset class.

When we discuss TPS, Layer 2, and the next hundredfold coin, topics like death, taxes, and intergenerational inheritance—these "heavy" subjects—are also essential cornerstones for building a sustainable and trustworthy crypto ecosystem.

Regardless, when industry leaders start designing solutions for users' "ultimate risks," it itself is the clearest signal: crypto assets are truly moving into households and are ready to be passed down as a form of wealth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。