The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

It has been nearly a week since I last analyzed the trends with everyone. More often, I feel that what is good to talk about is basically consistent with our previous predictions. However, many users are still asking me, has the downward space ended? Is there still a bull market this year? Responding to such questions is indeed tiring. Today, I will reply directly from the overall market, following the usual routine from the world situation to exchange rates and then to the overall financial impact on the cryptocurrency market. I will focus on explaining the exchange rates, so please watch patiently. Overall, we must admit that the current situation since World War II is extremely dangerous. Whether it is the Middle East or the Russia-Ukraine conflict, it will have an impact on the financial level. You can see that the prices of gold and energy have a significant sense of disparity. The overall world situation gives us an intuitive feeling of chaos, which reflects in the cryptocurrency market as a problem of capital connection. The amount of funds consumed by military expenditures is far greater than that consumed by the market. As long as there is war, all resources will tend to the military level. From the current world situation, it does not actually possess an overall bull market phase. Therefore, we cannot be too optimistic about the world's economic outlook. You have some reference cases regarding the current financial environment.

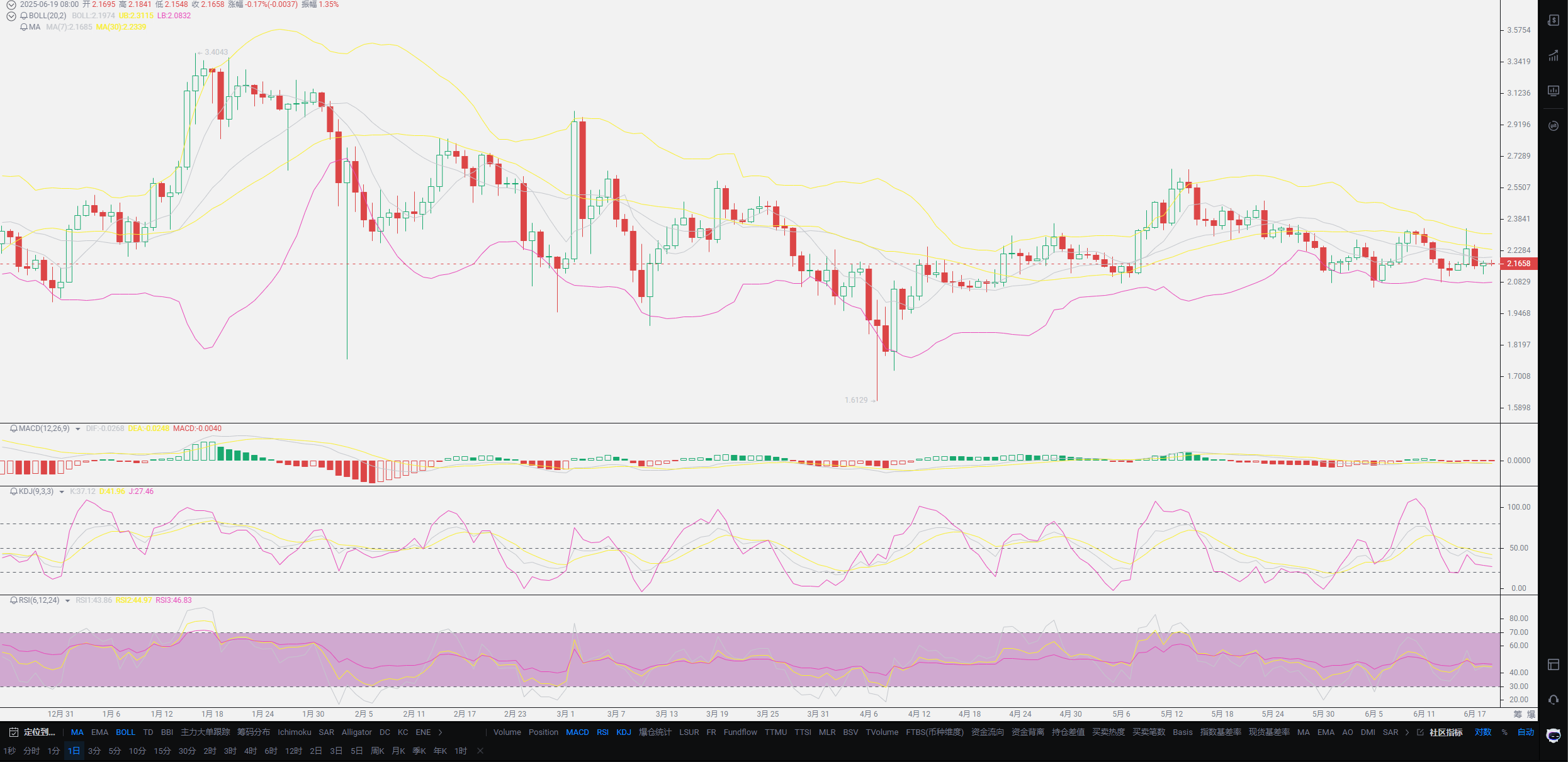

Since we have determined the world situation, it will be easier to understand the exchange rates. I will analyze the exchange rates based on this year's USD price. At the highest point, I sold at nearly 7.4, and it is currently stable below 7.2. You should be very clear about the impact of exchange rates on finance. Generally, around mid-year, the US tends to control the strength of the dollar, and only at the end of the year does the USD price surge. Just in time for the end of this bull market, you can clear your positions then. From the perspective of exchange rates, you can see some clues as to why the USD price is declining now. The delay in tariffs has instead caused the dollar exchange rate to fall. You can observe that during normal trade exchanges, the USD to CNY exchange rate was only about 1:6.2. With the decline in trade between China and the US, although the CNY has appreciated, it still has a significant impact on foreign trade. However, through the exchange rate, it can be clearly felt that it is at least better than last year's economic environment. The large industrial base, including expanding trade with the Middle East, Asia, and Africa, has offset some of the impact. With the optimization of tariffs, there is still a good chance that the exchange rate will break below the 7 mark, and when it breaks 7, it will basically lead to a boom in US foreign trade.

When it comes to exchange rates, many friends feel that I am forcibly linking it to the cryptocurrency market. The exchange rate, apart from GDP and purchasing power, is the most reflective of a country's economic strength. It is not about singing the blues for the domestic economy, but rather that the global economy is in a bottom rebound period. Japan's real estate bubble caused its economy to stagnate for twenty years, and how to handle it is indeed quite tricky. However, the repair of the exchange rate and the growth of GDP have already indicated that we are gradually recovering, and this recovery is stronger than that of most countries. I can only say this much; if I delve deeper, you may not see my article. But do not think that our recovery strength is good news for the cryptocurrency market. Since May 19, almost all the main forces in the domestic market have exited the cryptocurrency market. Currently, the pricing power in the cryptocurrency market is almost entirely determined by Europe and the US. There are not many low-value currencies held domestically, which refers to retail investors and whales, not national strength. The most prosperous stage of the domestic cryptocurrency market was when the entire industrial chain was completely retained domestically. From miners to the establishment of platforms, the top three exchanges in the world were basically in China, and even USDT was issued domestically. Now, the US has become the sole authority in the cryptocurrency market, and the pricing power has been handed over. Currently, the domestic economic situation has no practical impact on the cryptocurrency market; we will see how the stablecoin legislation in Hong Kong will guide the situation!

Do not think this is a strategic mistake; at least we still do not know who Satoshi Nakamoto is? The game is not over yet. The domestic platform exit is definitely a clever move. We cannot form a siphon effect like the US. The blockchain technology will not significantly help the domestic economy; it will only increase uncontrollable risks. Speaking a bit far, regarding the exchange rate issue, you can pay attention to the overall impact. Just be clear that we are still in the recovery phase. The exchange rate is also relative; the strength of the dollar may not necessarily be a good thing for the US. To maintain this exchange rate, they must pay a higher price. Including the inflation issues brought by tariffs and the unemployment rate, their domestic situation is currently a mess. In this struggle, there are no winners; Bitcoin is the one that profits. The struggle of traditional financial forms will only highlight the advantages of the cryptocurrency concept. This is also why domestic companies like Ant Group are investing in USDC to enter the stablecoin market, including JD, Baidu, and ByteDance, all laying out strategies regarding stablecoins. Any company related to foreign trade will rush in; this is an opportunity for stablecoins, which just eliminates the impact of exchange rates and even optimizes liquidity. What follows are tax issues? Of course, tax issues should be considered by the US, and we need not worry too much.

I want to emphasize that foreign trade companies will flood into the cryptocurrency market, including funds from various gray industries; this indirectly proves that the market value of the cryptocurrency market will increase, but it does not mean that all these funds will flow into Bitcoin or Ethereum. According to Trump's thinking, promoting the stablecoin legislation is not to drive up Bitcoin prices. At least these compliant foreign trade companies will not engage in other currencies; they use the cryptocurrency market only for capital flow issues. Stablecoins can only be considered good news for the cryptocurrency market; overall, it still depends on the listing of currencies and the process of interest rate cuts. These two factors will determine the timing of the bull market's onset. More foreign trade companies will choose stablecoins in Hong Kong, whether USDT or USDC; the issuance of these currencies will drive certain value. More will still rely on gray industries to push the entire bull market, which is the most significant difference between the cryptocurrency market and traditional finance. For traditional finance, it is almost impossible to have a bull market at this stage, but for the cryptocurrency market, it is precisely a bull market! The more unstable the world is, the more channels will be used in the cryptocurrency market, and the more assets will need to be transferred; this is the meaning of the cryptocurrency market's existence. Once the interest rate cuts are implemented, even more funds will flow in. This year is the most prosperous year for the cryptocurrency market; it may be the beginning or the end. This determination depends on how Trump strangles the gray industry to achieve the goal of debt reduction!

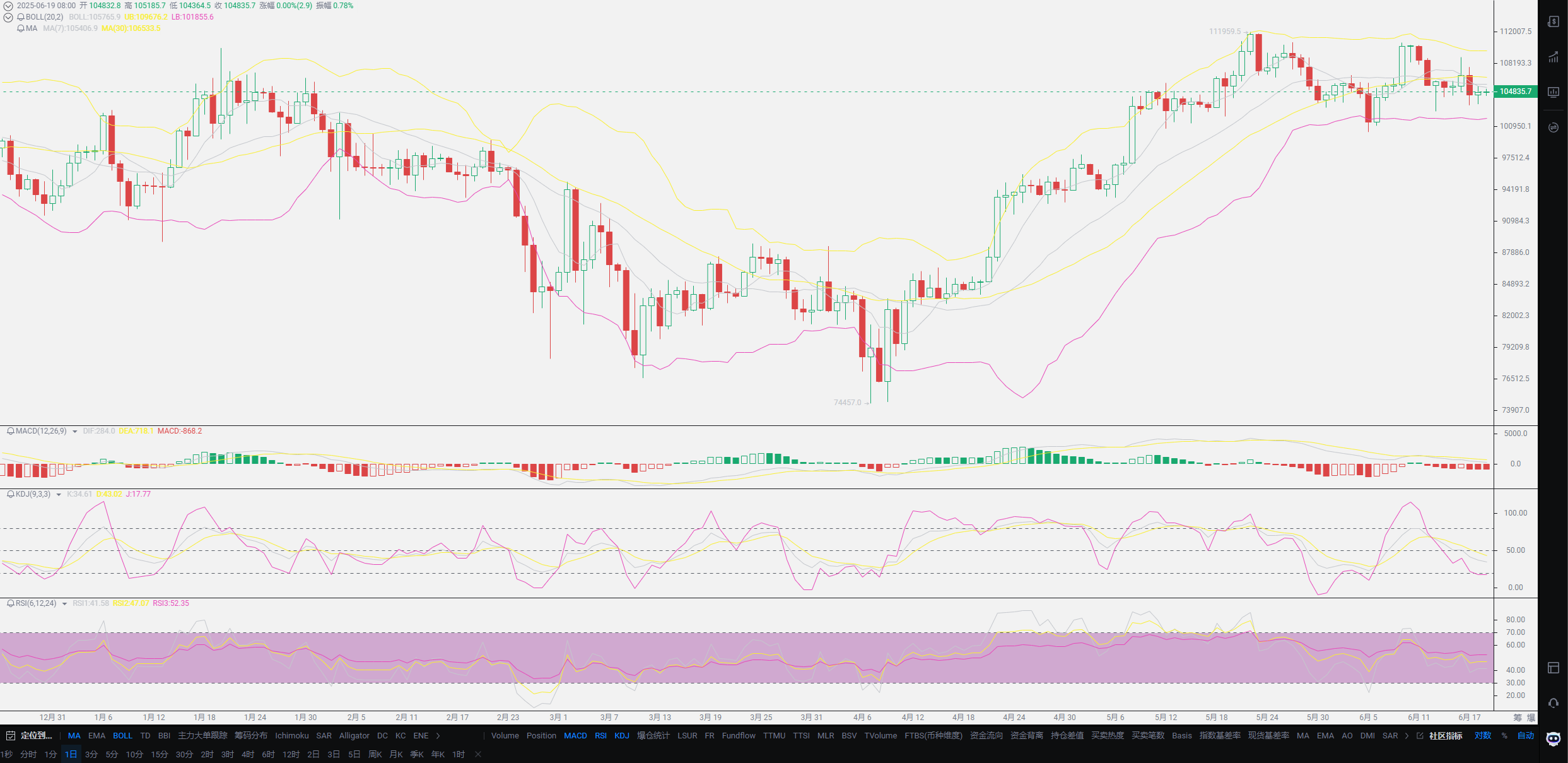

Lao Cui's summary: Based on the recent market fluctuations, the overall analysis is not a big problem, and we are still operating within our previous assumptions. The downward space will continue until mid-August, and the low point in the second half of the year will also occur during this period. Especially through Powell's speech yesterday, there will still be no interest rate cuts in the short term, and the next round of interest rate cuts may be delayed until September to have any response. This just coincides with our previous assumptions; we will lay out long positions for the bull market in mid-August, and currently, we are still mainly bearish. Since the US's job market has not shown any problems, and inflation is within expectations, the overall impact of inflation will be seen in September's feedback. The only thing that can influence the cryptocurrency market's trends in the short term is public opinion. On the military front, everyone should pay attention to the Russia-Ukraine situation; the conflict between Iran and Israel does not have a significant impact on the cryptocurrency market unless uncontrollable issues arise. Finally, I would like to inform you about my position; currently, the short position around 109,000 has not exited, and it is highly likely to continue holding to offset the losses in the spot market, and I have not exited the spot market either. For me, the holding strategy for the spot market will only be considered for clearing at the end of the year. You can rest assured that if there are any trend-related issues, I will notify everyone. Overall, regarding this round of the bull market, do not expect too high positions; levels like 180,000-200,000 are unlikely to appear this year. My thinking remains that I will clear out in the 120,000-150,000 range! Currently, there is no overall global bull market!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。