Bitcoin (BTC) is in a wide-ranging consolidation phase, with short-term resistance at $109,000 and support around $103,000; Ethereum (ETH) is moving in line with the market, showing overall wide fluctuations; the ZK, L2, and AI Agents sectors are leading in declines; the total net asset value of Ethereum spot ETFs has surpassed $10 billion, with over 20,000 Bitcoin addresses holding a value exceeding $10 million, and Ethereum staking volume exceeding 35 million coins.

Summary

Market Interpretation

Market Commentary

Popular Concepts

This week, Bitcoin experienced a high-level correction, and market sentiment is noticeably cautious. Altcoins continue to show a pattern of divergence, with mainstream sectors showing significant declines. According to Coingecko data, the ZK, L2, and AI Agents sectors have seen notable drops this week, with declines of approximately 23.2%, 15.1%, and 14.9% over the past seven days, respectively. The commonality among these three sectors lies in their high technical barriers and innovative narratives, all of which belong to previously long-standing hot tracks.

ZK

The ZK (Zero-Knowledge Proof) sector refers to crypto assets that utilize zero-knowledge proof technology, focusing on privacy protection, scalability, and efficient data verification, typically represented by ZK-rollups and privacy public chains, combining technological innovation with application potential. As the demand for privacy and performance in blockchain grows, ZK projects have rapidly emerged and gained significant market attention. On one hand, they attract developers and institutional investors with high technical barriers and Layer 2 optimizations; on the other hand, they have also become a speculative focus in capital rotation due to the hype surrounding their technological narratives. — Over the past seven days, this sector has seen a decline of 23.2%, with ZKJ, ZKB, and MOZ showing particularly pronounced drops.

L2

The L2 (Layer 2) sector refers to crypto assets based on second-layer blockchain scaling solutions, aimed at improving transaction speed and reducing costs on the main chain, typically represented by Rollups and sidechains, combining performance optimization with ecological expansion potential. With the surge in demand for scalability and low costs in blockchain, L2 projects have rapidly risen and are highly sought after in the market. They attract developers and users with efficient technical architectures and main chain compatibility. — Over the past seven days, this sector has seen a decline of 15.1%, with SWAN, GLS, and GEL showing particularly pronounced drops.

AI Agents

The AI Agents sector refers to crypto assets based on artificial intelligence agent technology, typically centered around autonomous and intelligent applications, combining blockchain to achieve decentralized AI services, possessing technological foresight and ecological expansion potential. As AI technology continues to gain traction in the cryptocurrency market, AI Agents projects have rapidly emerged and are highly sought after by capital. On one hand, they attract developers and institutional investors with intelligent narratives and cross-domain applications; on the other hand, they have become a key focus for speculative capital in hot rotations due to the AI innovation boom. — Over the past seven days, this sector has seen a decline of 14.9%, with previously popular tokens like AI16Z, VIRTUAL, and AIXBT all dropping over 10%.

Focus of the Week

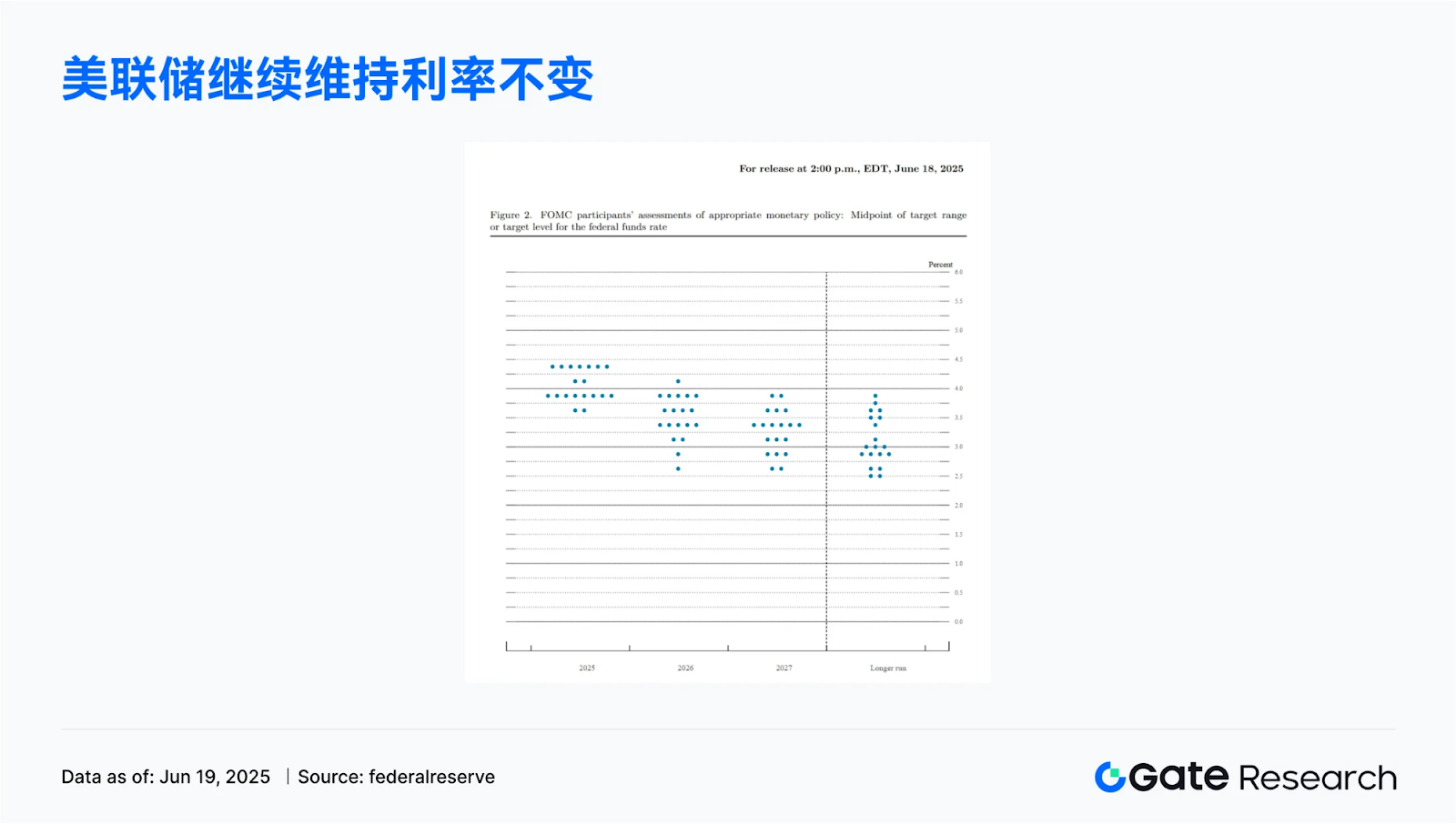

Federal Reserve continues to maintain interest rates, expected to cut rates twice in 2025

At 2 AM today, the Federal Reserve kept the benchmark interest rate unchanged at 4.25%-4.50%, marking the fourth consecutive meeting without changes, in line with market expectations. Additionally, the Fed's dot plot indicates that it maintains its expectations for rate cuts this year, with two cuts anticipated in 2025.

According to the latest market data, U.S. interest rate futures predict a 71% probability of a rate cut in September, up from 60% previously. U.S. interest rate futures reflect a projected rate cut of 46 basis points in 2025, showing little change compared to before the Fed's statement.

The Fed's decision to maintain interest rates aligns with market expectations, providing a stable policy environment for risk assets in the short term. Although inflation is close to target, the Fed remains cautious, indicating a reserved attitude towards economic overheating and premature policy easing. The dot plot maintains the outlook for rate cuts this year, reinforcing the signal of "maintaining high rates for a longer time." Interest rate futures show the probability of a rate cut in September rising to 71%, with market expectations for easing policies heating up, which may support high-elasticity assets like cryptocurrencies and tech stocks, but volatility remains unavoidable, and investors should still pay attention to short-term sentiment changes.

Ink announces the launch of its native token INK, airdropping to early participants of the liquidity protocol

Recently, the Layer 2 network Ink announced the launch of its ecosystem's native token INK, with a total supply permanently capped at 1 billion coins, and no further minting through governance in the future. The governance of this chain remains under the Optimism superchain, and the INK token is applicable to users and the application layer, with the airdrop targeting early participants of the liquidity protocol.

This move highlights the long-term stability of its decentralized finance (DeFi) ecosystem, as the INK token will not participate in on-chain governance of the Optimism superchain but will focus on incentivizing users and developers, promoting DeFi innovation and capital coordination, with the first application being a liquidity protocol based on Aave, where early participants will receive airdrop rewards. This change aims to enhance the liquidity and user participation of the Ink ecosystem. Some users believe that with fewer participants, the airdrop may yield higher returns. The launch of INK marks a new phase for the Layer 2 network in the DeFi ecosystem, potentially attracting more developers and capital into the Optimism superchain.

Truth Social plans to launch a dual BTC and ETH ETF

On June 16, Trump's social platform Truth Social submitted an S-1 form to the U.S. Securities and Exchange Commission (SEC) to launch the "Truth Social Bitcoin and Ethereum ETF (B.T.)." This fund plans to adopt a 75% Bitcoin and 25% Ethereum asset allocation, providing investors with a simplified dual-coin exposure, marking its further layout in the crypto finance sector.

This move follows Truth Social's previous submission of a single Bitcoin ETF application, highlighting the Trump family's continued bet on crypto assets. Given its political influence and brand effect, if this product is approved, it is expected to attract significant market attention and may accelerate the mainstream adoption of crypto assets.

On the other hand, this ETF still needs to go through the SEC's 19b-4 form approval, a process that could take up to 240 days, and there are regulatory uncertainties and competitive pressures from traditional institutions. Meanwhile, Trump Media recently established a Bitcoin reserve through $250 million in financing, doubling down on its crypto strategy, but its stock price (DJT) has recently dropped about 2%, reflecting the market's cautious attitude towards its expansion path. The involvement of political factors may also trigger stricter scrutiny and volatility risks, which investors should continue to monitor.

Highlight Data

Total net asset value of Ethereum spot ETFs surpasses $10 billion

As of June 19, 2025, the total net asset value of Ethereum spot ETFs reached $10.103 billion, accounting for 3.27% of Ethereum's total market capitalization. Ethereum spot ETFs have recorded continuous net inflows over the past six weeks, with strong capital inflows. In the past three weeks, BlackRock's ETHA has led with a net inflow of $683 million, bringing its assets under management to $4.18 billion, highlighting its dominant position among institutional investors.

The total net asset value of Ethereum spot ETFs surpassing $10 billion indicates that ETFs have become an important component of the Ethereum market. The Ethereum ecosystem continues to expand, with widespread DeFi and NFT applications driving network activity and ETH demand. If the regulatory environment remains friendly and institutional participation continues to rise, ETFs are expected to further drive ETH prices up while attracting more investors into the crypto ecosystem, strengthening Ethereum's network effects and value foundation.

Over 20,000 Bitcoin addresses hold a value exceeding $10 million, accounting for nearly 9.43% of total BTC supply

According to Alphractal data, currently, over 20,000 Bitcoin addresses hold a value exceeding $10 million, totaling approximately $200 billion, accounting for nearly 9.43% of total BTC supply and over 21% of "realized market cap."

The "realized market cap" operates on the logic that when BTC is transferred into a wallet, it is considered a "buy," and when transferred out, it is considered a "sell." By calculating the average cost basis of each wallet × the amount held, the total "realized market cap" of the entire network can be derived, reflecting the total capital that has entered the Bitcoin market through real on-chain activities.

Currently, in the Bitcoin market, there are over 20,000 large addresses holding over $10 million, concentrated in approximately $200 billion in assets. These addresses control nearly 10% of Bitcoin supply, indicating a trend towards concentrated capital distribution. The cost basis of these funds mostly comes from real on-chain transactions, and the "realized market cap" is an important indicator of the inflow of such funds, accounting for over 20%. This shows that institutions and high-net-worth users have a strong willingness to allocate Bitcoin, and most of these funds are long-term holdings, providing stability to the market and potentially amplifying the market influence of large holders.

Ethereum staking volume exceeds 35 million coins, reaching an all-time high

According to CryptoQuant data, the current Ethereum staking volume exceeds 35 million coins, reaching an all-time high. Meanwhile, the number of "accumulation addresses" (i.e., addresses that have never recorded a sale) has also reached a historical peak, currently holding 22.8 million ETH.

The recent strong performance of Ethereum (ETH) is supported by a resonance of on-chain data, institutional capital, and market sentiment. The record high in staking volume and accumulation addresses serves as core support, with the proportion of long-term holders, or "diamond hands," increasing, significantly reducing market selling pressure. At the same time, institutional capital continues to accumulate through ETFs, with a strong overall inflow trend, exceeding $1 billion in inflows over the past month. Institutions like BlackRock have frequently increased their holdings by over 10,000 ETH in a single day, forming a bottom support of "buying more as prices rise."

Potential risks to watch include short-term divergences and yield competition: derivative traders are currently cautious (active buy-sell ratio).

Related: Ohio House passes bill allowing up to $200 tax-free cryptocurrency payments

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。