Original Title: "The Eve of the Great Transformation of Stablecoins -- The Surge of Circle and the Acceleration of Stablecoin Opportunities"

Original Author: Master Brother from Australia

If there is anything that has recently stirred up passionate discussions among global financial practitioners, whether in web2 or web3, it would be the outrageous surge of Circle after its listing on the US stock market. While Web3 players generally view it pessimistically and have even shorted it in anger, Web2 players are bullish and FOMO-ing in. This terrifying explosive power has made many traditional financial giants uneasy, forcing them to confront the revolutionary impact that stablecoins may bring globally. It makes me feel like I am once again on the rolling wheels of history, reminiscent of a "great era."

First, let’s look at what @CryptoHayes wrote in his article "Libra: Zuck Me Gently": "I recently spoke with a board member of a large bank about stablecoins, and they said, 'We are doomed.' They believe stablecoins are unstoppable and cited the situation in Nigeria as proof. I was previously unaware of the extent to which USDT has penetrated that country, but they told me that one-third of Nigeria's GDP is conducted in USDT, even though the central bank is very serious about trying to ban cryptocurrencies."

From my own travel experiences and understanding of several countries with poor currency sovereignty, Nigeria should be a common representation of these countries. Wherever there is high inflation and significant exchange rate fluctuations, stablecoins, blockchain wallets, and even U cards will be the first to make an impact; administrative measures cannot eliminate this.

However, compared to the previous underground black market, the characteristics of stablecoins and blockchain make regulation significantly more challenging. Stablecoins will become a "financial version of the Starlink system" — funds can be freely settled without going through the country's central bank. This is not just a financial reform; it has turned into a tug-of-war between national sovereignty and open markets.

The "monetary sovereignty" of many small countries will be further stripped away. I believe one of the most exciting dreams from the Defi Summer — the flattening of global finance — is gradually becoming a reality. Imagine a scenario: users in Nigeria, Namibia, the Philippines, or even India and China, after exchanging their local currency for stablecoins and storing them in wallets, simultaneously choose a defi protocol to invest in (like USDe), enjoying not only a lack of depreciation but also an annualized return close to 10%.

What does that feel like? A unified financial world! For asset managers, stablecoin issuers, RWA players, and wallet providers, how massive is the influx of new blood? This is akin to when we could only make local calls because long-distance was too expensive, and international calls were even more unimaginable. Suddenly, the internet arrived, enabling global communication, even video calls, at almost no cost, flattening communication and drastically reducing costs, turning the Earth into a closely-knit global village.

This is a major transformation, a financial revolution that could change the behavioral patterns of a large population on this planet; we are now on the eve of this revolution.

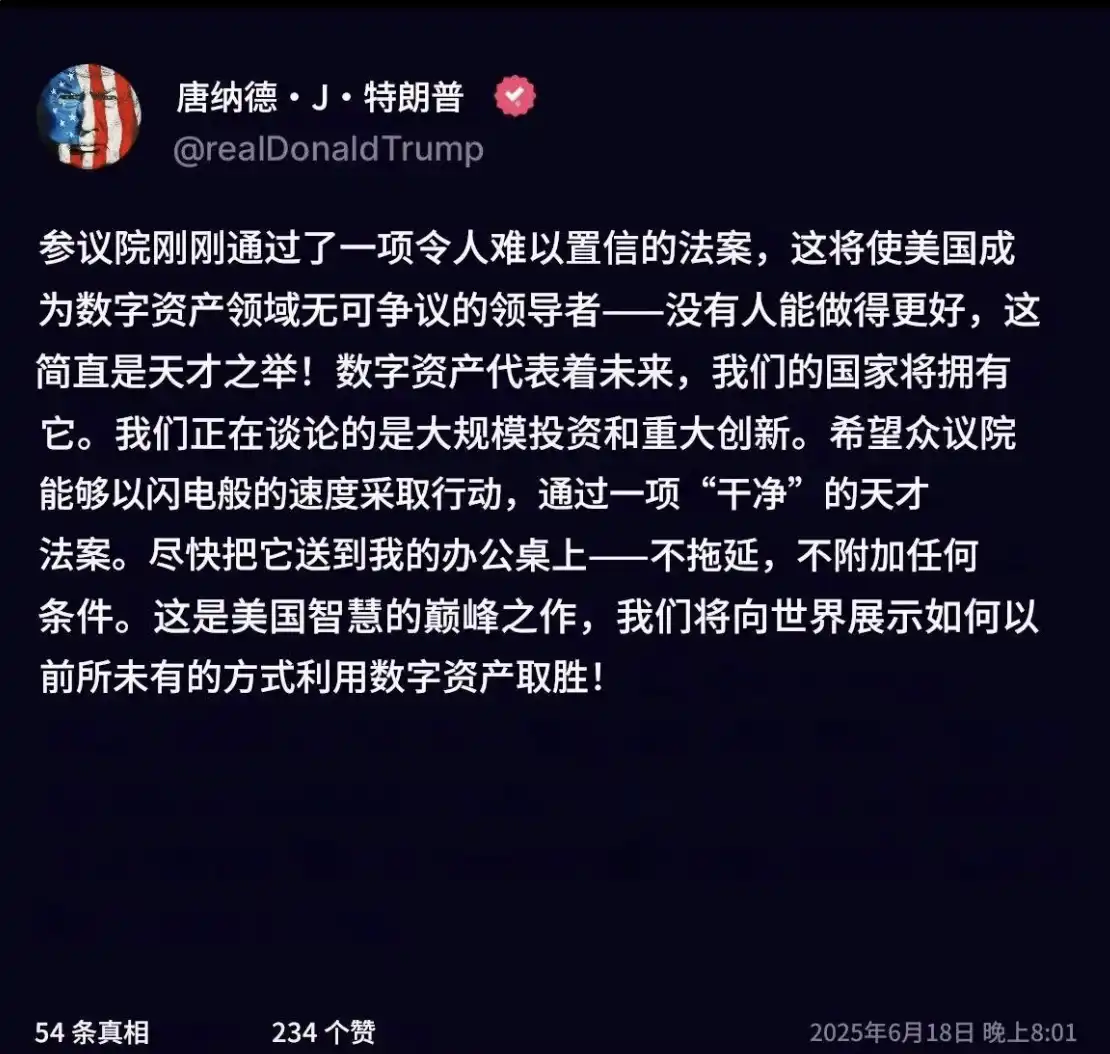

But even greater changes will come from other traditionally stable currency countries, including the United States itself and even China. After the stablecoin bill is passed, the legalization of USD stablecoins will lead to a massive entry of mainstream finance. Banks and payment giants (Visa, PayPal) will directly issue stablecoins (like PYUSD, USDC bank version), while current first-mover players like Circle, Paxos, Fidelity, and BlackRock will accelerate the expansion of on-chain USD operations.

I have no doubt that we will see the total market capitalization of stablecoins rapidly break through $500 billion from the current approximately $160 billion, becoming the main artery of on-chain USD, while payment settlement/AI/gaming/DePIN ecosystems based on stablecoins will quickly become compliant. With policy shifts, media exposure, major stablecoin issuers competing for market subsidies, and even the president personally promoting products, the number of people holding stablecoins will first achieve significant breakthroughs in the U.S. among developed countries, and the proportion of people with cryptocurrency digital wallets will also rise dramatically, creating a breeding ground for the further explosion of Web3. After USDC/USDT become compliant and enter more national financial apps, it will bring hundreds of millions of new user dividends.

Now, let’s talk about China: Recently, the former and current governors of the People's Bank of China, Zhou Xiaochuan and Pan Gongsheng, have begun to pay attention to the global impact of USD stablecoins and have spoken publicly about it. Zhou Xiaochuan stated: "Stablecoins (especially USD-pegged ones) may promote dollarization, posing a threat to economic sovereignty and the independence of monetary policy, and should be included in the scope of prudent assessment." Pan Gongsheng responded from a practical and regulatory perspective, indicating that the central bank has included stablecoins in the overall promotion of digital currency and is addressing potential risks through institutional and policy mechanisms.

Although China's iron fist in controlling its citizens, propaganda lockdown, and financial regulation has an unusually effective impact compared to third-world countries, it is undeniable that the public's awareness and demand for stablecoins have been increasing. I believe the recent crackdown on U cards is related to this financial regulatory demand, as the proliferation of USD stablecoins directly conflicts with China's foreign exchange controls. Currently, the main strategies for dealing with stablecoins domestically can be summarized as "block," "divert," and "exchange."

1. Block includes

Controlling exchanges, over-the-counter trading venues, and inflow and outflow channels, but the effect is limited.

2. Divert includes

Promoting the digital yuan (e-CNY) as a legal domestic alternative, guiding e-commerce, cross-border scenarios, and port settlement systems to gradually test the digital yuan. This initiative started in 2023, and there have been pilot projects for cross-border taxi rides/payments between Hong Kong and Shenzhen, but "strong regulation, low returns, and off-chain dominance" means it is unlikely to take off.

3. Exchange includes

Encouraging overseas institutions to issue RMB-pegged stablecoins (CNH stablecoin) such as:

· HKDC (promoted by the Hong Kong Monetary Authority)

· MobiDollar (involved by Standard Chartered Bank)

· Red Date (the overseas version of the Blockchain Service Network BSN)

Essentially, this is about issuing coins through "friendly third places" to achieve RMB circulation rather than being directly led by the central bank; direct opening to the mainland is impossible. However, the recent bold statement by JD.com about wanting to create stablecoins to reduce time costs in international settlements has made more domestic entrepreneurs start to understand this concept, and we will observe how it unfolds.

Possible opportunities for retail investors:

1. Wealth management opportunities

Due to the requirement of 100% U.S. Treasury reserves, stablecoins will become "digital national debt ETFs," and U.S. Treasuries will increasingly become the underlying source of stablecoin returns. Therefore, the annualized return for users holding stablecoins may rise from 0% to 3-5%, approaching U.S. Treasury yields. Simply put, in the future, whether you hold U on trading platforms, wallets, or Perpdex, most places will offer relatively safe wealth management products, similar to Alipay's Yu'e Bao, and the closer it is to U.S. Treasury annualized returns, the safer it will be. This is a massive attraction for currently outside investors to enter the crypto space. For example, I asked many retail friends in China, and they were very happy with a 2% return; they wouldn't even believe a 5% return. Now, if you can hold stablecoins and earn interest without being restricted by China's wealth management channels or bank accounts, without needing to open an account in Hong Kong, and without being hassled by banks for transfers, would you do it?

2. Defi projects

Defi OGs know that Defi is like financial Lego, and many variations can be played based on the underlying returns of U.S. Treasuries to enhance stablecoin yields. Besides the current leader AAVE, other established projects like Ethena, Pendle, and even Frax have opportunities to benefit. But I am more looking forward to seeing more Defi innovations emerge in the market, including fixed-income projects that were attempted last summer. New projects mean many opportunities, such as early participation in airdrops, contributing funds to earn tokens, or becoming contributors/secondary holders.

3. RWA track

The integration of yield-bearing stablecoins (with interest) and RWA (real-world assets) protocols will become a trend, with on-chain bonds and asset pools directly supporting stablecoins. Now even @coinbase is trying to directly support stock tokenization, and RWA is really gaining momentum. RWA series tokens — both old and new — will have more opportunities than other traditional crypto tracks. Currently, I am most focused on $ONDO$Plume, and I also have a good feeling about some new ones, which I will update later.

Final Summary:

The compliance of stablecoins is a significant event for the reconciliation/integration of cryptocurrency with the real world, potentially affecting the lives of hundreds of millions of ordinary people. This also contains enormous opportunities; the unexpected surge of $CRCL beyond the expectations of the crypto community is just one sign of this. Perhaps we have stayed too long in the small web3 world, failing to place ourselves in a larger pond, a bigger stage to assess the expectations and FOMO of outsiders towards a financial innovation (I am the same; I previously saw a maximum of 100). But let’s seize more opportunities together moving forward; the new world is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。