Today's homework is not difficult to write. The entire market is still playing around the geopolitical conflict. Yesterday, Powell said that the war in the Middle East has a short-term impact on energy prices, meaning it won't significantly affect inflation. However, looking at today's rise in oil prices, many investors are still worried. Today, the price of WTI crude oil rose to nearly $76, and Brent is almost $79, indicating that the war is unlikely to end soon.

The U.S. has not yet stated whether it will intervene. Trump's latest announcement is that he will decide within two weeks whether to negotiate or make a decision. I noticed that Trump really likes the number two weeks; the last time he gave Russia a deadline, it was also two weeks, but ultimately there was no result. This statement seems to be putting pressure on Iran as a final ultimatum.

However, after multiple bombings of Kyiv by Putin in Russia early yesterday morning, he publicly stated that he is ready to start peace talks with Ukraine. It is unclear how Ukraine will decide now, but it feels like Putin wants to take revenge first before discussing anything else. Overall, the main market sentiment is still focused on the geopolitical conflict, but in July, the issue of increasing tariffs will arise. Currently, it seems quite likely that the reciprocal tariffs will continue to be postponed.

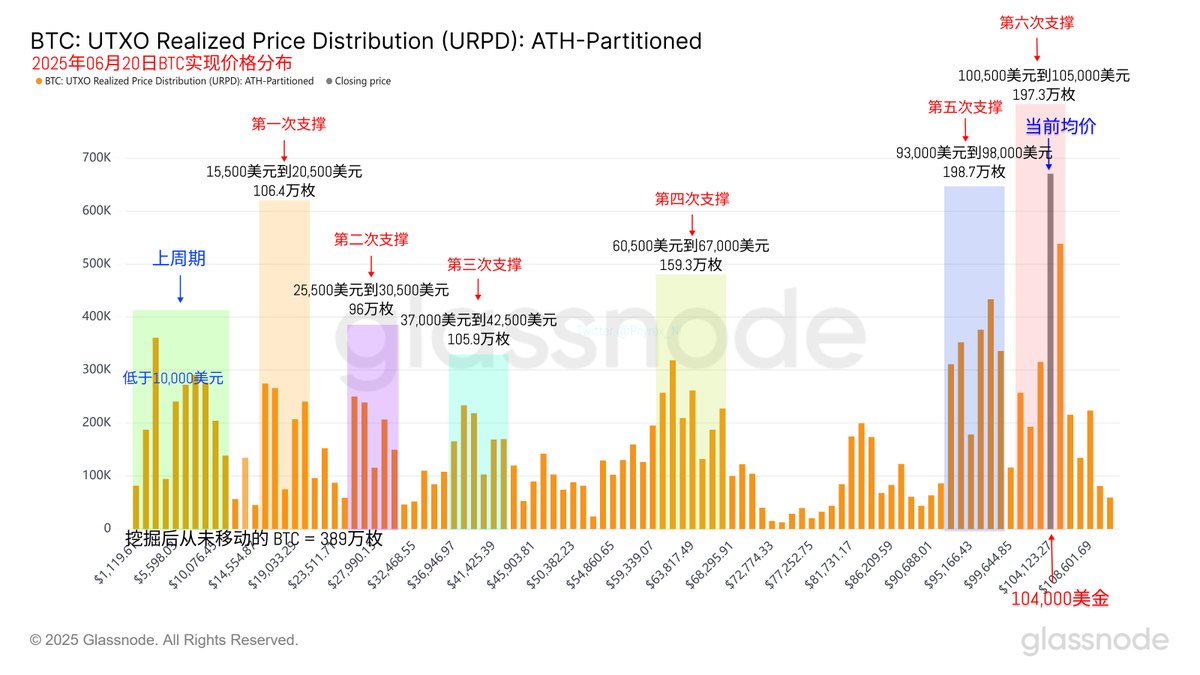

Looking at Bitcoin's data, since the U.S. stock market is closed today, liquidity and turnover rates are very low, similar to the weekend. The main trading activity comes from investors who chased prices higher in the last two days, and the geopolitical conflict has not triggered panic among earlier investors; market sentiment remains good.

From the support data, the support between $93,000 and $98,000 is still very solid, but the accumulation of chips between $100,500 and $105,000 continues to rise. The volume in this range will soon exceed the volume in the support area, especially the volume between $104,000 and $105,000 has already surpassed 1.2 million $BTC.

For now, it looks fine, but if this accumulation continues, especially if a single price exceeds 1 million coins, investors will become more urgent in their directional choices. The risk will increase.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。