Jesse stated that in the future, users will be able to directly use the account balance in the Coinbase app to interact with Base chain projects.

Written by: BitpushNews

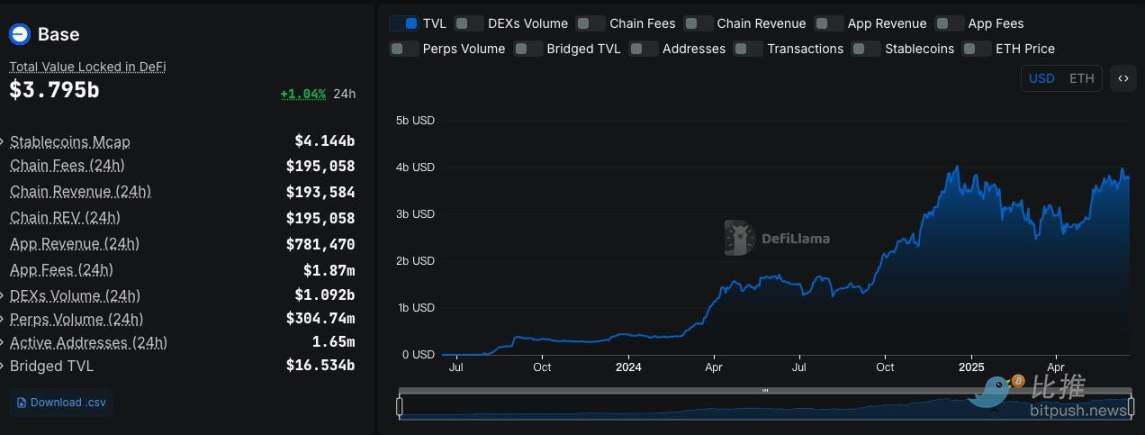

As an Ethereum Layer 2 chain fully supported by Coinbase, the Base chain ecosystem is quietly gaining traction.

From Coinbase's own strategic integration of Base to traditional financial institutions like JPMorgan testing the waters, and the continuous expansion of real-world payment scenarios, the Base chain is moving from technical infrastructure to broader practical applications.

This article will briefly analyze the recent important developments of the Base chain and outline projects within the current ecosystem that are worth attention.

Coinbase's Platform Integration: Promoting On-chain Asset Mainstreaming

Recently, Coinbase has been continuously promoting the integration of the Base chain into its core product logic. According to Jesse, the head of the Base chain, in the future, users will be able to directly use the account balance in the Coinbase app to interact with Base chain projects without complex on-chain operations. This integration strategy has brought about two significant changes:

Lower user threshold: A seamless trading interface similar to a centralized experience makes it easier for ordinary users to access decentralized applications.

Potential high liquidity: Once Base chain projects gain support, they can quickly reach Coinbase's tens of millions of users, providing important launch soil for early applications.

In addition, Max Branzburg, Coinbase's product head, has publicly stated that the company plans to integrate tens of thousands of on-chain assets into the main Coinbase app, building a more complete on-chain asset trading closed loop.

Real-World Scenario Breakthrough: Shopify Opens USDC Payments

In June 2025, the e-commerce platform Shopify announced a partnership with Coinbase and Stripe to allow merchants to accept USDC payments on the Base chain, covering consumers in over 30 countries worldwide. This marks the first large-scale entry of the Base chain into mainstream payment systems, indicating that its potential influence is expanding from crypto-native users to a broader internet economy.

Financial Giants Involvement: JPMorgan Pilot Issues "Compliant Stablecoin"

More noteworthy is the attitude of traditional financial institutions. JPMorgan recently tested the issuance of its "Deposit Token" (JPMD) on the Base chain, representing dollar deposits. Such assets may have future interest-earning capabilities and comply with regulatory paths. JPMD is seen as an alternative to traditional stablecoins, and if progress goes smoothly, it could become an important foothold for traditional institutions like banks, brokerages, and payment platforms to "go on-chain."

Against the backdrop of the Base chain welcoming its "financial backers," potential projects within the ecosystem are also worth our close attention.

1. Aerodrome (AERO)

The core DEX on the Base chain, utilizing the ve(3,3) model to govern liquidity incentives through voting and depth.

- Current TVL reaches $990 million, making it the largest AMM protocol on the Base chain.

- After integration with the Coinbase App, the number of users and transaction volume has further increased.

2. Spark Protocol: Lending Platform Based on Compound

Spark is a lending protocol initiated by MakerDAO community members and developed based on the Compound v3 engine, officially deployed on the Base chain. Its design goal is to optimize traditional lending models, making strategy execution more flexible and suitable for various asset allocation needs.

- More flexible interest rate mechanism: Compared to traditional Compound, Spark has optimized its interest rate model to dynamically adjust borrowing costs based on market changes, better supporting leveraged trading and re-staking of stablecoin assets.

- Rich asset support: The platform supports lending of mainstream stablecoins including DAI and USDC, suitable for conservative fund management needs.

- TVL performance: As of June 2025, Spark's total locked value on the Base chain has reached $410 million, ranking among the top lending platforms in the ecosystem and is one of the most stable growth protocols on the chain.

3. Stargate Finance: Cross-chain Bridging Hub on the Base Chain

Stargate is the core bridging protocol in the LayerZero ecosystem, now fully integrated with the Base chain, providing a secure and efficient underlying channel for asset flow between chains.

- Seamless cross-chain functionality: Users can perform one-click asset transfers between Base and main chains like Ethereum, Arbitrum, and Optimism, suitable for DeFi users, asset arbitrageurs, and multi-chain strategy accounts.

- Enhanced settlement layer status: As USDC, HUSD, DAI, and other stablecoins gradually accumulate on the Base chain, Stargate has become an important channel for supporting cross-chain transfers and fund flows of these assets.

- Clear ecological positioning: Stargate not only enhances the external interoperability of the Base chain but also attracts more developers to build integrated application protocols.

According to DefiLlama data, Stargate's TVL on the Base chain currently stabilizes around $120 million, ranking among the top cross-chain protocols.

4. Moonwell: A Lending Protocol Focused on User Experience and Security

Moonwell is one of the few lending platforms on the Base chain designed with ordinary users as the core focus, emphasizing security, transparency, and ease of use.

- Dual security mechanism: The platform integrates Chainlink oracles and Gauntlet risk models, allowing timely parameter adjustments during significant asset price fluctuations to reduce liquidation risks.

- Education-friendly design: Moonwell provides detailed user guides and community governance transparency, attracting new users to participate in lending while promoting user involvement in governance proposals.

- Integration with Coinbase Smart Wallet: Recently, Moonwell has integrated with Coinbase Smart Wallet, allowing users to operate lending directly in the Coinbase App without needing a mnemonic phrase, significantly lowering the usage threshold.

- Development status: As of mid-June, Moonwell's TVL on the Base chain has steadily grown, currently around $64 million, with a stable overall growth trend and long-term accumulation potential.

Summary

The Base chain is gradually evolving from a single technical infrastructure into a bridge connecting centralized exchanges, payment scenarios, traditional financial institutions, and crypto users. For ordinary investors, paying attention to the development of the Base chain ecosystem may mean gaining a forward-looking perspective in the next round of public chain narratives or user migration trends. The projects mentioned above, although at different stages of development, have all shown certain progress in community activity, technical design, or capital support. Of course, risks in the crypto market always exist, and it is advisable to conduct in-depth research before making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。