Today's homework is a bit difficult to write. The volatility in the last 24 hours has been quite significant, dropping from a high of $106,500 to nearly breaking below $102,000. Although I am not well-versed in geopolitical conflicts, the recent fluctuations are likely due to the conflicts in the Middle East. Looking at the oil price trends, today the price of WTI (West Texas Intermediate) has risen above $74, while Brent oil has slightly decreased.

This situation is relatively rare, mainly because of regional differences; WTI is more closely tied to domestic consumption and reserve demands in the U.S. The geopolitical conflict has sparked market concerns about U.S. energy security, coupled with a potential decline in U.S. crude oil inventories, leading to speculative inflows that have pushed up WTI prices.

In contrast, Brent oil primarily serves the global market and has recently been suppressed by weak European demand and downward adjustments in global economic growth expectations. Additionally, shipping in the Middle East has not been substantially interrupted, which has put pressure on Brent. Some institutions may also be engaging in arbitrage by going long on WTI and shorting Brent, further amplifying the divergence in their price movements.

Overall, the current war has led U.S. investors to believe that its impact on the U.S. will be greater, possibly due to concerns about the U.S. getting involved in the conflict or worries that the war will drive up energy prices, thereby exacerbating inflation and keeping interest rates high for an extended period.

Looking back at Bitcoin data, although the price of $BTC has shown significant volatility, the turnover rate has actually been declining, with most of the exiting investors being those at a loss. This indicates that while the war has triggered some panic, the panic sentiment has not intensified, and more investors seem to be indifferent to the geopolitical conflict.

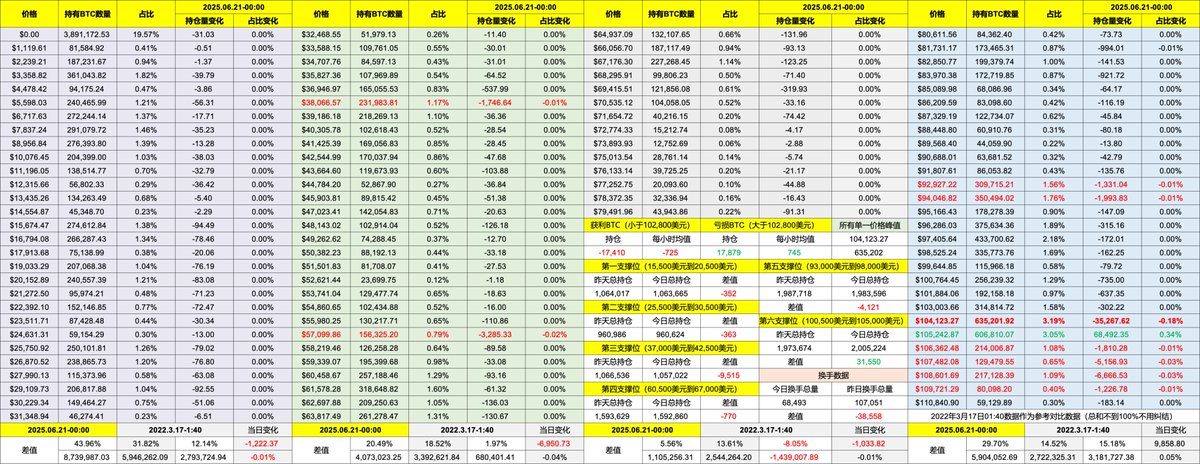

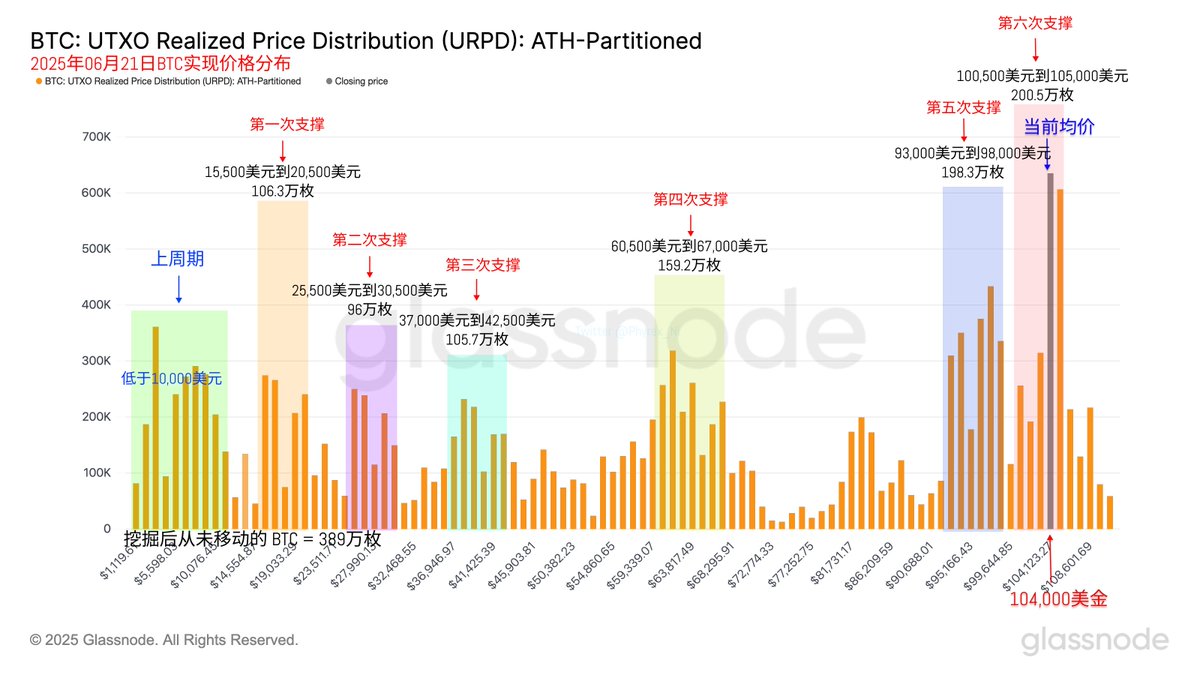

From the supporting data, while the $93,000 to $98,000 range remains the most solid support level, the accumulation of BTC in this range is now less than that between $100,500 and $105,000, where the stock has exceeded 2 million coins.

Currently, the impact is not significant, but if accumulation continues, it could force the market to choose a direction, especially since the stock in the $104,000 to $105,000 range exceeds 1.2 million coins. While the choice of direction may not necessarily be downward, if the market continues to release panic sentiment, the volatility of BTC may continue to increase.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。