Stablecoin Legislation + Retail Terminal Implementation, pulling the "threat of ten years later" into a valuation window of 24-36 months, the market is preemptively re-evaluating the "net fee rate curve" with stock prices.

Author: The Beauty of Bayesian

On June 13, the entire payment sector in the US stock market, including Visa and Mastercard, which have the deepest business model barriers, saw significant declines in stock prices. Why could the "stablecoin expectations" instantly penetrate the payment sector?

On June 11, the US Senate passed the "GENIUS Act" with a vote of 68-30, which for the first time made a national stablecoin license "almost a done deal," significantly reducing regulatory uncertainty and lowering the threshold for issuing coins;

On June 12, Shopify and Coinbase announced a pilot for USDC settlement on the Base chain, with the first batch of merchants going live the same day, indicating that small and medium-sized merchants can bypass card organizations and directly receive payments in on-chain dollars;

On June 13, the WSJ reported that Walmart and Amazon are evaluating the issuance of their own stablecoins; several media outlets followed up on the same day.

For Visa and Mastercard, the giants turning against them means that the "rate moat" is facing its first direct threat, leading to panic selling by institutions and significant stock price fluctuations during the day.

From the perspective of the entire payment industry chain, the decline is not "market beta," but rather "business model delta."

Visa, transaction assessment fee + interchange share ≈ total revenue 55%;

Mastercard, business structure similar to Visa, with higher leverage;

PayPal (leading the decline in the S&P payment sector), Branded Checkout fee 2.9%+, facing the greatest threat of substitution;

Shopify, Merchant Solutions (including Shopify Payments) ≈ gross profit 2/3;

Relative to the S&P 500's -1.1% pullback on the same day, payment stocks fell 2-6 times more than the index.

So, which revenue curve did the "stablecoin shockwave" actually hit?

Why is this the first time it truly threatens the 200 bp rate moat?

As soon as the news of Amazon and Walmart issuing stablecoins came out on Friday, the entire payment sector plummeted. The scale + bargaining power is large enough, with Amazon, Walmart, and Shopify collectively accounting for over 40% of US online GMV. If they collectively guide users to switch to "their own coins," they can bypass the cold start problem all at once. Unlike the "crypto payment" of the past, this time the on-chain cost-performance curve can rival that of card networks (Base chain TPS 1,200+, single transaction $0.01 Gas).

① The core still lies in the rate difference: 2.5% (traditional card payment model) → 0.2% (stablecoin payment model)

The average total cost for US merchants is approximately 2.1-2.7% (card fees + assessment fees). For on-chain stablecoins settled with USDC/L2, the combined Gas + On/Off-Ramp costs can be compressed to 0.25%. Merchant retention rates increase by an order of magnitude, immediately providing negotiation leverage.

② The yield on capital occupation is inverted

Stablecoin issuers must hold T-Bills 1:1, and the coupon yield can be fully or partially passed on to merchants/users, but traditional card clearing with daily "T+1/2" settlements does not share interest → income structure is double-hit (rate compression + liquidity yield loss).

③ Barrier shift, the global acceptance network and risk rules of card organizations are decades of accumulated "multilateral network effects," but on-chain contracts + international clearing replace the "physical terminal network" with "public chain consensus layer" and "offshore dollar reserves," rapidly migrating network externalities. The addition of Walmart/Amazon solves the "cold start" problem all at once.

Company-level sensitivity analysis?

For Visa / Mastercard, every 1 bp rate change ≈ EPS 3-4%;

For PayPal, its transaction profit margin is already under pressure; if stablecoins accelerate the replacement of Braintree (low-cost gateway), Branded Checkout gross profit will be diluted;

For Shopify, the Merchant Solutions take-rate (2.42%) includes card fees; if it shifts to on-chain, the Shop Pay commission needs to be repriced;

In the short term, Visa and Mastercard are testing their own Tokenized Deposit & Visa-USDC settlements, but the scale is still only 0.1% TPV;

PayPal has issued PYUSD, which can leverage the switch to "issuer" for profit, but it requires sacrificing high-margin business.

For Shopify, the company is transforming into a "multi-channel payment platform," which can pass on rates while retaining volume, but the GMV burden increases.

Long-term moat perspective

Visa and Mastercard still have hard barriers in fraud risk control, brand trust, and acceptance interfaces in over 200 countries. The moat remains the deepest in the payment stack;

PayPal's 430 million active accounts and BNPL/wallet ecosystem still have a lock-in effect, but the company also needs to undergo profound transformation;

Shopify's SaaS binding + OMS/logistics ecosystem, where payment is just an entry point, can migrate profits to SaaS ARPU by maintaining the front end.

Scenario Simulation: What does a 10% outflow of traffic mean?

Assumption: In 2026, US online retail is $1.2 T, with stablecoin penetration at 10% and a rate difference of 200 bp.

Visa + Mastercard: Potential annual revenue decrease ≈ $1.2 T × 10% × 200 bp × 55% share ≈ $1.3 B → EPS impact ≈ -6%.

PayPal: If 15% of Branded TPV flows out, operating profit may decline by 8-10%.

Shopify: Assuming only 20% GMV migrates and the take-rate torque decreases by 40 bp, gross margin compression ≈ 150 bp.

But more importantly, the low rates of stablecoins impact the entire payment system's fee structure. Even if they replace 10%, the total fee cake that this payment stack can share faces significant rate pressure.

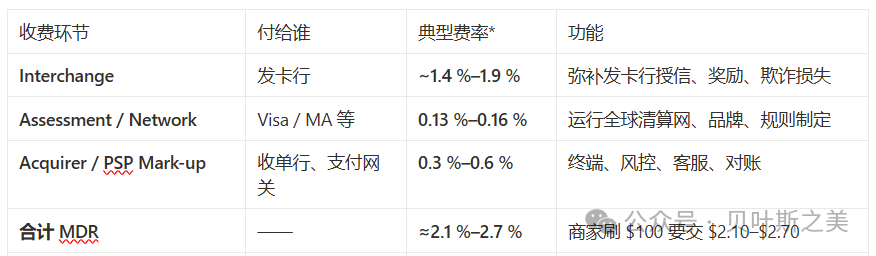

Here, let's analyze the payment stack for US merchants

The average total fee for most merchants in the US and Canada falls between 2.0%–3.2%; the example in the text is 2.34% (1.80% + 0.14% + 0.40%). Below, we break down the jump from "2.5% → 0.2%" to analyze which fee segments have been reduced to mere fractions by on-chain stablecoins.

1. Traditional Card Path: 2%–3% "Three-Level Sharing"

Interchange = the "cake" of the issuing bank (covering credit, points, fraud risk).

Assessment / Network & Processing fee = the "cake" of Visa and Mastercard, with rates around 0.13%–0.15% (domestic benchmark), plus a few cents per transaction processing fee.

Card organizations "set but do not share" interchange fees, charging acquirers through independent network fee items, which are then passed on to merchants, forming the core revenue in Visa / Mastercard's annual reports.

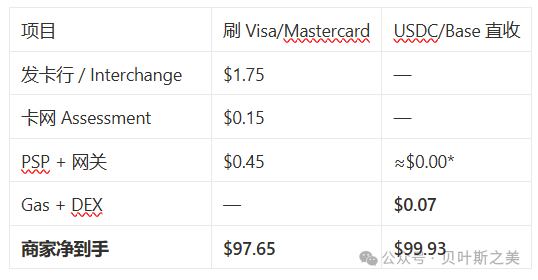

2. Stablecoin Path: Reducing "Each Level's Cut" to a Decimal Point

Scenario assumption: A Shopify merchant receives a $100 order, and the customer pays with USDC (Base chain). The merchant is willing to retain USDC and not immediately convert it back to a bank account.

If the merchant insists on converting back to fiat, they can use Coinbase Commerce's "1% off-ramp"—overall cost ~1.07%, still significantly lower than 2%+. However, long-tail merchants often retain USDC to pay suppliers and advertising fees, directly skipping the "withdrawal" step.

Why can it be as low as 0.25%?

First, Interchange is completely cut out, with no issuing bank and no credit risk → the largest portion of 1.5%+ goes directly to zero.

Second, Network costs are drastically compressed, with public chain consensus fees (Gas) priced at a few cents; on $100–$1,000 face value, this is almost negligible.

Then, the acquirer/gateway segment is commoditized, with Coinbase, Circle, and Stripe competing for "zero to a few tenths of a percent" to gain volume, significantly increasing merchants' bargaining power, putting the most pressure on aggregated payment platforms;

Additionally, there are reverse subsidies: Shopify announced a 1% USDC cashback to consumers, essentially using "interest + marketing budget" to offset residual fees and lock traffic back into its ecosystem.

3. A Comparison Bill (for a $100 transaction)

In the Shopify pilot, the acquirer fee is subsidized to 0; if using the Coinbase Commerce channel, it changes to $1.00.

4. What Other "Invisible Income" Has Been Taken Away?

Thus, the shift from 2.5% → 0.2% is not just a slogan, but a transformation where Interchange, Network, and Acquirer three-layer commissions are all reduced to "Gas + DEX + extremely thin gateway," shrinking the scale by two decimal places.

The turn of giants like Shopify and Amazon has made zero-fee/negative-fee solutions have considerable GMV for the first time, leading the market to reprice the fee moat of payment giants.

For Visa and Mastercard, the current impact is limited. Based on Visa's latest complete fiscal year (FY 2024, ending September 2024) public financial report data, the "platform Take Rate"—i.e., net operating income ÷ payment amount:

Visa's net operating income is $35.9 B, payment amount is $13.2 T, thus 35.9 ÷ 13,200 ≈ 0.00272

≈ 0.27% (≈ 27 bp), if using the "total payment + cash withdrawal amount," the total amount during the same period is $16 T.

35.9 ÷ 16,000 ≈ 0.00224 ≈ 0.22% (≈ 22 bp)

Payments Volume is a benchmark commonly used by Visa for pricing, excluding ATM cash withdrawals; therefore, 0.27% is the more frequently cited Take Rate in the industry. If ATM/cash withdrawals are included, the denominator increases, diluting it to about 0.22%. This Take Rate includes all of Visa's operating income (service fees, data processing fees, cross-border fees, etc.), but does not include the Interchange received by issuing banks—the latter is not Visa's income.

Further breakdown of FY 2024 revenue: service fees $16.1 B → corresponding to Payments Volume of about 12 bp, data processing fees $17.7 B, cross-border fees $12.7 B, etc., are mainly priced based on transaction volume/cross-border weight, making it impossible to directly convert to payment volume.

Thus, according to Visa's FY 2024 annual report, the most commonly used "net income Take Rate" is about 0.27% (27 bp); if cash withdrawal volume is included, it is about 0.22%, which is not much different from domestic payment channel fees, where domestic WeChat Pay and Alipay typically charge 0.6%; service providers can reduce it to 0.38%/0.2% (promotions, small businesses), so the core in the US is still that Interchange rates are much higher than those domestically.

Next, we need to monitor two lines:

The speed of merchant penetration after the bill passes—penetrating 10% GMV would be enough to erode Visa/MA EPS by 5%+;

Whether card networks can re-"pipeline" on-chain settlements—if they can recover 0.1%-0.2% of clearing fees, stock prices may revert to the mean.

Once the rate moat is thinned, the denominator of the valuation model changes—this is the fundamental reason why payment stocks were hammered by institutions last week.

What "high-frequency signals" should we monitor next?

June 17 Senate final vote & July House scheduling (legislative landing rhythm).

Amazon/Walmart white papers or patent applications (to judge real coin issuance vs negotiation leverage).

Shopify-USDC TPV KPI: If monthly flow exceeds $1 B, it will validate merchant-side feasibility.

Visa/MA stablecoin clearing network tested rates: whether they can incorporate "on-chain settlements" into their own pipeline.

Circle, Tether, and other reserve scales: if T-Bill holdings grow >25% over six months, it indicates that capital outflow is indeed occurring.

Therefore, the collective adjustment in payments is not "news trading," but rather a rewriting of the premises of the valuation model. Concerns have already arisen, and the entire traditional payment chain and rates in the US will face impacts. The subsequent development of stablecoins will need to be observed, with limited short-term impacts.

Stablecoin legislation + retail terminal implementation pulls the "threat of ten years later" into a valuation window of 24-36 months, with the market preemptively re-evaluating the "net fee rate curve" using stock prices.

Payment giants are not defenseless: Network-as-a-Service, custodial settlement layers, and Tokenized Deposits may all help rebuild barriers, but they require time and capital.

In the short term, the decline reflects the scenario of "most pessimistic rate compression-EPS sensitivity." If legislative provisions are ultimately tightened, or if card organizations successfully re-"pipeline" on-chain payments, there is room for stock prices to exhibit Beta-mean-reversion.

In the medium to long term, investors need to use second derivatives (changes in gross profit structure) rather than first derivatives (flow growth) to assess whether the moats of payment companies are genuinely narrowing.

Stablecoins represent a parallel clearing network of "zero fees + interest returns." When the strongest buyers (Walmart/Amazon) and the most inclusive sellers (Shopify merchants) embrace it simultaneously, the traditional flat 200 bp rate myth becomes difficult to maintain—stock prices have already given a warning ahead of revenue.

The end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。