I just realized that I forgot to do my homework yesterday. My bad. It’s not easy to give myself a break and go on a three-day vacation over the weekend, and I’ll be back home on Monday. I was thinking that there wouldn’t be much going on over the weekend, so I could just relax a bit, but then I got depressed by the geopolitical conflicts. Especially since liquidity is already weak on weekends, investors' emotions get amplified. The US stock market is also closed, so all the negative emotions are absorbed by cryptocurrencies.

To be honest, I think the reaction is a bit excessive. Although the escalation of geopolitical conflicts has indeed pushed up oil prices, this increase is not something the Federal Reserve is overly concerned about. Powell mentioned last time that the oil prices caused by geopolitical conflicts will be corrected, and the impact is mostly short-term.

So the Federal Reserve's focus is still on Trump's tariff policy. However, after the CME opens on Monday, the first thing we will see is the reaction from Asian investors, followed by European and American investors. Compared to Friday, the stock market may see a decline, but I still feel that the current situation of $BTC is oversold. The panic sentiment has been amplified by some investors. If it were a high liquidity weekday, the decline wouldn’t be this significant.

Additionally, looking at the selling situation, it occurred after 9 PM Beijing time, which is during the US trading hours. This can be seen more clearly from the candlestick chart. Asian and European investors did not react as strongly to the price changes. Although I marked the drop timeline on Sunday, if you look closely at Saturday and Friday, there were also significant declines during the US time zone.

On the contrary, there are signs of some rebounds in the Asian time zone. Of course, I’m not saying that there will definitely be a rebound on Monday. After all, the CME has opened, and Asian investors may see it as a suitable opportunity to buy the dip or panic sell. We’ll know in a few hours. Next, we’ll see if the US can resolve things quickly.

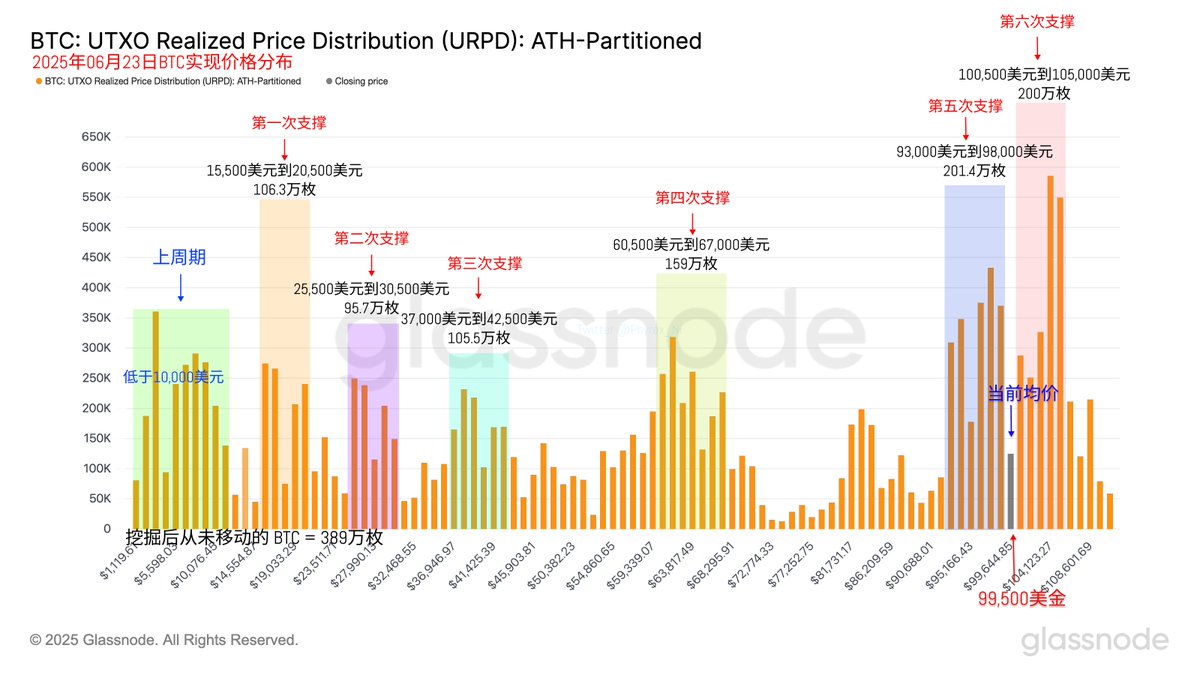

I forgot to organize the BTC data yesterday, but I’ve reorganized it today, and I can continue to post it tomorrow. From the support levels, $93,000 to $98,000 is still very stable. Currently, there are no signs of panic collapse. The current price changes are mainly due to the negative impact of geopolitical conflicts, which doesn’t need much justification. It’s just that investors are worried about oil prices or the instability of regimes leading to risk-averse sentiment.

Structurally, it looks very similar to Trump’s tariff issues in February. Once resolved, there is still a possibility of price rebounds.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。