Original Title: "Iran Becomes a Financial Market Trigger, Can Bitcoin Hold the $100,000 Mark?"

Original Author: 1912212.eth, Foresight News

On the evening of June 22, Kousari, a member of the Iranian Parliament's National Security Committee, stated that the parliament has concluded that the Strait of Hormuz should be closed, but the final decision rests with Iran's Supreme National Security Council. Once the news was released, BTC dropped from $102,810, eventually falling below $100,000 to a low of $98,200, and has now rebounded to around $100,800. ETH briefly fell to $2,111, marking a fourth consecutive daily decline. SOL dropped to $126, with a 24-hour decline of 3.45%, while other altcoins also saw widespread losses.

In terms of contract data, according to coinglass, the total liquidated contracts across the network amounted to $658 million in 24 hours, with long positions liquidating $526 million. The largest single liquidation occurred on HTX - BTC-USDT, valued at $35.4503 million.

With the market in turmoil, BTC briefly fell below $100,000. Will Iran really close the Strait of Hormuz?

The Strait of Hormuz is located between Oman and Iran, connecting the eastern Oman Gulf and the western Persian Gulf. It is the only maritime route for oil exports from the Gulf region to the rest of the world, with about one-third of global maritime crude oil trade passing through the Strait. Iran controls a significant amount of high ground, caves, and key islands on the western shore of the Strait, such as Hormuz Island, Fars Island, and Lark Island. If a blockade is ordered, a "layered fire blockade network" can be established immediately.

Historically, Iran has threatened to close the Strait of Hormuz multiple times but has never actually implemented it. For example, during the Iran-Iraq War in the 20th century, Iran threatened to close it but ultimately did not follow through. In recent years, after the U.S. withdrew from the Iran nuclear deal and reinstated sanctions, Iran has also issued similar threats.

Iran's economy heavily relies on energy exports through the Strait of Hormuz. If the Strait is closed, Iran's economy would suffer a severe blow, making life more difficult for its citizens and potentially accelerating a legitimacy crisis for the regime. Additionally, a blockade would severely worsen Iran's foreign relations, isolating it further in the international community.

Dr. Liu Qiang, Vice Chairman and Director of the Academic Committee of the Shanghai International Strategic Research Center, stated, "If Iran is rational, it is highly likely that it will not decide to close the Strait. The disadvantages of closing the Strait outweigh the benefits for Iran. Currently, the international community tends to sympathize with Iran, and if a blockade is implemented, it will only provoke opposition from various countries and reverse the favorable international opinion."

U.S. Vice President Vance stated, "Iran's attempt to block the Strait of Hormuz would have a suicidal effect on their economy. In his view, it is unlikely that Iran will decide to do so."

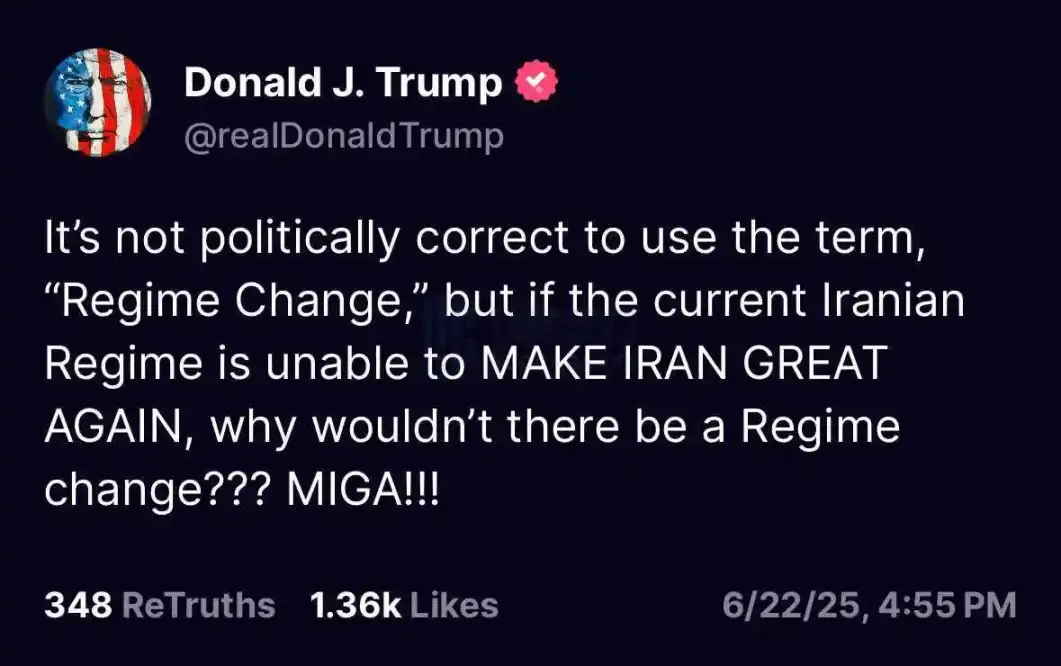

Trump stated on his social media platform Truth in the early hours of June 23, "Using the term 'regime change' is politically inappropriate, but if the current Iranian regime cannot make Iran great again, why can't a regime change happen? MIGA."

What choice will Iran ultimately make? The market is holding its breath.

The crypto community is in despair; is the bull market still alive? Is now the right time to buy the dip?

Trader Eugene Ng Ah Sio posted on his personal channel at 10 PM last night, "I am quite actively opening long positions here, including Bitcoin and some altcoins. I believe that the bombing actions by the U.S. earlier today, combined with the closure of the Strait of Hormuz, are a continuous blow to early bulls, and it has been enough to wash out positions. Now is the time to 'buy the dip.' If the market directly gaps down to $95,000, then we can only say 'good night,' but this is the last battle for the bulls, and I am already positioned."

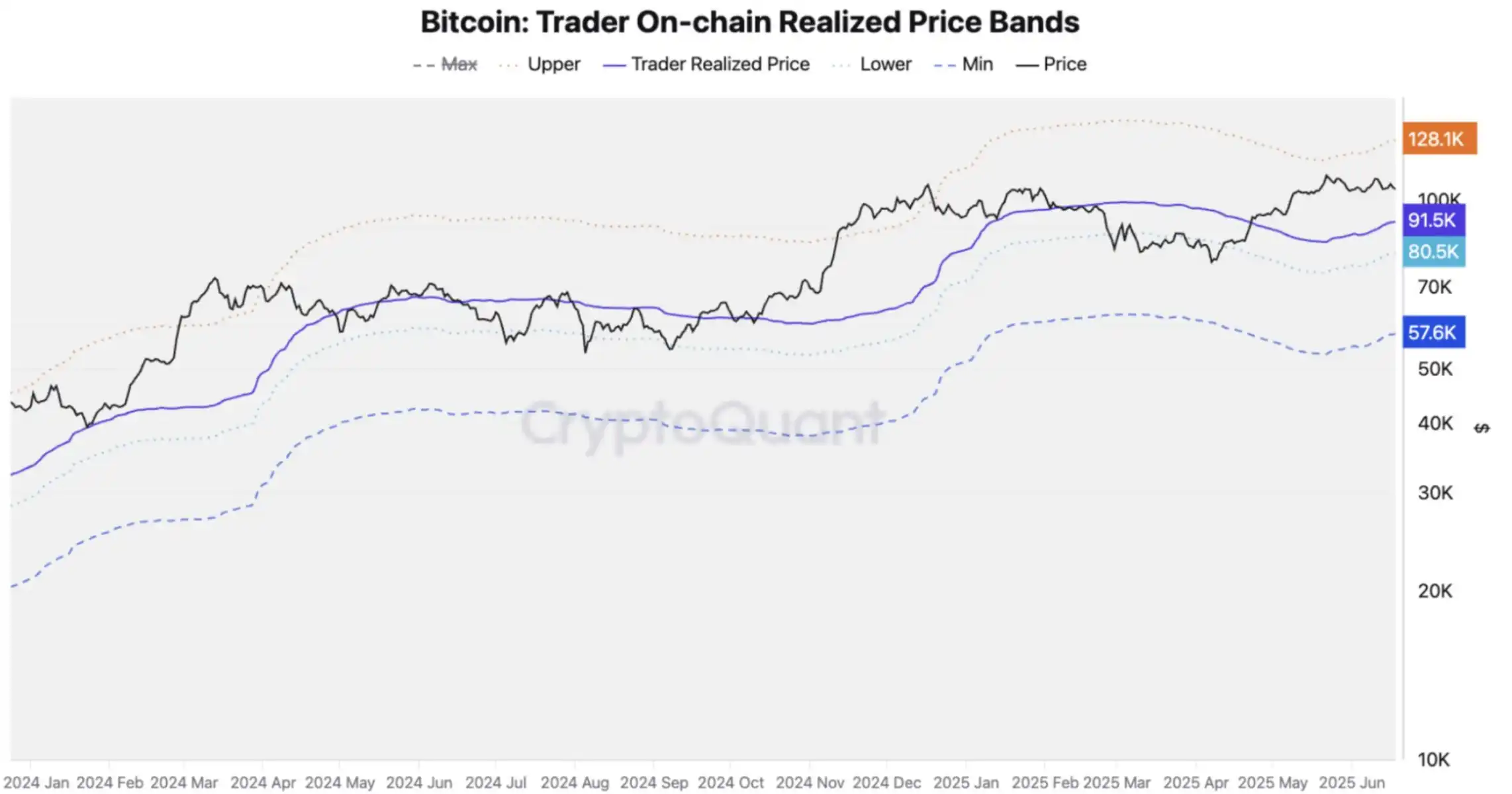

Julio Moreno, Head of Research at CryptoQuant, stated that Bitcoin demand is showing signs of cooling after a period of accelerated growth, with prices nearing $112,000. Spot demand is still increasing, but the growth rate has slowed and is currently below historical trends. The purchasing volume of Bitcoin by whales and ETFs has halved. The demand from new investors is also declining. In the futures market, investors have recently chosen to take profits and start building new short positions.

If demand continues to weaken, Bitcoin may find support around $92,000, which corresponds to the on-chain actual cost price for traders and is a typical support area during a bull market. If this support fails, the next support level may be at $81,000, close to the lower bound of the on-chain actual cost price for traders.

On-chain data analyst Murphy tweeted that although the price of ETH has retraced nearly 20% from its highs, he still does not believe this is the best buying opportunity. The percentage of profitable supply data shows that it is still at 55%, meaning that even at the current price, 55% of circulating tokens are in profit. Historically, only when a large portion of circulating tokens are in loss does it become a more cost-effective time to buy the dip.

Mike Novogratz, founder of Galaxy Digital, tweeted that the next 72 hours are crucial, but if Iran does not retaliate, the market will rise significantly by the weekend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。