Original Title: Bitcoin as corporate treasury: Why Meta, Amazon and Microsoft all said no

Original Author: Marcel Deer

Translation: Asher(@Asher_0210)

Editor’s Note: Bitcoin, as an emerging digital asset, is gradually being viewed by some companies as an alternative financial reserve, attracting considerable attention. However, its price volatility, uncertain regulatory environment, and potential dilution of shareholder value have led most large enterprises to adopt a cautious stance. Tech giants like Meta, Amazon, and Microsoft have explicitly rejected the establishment of Bitcoin reserves, prioritizing financial stability and business continuity.

In contrast, Strategy has actively positioned itself in Bitcoin, achieving significant stock price growth through its upward potential, but also bearing considerable risks. Overall, companies are generally weighing innovation against risk, and in the short term, Bitcoin financial strategies remain a minority attempt, with future development still reliant on further clarity in regulatory and market environments.

The Basic Logic of Corporate Bitcoin Reserves

When a company holds Bitcoin on its balance sheet, it is referred to as a Corporate Bitcoin Treasury. Unlike merely holding traditional financial assets and cash, some companies also view Bitcoin as an alternative means of value storage or investment strategy. Converting cash reserves into cryptocurrency represents a new shift in corporate financial strategy. In recent years, this concept has garnered significant media attention, especially with Strategy's ongoing expansion of its Bitcoin reserves, sparking widespread discussion.

Currently, an increasing number of companies are considering shifting funds from traditional "safe assets" to this more volatile category of digital assets, with the most optimistic forecasters predicting Bitcoin prices could range between $130,000 and $1.5 million.

On the other hand, establishing a corporate cryptocurrency strategy also means that companies need to bear considerable risks. Traditional financial management emphasizes capital preservation, while Bitcoin financial management introduces speculation and volatility into the balance sheet. Matthew Sigel, head of digital assets at VanEck, warns that companies like Metaplanet, which actively raise funds to purchase Bitcoin, may shift from "strategic growth" to "shareholder impairment." Once a company's stock price merely aligns with net asset value, issuing new shares to buy Bitcoin ceases to be a strategic action and becomes value erosion.

In other words, if a company's stock is no longer trading at a premium, then using new stock issuance to purchase Bitcoin will dilute shareholder value rather than increase company assets, which is a dangerous signal for investors. Therefore, how a company manages its capital reserves will directly impact its valuation and ability to respond to economic downturns. For publicly traded companies, introducing a Bitcoin financial strategy also requires shareholder support, and large tech companies like Meta, Amazon, and Microsoft have recently proposed similar concepts.

The Stance of Meta, Amazon, and Microsoft on Bitcoin Financial Strategy

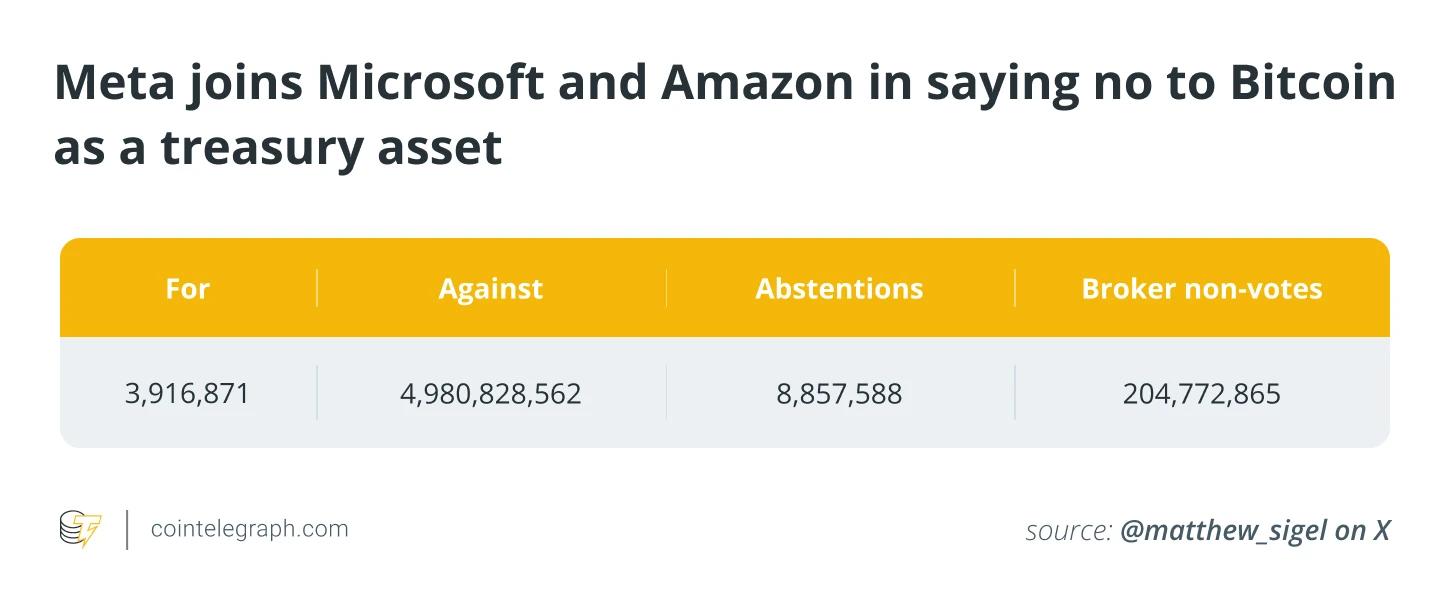

Shareholders of Microsoft, Amazon, and Meta have explicitly rejected proposals to establish strategic Bitcoin reserves. At Meta's 2025 annual shareholder meeting, shareholders expressed strong opposition to the establishment of Bitcoin reserves, with over 90% voting against the proposal. The proposal suggested that Meta consider converting a portion of its $72 billion cash reserves into Bitcoin, and here are the voting results:

Votes in favor (3,916,871 votes): Number of shareholders supporting Meta's introduction of Bitcoin reserves;

Votes against (4,980,828,562 votes): Shareholders strongly opposing the proposal, holding an absolute majority;

Abstentions (8,857,588 votes): These shareholders chose not to express a stance, and abstentions are not counted in the results;

Broker non-votes (204,772,865 votes): Shares held by brokers but without voting instructions; brokers cannot vote on specific proposals without client authorization.

It is evident that nearly 5 billion votes opposed the proposal, and Meta shareholders firmly rejected the inclusion of Bitcoin on the company's balance sheet.

Nevertheless, Bitcoin supporters continue to emphasize its scarcity and long-term value storage advantages. At the 2025 Bitcoin Conference in Las Vegas, Strive Asset Management CEO Matt Cole called on Mark Zuckerberg to support the proposal, joking, "You've already taken the first step by naming your goat 'Bitcoin'; I urge you to take the second step and formulate a bold corporate Bitcoin financial strategy." However, ultimately, the proposal received less than 1% support. The board had previously recommended rejecting the proposal, stating, "We do not evaluate whether crypto assets are superior to other assets, but given our existing corporate financial management processes, the board believes this assessment is unnecessary."

This statement aligns Meta with Amazon and Microsoft, as these three tech giants have also rejected proposals to shift company reserves toward Bitcoin, collectively choosing to avoid the volatility risks of the cryptocurrency sector and adhering to a strategy of financial stability.

Why Tech Giants Reject Bitcoin?

The Meta board and shareholders listed several reasons for rejecting a Bitcoin financial strategy, primarily including risks, regulatory uncertainty, and business focus considerations:

Volatility concerns: Bitcoin remains a highly volatile asset. Including it on the company's balance sheet could lead to significant fluctuations in company earnings and financial status, which poses a major concern for traditional investors regarding financial planning uncertainty;

Regulatory uncertainty: There is still a lack of clear and unified regulatory frameworks for crypto assets. With constantly changing legal and tax policies, additional compliance risks are introduced for publicly traded companies;

Business focus: Shareholders of large tech companies prefer to maintain predictability and stability in business operations. In the context of accelerated AI and digital transformation, both the tech and crypto industries are rapidly evolving, and companies generally wish to focus on core business areas, avoiding distractions from speculative assets;

Fiduciary responsibility: Companies must balance innovation with accountability to shareholders. From a legal perspective, companies have an obligation to manage assets responsibly, while Bitcoin is viewed by many as a speculative asset, which conflicts with corporate fiduciary duties. Due to cautious considerations of legal risks, boards generally tend to adopt a "wait-and-see" attitude.

Strategy as an Outlier in Bitcoin Financial Strategy

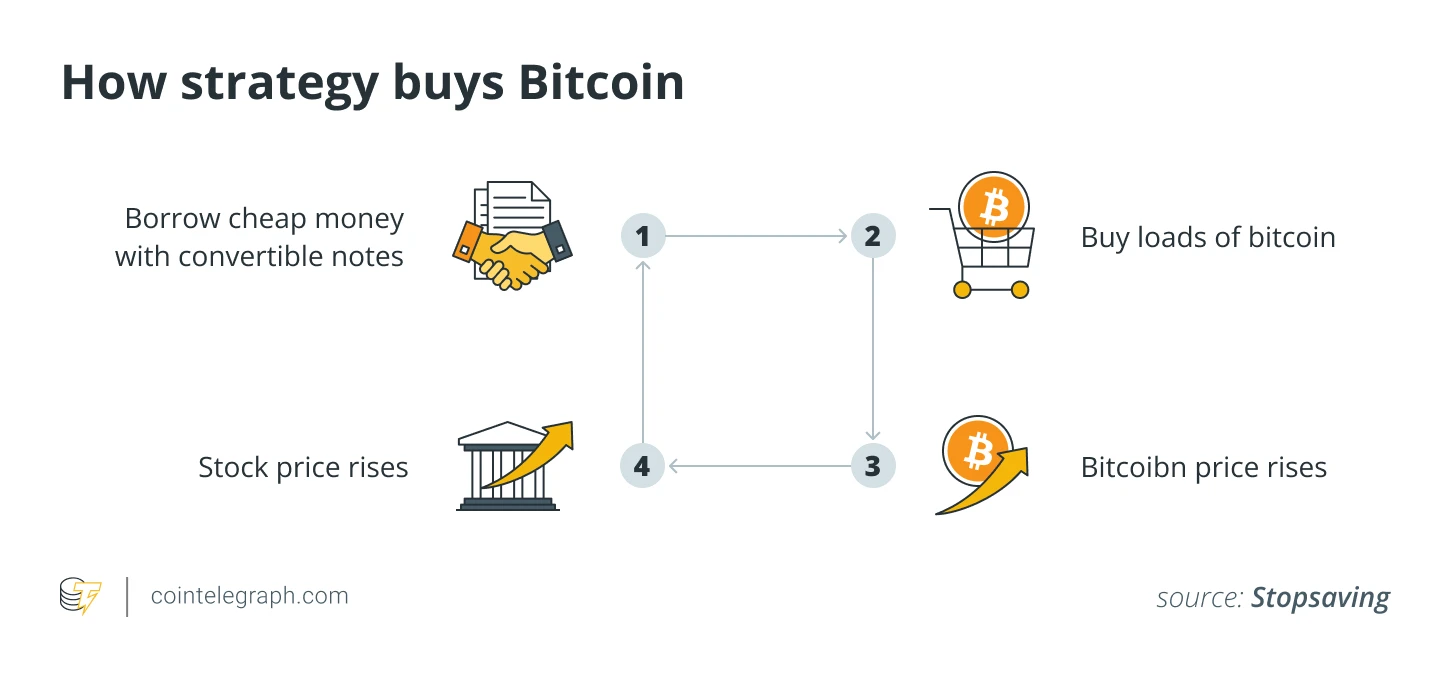

Since 2020, Strategy has accumulated over 500,000 Bitcoins, with a total investment exceeding $33 billion (calculated at an average price of $66,279 per Bitcoin). This American company is initially known for its business intelligence services, which remain its core business, but due to its expanding Bitcoin reserves, Strategy has often been viewed as a "Bitcoin proxy." Company chairman Michael Saylor stated, "The current focus has shifted to a Bitcoin acquisition strategy, which has proven effective: on December 23, 2024, Strategy successfully joined the Nasdaq 100 index, becoming a landmark company in the context of digital assets."

As of June 2025, Strategy holds over 2% of the total Bitcoin supply, attracting widespread media attention. As Bitcoin prices continued to rise in late 2024 and early 2025, Strategy's stock price and company valuation also surged. By June 12, 2025, Strategy (MSTR) stock price had skyrocketed 3,180% over five years, soaring from $11 to $387, with its stock performance highly correlated to Bitcoin's movements, providing shareholders with similar exposure to direct holdings. However, this high correlation also means that investors must face the high risks brought by the cryptocurrency market's volatility. The case of Strategy demonstrates the enormous upside potential of transforming a company through a Bitcoin financial strategy—however, this aggressive path is not a risk most companies are willing to take.

Outlook for Companies Adopting Bitcoin Reserves

Tech giants like Meta, Amazon, and Microsoft currently remain focused on their core businesses. At least in the short term, they are still waiting for a clearer regulatory framework for crypto assets and a more predictable risk environment; until then, these companies are unlikely to take aggressive financial actions.

Bitcoin financial strategies remain an exception rather than the norm. The rejection of related proposals by Meta shareholders indicates that this concept still resembles more of a hype than a reality; even in the face of potential returns, even innovative companies are reluctant to take on the significant risks of volatility and strategic distraction. American tech giants are generally cautious and have not followed Strategy's example of using Bitcoin as a reserve asset, instead continuing to adhere to traditional, safe financial management practices.

The core principles of corporate financial management—risk minimization, liquidity assurance, and alignment with operational needs—are fundamentally incompatible with high-volatility assets like Bitcoin. Bitcoin's price can fluctuate dramatically by over 50% within months, far exceeding the tolerance levels of most corporate finance departments. Therefore, companies like Meta, Amazon, and Microsoft continue to concentrate their financial reserves in cash equivalents, short-term securities, and diversified assets, aligning with their core business strategies. Even among innovative companies, crypto assets are often viewed more as a burden than an advantage. In 2024, several companies related to the crypto industry collapsed, and the ongoing scrutiny from the U.S. SEC and global regulators further reinforced the conservative stance of enterprises.

Until a clearer regulatory framework, accounting standards, and custodial solutions are established, Bitcoin as a corporate reserve asset will remain an attempt by a very small number of companies. In the short term, supporters hoping for Bitcoin to be widely incorporated into corporate balance sheets may still need to be patient. For most CFOs, their evaluation criteria are the robustness of assets, not the speculation of assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。