Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

On June 12, the U.S. Senate passed the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" (GENIUS Act) with an overwhelming majority of 68 votes in favor and 30 against, establishing the first federal regulatory framework for dollar-pegged stablecoins. This bill, known as the cornerstone of the "digital infrastructure of the dollar," is now just a step away from becoming law, pending approval from the House of Representatives and signature from President Trump, and is expected to be officially enacted before the August congressional recess.

The news of the bill's passage quickly triggered a chain reaction in the market. Stablecoin issuer Circle successfully listed on the New York Stock Exchange, with its stock price soaring over 200% on the first day of trading, currently reported at $240.6, marking an astonishing increase of 774% compared to its issuance price of $31, making it the "first stock of stablecoins" (For details, see: "Crypto Bull Market, All in U.S. Stocks: Circle from $31 to $165 in Ten Days". Meanwhile, the total market capitalization of stablecoins surpassed $250 billion, with annual trading volume exceeding the combined total of Visa and Mastercard, and the number of active addresses globally reached 261 million, with stablecoins quietly becoming the "water, electricity, and coal" of the global digital financial system.

This policy turning point resembles the legislative moments of the internet in the 1990s: The rule-makers are not necessarily the innovators, but they often act as accelerators. When the policy wind rises, the market is bound to become restless. So, in this "gold rush" for stablecoins ignited by the GENIUS Act, who has taken the lead? Who will rise? And how can ordinary people share in the spoils of this wave?

Market Barometer: Who Will Take the Lead?

The passage of the GENIUS Act is triggering a structural reassessment of the entire capital market, not only benefiting stablecoin issuers with "regulatory dividends," but also prompting traditional financial institutions and tech giants to place bets and accelerate their entry into the compliant stablecoin ecosystem. A number of crypto concept stocks have even reacted in advance, becoming barometers for the market to capture policy dividends.

Stablecoin Issuers: Compliant Giants Welcome Spring, Offshore Players Face Challenges

Circle (CRCL): The issuer of the world's second-largest stablecoin USDC is the first to benefit from the compliance dividends brought by the GENIUS Act. Circle successfully listed on the NYSE in June 2025, with an issuance price set at $31, and its stock price soared to $69 on the first day, an increase of over 200%, triggering the circuit breaker mechanism multiple times during trading. Circle has publicly stated that it will fully comply with the GENIUS regulatory requirements, using U.S. Treasury bonds and cash as core reserve assets, becoming one of the representatives of "Dollar 2.0."

Licensed institutions such as Paxos and TrustToken (TUSD issuer) are also accelerating their transition to the GENIUS framework, striving for federal-level stablecoin issuance qualifications; in contrast, a number of offshore projects like Tron USDD and Tether USDT (registered in BVI) face pressures regarding information disclosure and reserve structure audits. If they encounter cross-chain liquidity restrictions or bank channel compressions, they will gradually lose mainstream trading scenarios.

SBET (StableBet Technologies): A new concept stock that has recently emerged in U.S. stock trading, seen as a dual windfall player of "compliant stablecoins + on-chain gambling payments." Its core product is to build a real-time settlement channel for USDC in decentralized gambling platforms, and it has already integrated into the Base and Polygon on-chain ecosystems. After the announcement of the GENIUS Act, this stock hit the daily limit for three consecutive days, attracting retail and institutional investors.

Previously, more U.S. stock crypto concept stocks, such as SRM Entertainment, SharpLink Gaming, and Coinbase, have been compiled and organized by Odaily Planet Daily in "Crypto Bull Market, All in U.S. Stocks: Circle from $31 to $165 in Ten Days".

Traditional Financial Institutions: Actively Embracing Stablecoins, Layout for Digital New Map

JPMorgan: Its stablecoin project "JPM Coin" has already been applied in internal settlements and is now gradually expanding to connect with USDC channels, providing on-chain settlement services for institutional clients. After the passage of the GENIUS Act, JPM announced it is considering applying for a formal stablecoin license to expand its external client business.

Goldman Sachs, Citigroup, and Bank of America are accelerating cooperation with compliant issuers like Circle and Paxos, integrating stablecoin clearing pools through APIs to meet the surge in client demand for real-time cross-border settlements and RWA tokenization.

SRM (Secure Reserve Management): This company is considered a potential pioneer in "traditional asset management + stablecoin custody services," focusing on asset management based on a combination of Treasury bonds and stablecoins. Its stock price has also been favored after the passage of the GENIUS Act, being dubbed the "on-chain version of BlackRock." On June 16, the stock surged over five times in a single day, with its market value skyrocketing from tens of millions to approximately $158 million. The surge was driven by the company's announcement of securing a $100 million investment and launching a token treasury strategy on the Tron network, becoming "Tron's version of MicroStrategy betting on crypto asset reserves." (For further reading: "Tron Merges with SRM Aiming for Nasdaq, Sun Yuchen's Move in the Stratosphere")

Tech and Internet Giants: Entering Payment and RWA Tracks, Expanding Application Boundaries

Ant Group: Announced in June 2025 that it will simultaneously apply for stablecoin issuance compliance licenses in Hong Kong, Singapore, and Luxembourg, and has completed regulatory sandbox testing, becoming a representative of Asian internet companies that have successfully navigated compliance paths. Its "Trusple on-chain payment + USDC settlement" product has been piloted in Southeast Asia.

JD Technology: Quietly launched an "on-chain cross-border procurement settlement platform," planning to connect with USDC, HKDC, and other diverse stablecoin resources for supply chain settlements, especially targeting e-commerce scenarios along the Belt and Road. In the future, it may enable RWA custody functions, embedding blockchain invoices and asset rights confirmation. (For details, see: "After Missing the Payment Decade, Liu Qiangdong Aims to Spark JD's 'Second Payment Revolution' with Stablecoins?")

Amazon, Google, Apple, and X are also using stablecoin wallets, NFT identity verification, and cloud-hosted USDC accounts as breakthroughs, attempting to integrate stablecoins into their payment systems. For example, Amazon's Web3 team has reached a cooperation agreement with Circle to integrate USDC as a settlement method in some regions of Prime.

Who Will Win in the Second Half?

DeFi Ecosystem: Yield Logic Reshaped

Once "compliant stablecoins" dominate the market, DeFi will bid farewell to its wild growth. The regulations on reserves and settlement paths may lead DeFi to become more "financial fundamentalist"—returning to the essence of "decentralized finance" rather than being "arbitrage aggregators."

The author believes that the passage of the GENIUS Act has profound implications for the DeFi industry, as protocols relying on USDT for high leverage and interest rate arbitrage face compliance pressures and need to quickly adjust their models. In contrast, projects that emphasize transparency, decentralization, and resistance to censorship, such as MakerDAO and Uniswap, will be able to leverage the compliance dividends of the act to further expand their market share. In the future, as the compliant stablecoin market expands, the DeFi ecosystem will gradually become a core pillar of digital finance.

RWA Track: A Trillion-Dollar Market Enters the Explosive Point

The GENIUS Act explicitly allows stablecoins to be pegged to real assets such as U.S. Treasury bonds as reserves, which not only provides legal protection for stablecoins but also directly opens the door for the RWA tokenization track.

According to Goldman Sachs' predictions, by 2030, the global RWA tokenization market size will exceed $16 trillion, with U.S. Treasury bonds, corporate bonds, real estate, and gold being the primary assets to be tokenized. Currently, the total market value of U.S. Treasury bonds alone exceeds $26 trillion, with short-term Treasury bills (T-Bills) becoming the preferred underlying asset for compliant stablecoins and on-chain RWA products.

In this trend, global asset management giants are rushing to build "on-chain Wall Street":

BlackRock: Launched the BUIDL fund, allowing institutions to subscribe to on-chain Treasury bond products through USDC, currently managing over $450 million.

WisdomTree: Has launched the WisdomTree U.S. Treasury Digital Fund and included it in its SEC-registered fund platform.

Franklin Templeton: As early as 2023, it launched Benji Investments, moving some short bond funds to operate on-chain.

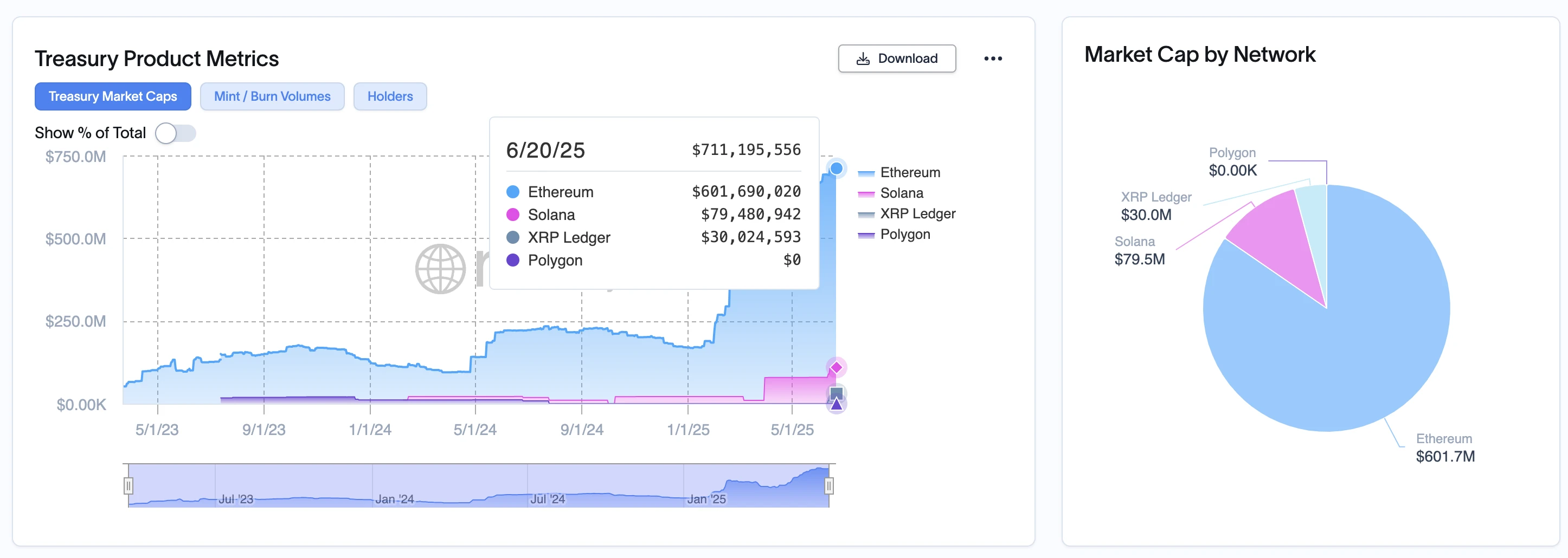

At the same time, on-chain RWA platforms are also experiencing a peak in financing and user activity: Ondo Finance's short-term U.S. Treasury bond token OUSG has reached a total market value of $711 million; on-chain credit platforms such as Maple Finance, Centrifuge, and Goldfinch have successively launched asset packages for debt, real estate, and supply chain finance; Chainlink provides off-chain asset pricing oracles, becoming an important component of the RWA industry infrastructure. (Recommended reading: "RWA Weekly | The GENIUS Act to undergo final voting at midnight on the 18th; Plasma's $500 million public offering sold out in minutes (6.10-6.17)", summarizing the latest industry insights and market data.)_

With the advancement of the GENIUS Act and the clarification that "RWA can be used as reserves for stablecoins," RWA products are expected to enter an exponential growth path similar to that of stablecoins:

In the past five years, the market value of stablecoins has grown from less than $5 billion to over $250 billion, and RWA is also expected to replicate a similar path.

In the next 3 to 5 years, RWA may become a new asset allocation channel for institutions and retail investors, with on-chain funds, on-chain real estate, and on-chain gold likely entering the investment landscape. Transitioning from "niche innovation" to "mainstream allocation," RWA is standing at the starting point of an explosion.

Cross-Border Payments: A New Paradigm is Taking Shape

For decades, global cross-border payments have heavily relied on the SWIFT system, but its essence remains a messaging network dependent on bank node intermediaries, which generally suffers from high latency (T+2 or even longer), high costs (fees often exceeding 5%), and low transparency (unclear paths), making it difficult to adapt to the real-time and open nature of global digital transactions.

The emergence of stablecoins, especially dollar-pegged USDC and USDT, is reshaping this landscape. They possess advantages such as programmability and settlement upon clearing, making them naturally suitable for cross-border transfers, B2B settlements, and supply chain payments. Data shows that in the first quarter of 2025, the P2P cross-border transaction volume through USDT in Latin America increased by 193% year-on-year, with Argentina and Venezuela accounting for nearly 41% of the total, reflecting a strong demand for hedging in high-inflation environments.

On the other hand, the U.S. is using the GENIUS Act to bring this phenomenon of "digitalization of the dollar" into a compliant framework, aiming to control its flow and guide its ecological development, effectively providing sovereign credit backing for the circulation of dollar stablecoins globally.

This also opens a new window for enterprise-level payments. Several tech and retail giants are exploring prototypes of on-chain dollar networks: Amazon is incubating a "supply chain stablecoin settlement project" within its AWS department, aiming to optimize settlement efficiency for suppliers in Southeast Asia and India; Musk's X platform is testing the X-Pay system, integrating its social network with stablecoins to connect the global content economy; the Telegram TON ecosystem has fully integrated USDT and is gradually expanding to integrated scenarios of "tips, e-commerce, and transfers."

Additionally, stablecoins have become powerful tools for small and medium-sized cross-border merchants globally. Local wallets such as AirTM (Latin America), Yellow Card (Africa), and Coins.ph (Southeast Asia) are integrating USDC/USDT as default cross-border settlement tools, covering tens of millions of unbanked users.

In regions where global settlement infrastructure still has gaps, stablecoins may become a "lightweight deployment form of digital dollars," thereby changing the power structure of payment entry points.

Blockchain Infrastructure: Revaluation of Public Chain Value in the New Compliance Era

The implementation of the GENIUS Act also means unprecedented regulatory compatibility requirements for the infrastructure layer. Assets such as stablecoins and RWAs circulating on-chain no longer pursue "technical performance" alone but must meet "compliance-friendly features" such as KYC/AML compliance interfaces, on-chain audit traceability, and regulatory agency collaboration permissions.

This has made compliant chains, consortium chains, and modular public chains hot topics. For example, Avalanche and Berachain are exploring "on-chain regulatory as a service" modules, while cross-chain protocols LayerZero and Wormhole are gradually integrating into compliance frameworks to ensure that stablecoin assets can still be tracked and frozen during cross-chain transfers, meeting the dual requirements of "assets can cross chains, and regulation can be located."

It is foreseeable that the future competition for infrastructure will no longer be just a race for TPS or gas optimization, but around who can provide more comprehensive, flexible, and compliant data control and identity verification solutions. Underlying public chains will shift from a "free geek paradigm" to a "sovereign collaborative paradigm," and this transformation may reshape the trust foundation of the entire crypto world.

Conclusion: The Intersection of Policy Winds and Wealth Reconstruction

The accelerated advancement of the GENIUS Act is pushing stablecoins, this digital financial tool, towards institutionalization, compliance, and global infrastructure. This marks the arrival of a regulatory era and a reshaping of market logic.

For ordinary people, this is a test of information sensitivity and judgment. Under the triple force of "policy endorsement + capital boost + tech giants entering the fray," stablecoins are no longer just technical tokens on the chain but may become one of the most explosive golden tracks in Web3 over the next decade.

As U.S. Treasury Secretary Yellen stated: "The stablecoin ecosystem will drive structural demand for U.S. Treasury bonds from the private sector, helping to control national debt levels and attract global users to participate in the dollar-dominated digital economy. This is a 'triple win' systemic transformation."

Trump referred to the GENIUS Act as "a reflection of American wisdom," giving it a national strategic positioning. However, some critics warn that this resembles a "digital minting revolution" plotted by capital elites—decentralized in technology, but forever centralized in finance.

Is it a new cornerstone of trust or a new tool of power? The future will depend on whether the system can check greed and whether technology truly serves trust.

At this moment, the wind is rising, and the tide is surging. The stablecoin gold rush is quietly rewriting the wealth map of global finance.

Related Reading

Dollar Hegemony 2.0: How Does the GENIUS Act Reshape the Global Landscape of Stablecoins?

After the U.S. GENIUS Act, what new highlights are there in the stablecoin bill passed in Hong Kong?

Which crypto assets will benefit from the passage of the GENIUS Act?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。