On June 24, the stock price of stablecoin giant Circle briefly surged to $298 during trading, with a total market capitalization exceeding $77 billion, far surpassing the market value of its issued USDC stablecoin (approximately $61 billion). By the end of the trading day, Circle's stock price fell back to $263.45, with a market capitalization of about $63.89 billion, still exceeding the USDC issuance by approximately $2.215 billion.

This valuation breakthrough has sparked widespread controversy in the on-chain community and the crypto market: Has Circle's valuation "decoupled" from USDC? Behind the high premium, is it a leap in crypto financial infrastructure or an unexploded valuation bubble?

Is the market really buying "Circle's future"?

On the surface, Circle's market value increase reflects the market's bullish outlook on its "super stablecoin business":

Circle is transitioning from a stablecoin issuer to a Web3 financial infrastructure provider;

It has launched the on-chain clearing protocol CCTP and established a cooperative network with Visa, Solana, and others;

Circle Mint, compliant custody, cross-chain settlement, and other services are seen as the early prototype of an "on-chain version of Swift + PayPal."

Investors are betting not on USDC itself, but on the on-chain clearing network, corporate payment interfaces, and compliant trading channels that Circle may control in the future.

Risk Signals: Market Value Decoupling May Intensify Structural Vulnerabilities

However, several on-chain data analysts and crypto research institutions have pointed out that the current valuation structure has shown significant imbalance, with Circle's stock price performance severely outpacing fundamental support, hiding three major risks:

1. Slowing USDC Growth, Pressured Profit Model

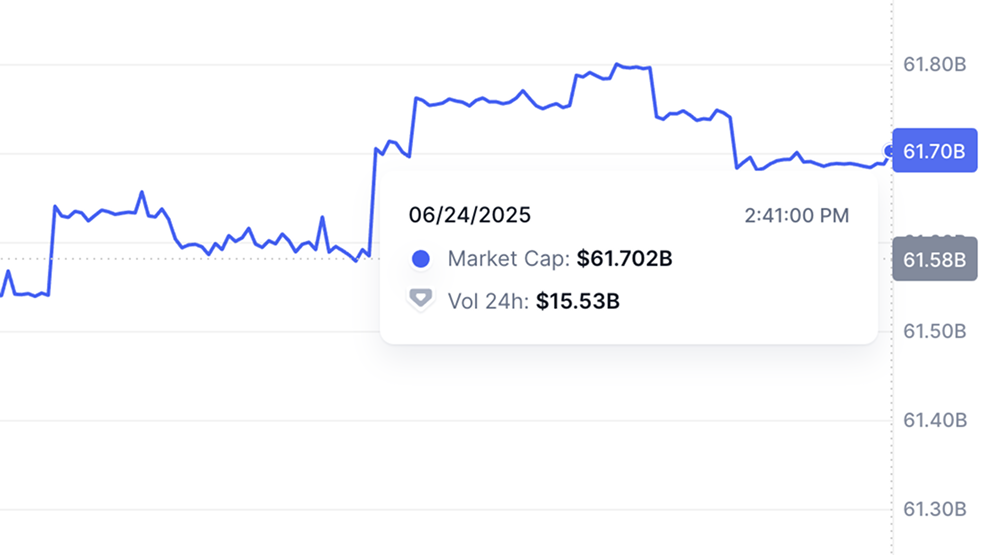

According to DeFiLlama data, as of June 24, the USDC issuance was approximately $61 billion, down nearly 15% from its peak in 2022. The main profit source for USDC is the interest margin on reserve assets, and once U.S. Treasury yields peak and decline, its revenue capacity will face natural decline.

If Circle cannot establish sufficient "non-USDC revenue pillars" in the future, the current high valuation will be difficult to maintain.

2. Market Value Exceeding USDC is Essentially Leveraging Equity Against Stablecoins

In traditional financial structures, if the equity value of a custodian institution significantly exceeds the scale of the assets it manages, it often indicates that the market is overly optimistic about its future cash flow expectations. Once confidence reverses, high valuations will amplify the impact of any negative news.

If Circle's stock price experiences severe volatility, it will not only affect shareholder confidence but may also impact institutional users' trust in USDC—forming a "reverse transmission of value anchoring."

3. Circle Still Faces Dual Pressure from Compliance Regulation and DeFi Dependency

Although Circle has been quite active within the compliance framework (including frequent communication with the U.S. Treasury and NYDFS), the extensive circulation of USDC still relies on DeFi protocols (such as Uniswap, Aave, MakerDAO) and CEX usage scenarios. Should any of the following occur, USDC and Circle's valuation may face a double whammy:

Large DeFi platforms cease USDC support due to a black swan event;

U.S. stablecoin regulatory legislation is unfavorable to Circle's structure;

Sovereign digital currencies or CBDCs pose a substitute for USDC.

Conclusion: Is the Valuation Anchor of Stablecoins Dissolving?

Circle's market value surge undoubtedly reflects the market's expectations for a central role in Web3 finance. However, it also brings about a more fundamental reflection:

When the valuation of a "stablecoin issuer" begins to far exceed its anchored assets, are we witnessing the formation of a crypto version of "shadow banking" logic?

And if the market is buying a narrative, who will bear the systemic consequences when the narrative bubble bursts? In a highly interconnected on-chain financial world, once the valuation of a stablecoin issuer decouples, its impact will extend beyond shareholders and may affect the entire Web3 credit system.

Note: Three Forward-Looking Signals for Investors to Watch

Changes in the daily average on-chain active addresses for USDC (whether on-chain demand is growing)

Public disclosure of revenue from non-USDC businesses such as Circle Mint/cross-chain protocols

Changes in the U.S. stablecoin bill and the International Settlements Organization (BIS) stance on private stablecoin regulation

End of Article Suggestion: Circle's "valuation independence" has become a reality, but whether it possesses "valuation coherence" will be a question that the Web3 market must answer in the coming year.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。