The biological mechanism of winning is almost inscribed in the genes of all living beings.

Written by: VKTR

Compiled by: Luffy, Foresight News

After a long break, I recently started actively trading perpetual options again. This reminded me of when I first began trading in 2018. At that time, some of my favorite traders shared knowledge that forever changed the way I view the market. I'm not great at writing, but I've always appreciated my predecessors and hope to pass on this knowledge. So let's give it a try.

One principle I remember to this day: the biological mechanism of winning is almost inscribed in the genes of all living beings.

When two lobsters fight, the winner's hormones surge. He is filled with serotonin and testosterone, strutting around like a "macho lobster"; while the loser curls up, sulking, entering "beta lobster" self-soothing mode.

This is not just random nonsense from a nature documentary. Jordan Peterson, despite being somewhat mentally unstable, is fundamentally correct in his views. There’s a reason he talks about this. Winning truly reshapes your brain; your posture changes, your confidence skyrockets, and you see opportunities instead of threats. This is a process of millions of years of evolution; your brain doesn’t care whether you are fighting for territory or competing in the market.

The logic of trading is just like that.

Every small profit excites you. Every profitable trade sharpens you, preparing you for the next victory. But in my experience, most novice traders do the exact opposite.

They chase "get-rich-quick" schemes instead of accumulating boring profits; they flaunt screenshots instead of earning actual profits; they endure an 80% drawdown, calling it "faith"; they revenge trade after losses instead of thinking calmly; they compare their meager 2% unrealized gains to some KOL's tenfold insider trading.

True winners quietly accumulate boring profits and let time do the repetitive work.

Why Your Brain Wants You to Go Bankrupt

When you fail, your serotonin plummets, your shoulders droop, and you see danger everywhere. Your risk assessment goes completely haywire because your brain thinks you are now at the bottom of the dominance hierarchy.

So, what do bankrupt traders do? They try to win back all their losses in one trade. They increase their positions, chasing the next garbage coin with a market cap under $60,000. They believe some former "Fortnite" scammer's signals on Telegram.

Excellent traders, on the other hand, do the exact opposite. They take their losses, possibly spend just five minutes figuring out what went wrong, and then move on. They know that one down day among twenty up days is just noise. They protect their mindset more aggressively than they protect their portfolio.

I often see this scenario. Someone takes a loss and immediately goes all-in with 20% of their capital on a bunch of garbage coins, like watching someone continuously slap their own face, not understanding why their nose hurts.

Compound Interest is Always Underestimated

Most people cannot grasp compound interest because it starts slowly and is boring. Earning $50 on a $10,000 account makes you think, "What’s the point?" But that’s precisely why it works: boring can make money, while excitement comes at a high cost.

Einstein called compound interest the "eighth wonder of the world." The person who proposed relativity held basic math in such high regard—think about that.

You don’t need to make big profits every day; the market doesn’t work that way. Sometimes you earn 1%, sometimes you earn nothing, and sometimes you lose a little. The key is that over time, your net gains will exceed your net losses.

Take @gametheorizing as an example. I remember reading in @thiccyth0t's blog that he keeps his net worth growth around 2x per year, spending the rest of the time "zen." He ensures he doesn’t overtrade or reach "peak." Those who make 100x usually can’t hold onto their money, just like lottery and casino winners; they don’t know how to manage wealth.

What is an Effective Strategy

Take profits early; stop thinking about diamond hands. The market doesn’t care about your beliefs; it cares about supply and demand. Always take profits when you’re in the green, even if it’s just a little.

Record your victories. Take screenshots of every win, create a folder, and look at it when you’re feeling down. Your brain needs evidence that you are a winner, not just an abstract memory of when you made money. It’s fine to show realized gains, but showing unrealized losses is usually a bad idea—just ask any veteran.

Control your leverage. Start with 1x or 2x. Only increase leverage after you prove you can be profitable even without it. Leverage amplifies everything—including your stupidity.

Set daily goals, but be realistic. Don’t trade just for the sake of trading. Trading is about achieving goals and then exiting. Go for a walk, connect with nature. The market will still be there tomorrow, and it might look completely different.

Track your win rate. Prepare a simple spreadsheet, or use profit and loss pages like @CoinMarketMan, @tradestream_xyz, or @AxiomExchange. If your win rate is below 60%, your strategy has issues—fix it quickly.

Establish a Ritual. Same setup, same time, same process. Your brain loves patterns. Create a pre-trade ritual that puts you in a winning mindset; it could be drinking coffee, reviewing your rules, or doing push-ups.

The Hardest Part of Small Wins

Most people make mistakes when they start accumulating small wins: you must ensure your losses are small. Small wins mean you also have to control your losses.

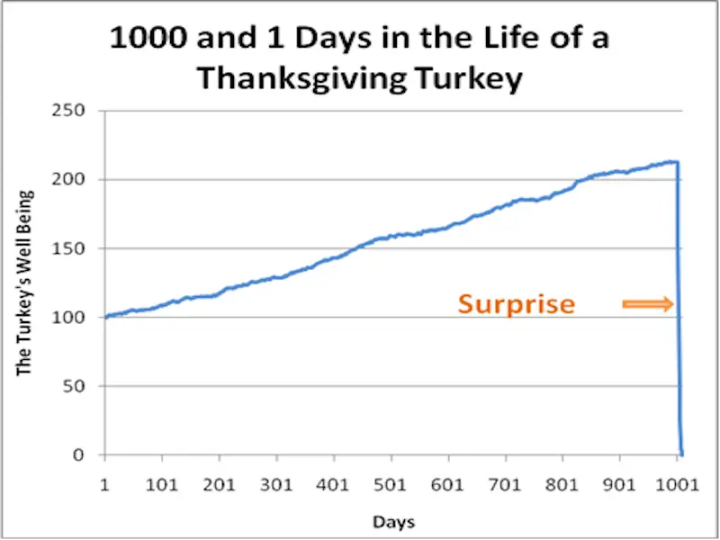

I struggled with this at first. My equity curve looked like a Thanksgiving turkey chart—first a small rise, then a massive red candle that wiped out weeks of gains. This might be the hardest part of the entire strategy, but it is non-negotiable. A strategy of small wins and big losses will slowly destroy your account.

Losers do this: they blame others for manipulating the market. They change strategies every week. They join Discord servers looking for "alpha." They are addicted to gambling instead of treating it as a business.

Winners do this: they take their losses, learn every lesson, and prepare for tomorrow. They understand that trading is a marathon, not a sprint. They know that persistence is more important than excitement.

One failure among dozens of victories has almost no impact on the overall result.

The True Path to Success

While others are betting on the next L1 meme coin, you might be building a truly effective strategy. While they stare at their open positions all day, you might be working towards your goals and then hitting the gym.

The real advantage lies not in some secret trading strategy but in discipline. In treating trading as a business, not a casino. In understanding that the goal is not to be right, but to be profitable.

Most traders aim to be right, while winners aim to make money; there is a huge difference between the two.

Getting rich slowly is boring and not cool at all. Your garbage posts won’t go viral because of stable profits. But you know what’s even less interesting? Being poor at 30 because you chased a never-arriving 100x "faith position" in your 20s.

Most people flaunting Lamborghinis on social media are actually poor. They rely on a single "moonshot" to show off on social media, only to lose everything.

Of course, there are many exceptions, but in most cases, the true winners are the ones you don’t see.

Just Win

Small victories build momentum, and momentum puts you in a flow state. Lock in profits, boost your confidence, and become the lobster that controls the rocks.

Stop trying to prove you’re smart; start proving you’re disciplined. Either win or be poor.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。