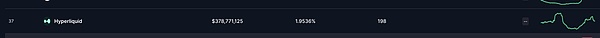

After the crisis, Hyperliquid quickly rebounded with whale stickiness and ecological expansion, setting new highs in trading volume, open interest, and $HYPE price.

Author: Mario @IOSG

TL;DR

Hyperliquid is a high-speed on-chain perpetual contract DEX, operating on its self-developed Layer 1, providing centralized exchange-level performance while maintaining on-chain transparency.

Its native token $HYPE is responsible for network governance, can reduce trading fees after staking, and captures value through listing auctions and buybacks.

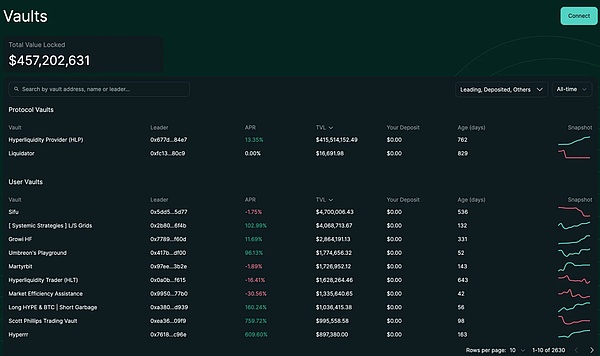

The core liquidity of the protocol is the HLP Vault, a hybrid vault combining market makers and liquidators, accounting for over 90% of TVL.

In March 2025, Hyperliquid encountered a severe black swan event: the $JELLYJELLY manipulation incident, which nearly triggered a chain liquidation of the entire vault.

The incident exposed the centralization issues of validator governance: the Hyper Foundation intervened to prevent a collapse, which ensured survival but sparked decentralization controversies.

However, after the crisis, Hyperliquid quickly rebounded with whale stickiness and ecological expansion, setting new highs in trading volume, open interest, and $HYPE price.

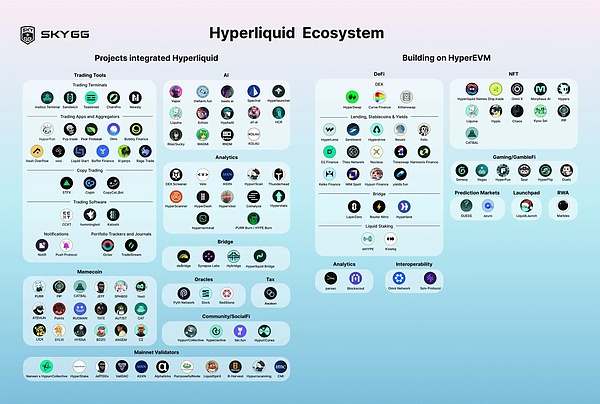

Today, the platform (including HyperEVM) has launched over 21 new dApps, covering NFT, DeFi tools, and vault infrastructure, far exceeding the functionality of perpetual exchanges.

Where do "Degen" whales trade?

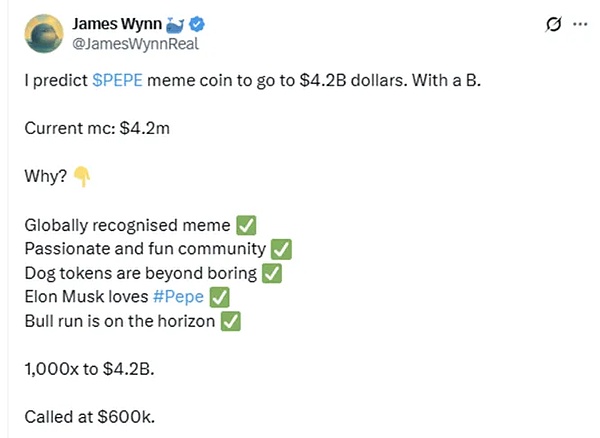

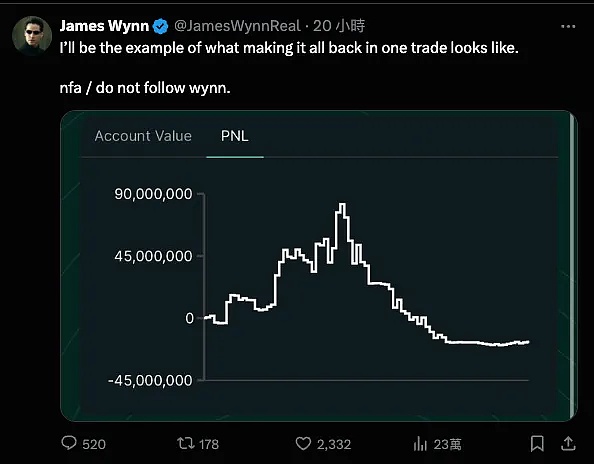

James Wynn is a well-known degen in the crypto circle; he is an anonymous whale who turned $210 into $80 million in three years. His most famous achievement is turning $7,000 of $PEPE into $25 million, and he often makes nine-figure positions using 40x leverage.[1]

Wynn frequently showcases his entry points, responding in real-time to market fluctuations, and even seems unfazed by eight-figure liquidations. But the key question is not who Wynn is, but where he trades.

For Wynn and all high-leverage, high-position degens, Hyperliquid is the new arena. Anonymous whales (like "Insider Bro") trade large positions on Hyperliquid, and their positions are now seen by Chinese crypto media as a real-time indicator of market sentiment and platform dominance.

So how did Hyperliquid get to this point? Why do high-risk traders choose it?

We will break it down one by one.

What is Hyperliquid?

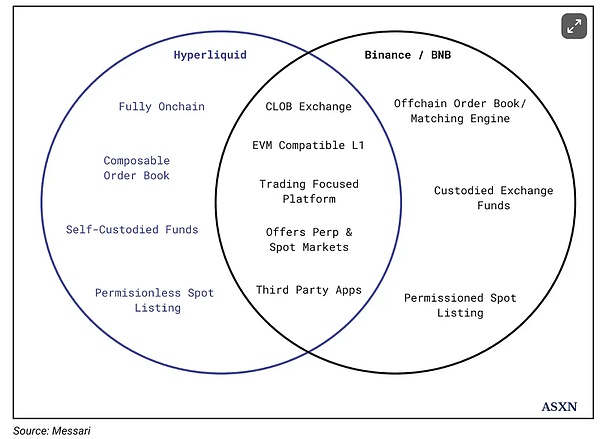

Hyperliquid is a decentralized exchange, but it does not adopt an AMM model like Uniswap.

It uses a fully on-chain order book mechanism, pricing through on-chain matching rather than liquidity pools, providing a real-time trading experience similar to CEX. Limit orders, transactions, cancellations, and liquidations all occur transparently on-chain and can be settled within a block.

Hyperliquid has built its own Layer 1 blockchain, also named "Hyperliquid," specifically designed for high performance. This allows it to execute trades with the speed and stability required by high-frequency traders.

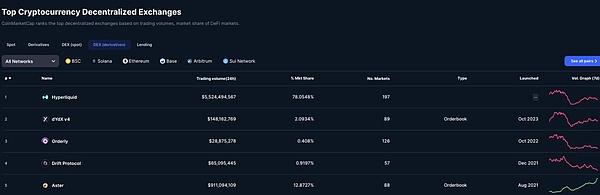

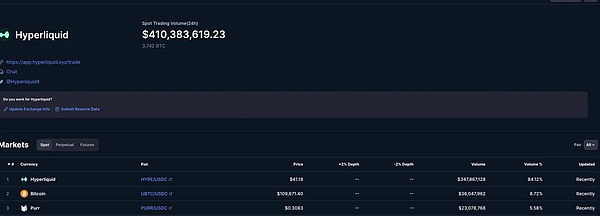

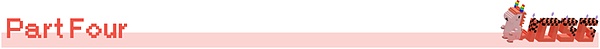

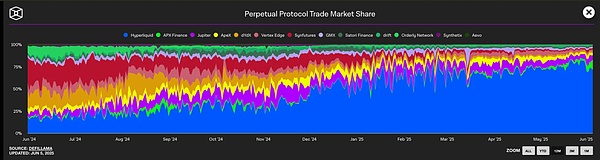

This performance is not just talk. By June 2025, Hyperliquid's share in the on-chain derivatives market reached 78%, with daily trading volume exceeding $5.5 billion.[2]

$HYPE

Hyperliquid is not just a trading platform; it is a complete on-chain financial system, and its core token is $HYPE.

Tokenomics and Philosophy

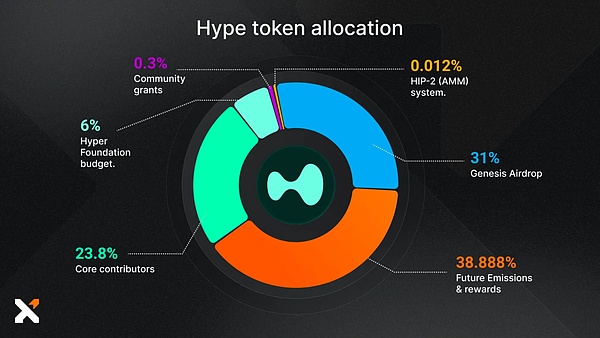

The total supply of $HYPE is 1 billion tokens, with 310 million (31%) distributed to approximately 94,000 users through a large-scale airdrop in November 2024, making it one of the most genuine user distribution projects in recent years.[3]

A total of 70% is allocated to community airdrops, incentives, and contributors: there are no VCs involved. This is due to the clear philosophy of founder Jeffrey Yan, a Harvard math graduate and former high-frequency trading engineer at Hudson River Trading.

Yan has publicly stated, "Letting VCs control the network would be a scar." He aims to build a financial system "built by users and belonging to users." [4]

This "community-first + protocol performance" philosophy is also reflected in the mechanism design of $HYPE: it is not only a governance tool but also a token that can be used practically.

Utility

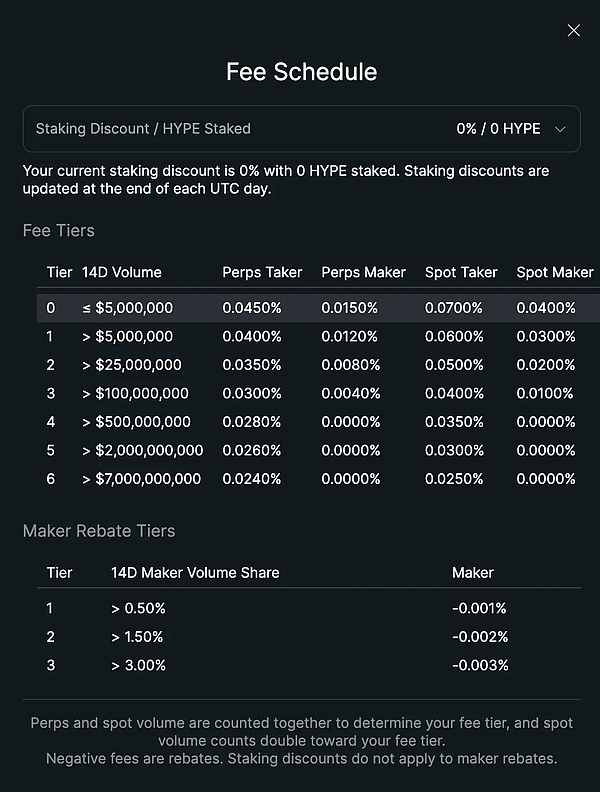

In addition to governance functions, $HYPE is also directly used to reduce trading fees. Users can stake $HYPE to receive fee discounts.

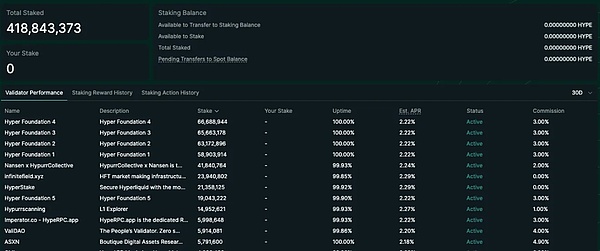

Moreover, $HYPE is central to network security. Hyperliquid operates on a Proof-of-Stake consensus mechanism, and staking $HYPE is not just for fee reduction or earning rewards; it is the foundation of the entire block production mechanism.

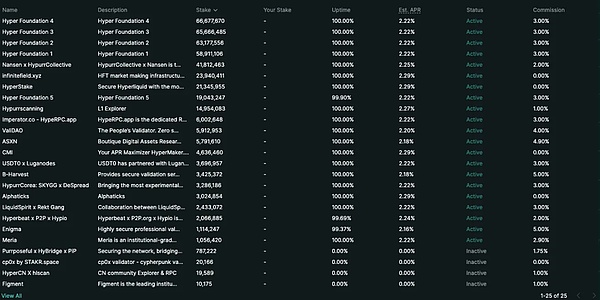

To become a validator, the following conditions must be met:[5]

Stake at least 10,000 $HYPE

Complete KYC/KYB identity verification

Build high-availability infrastructure (including multiple non-validator nodes)

Node performance will be continuously monitored and managed through the delegation program of the Hyper Foundation for rights distribution.

Current annual staking returns for validators are approximately 2.5%, with the yield curve designed based on the Ethereum model.

Other Features of Hyperliquid

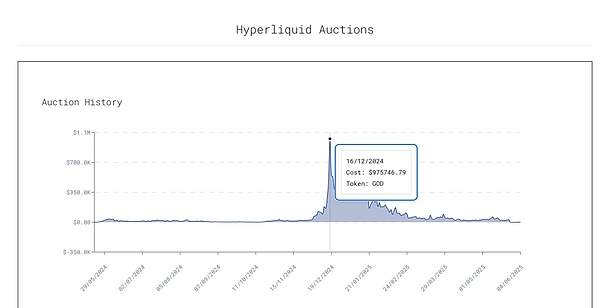

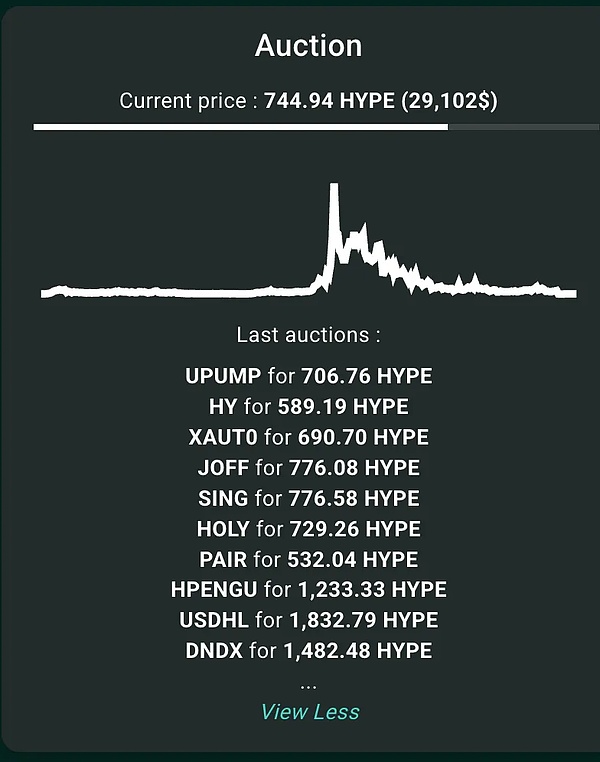

a. HIP-1 Auction Mechanism: Decentralized Token Listing Process

One of Hyperliquid's most unique and often underestimated mechanisms is its auction-based token listing system: HIP-1.

This mechanism determines the listing eligibility of new tokens through on-chain Dutch auctions:

The starting price is twice the last transaction price;

The price decreases linearly for 31 hours, down to a minimum of 10,000 USDC;

The first wallet address to accept the current price gains the right to create and list the token.

Unlike centralized exchanges (like Binance and Coinbase) that operate in a black box and charge high listing fees, HIP-1 token listings are completely transparent, with no negotiations or insider allocations.

For example, at the end of 2024, the CEO of Moonrock Capital accused Binance of demanding 15% of tokens from a Tier 1 project as a listing fee (approximately $50 million to $100 million). Coinbase was rumored to require listing fees as high as $300 million.[6]

Even with Binance's introduction of the "Batch Vote to List" mechanism, there are still transparency issues, such as voting to list 2 projects but actually listing 4.

On Hyperliquid:

The auction process is fully on-chain and executed entirely by smart contracts;

100% of the listing fees go to the Assistance Fund, which is used to buy back and burn $HYPE;

- There are no team cuts or reserved quotas.

Compared to other protocols where teams and VCs often receive listing fees, Hyperliquid's fee distribution logic is:

- All fees are obtained by the community: shared among HLP, the assistance fund, and spot publishers.[7]

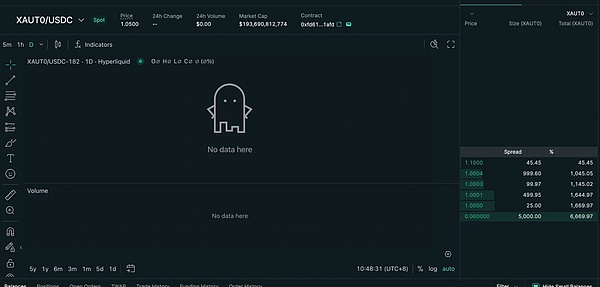

However, despite the transparent mechanism, Hyperliquid's spot market still has significant issues:

- Most auction transaction prices are close to the bottom price (e.g., 500 $HYPE), reflecting limited market interest in spot token listings;

- The trading volume of tokens after listing is extremely low;

The official page does not prominently display new token listing information, leading to low attention;

The current spot market accounts for only 2% of the total DEX spot trading volume, with 84% being the $HYPE/USDC pair.

If Hyperliquid wants to truly challenge the listing status of centralized exchanges, it must enhance UI visibility, activity, and secondary market linkage.

b. Vault Mechanism

Hyperliquid not only serves active traders but also provides users with a way to earn passive income through the vault system, allowing funds to participate in algorithmic trading strategies.

Currently, there are two types of vaults:

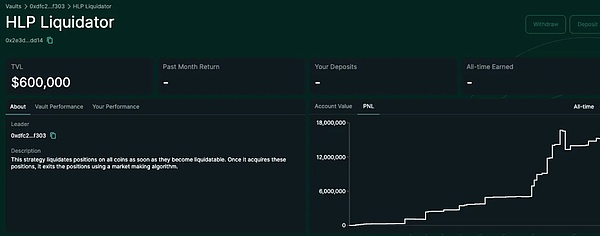

User-created Vaults: Anyone can initiate a vault and use the fund pool for trading. Investors share profits and losses proportionally, while the vault manager can charge 10% of the profits as a management fee. To ensure aligned interests, the manager must stake at least 5% of the vault's TVL (Total Value Locked). This model is similar to "Copy Trading" in centralized exchanges.

HLP (Hyperliquidity Provider): HLP vaults operate market-making strategies on Hyperliquid. Although the strategy execution is still off-chain, data such as positions, orders, trading history, and deposits/withdrawals are publicly available on-chain in real-time for anyone to audit. Anyone can provide liquidity for HLP and share profits and losses proportionally. HLP does not charge any management fees; all profits and losses are distributed entirely based on each provider's share in the vault.[8]

Currently, HLP accounts for 91% of Hyperliquid's total TVL. Its strategies are divided into two categories:

#

Market Making:

Continuously quote buy/sell prices;

Earn the spread.

Liquidator:

When a user's margin falls below the maintenance margin, the platform attempts to place limit orders to close positions;

If the position falls below 66% of the maintenance margin, the system will call the liquidation vault to take over the position;

HLP attempts to close the position at limit prices to reduce slippage and risk;

If the risk is too high and cannot be controlled, the Auto-Deleveraging (ADL) mechanism will be triggered to force a reduction in positions.

In summary, HLP = Market Maker + Liquidator.

As a market maker, HLP continuously provides liquidity (bid/ask quotes);

As a liquidator, HLP takes over the positions of liquidated users and manages the reduction.

Summary

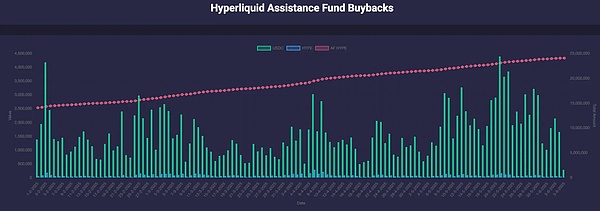

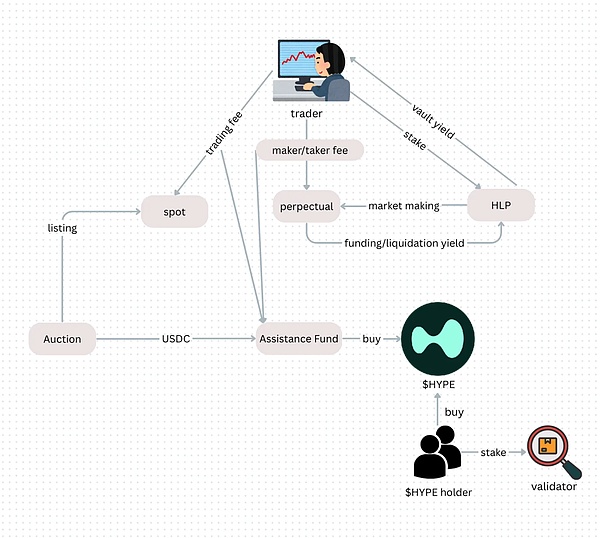

The revenue structure of the Hyperliquid platform is as follows:

Trading Fees (Taker/Maker): Allocated to HLP depositors;

Auction and Spot Trading Fees: 100% goes to the Assistance Fund for buying back and burning $HYPE;

No team commissions/financial fees, distinguishing it from most DEXs.

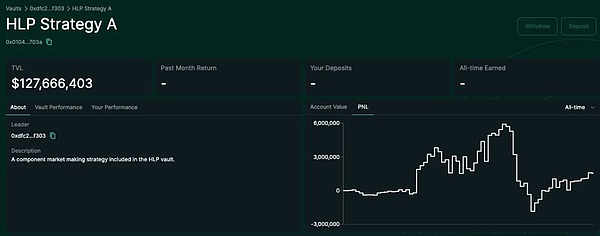

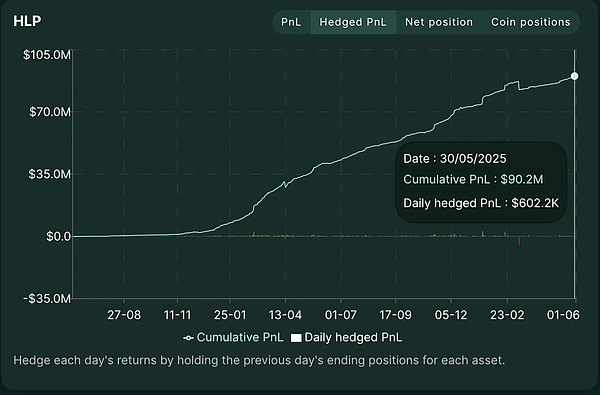

HLP Performance

We measure HLP's actual protocol revenue through "Hedged PnL." This data does not include unrealized gains or losses from market fluctuations, only including:

Taker/maker trading fees;

Funding rate income;

Liquidation fees, etc.

Thus, it reflects the protocol's true "Alpha" capability.

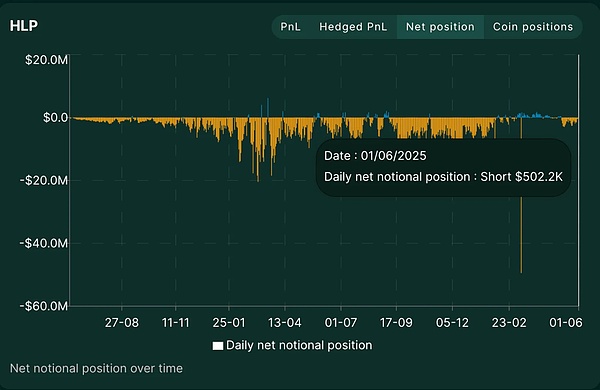

Data shows that during the bullish market in 2025, HLP's daily net positions were usually negative, indicating that it spent most of the time shorting the market. This is because the platform placed a large number of limit buy orders, causing HLP to passively take on sell orders, resulting in an overall short exposure.

In March, we can clearly see a huge spike, with net nominal exposure approaching -$50 million. This was precisely the moment when the $JELLYJELLY incident erupted, and Hyperliquid was nearly breached.

Hyperliquid's Risk Exposure

HLP's Risk Concentration Issue

As mentioned earlier, HLP accounts for over 90% of Hyperliquid's TVL and simultaneously bears the platform's main liquidity source and liquidation responsibilities. Such a high concentration poses systemic risk: if HLP fails, the entire platform may collapse.

We can see that HLP's TVL accounts for about 75% of the total TVL of the Hyperliquid chain.

This was starkly exposed during the $JELLYJELLY incident in March 2025. The incident was a carefully orchestrated attack that nearly caused a systemic chain liquidation of the entire HLP vault.

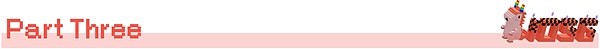

The event unfolded as follows:

$JELLYJELLY was a meme + ICM project on Solana, with a market cap that once reached $250 million, later dropping to $10 million, with extremely low liquidity;

The attacker deposited 3.5 million USDC as margin on Hyperliquid;

Shorted $JELLYJELLY at a price of $0.0095, with a short amount of about $4.08 million;

Simultaneously bought a large amount of spot, causing the spot price to skyrocket;

Then withdrew the margin, forcing the position to be liquidated, with HLP taking over the short position;

There were no counterpart buy orders in the market, and HLP passively held a massive short position;

At that time, the unrealized loss was as high as $10 million, and if the price continued to rise, it would trigger a chain liquidation across the entire platform.

Ultimately, Hyperliquid urgently issued a notice stating that it encountered "abnormal market behavior" and quickly coordinated validator votes to delist the JELLY contract and force liquidation.

But the key point is: The liquidation price was not the on-chain price but an internal price of $0.0095, effectively marking $JELLYJELLY down by 80%.

Although this allowed HLP to make a small profit and escape disaster, it also raised strong governance questions:

Who can manually change contract execution?

Is the oracle pricing trustworthy?

If a contract can be delisted, what is the meaning of decentralization?

Is Validator Governance a Mere Formality?

This incident not only challenged HLP's stability but also shook the decentralized foundation that Hyperliquid claimed to uphold.

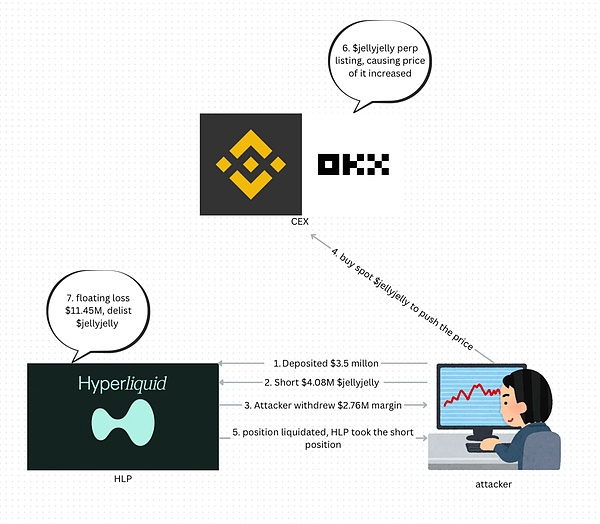

During the $JELLYJELLY liquidation process, the Hyperliquid validator group quickly coordinated:

Stopped contract trading;

Covered oracle data;

Manually delisted the asset and forcibly liquidated positions.

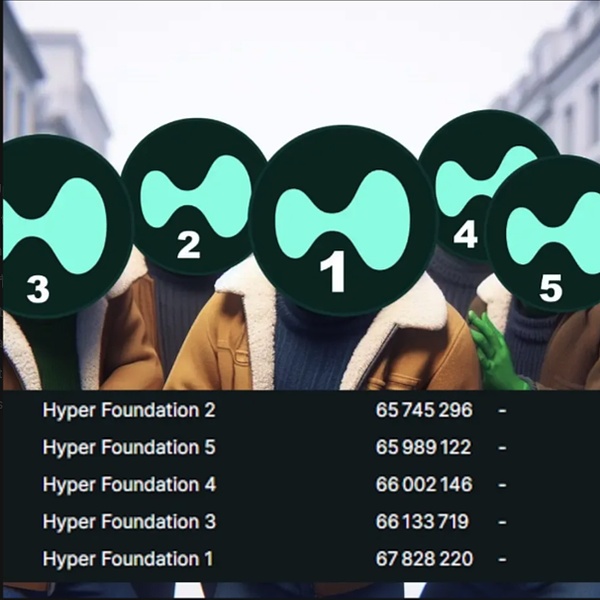

But there is a fatal reality: most validators have direct relationships with the Hyper Foundation.

According to on-chain data, by the time of the incident:

The Hyper Foundation controlled 5 out of 16 validators;

The total staking proportion reached 78.5%; [10]

- Even by June 2025, it still controlled about 65.3% of the staking ratio.

Therefore, the so-called validator governance is essentially closer to an "internal emergency response mechanism" rather than true decentralization.

The community has pointed out: since assets can be forcibly delisted and prices changed, is Hyperliquid merely "DEX architecture + CEX execution"?

Although this centralized governance avoided a systemic collapse, users began to question Hyperliquid's long-term credibility. After the incident, HLP's TVL saw a significant decline as users withdrew funds to mitigate risks.

How did Hyperliquid quickly recover from the crisis?

In the crypto space, being questioned is not fatal, but being "replaced" is.

After the $JELLYJELLY short squeeze incident in March 2025, Hyperliquid's HLP vault was nearly emptied, and its governance mechanism fell into controversy over centralization. Many believed it was doomed. On April 7, $HYPE dropped to $9, with the market filled with FUD and concerns about vault risks.

However, just over a month later, $HYPE rebounded strongly to over $35, reaching an all-time high and re-entering the top 20 crypto assets by FDV.

What allowed Hyperliquid to turn the tide?

Whales Never Left

Even at the height of the $JELLYJELLY incident, Hyperliquid maintained about 9% of Binance's perpetual contract trading volume, which is not just data but a signal:

Despite the trust crisis on the platform, institutional traders, whales, and KOLs continued to use Hyperliquid.

Why? Because it meets the core needs of the current market:

High-performance derivatives trading + No KYC required + Extremely strong capital efficiency.

Unlike centralized exchanges like Binance or OKX, these platforms:

Require identity verification;

Restrict access from certain regions;

Sometimes even freeze user assets.

Hyperliquid offers freedom while still maintaining CEX-like matching speed and depth.

Thus, it is highly attractive to the following users:

Whales seeking anonymity and leverage;

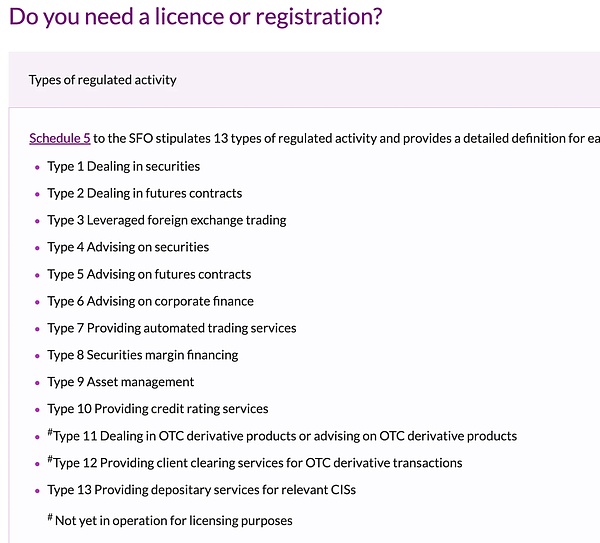

Institutions needing programmatic trading (e.g., Binance in Hong Kong cannot obtain API authorization Type 7);

KOLs relying on transparent trading records to build influence: forming a "capital + voice power flywheel."

Even after the crisis, these users not only did not leave but became more active. The meme coin market driven by figures like James Wynn made Hyperliquid the core battleground for on-chain speculation.

In fact, the $JELLYJELLY incident proved one thing:

Hyperliquid is the only on-chain platform that can "withstand the blows" like a centralized exchange.

Even if whales are bearish, they have nowhere to escape, as currently, only Hyperliquid has the depth to support their operations.

The Realistic Trade-off: Decentralization vs. Control

Hyperliquid has never claimed to be "pure DeFi"; its goal is to be a user-centric experience DEX.

Therefore, it has made pragmatic trade-offs: sacrificing some governance decentralization in exchange for high throughput and low-latency execution performance.

While this is controversial, it has clearly been effective.

As Foresight News stated: [12]

"To survive black swans, someone must hold the sword."

Hyperliquid has explicitly stated its willingness to be the "sword bearer"; when the protocol encounters a cascading crisis, it chooses to survive through manual coordination and upper-level intervention.

This is not censorship but operational resilience.

Take Sui Network as an example: On May 22, 2025, Sui's validators voted to pass a proposal to forcibly reclaim $220 million in assets stolen from the DEX aggregator Cetus during an attack. The proposal allowed validators to overwrite wallet control, revoking the hacker's access to $160 million of frozen funds. The entire operation was termed "hacking the hacker," sparking intense debate.

This "hacker counter-hack" has generated widespread controversy: one side criticizes it for violating DeFi principles, while the other claims it is a necessary measure for system self-rescue.

So, is Sui decentralized? Probably not.

But that is the point: Every high-performance blockchain must make trade-offs.

Speed, liquidity, UX, protocol security — it is impossible to maximize all at once.

The key is: Are these trade-offs transparent and effective?

Hyperliquid's validators are mostly controlled by the Hyper Foundation, posing centralization risks. But this is also why it can quickly respond to the $JELLYJELLY crisis.

Users voted with their wallets: even amidst FUD, Hyperliquid's open interest, TVL, and fee income all reached historical highs in May.

In true emergencies, most users do not care whether the system is "perfectly decentralized"; they only care: can this system save me?

Not Just a DEX, But an On-Chain Ecosystem

Despite the governance power still being somewhat centralized, Hyperliquid is no longer just a derivatives platform.

According to Cryptorank data, in the past three months, 21 new projects have been deployed on Hyperliquid, bringing the total number of ecosystem projects to over 80, covering:

DeFi

GameFi

NFT

Development tools

Analytics platforms

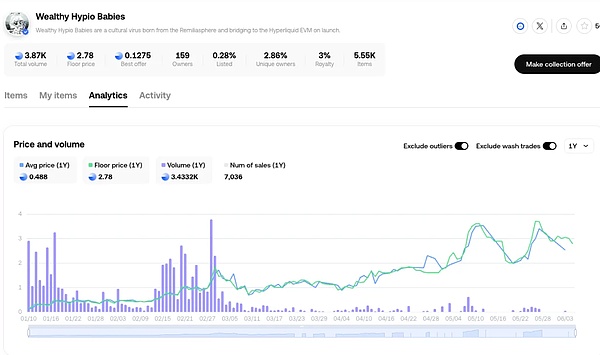

The Milady series NFT project has also launched on its chain, named Wealthy Hypio Babies, with the floor price continuously rising, reflecting strong on-chain native liquidity and a high level of community interest.

Even after experiencing governance controversies and large-scale liquidation crises, developers and users continue to bet that Hyperliquid is a high-performance and promising Layer 1.

The Real Growth Momentum of Hyperliquid

Why DEX?

Centralized exchanges (CEX) frequently face crises, leading to a continuous loss of user trust and accelerating the migration to DEX.

FTX collapsed in 2022, showing that even top exchanges can fail overnight, freezing user assets;

Over the past decade, CEXs have faced 118 hacking incidents, with total losses exceeding $11 billion, far surpassing on-chain attacks;

Every withdrawal suspension and asset freeze serves as a reminder to users: custodial platforms have inherent third-party risks.

With improvements in payment infrastructure, many people may not even need fiat withdrawals in the future.

In 2024, self-custody wallet users surged by 47%, with active addresses exceeding 400 million; in January 2025, DEX trading volume hit an all-time high. Users are voting with their feet, shifting towards self-custody and on-chain trading.

The original intention of blockchain is: decentralization, self-control of assets, and no need to trust intermediaries. However, many people in the past directly treated CEX as wallets for convenience — ignoring the essence of "not your keys, not your coins."

Now, this perception is changing. As infrastructure matures and on-chain opportunities increase, self-custody is not only a security measure but also an entry point for "early participation and high returns," such as airdrops and meme coins.

For example: $TRUMP was listed on CEX at over $20, but early on-chain users bought in at a much lower cost.

This trend indicates: convenience often means missing out, while control is proactive.

The future shift from centralized to on-chain is no longer a matter of ideology but a choice of returns and efficiency.

Why Hyperliquid?

Even after the $JELLYJELLY crisis, users remain on Hyperliquid, and DEXs like dYdX and GMX have not siphoned off users.

Hyperliquid has done three key things right:

Truly Community-Oriented Token Model

Hyperliquid is one of the few DeFi projects launched without VC investment.

No early allocations, no private sale rounds;

Over 70% of $HYPE is allocated to the community, with 31% airdropped to 94,000 addresses, averaging ~$45,000 per wallet.

This brings three major effects:

Established a sticky user base through Season 1/2 point farming;

Stable buybacks from the start (unlike dydx which has no such mechanism);

No VC unloading pressure (in contrast: dYdX allocates over 50% to internal distribution, GMX over 30%).

In summary: users are not just users, but "owners."

CEX-Level Trading Experience, Without CEX Risks

Hyperliquid achieves: Binance's speed, deployed on-chain.

GMX has inefficiencies with AMM;

dYdX v3 uses off-chain matching;

UI/UX has noticeable latency.

This attracts whales (like James Wynn with holdings over a billion), market makers, and HFT traders.

Even after the crisis, Hyperliquid's depth and slippage control remain leading (slippage only ~0.05%).

Product Depth: More Than Just Perpetuals

At the beginning of 2025, Hyperliquid launched several new modules:

Launched a spot market;

Released HyperEVM for DeFi developers;

Introduced HLP vault and copy trading system;

Launched meme coin standard (HIP-1), supporting integrated spot + perpetual trading;

Established a risk fund supported by real-time rates (for $HYPE buyback and burn).

These constitute a "comprehensive DeFi trading platform":

Trade BTC spot, ETH perpetuals, and meme coins all on one UI;

Participate in HLP or copy top traders;

One wallet handles all operations, fast, cheap, and gas-free.

In contrast, dYdX or GMX resemble "single protocols," while Hyperliquid has already evolved into a multifunctional ecosystem.

In-Depth Analysis of the HyperEVM Ecosystem

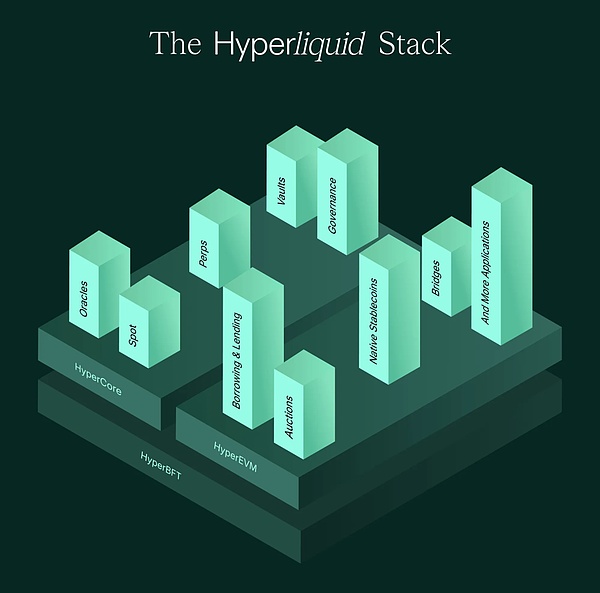

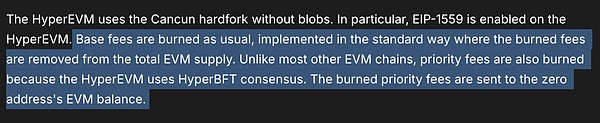

HyperEVM is the smart contract layer launched by Hyperliquid, supporting the construction of EVM-compatible dApps, forming a three-layer architecture with the core trading layer HyperCore and the consensus layer HyperBFT:

HyperCore: Core asset and matching engine, all assets first enter here, equivalent to "exchange balance."

HyperEVM: Smart contract execution layer, supporting modules like DeFi, NFT, GameFi, etc.

HyperBFT: BFT consensus mechanism based on HotStuff, optimizing low-latency and high-throughput transaction execution.

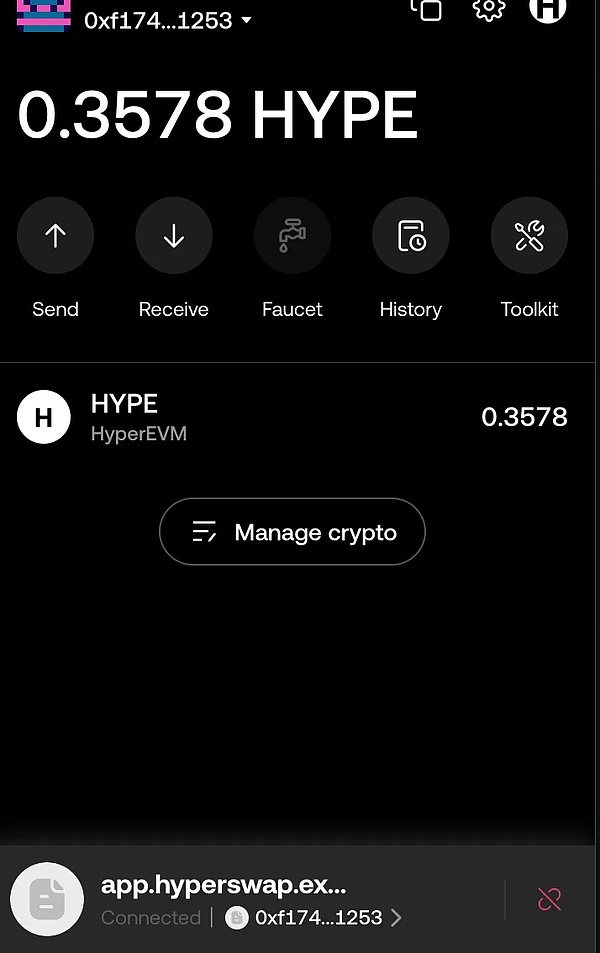

Assets must be manually transferred from HyperCore to HyperEVM to interact with smart contracts, with gas fees paid in $HYPE.

How to Enter the HyperEVM Ecosystem?

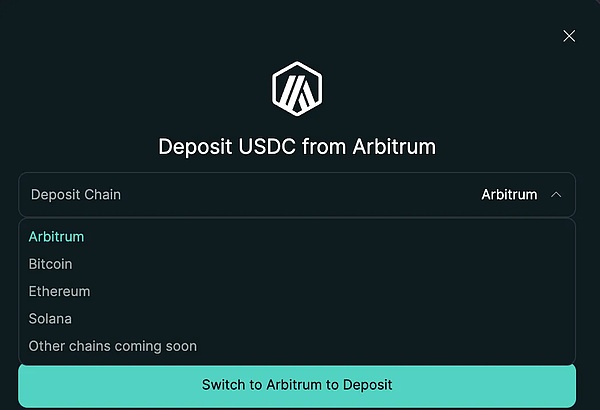

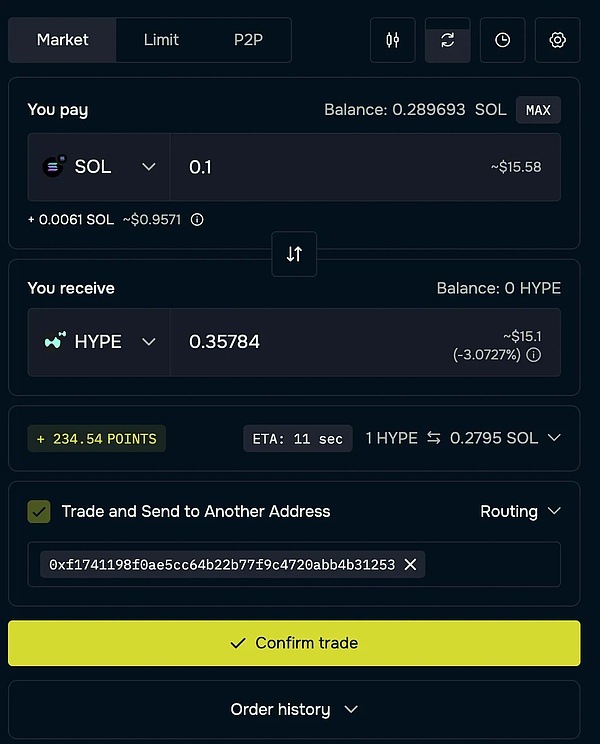

External Chain → HyperCore → HyperEVM

a. External Chain → HyperCore

Common supported chains include Ethereum, Arbitrum, Solana, Bitcoin, with supported assets including USDC, ETH, BTC, SOL, etc.

b. HyperCore → HyperEVM

External Chain → Direct Transfer to HyperEVM (e.g., using deBridge)

Popular Projects on HyperEVM

DEX (Non-Perpetual)

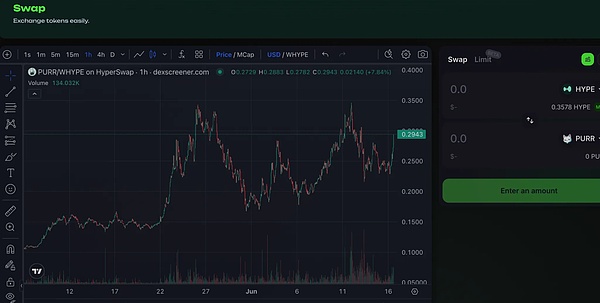

- Hyperswap: Supports new coin listings, providing liquidity mining incentives.

- Liquidswap: Aggregator DEX, unifying routing across multiple pools.

DeFi Protocols

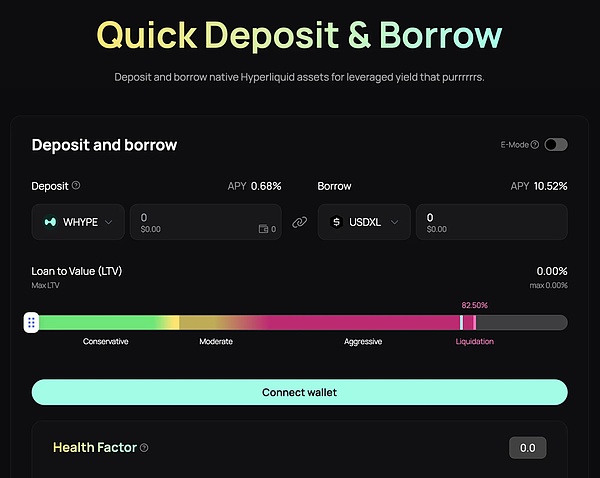

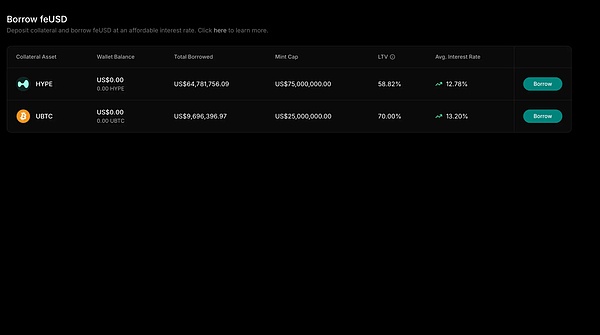

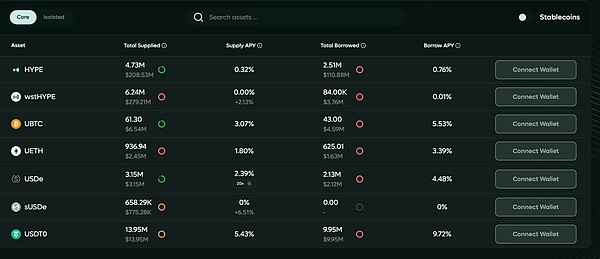

- Hyperlend / Felix / Hypurr.fi: Support for lending, LP, and various combination plays.

#

Launchpad

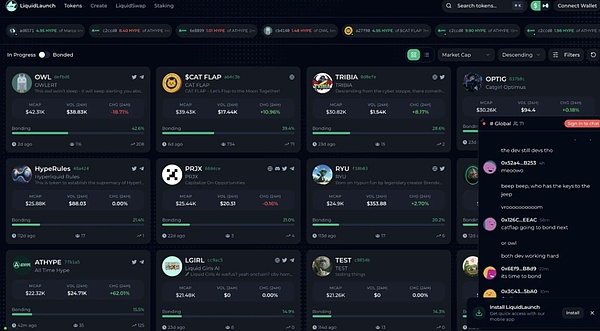

- Liquidlaunch: Early project launch platform.

Why is HyperEVM Important?

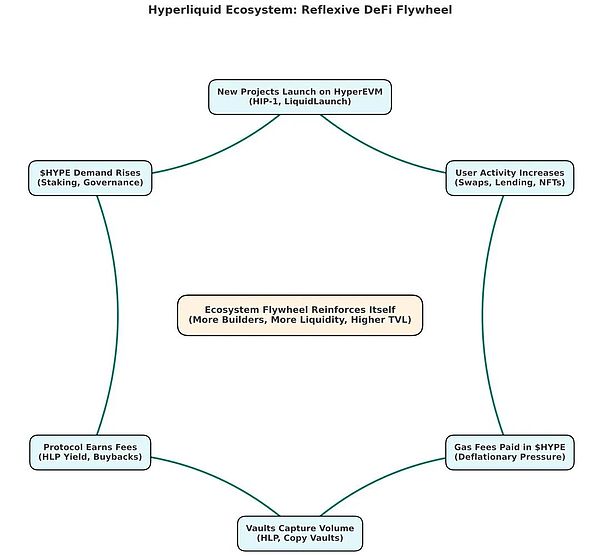

As protocols like DeFi, stablecoins, and NFTs continue to be deployed on HyperEVM, on-chain trading becomes increasingly active, the consumption of $HYPE as the gas payment token also rises, forming a deflationary logic. All gas fees (including base fees and priority fees) will be burned.

Additionally, future airdrops may also consider EVM activity, further driving user and developer migration.

This means HyperEVM is not just about functional completion, but brings real network effects and a narrative flywheel:

New project deployment → Increased gas consumption → Supporting $HYPE value → Attracting more users → Attracting more developers → Repeat.

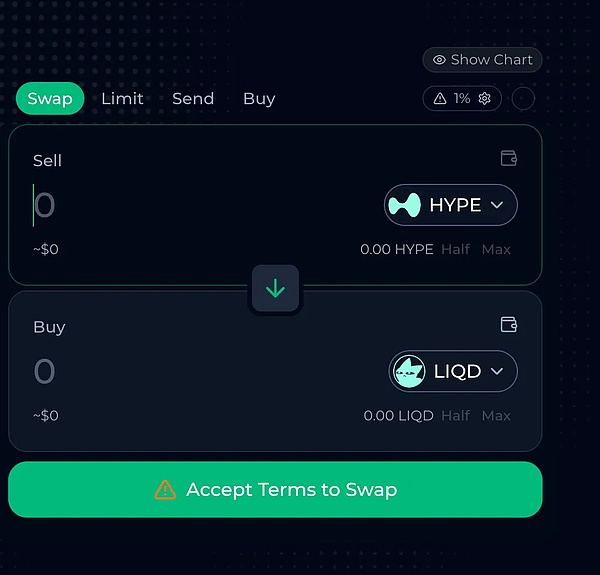

Potential High Beta Projects: Ecosystem Tokens

While $HYPE remains the core asset capturing the value of the Hyperliquid system, emerging tokens on HyperEVM (such as $LIQD, the governance and incentive token of the LiquidSwap ecosystem, distributing $HYPE to stakers) provide higher beta exposure to ecosystem growth. These tokens typically represent:

Localized revenue-sharing models

DeFi base assets

Early liquidity opportunities

As $HYPE appreciates, these tokens may benefit from several aspects:

Increased trading volume and user inflow, enhancing token utility and fee capture ability;

Increased yield (APY) denominated in $HYPE, as demonstrated by staking $LIQD;

Speculative upside potential, as traders rotate into smaller market cap ecosystem projects;

Airdrops or governance incentives related to early usage.

In a high-speed compounding growth ecosystem like HyperEVM, these "water seller" type tokens (driven by $HYPE gas fees but not strongly correlated in token design) may outperform $HYPE itself in early cycles.

For example: if $HYPE doubles, a $LIQD with an FDV of $100M, if paired with depth growth, could potentially see a 4x increase.

These tokens are not just bloodsucking projects; rather, they are amplifiers of ecosystem growth — more usage → more gas → more $HYPE burned.

Forming a positive feedback loop.

Conclusion

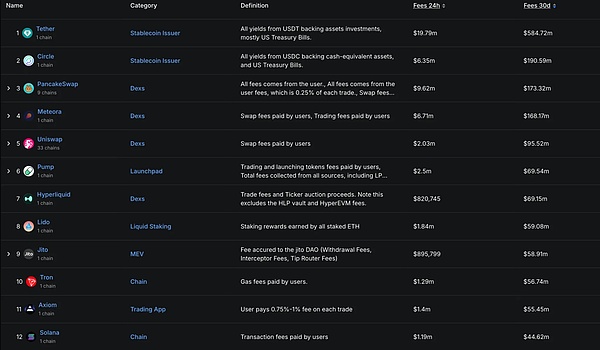

Although many people see Hyperliquid as "just another DEX" or "emerging L1," the fee data tells a different story:

Hyperliquid ranks seventh in 30-day fees among all protocols ($69.15 million), surpassing Tron, Solana, and even the staking leader Lido.

This does not even include the income from HLP Vault and HyperEVM, indicating that its revenue potential has not been fully realized.

From a valuation perspective, Hyperliquid's fundamentals are comparable to mainstream L1s, but its true potential lies in becoming the first DeFi-native trading platform that can match CEX in trading experience, fees, and execution.

Most DEXs still rely on swap models, resulting in poor liquidity, while Hyperliquid has built a real order book + HLP2 mechanism, with cross-chain slippage controlled within 0.3%, and no need for frequent wallet switching.

We believe Hyperliquid is becoming the only on-chain trading platform needed, from spot to perpetuals, and across the entire ecosystem.

In a sense, it is not trying to defeat Uniswap, but is directly targeting Binance.[16]

Why is it impossible for another Hyperliquid to be replicated?

Even if you want to go all in on the next "explosive perpetual DEX," I believe the DEX boom has already ended.

Four main reasons:

Market Share Dominance

Occupying 80% of on-chain perpetual trading volume, with weekly trading volume exceeding $60 billion, it has formed a closed-loop flywheel of liquidity → users → liquidity. New projects wanting to enter must first achieve billions in daily trading volume — a daunting task.

Inimitable Economic Model

No VC funding, self-raised startup; it is not a meme but has built real trust and long-term consistency. New DEXs need financing, token issuance, reserved shares, background checks, disclosure, token incentives… the user structure is completely different.

Top-tier Founding Team

The founders come from HRT, MIT, and Caltech, with a high-frequency trading background directly designing CEX-level infrastructure. Founder "Jeff" has revealed that his network consists of seasoned traders, who became the earliest users and sources of feedback; this "moat" is hard for others to replicate.

Mature Product Ecosystem

Hyperliquid is not just a DEX, but a complete high-performance L1 — its underlying architecture, user structure, and governance model are self-consistent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。