Original Title: Circle execs and VCs misread the market—it cost them $2B

Original Author: Protos

Original Translation: Ismay, BlockBeats

Editor’s Note: Since its IPO, Circle's stock price has continued to soar, with CRCL skyrocketing from an issuance price of $29.30 to $300, becoming one of the biggest winners at the intersection of Wall Street and the crypto world. However, in this equity feast of the stablecoin leader, the earliest executives and venture capitalists have instead become the "losers" who missed the main upward trend. Many of them chose to reduce their holdings on the day of the IPO, missing out on potential gains worth billions of dollars in just two weeks. This not only reveals a serious misjudgment of market expectations but also reflects a cognitive gap between the primary and secondary markets in the new era of crypto finance. When even the founders failed to predict the true value of their own stock, we may need to rethink: in this era filled with narrative-driven and emotional leverage, who is the real smart money?

The following is the original content:

In the Circle (stock code: CRCL) IPO, executives and venture capitalists who chose to sell their shares missed out on a price surge comparable to a rocket launch.

As of June 6, 2025, the potential gains missed by these early sellers reached as high as $1.9 billion. Rather than selling, it could be said they "lost by not buying"—their choice was indeed painful.

These executives and VCs cashed out at a price of $29.30 per share, totaling about $270 million. However, if they had been willing to hold on for a few more weeks, the value of their shares would have reached billions of dollars.

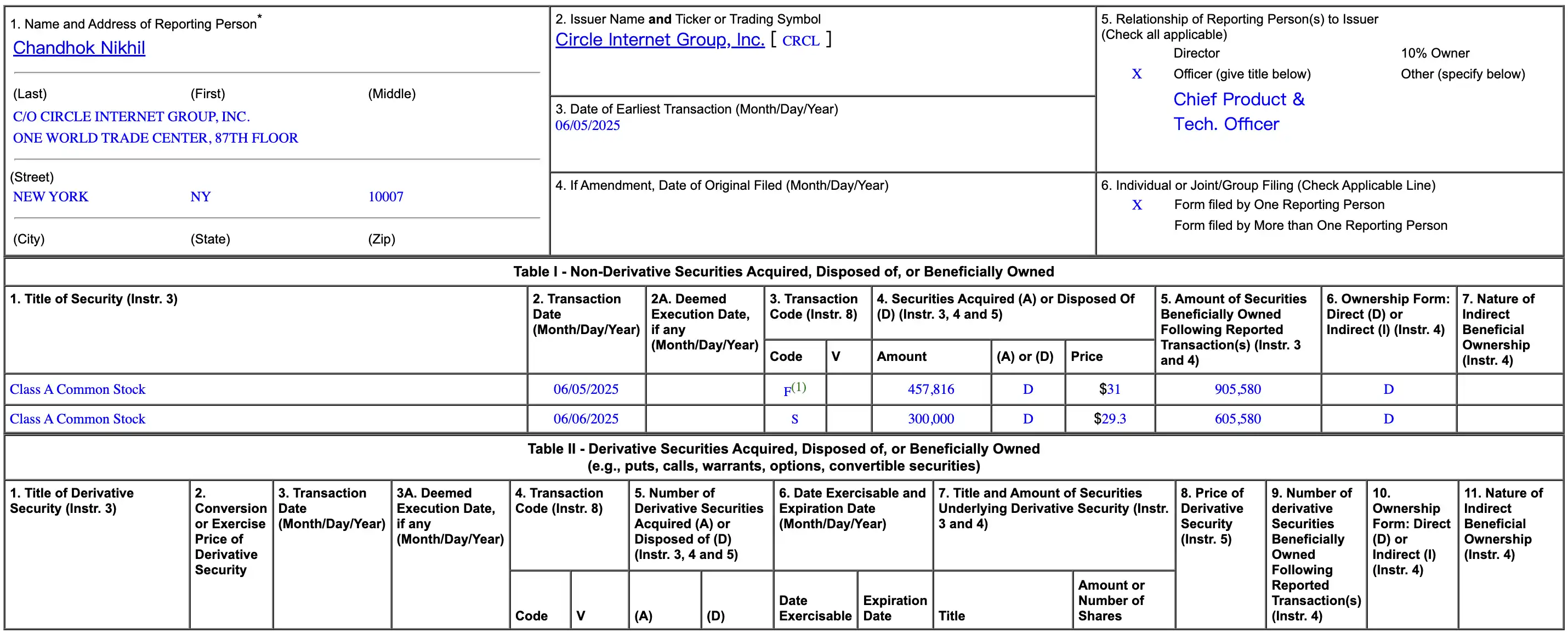

Take Circle's Chief Product and Technology Officer as an example; he sold 300,000 shares of Class A common stock during the IPO at a price of $29.30 per share. If he had not sold these shares, as of last Friday's close, their value would have reached $240.28 per share. This means he personally missed out on approximately $63 million in potential gains.

Circle's Chief Financial Officer also sold 200,000 shares at the same price during the IPO, missing out on approximately $42 million in gains.

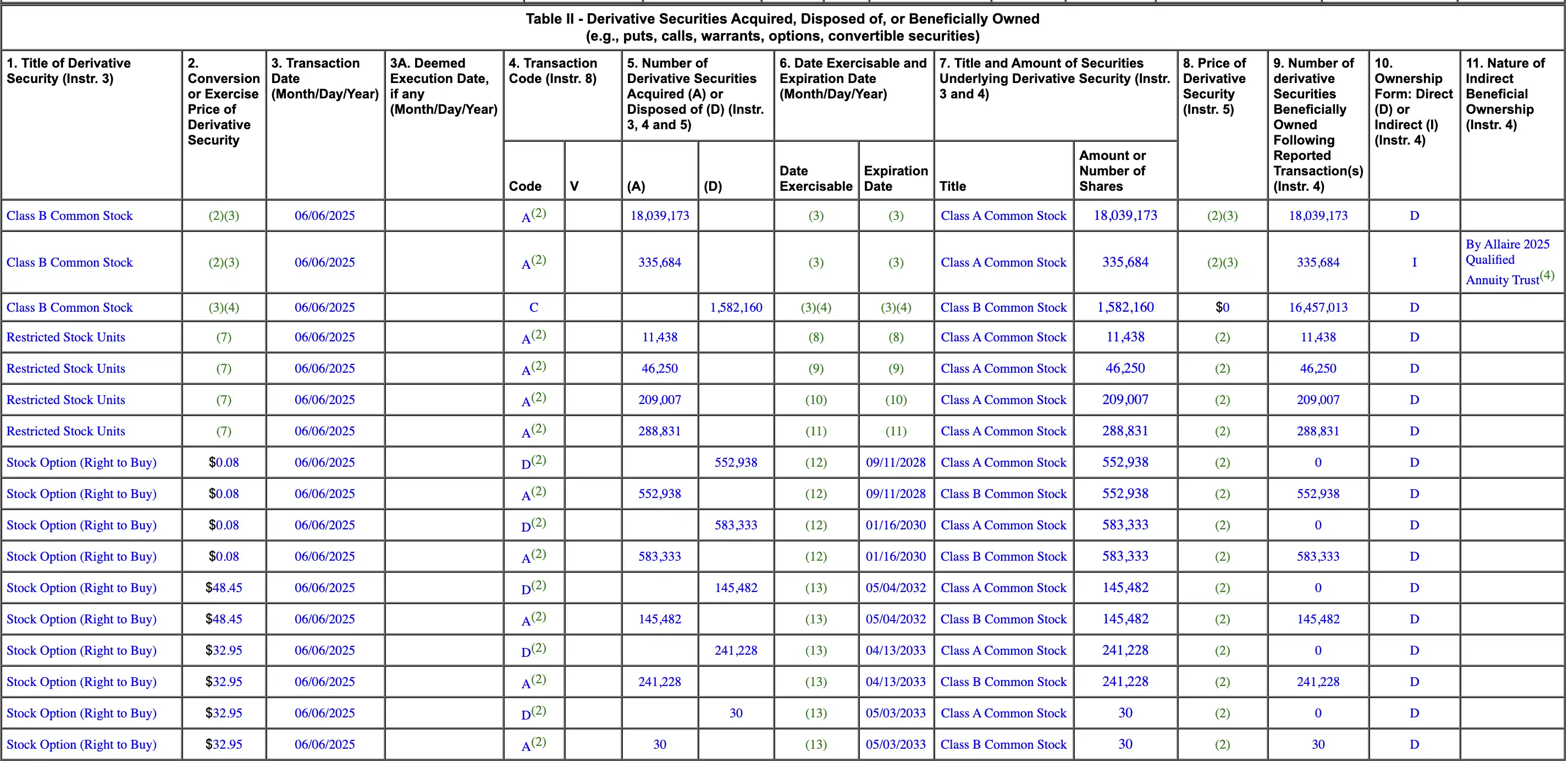

Even founder Jeremy Allaire was not spared. He sold 1.58 million shares during the IPO, also at $29.30 per share. Had he chosen to hold, he would now have an additional $333 million in paper gains.

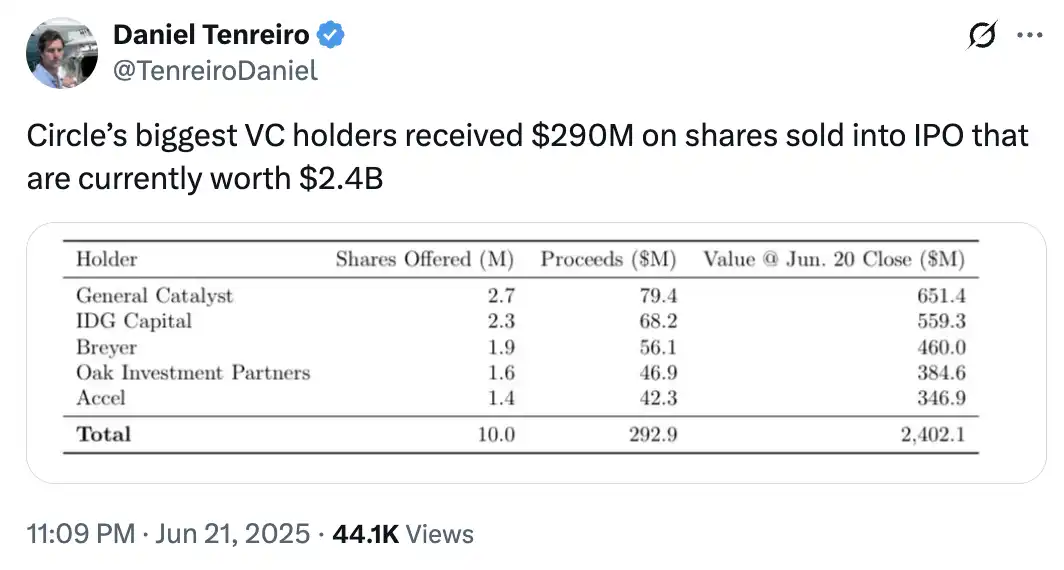

Circle VCs miss out on billion-dollar gains

In Circle's initial public offering (IPO), venture capital firms, executives, and other insiders sold at least 9,226,727 shares of common stock at a price of $29.30 per share.

Although these stocks brought them a substantial cash-out gain of $270 million, just two weeks later, the "opportunity cost" of this transaction was astonishing.

If they had chosen to continue holding these shares, they could have earned an additional $1.9 billion today.

Objectively speaking, some VCs only reduced part of their holdings during the IPO. For example, the well-known venture capital firm General Catalyst sold only about 10% of its CRCL shares. According to its latest Form 4 filing with the U.S. Securities and Exchange Commission (SEC), the firm still holds over 20 million shares.

Founder Jeremy Allaire's situation is similar; he currently still holds over 17 million shares and has options and restricted stock. Many other venture capital firms and company executives also retained a significant portion of their initial investments.

Even so, the decision to sell at $29.30 appears quite awkward in light of CRCL's current stock price of $240.28. While no one can predict the future, a forecasting deviation of up to 88% is undoubtedly a "stunning misjudgment," which has already carved out its place in financial history.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。