Backpack truly centers its core business logic around "native Crypto products + wallet + asset issuance + community governance," accurately addressing the urgent demand in traditional capital markets for capturing genuine Crypto potential.

Written by: Deep Tide TechFlow

The initial public offering was oversubscribed by more than 25 times, expanding from 24 million shares to over 34 million shares, and on the first day of trading, it triggered multiple circuit breakers, closing up 168%, with the stock price briefly surpassing $118…

As the first stablecoin company listed on the New York Stock Exchange, Circle is undoubtedly a significant success: with Circle as a key node, a new financial order is forming, and crypto, as the new darling of finance, is moving towards mainstream acceptance, winning the favor of Old Money. The recent surge in U.S. crypto stocks also confirms the capital market's attention to crypto equities.

Amidst the craze: multiple crypto companies are gearing up to put their IPO plans on the agenda, while investors are eager to find the next Circle.

In addition to Kraken, Ripple, and Bullish being discussed as popular contenders for "the next Circle," recently, Backpack has attracted countless fans through its smooth fiat deposit and withdrawal features, while officially launching the withdrawal process for former FTX EU users. With its dual advantages of product and compliance, Backpack has also been prominently nominated in the competition for "the next Circle."

The IPO Boom of Crypto Companies: The Scarcity of Web3 Attributes

As crypto equities have become the center of market discussions, we have compiled a list of crypto-related listed companies on major global stock exchanges:

With more and more crypto concept companies successfully going public, the crypto industry is demonstrating an increasingly powerful influence in the traditional financial sector.

The tremendous success of Circle's IPO not only reflects traditional financial investors' interest in crypto but also, on a deeper level, showcases investors' preference for native Crypto projects. This is understandable: in the quest for crypto wealth, targets that better represent the essence of crypto are naturally more appealing.

However, among the currently listed crypto concept companies, there are not many true Crypto targets.

In terms of composition, among the 45 crypto listed companies we reviewed, crypto mining-related companies account for the highest proportion, with 24 companies making up 53%. A typical representative is Bit Digital, a leader in the Bitcoin mining sector operating green energy mines in North America and Asia, which has recently expanded its revenue sources through AI computing services. Next are investment and financial service-related companies, totaling 9, which account for over 20%, with Strategy being a typical representative that has continuously increased its Bitcoin holdings through debt financing, becoming the company with the most Bitcoin globally.

These two categories of crypto listed companies account for over 73% of the total, but strictly speaking, both categories belong to crypto concept companies and do not qualify as true crypto enterprises.

Backpack's founder, Armani Ferrante, recently pointed out on the X platform: In the eyes of traditional capital markets, there are very few true Web3 companies. Wall Street is eager to capture Crypto companies that can be valued and measured, but such targets are still far from sufficient.

This is a true competition of capabilities: who better understands the core of crypto and translates it into products? Who can present crypto products in a form that traditional finance can quickly comprehend? Who can better adapt to the operational rules of traditional finance regarding compliance and other aspects?

Amidst Circle's popularity, which current seed players are most likely to become the next Circle?

Many crypto projects have already clearly stated their IPO plans for 2025, including but not limited to: trading platforms Kraken, Gemini, Bullish, as well as XRP issuer Ripple, and crypto custody company BitGo.

We can see that after the successful listings of predecessors like Coinbase and Robinhood, there are many candidates waiting to go public in the trading platform sector. Trading platforms have the clearest business model—transaction fees—and are also the core business model of crypto.

In the same trading platform sector, Backpack does not seem to have a significant competitive advantage compared to established players like Kraken and Gemini, whether in terms of development time or business scale. However, Backpack, adept at combining strategies, is building a trading ecosystem through an innovative matrix of native Crypto products, achieving a closed user path, while also deeply engaging in compliance, making significant breakthroughs in multiple countries/regions. Coupled with rapid growth driven by incentive activities, Backpack's overall product is increasingly approaching the structure of U.S. stocks, positioning itself at the competitive table for "the next Circle."

Product Matrix: Wallet + Exchange + Mad Lads as a Super Ecosystem

Why is Backpack considered the next Circle closest to the U.S. stock structure?

Like Circle, Backpack truly centers its core business logic around "native Crypto products + wallet + asset issuance + community governance," with a rich and comprehensive Web3 product matrix that accurately addresses the urgent demand in traditional capital markets for capturing genuine Crypto potential.

Backpack Wallet: Web3 Entry Point

The wallet is not only an important tool for users to explore Web3 daily but also the first step for new users entering Web3. Therefore, a simple and user-friendly wallet product plays a significant role as a traffic entry point for the Web3 ecosystem.

As the foundational component of Backpack's "inclusive Web3 finance," Backpack Wallet focuses on security and usability to create a truly consumer-oriented wallet product: currently, the wallet supports multiple blockchains, including Solana, Ethereum, Optimism, Arbitrum, Polygon, Base, and Sonic, with various versions available, including an app and browser extension, and it has been launched on the Apple Store and Google Play platforms. Users can use the wallet to send/receive/exchange/stake crypto assets, covering almost all daily trading needs in crypto.

xNFTs are one of the core features of Backpack Wallet: xNFTs are assets that can be traded and are also dApps running within the Backpack wallet. This transforms the wallet into an open programmable platform. This "wallet + executable NFT" model is akin to the Web3 version of "WeChat + Mini Programs," using the wallet as the core to create a super application ecosystem through xNFTs, further guiding users to explore a richer Crypto world.

Additionally, the wallet is seamlessly integrated with Backpack Exchange, providing a lower barrier and smoother interaction experience.

Backpack Exchange: Core Financial Hub

As a trading platform designed specifically for traders, the core of Backpack Exchange lies in: how to achieve higher capital efficiency under more compliant and secure conditions, helping users realize more profit opportunities.

On one hand, Backpack Exchange does not operate its own market makers, and the three-stage clearing mechanism further ensures the system's solvency, building a more robust risk engine.

On the other hand, under Backpack Exchange's innovative global margin + automatic lending + automatic profit and loss settlement mechanism, all available assets that meet lending conditions will automatically be deposited into the lending pool to earn profits and settle in real-time, achieving an extreme enhancement in capital turnover efficiency.

Moreover, the recent launch of fiat deposit and withdrawal functions by Backpack Exchange further opens up compliant channels between the crypto world and the real world, facilitating more Web2 users to seamlessly enter the crypto world and participate in on-chain finance, which is an important piece of Backpack's construction of "inclusive Web3 finance."

Click to read the article to learn more about Backpack: “Disruptor” Backpack: Completing the FTX Puzzle, Leveraging Compliance to Become a Leader in TradFi

Mad Lads: Community Culture Carrier

A project that can continue to grow relies on a strong and active community, and the maintenance of the community depends on the project's deep cultivation in aspects such as community identity recognition, member cohesion, and brand dissemination, continuously enhancing the sense of participation and belonging among community members, thus forming a self-driven, sustainable ecosystem.

As a leading NFT project in the Solana ecosystem, Mad Lads represents the spirit of the Backpack community. It achieved great success at its launch, boasting over 8,000 independent holders and quickly establishing a real and highly active fan community, generating over $8 million in initial issuance revenue.

Subsequently, through initiatives such as content creation incentive programs launched by the official team, Mad Lads has demonstrated strong resilience: high-quality content from the community has been widely disseminated across social media platforms like Twitter, YouTube, Instagram, and TikTok, becoming an important window to showcase the brand and attracting more people to experience and develop new products and technologies of the project.

At the same time, Mad Lads holders also enjoy varying degrees of rights in other related Backpack products, further binding community members to ecological development, achieving a dual empowerment of community and ecosystem.

It can be said that through the combination of wallet + exchange + Mad Lads, Backpack has formed a super application paradigm that integrates "Robinhood + MetaMask + USDC Network," with highly integrated functions and seamless user experience, covering the full-cycle Web3 services from ecological exploration, trading finance to identity recognition, further creating an inclusive trading platform aimed at consumer-level users in the Web3 era.

Compliance First: Covering Users in 95% of Global GDP Regions by 2025

The deeper logic behind the crypto U.S. stock boom is the deeper integration of crypto finance and traditional finance.

In this overarching trend of integration, compliance has become a path that, while difficult, must be taken, and it has also become the key for projects to stand out in the competition of crypto U.S. stocks.

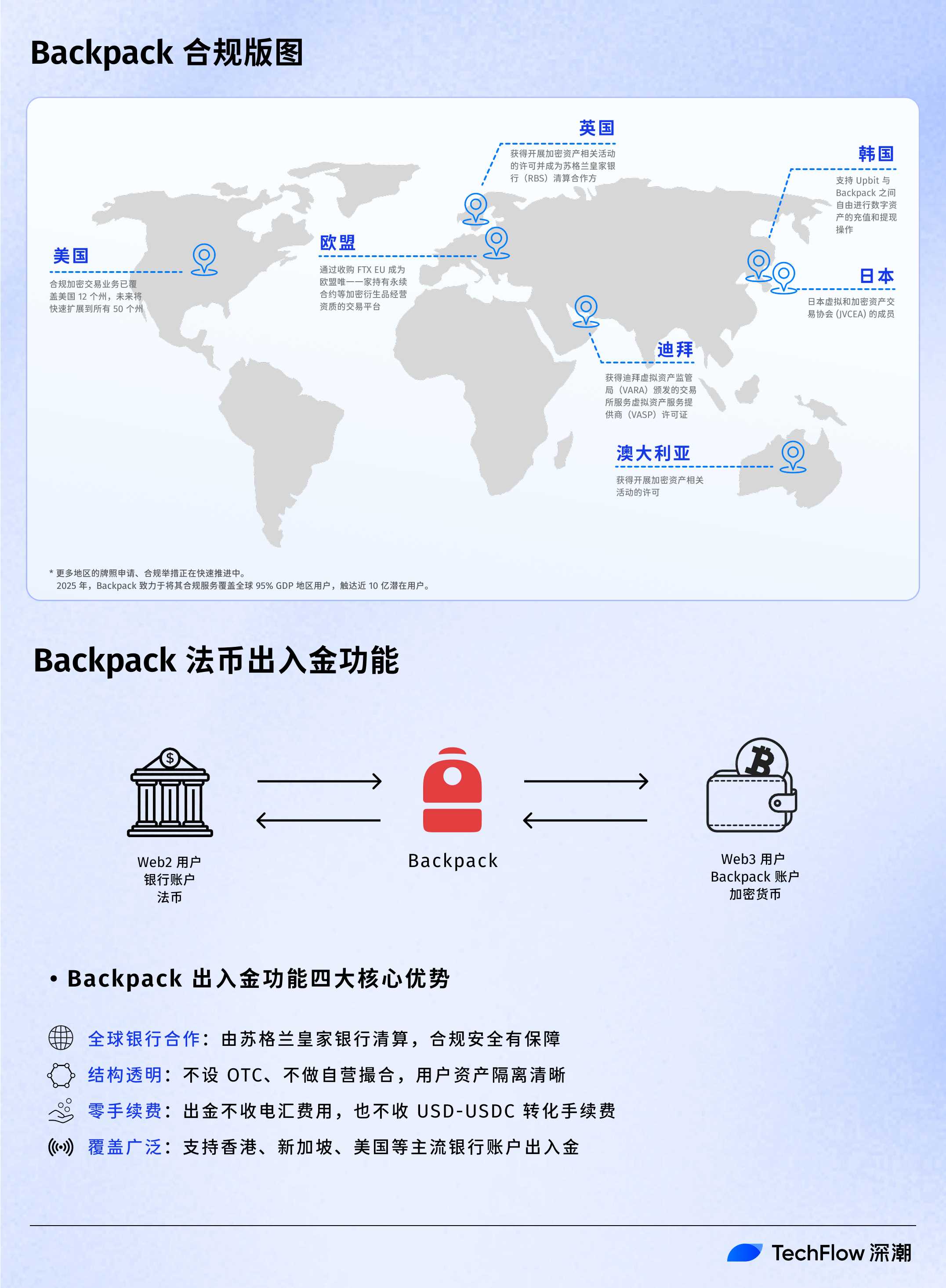

As one of the few crypto companies that have firmly embraced compliance since its inception, Backpack has made significant efforts over the years, and its compliance landscape has blossomed in multiple locations around the world:

In the current siphoning of attention from crypto and traditional finance by crypto U.S. stocks, Backpack's recently launched "fiat deposit and withdrawal" function has further opened an important compliant and seamless channel between traditional finance and crypto, laying a solid foundation for Backpack to gain recognition in the traditional financial market and achieve widespread adoption.

At the same time, Backpack has now included USDC and pyUSD in the "dollar equivalent pool." After enabling the Auto-Lend function, users can enjoy an APY that combines U.S. Treasury yields supported by stablecoins and lending rates. Currently, the annualized yield reaches 5.56% (4% Treasury yield + 1.56% lending rate), providing higher capital efficiency in crypto earnings on top of a seamless deposit and withdrawal experience.

It is worth mentioning that amidst the trend of crypto companies going public in the U.S., the compliance-focused Backpack may have a more pronounced advantage in the competition for "the next Circle":

It is important to note that behind Circle's taste of IPO success lies a full seven years of preparation from 2018 to 2025, with numerous challenges along the way;

Another strong competitor for "the next Circle," Kraken, has also faced a tumultuous path to listing. In June 2021, Kraken's then-CEO Jesse Powell boldly stated that they planned to go public within 18 months. However, due to various reasons, Jesse Powell left in September 2022, and Kraken's IPO plans were temporarily shelved until they were brought back to the agenda in 2024.

Moreover, many former FTX employees on the Backpack team come from legal and compliance departments. This mature compliance team, consisting of dozens of members, enables Backpack to better understand how to advance compliance strategies globally compared to other crypto trading platforms, and it also allows Backpack to navigate issues with national/regional regulatory agencies more adeptly.

Conclusion

As one of the most successful IPOs in recent years, Circle's success not only highlights investors' desire for exposure to crypto targets represented by CRCL but also reflects the deep empowerment of traditional capital markets towards Web3 projects through this unique phenomenon of liquidity mismatch between traditional Web3 and U.S. stock markets.

It can be said that Circle has provided a clear path for subsequent Web3 projects: the traditional financial market places a significant premium on Web3 targets with quality cash flow and compliance, while compliance, innovation, and marketization are key to entering traditional capital markets. Projects capable of achieving these key factors will experience exponential growth with the support of global capital.

Clearly, whether in terms of product aspects being "closest to U.S. stock structure," the community's continuous ability to generate and sustain, or being ahead in compliance, Backpack possesses tremendous potential to become "the next Circle."

Since entering 2025, Backpack has shown exponential growth in several core data points, seemingly validating the market's recognition of Backpack, especially during the Season 1 points activity: Backpack issued a total of 10 million points, with the platform's 24-hour perpetual contract trading volume exceeding $1.1 billion; total assets lent surpassed $165 million; total assets borrowed exceeded $56 million. Points, as a representation of Backpack's ecological rights, will have more empowering roles in the future.

Before the official launch of Season 2 points activity, Backpack recently initiated the "Season Special: Month of Benefits" series of activities, using a multi-reward drop format to create a benefit side quest filled with unknowns and expectations, continuously attracting users to participate in trading and exploring products.

As the integration of the crypto industry and traditional finance accelerates, will the next crypto milestone be created by Backpack? With more product innovations and market initiatives being implemented, we look forward to Backpack bringing more innovations to the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。