**In the midst of strategizing, we can win from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

**

In the past few days, the market has been quite volatile and the momentum has been rapid. Many fans have sent private messages to Lin Chao, and I apologize for not being able to respond in time. I am accustomed to focusing on one thing at a time, and trading indeed requires full concentration. If the waiting time is long, I ask everyone to be a bit more patient or to send a reminder message to Lin Chao later. Recently, the most concentrated question from fans is whether we are still in a bull market or if a bear market has begun. With so many positive factors, can we expect the market to explode immediately? In today’s article, Lin Chao will provide some criteria for judgment.

In addition to the rapid market movements in the past two days, the fundamentals are also being pulled to the extreme. Who would have thought that the powder keg in the Middle East, which seemed ready to explode, would be halted overnight? The Israel-Iran conflict went from exchanging harsh words and being on the brink of war to suddenly hitting the pause button. Trump also showcased his unique diplomatic skills, using "Tomahawk" missiles to precisely strike Iranian nuclear facilities while quickly engaging in intensive mediation through Qatar and other channels. In just over ten hours, Trump announced that Israel and Iran agreed to a "comprehensive ceasefire." Although the Iranian foreign minister later clarified that no formal agreement had been reached, it also sent a signal that "as long as Israel ceases fire, Iran will not continue to respond."

Almost at the same time, the Federal Reserve also blew a "warm wind." Previously, the Federal Reserve was known for being "hard-nosed" on interest rate cuts, with a firm attitude. However, just last night and this morning, two heavyweight officials from the Federal Reserve released signals that they might shift direction. Governor Bowman stated that if inflationary pressures are controlled, she "will support a quick reduction in the policy rate at the next (July) meeting." Another Fed Chair, Goolsbee, believes that the pause in rate cuts earlier this year was mainly due to policy (tariff) uncertainty, and that the Fed should return to the "golden path" planned at the beginning of the year to continue cutting rates. Such strong hints have sharply raised expectations for a rate cut in July.

Stimulated by these anticipated favorable policies, the cryptocurrency market responded with a rise, with mainstream cryptocurrencies showing the following 24-hour changes: BTC: 4.61%, ETH: 9.01%, SOL: 10.04%, DOGE: 9.14%. Many aggressive users feel that this wave of market movement is a "one-night bull return." However, Lin Chao believes that at this stage, everyone should be more conservative, especially since Bitcoin has already recovered more than 4% of its decline within 24 hours, and the rebound speed is very fast. Market sentiment is also quite intense, and it cannot be ruled out that aggressive individuals are stirring market emotions. We cannot directly conclude that 98K is the absolute bottom of this round just because of anticipated policy news. After all, there has not yet been a clear signal of a pullback confirmation in the market.

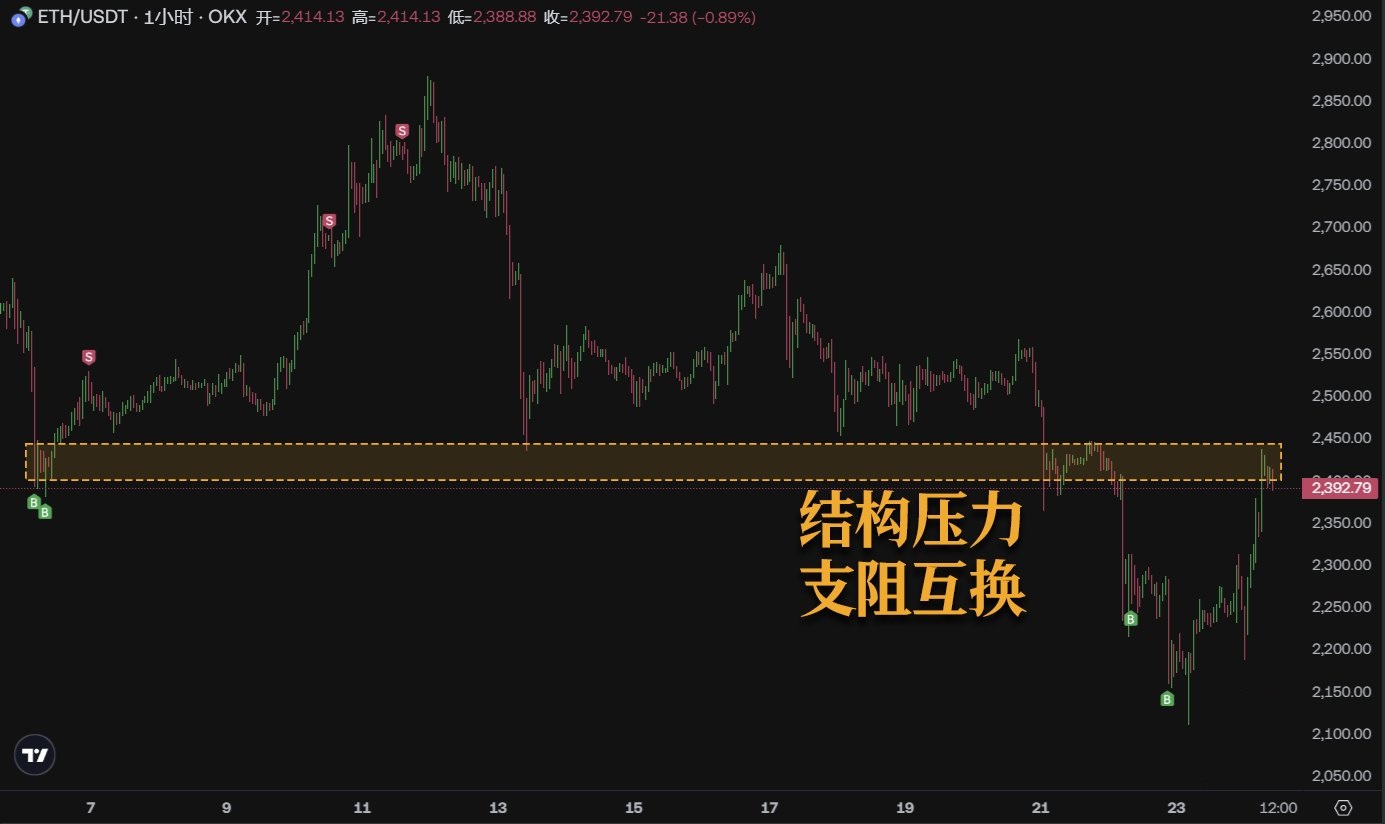

From the hourly chart of ETH, we can more clearly see that this rebound is very rapid. On the surface, it seems to have bottomed out, but the daily structure has actually broken down, with the original support turning into resistance. I suggest that everyone should not subjectively guess whether it is a breakout or a drop back, especially for contract users. Currently, it is advisable to take profits in batches for positions built around 2200, focusing on maintaining profits overall.

Some fans asked Lin Chao if the end of the Iran-Israel war would lead to a rise. In fact, the financial market itself is a complex web of interconnections, especially in the high-risk trading market of cryptocurrencies. Lin Chao has previously emphasized in articles that we should not predict future market trends based on any single factor. As analysts, we mainly divide our analysis into three major systems. Simply put, they are: fundamentals, sentiment, and technicals. Objective judgment of trends actually requires the combination of these three systems, and each has its own boundaries and traps. It is essential to clarify positioning first, avoid using the wrong tools, and never replace rational judgment with "subjective imagination."

Fundamental investment focuses on the big direction and slow variables, essentially suitable for long-term layouts measured in years. The biggest misconception for novice traders is using macro logic to predict short-term fluctuations. In the real market, the relationship between fundamental factors and prices often "diverges," being positively correlated today, negatively correlated tomorrow, and possibly having no relation the day after. Do not fantasize about making every trade based on "fundamental signals," as this will only lead to repeated setbacks.

Sentiment is essentially the "collective imagination" of market participants, with news and public opinion being an important part. The difficulty lies in the fact that the "signals" here have no standard boundaries and rely entirely on experience and information discernment ability for judgment. If you see a piece of news and can only make simple attributions and inferences, it is akin to carving a boat to seek a sword. For example, if news comes out that the Iran-Israel war may end shortly, one might think the decline has ended; seeing a change in the Federal Reserve's attitude might lead to the conclusion that a bull market has begun. This is far from professional judgment.

The greatest value of technical analysis is to make trading a quantifiable and executable action. The so-called "small profits, small losses, occasional big profits, and never big losses" is essentially a victory of execution and risk control.

Lin Chao wants to emphasize here that as a trader, what you should do is to use statistical advantages as the core of your trades, with risk management as the bottom line, then accurately calculate the risk of each trade, and follow your trading plan to ultimately achieve the set goals and realize profits, rather than trading based on vague "news situations" that even you find hard to make solid judgments about.

Lin Chao's Summary

Lin Chao believes that although the market has shown many anticipated positive signals, the focus should be on "expectations" rather than "positives." Looking at it calmly, whether the foundation of this rebound is solid still raises questions. On one hand, the "peace" in the Middle East is still fragile, and Iran's official statements still leave room for maneuver. The final implementation and execution of the ceasefire agreement remain to be observed. On the other hand, the Federal Reserve's hints about rate cuts are still just "verbal signals." Whether they can truly materialize in July still requires subsequent economic data (especially inflation data) and more explicit statements from officials for verification. The short-term excitement in the market can be understood, but whether in geopolitics or monetary policy, all parties exhibit characteristics of "extreme pulling" and "changing attitudes." Therefore, I believe that the subsequent trend of the cryptocurrency market is unlikely to be smooth sailing; it is more likely to seek a clear direction amid fluctuations and uncertainties. We should not let any expectations sway our judgments, nor should we subjectively "guess" whether it will rise or fall. Instead, we should focus on a solid fundamental core, combined with actual market sentiment and technical indicators as references, to gradually and strategically plan our trading direction and layout.

The market is always the market; the harsh reality will not change because of your losses, nor will it cease due to your tears and complaints. To change your fate, you must continuously learn investment skills and improve your own strength to truly stand firm. The greatest prison in the world is the human mind. If you cannot earn money beyond your cognition, then learn to leverage.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

For real-time consultation, please follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。