Selected News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

KAITO: Today's discussion about KAITO mainly focuses on the large airdrop rewards issued by Magic Newton, which has become a hot topic in the community. Many users expressed surprise and gratitude, with some even stating that this airdrop has covered their entire KAITO investment cost. Meanwhile, the potential of the KAITO ecosystem is receiving increasing attention, including staking rewards, the introduction of an on-chain reputation system, and KAITO's empowerment of projects like NOYA and Hana Network. The community is also actively participating in leaderboard competitions, exploring more opportunities within the KAITO ecosystem.

SEI: SEI is receiving widespread attention for its strong performance and strategic layout. As one of the standout projects this quarter, SEI saw a 59% increase in the second quarter. Circle currently holds the most tokens on its balance sheet, which are also SEI tokens, and Wyoming has chosen SEI as the infrastructure for its stablecoin pilot. SEI's market share in the Web3 gaming sector is continuously expanding, and it ranks high in blockchain technology ratings. The filing for the SEI ETF and its key role in the stablecoin narrative have further heightened market interest.

NEWTON: Today's discussion about NEWTON focuses on the large-scale airdrop of the $NEWT token, which has sparked widespread attention in the crypto community. Many users expressed gratitude to Magic Newton and KaitoAI, with several sharing their earnings from the airdrop and the subsequent spending experiences. However, some users raised questions about the qualification and distribution process, with some claiming they were not recognized in the leaderboard snapshot and thus missed out on rewards they should have received. This discussion also highlights NEWTON's integration path and future potential within the KAITO ecosystem.

APT: Today's topic surrounding APT mainly focuses on the new project Shelby, co-developed by Aptos Labs and Jump Crypto—a decentralized hot storage network aimed at providing real-time, highly liquid, chain-agnostic data storage solutions for Web3. Shelby is seen as an important breakthrough in blockchain infrastructure development, bringing Aptos back into the spotlight, with its advantages in performance and scalability becoming key discussion points. Additionally, the deep partnership with Jump Crypto and the potential for Aptos to narrow the gap with Solana have also become highlights of market discussions.

Selected Articles

On June 25, Cathay Securities International's stock price surged 80% at the start of trading, skyrocketing over 190% during the day, becoming one of the strongest Hong Kong stocks. The stock price surge is accompanied by this traditional financial brokerage's high-profile entry into the coin stock arena, as the company announced today that it has received approval from the Hong Kong Securities and Futures Commission to officially enter the cryptocurrency trading service. Coupled with several Hong Kong-listed companies previously laying out Bitcoin and Ethereum asset allocations, as well as the impending implementation of the "Stablecoin Regulation," the Hong Kong stock market is quietly welcoming a wave of "coin stock fever."

The surge of CRCL reflects a long-term optimism towards the stablecoin payment sector, but Coin, as the intersection of its underlying settlement ecosystem, on-chain network, and user traffic, seems closer to the "ontology" of this narrative. Moreover, Coinbase is also one of Circle's largest shareholders, holding about 50% of the latter's shares. With this collection of "advantages," is Coinbase's value underestimated?

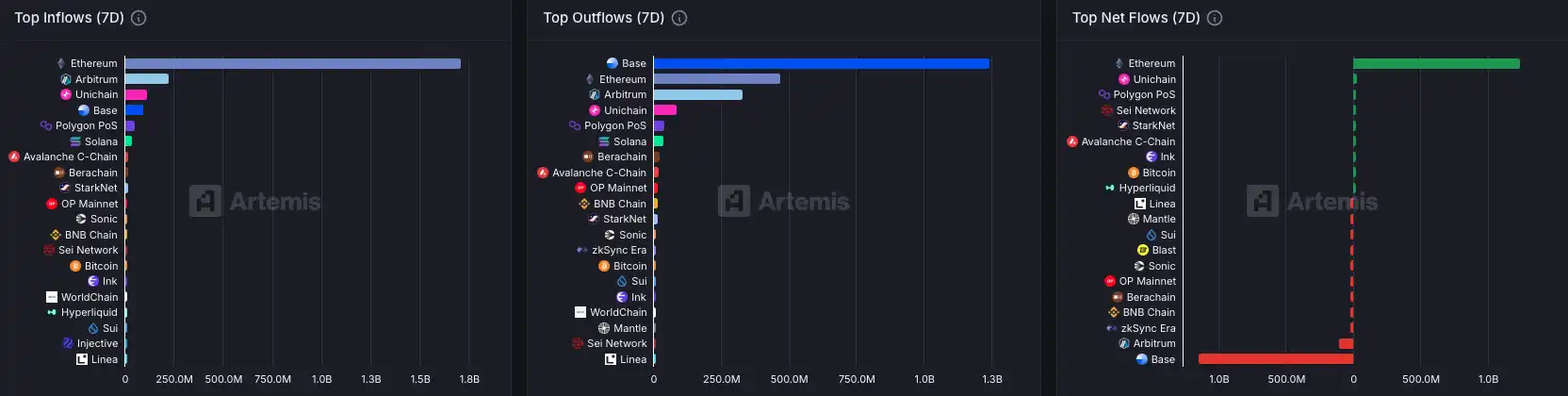

On-chain Data

On June 25, the on-chain capital flow situation

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。