U.S. Federal Reserve Chairman Jerome Powell was on the hot seat for the second day in a row, this time in front of the U.S. Senate’s Committee on Banking, Housing, and Urban Affairs, where he acknowledged that crypto is no longer a dodgy industry that should be shunned but rather a promising innovation that is “maturing” and “becoming much more mainstream.” The broader crypto market inched up 0.10% on the news, while bitcoin rose 1.38%, trading as high as $108K in the morning.

Powell was conducting his Semi-annual Monetary Policy Report to the Congress, where he testifies before the House and the Senate twice a year. Cynthia Lummis, Wyoming’s Republican Senator and so-called “Crypto Queen,” blasted Powell for his role in Operation Choke Point 2.0, a Biden-era effort to debank the crypto industry. She acknowledged that the Fed is now more receptive to digital assets but also challenged Powell on language contained in Section 9(13) of the Federal Reserve Act.

(U.S. Senator Cynthia Lummis, R-Wyoming is affectionately known as the “Crypto Queen.” She heads the Senate Banking Subcommittee on Digital Assets / Wake Up Wyoming)

The language in the act states that “issuing tokens on open, public, and/or decentralized networks, or similar systems is highly likely to be inconsistent with safe and sound banking practices.” Given Powell’s softer stance on crypto, Lummis asked him how his views had changed and whether the language in the act, which was adopted by the Federal Reserve Board in 2023, would be taken out.

“What has changed is that if you go back, that’s a couple of years ago, that was a period of high-profile failures and fraud,” Powell explained. “What has happened is that the industry is maturing, our understanding of it is improving, and in a sense it’s becoming much more mainstream.”

Regarding striking out the negative language in the act, Powell appeared non-committal and told Lummis he would get back to her.

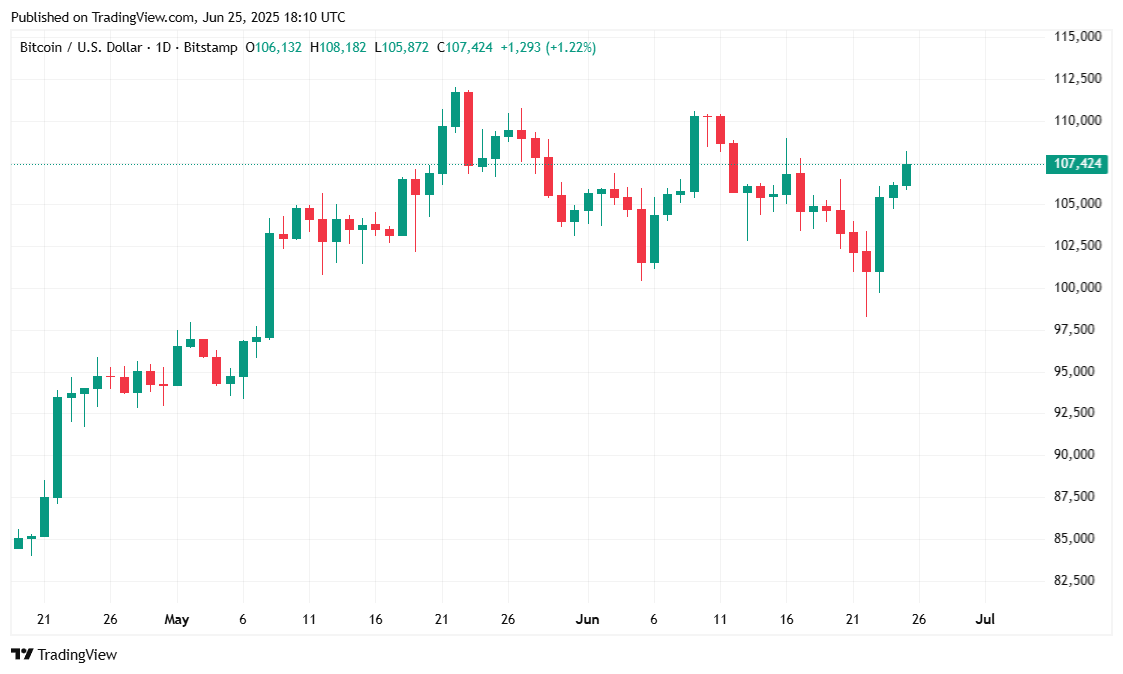

Powell’s remarks weren’t the only reason for bitcoin’s positive performance today, but they certainly helped. The cryptocurrency traded between $105,359.97 and $108,168.40 and is currently priced at $107,364.36 at the time of reporting, a 1.25% gain since yesterday and a 3.05% increase over the past week. However, trading volume fell by 14.25% to $51.05 billion despite the bullish momentum.

( BTC price / Trading View)

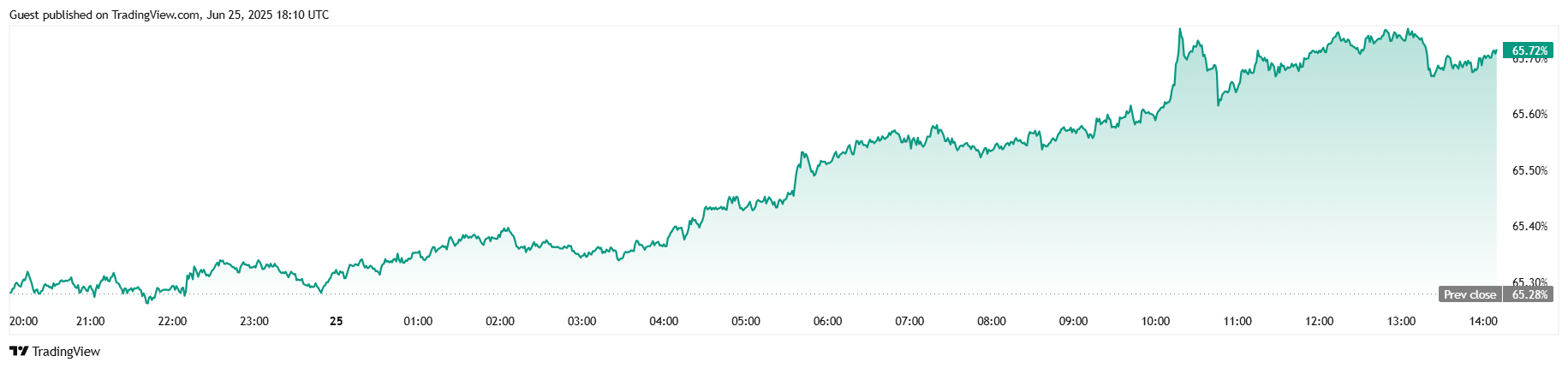

Bitcoin’s total market capitalization rose to $2.13 trillion, up by 1.39% since yesterday. BTC dominance climbed to 65.72%, a significant 0.71% increase and the highest it has been since January 2021.

( BTC dominance / Trading View)

Futures markets showed total BTC open interest jumping 4.85% to $73.31 billion, according to Coinglass data. The derivatives market paints a positive picture for bulls over the last 24 hours. Roughly $71.39 million in bitcoin positions was liquidated. Bears’ short liquidations totaled $60.46 million and long liquidations were a relatively smaller $10.93 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。