The sage never dies, the great thief never stops.

Written by: Zuo Ye

"Don't pay attention to those BNB, P small players who want to make cycles, but rather to friends of new cycles, not old money. In the face of a new cycle, the capricious market will quickly erase the experience advantage of old money, which is also the charm of Web3."

Binance started in China, raising $15 million in 2017, with many individual investors, including major nodes.

Binance roams the world, earning money from Chinese people, donating to schools in Africa, seeking fame in Europe and America, with the ultimate pursuit of moving from Asia to Europe.

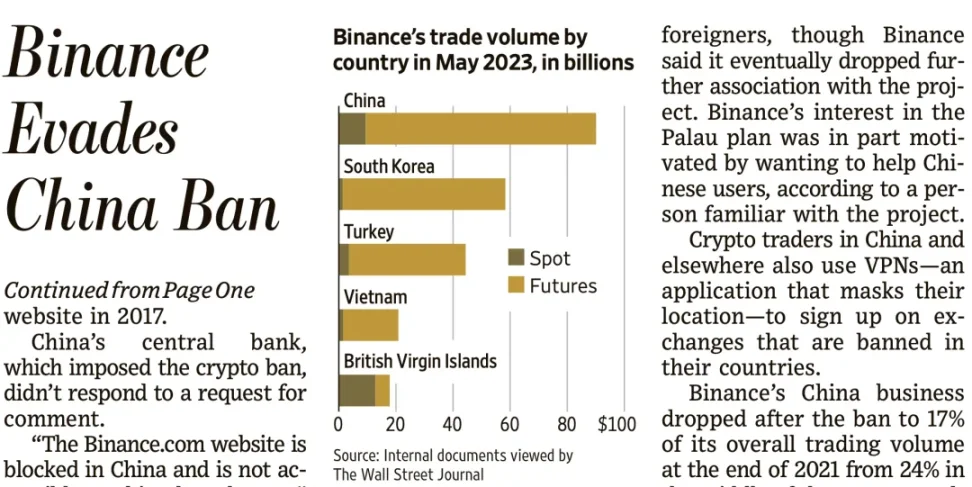

In 2023, when the media has not been completely bought out, the last report from the WSJ shows that Binance's users and market share are still concentrated in China. By 2025, we will be unable to assess the importance of the Chinese market.

Image description: Binance trading volume in 2023, image source: WSJ

It's not that the Chinese market is no longer important, but rather the obscuring of information, with a centralized will flowing behind it.

An industry that declares decentralization and is led by financial equality, after eight years of Binance's establishment, has directly moved towards its opposite.

Crypto OGs go to play in the US stock market, KOLs are constantly bought out, and regulation has lost its fangs, creating a small universe where only retail investors, "chives," and Chinese users are getting hurt.

Clearly, we bear all the costs, yet we can only become the backdrop for the crypto king to enter and flatter, which is incredibly disgusting.

Has it always been this way, so it is right?

The crypto world is a huge Binance, and the voices of resistance will also be obscured, but we still need to represent the chives and shout to the Trisolarans; courage is humanity's final hymn, and bugs will never be exterminated.

The sage never dies, the great thief never stops

When did we become completely disappointed with Binance?

Personally, I feel it was after CZ was released from prison, after 100 days of enlightenment in Longchang, realizing today that I am me.

The CZ who once swore by decentralization in late reports has disappeared, replaced by a CZ unfamiliar with on-chain operations, even unaware of how poorly the Binance wallet performs.

The big brother of the crypto circle sees everyone as a dog.

We thought CZ could not interfere with Binance's operations, so Binance Labs was renamed YZi Labs, focusing on biotechnology and AI, amassing billions in wealth, and researching immortality in peace.

CZ thought we could not interfere with Binance's operations, believing that Binance should have more open access and be more connected to the BNB Chain ecosystem, unaware and uninvolved in the TST fast-track to Binance matter.

One coin, each expressing differently, no one is at ease desu.

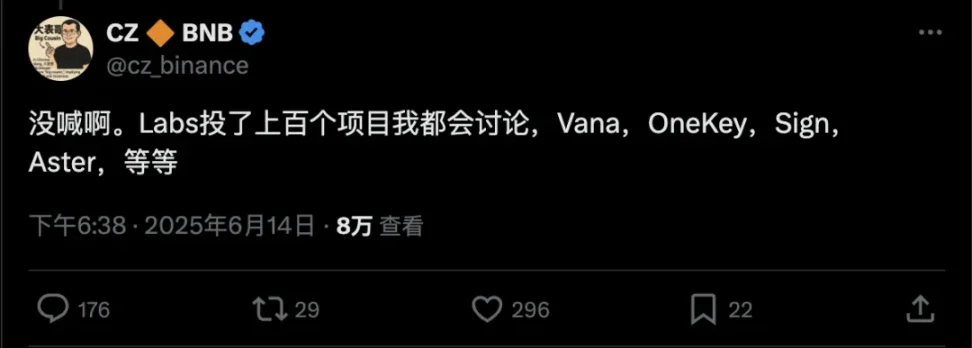

Image description: CZ's Dog, image source: @czbinance_

In early February this year, Broccoli emerged, CZ's Dog became a target for speculation, and BNB Chain's activity surpassed many public chains, with liquidity subsidies, demands for node control of MEV, even taking advantage of OKX being raided by EU regulators to attack the wallet ecosystem.

How to evaluate this? I think the most appropriate term is Binance's "institutionalization." Our system is about taking public exams and entering big companies, while for Binance, it is about obtaining monopoly profits from traditional internet companies, legal protection from Western governments, and deep recognition from Western society.

First and foremost, Binance is increasingly "Alibaba-like," wanting to swallow all potential profit points, with all project parties, KOLs, VCs, and market makers, as well as the broadest and most decentralized retail investors, all revolving around Binance, rolling in and out, air drops, Alpha, BNB Chain MVB, contracts, spot trading, YZi Labs, and even stablecoins and DeFi.

Perhaps that is still not enough; the entire trading market is the goal, from suggesting Bybit to "restrict" user withdrawals, to imitating Aevo's pre-market trading, seizing the opportunity to capture OKX's wallet market, encompassing everything, doing everything, but without any innovation.

Following closely, from acquiring CMC in 2020 to investing $200 million in Forbes in 2022, advanced speech control has never been about counterattacks and suppression, but rather "small insults helping the big," commonly known as black-red is also red.

Controlling the global source of speech, the rest will naturally have sycophants explaining, great scholars have always competed for positions.

To be honest, Binance has never been stingy in its actions, including KOLs and crypto media; Binance does not mind whether you are a bought follower, deeply researching, or purely looking for shortcuts, even with exceptionally lenient conditions, not needing to constantly maintain links to please sponsors, as long as you don't follow the trend.

This is really not as good as Sun's approach; in this regard, Sun is consistent both internally and externally, whether it's Trump or coconut chicken, showing the shamelessness and standardization of a multinational capitalist, regardless of black, white, yellow chives, or the dignitaries of the East and West, all are cut without exception.

Being both the king of crypto and a clay sculpture.

How Binance operates internally is beyond outsiders' speculation, but CZ is an interesting person, always wanting to place himself on a moral high ground, for example, never claiming to support, deny, or recognize anyone.

From a small project to the entire planet.

If anyone is a thorn in CZ and Binance's side, I nominate Hyperliquid. This year, Binance has at least twice taken action against Hyperliquid:

- In March, Binance and OKX quickly launched the $JELLYJELLY contract.

- In June, covering for Aster, encouraging everyone to innovate Perp DEX dark pools, but I didn't shout.

Image description: CZ denies calling for ASter, image source: @czbinance_

As of now, the entire market's liquidity is drying up; the crypto circle wants money from the stock market, and the stock market wants liquidity from the crypto circle, mutually dependent on liquidity, either spiraling upwards or lying together in hell.

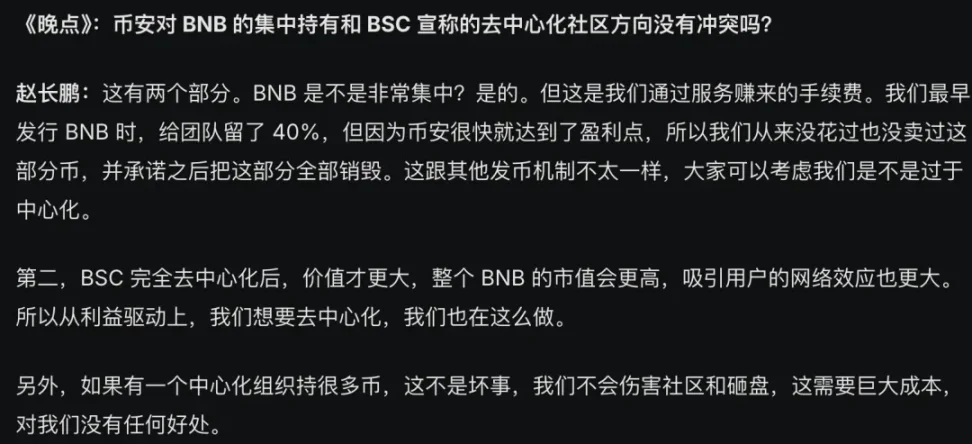

Image description: Not harming the community, image source: LatePost

In 2021, CZ promised not to harm the community; do you still remember in 2025?

Inwardly and outwardly troubled, living towards death

A new generation surpasses the old king.

Binance's centralization is not isolated; across the ocean, Coinbase is also collapsing in its persona, with Armstrong listing, sharing USDC profits, and launching the Stand with Crypto movement while promoting crypto punk culture.

Image description: Are crypto punks still crypto? Image source: @brianarmstrong_

Especially the Stand With Crypto movement aims to tame disobedient congressmen with money; I think this is how CZ sees himself, whiter and more Western, transforming his wealth into political and social influence.

From the rumors of Musk's willingness to leverage when buying Twitter to Binance.US regrouping, and even entering the market (sub) to comply with US regulations, we can see that the rebels in our world are not among the leaders of cryptocurrency.

Image description: CZ and Musk's love-hate relationship, image source: Deep Tide

Striking a rebellious pose is to sell oneself at a better price; is such a Binance still the decentralized pioneer that roams the globe without a headquarters or office?

We all know it is no longer so; Binance has obtained the Dubai VASP license, is compliant in the US, accepts investments from the UAE, and receives payments in USD1 stablecoins related to the Trump family.

Image description: Binance recruitment, starting from college, image source: @binancezh

Binance increasingly prefers resumes from large companies, prestigious schools, and "rich experience" professionals. When facing doubts, only He Yi can withstand several hours of AMA, and immediately take action; a college degree is sufficient for employment.

However, He Yi also mentioned that there are no more than 10 purely Chinese positions at Binance, so it is assumed that all college graduates will have at least a level four proficiency.

During the opening remarks of this AMA, a series of introductions of Stanford employees were shocking; has Binance's confidence reached this level?

What do real crypto people look like?

They are 25-35 years old, working in Shenzhen, checking Binance for market updates after finishing their shifts in tech parks;

They are 18-22 year old naive students, working internships in development, BD, and VC for 200 yuan a day;

They are marginalized individuals over 35, with Didi drivers and delivery workers being sources of liquidity in the crypto circle.

If we truly recognize the role of retail investors, then they should never become sources of liquidity for institutions and Western projects; the role of liquidity is for innovation, not for personal private domains.

Today's crypto is becoming a mainstream financial trend; all CEXs are competing for the last crypto users and accepting new mass users, with strategies and gameplay highly converging, BN supporting Aster, Bybit entering to do Byreal, and Coinbase integrating Base DEX.

But what is Binance doing?

Binance is stifling all innovation, from inscriptions to memes, and now to stablecoins; the BNB version strategy Nano Labs has also arrived, and BNB reserves have entered Bhutan, as if Binance is not the entity, but BNB is.

It is hard to cite original products from Binance; the only one I can think of is Binance LaunchPad, which opened the irreversible path for liquidity makers; everything is for liquidity.

There are many failed innovations, from unacknowledged voting for new coins, to investment standards for new release models, and the unacknowledged DeSci representative work Bio Protocol; you will find an interesting fact that these seem to have never happened.

Inwardly and outwardly troubled: internally, Binance actively sells retail investors in the crypto circle for a good price, externally, stablecoins and US stocks are swallowing the liquidity of the crypto circle.

Living towards death: the crypto circle dies, Binance lives.

Conclusion

There are many accusations and questions directed at Binance; I do not expect to change anything, but in the face of countless facts, we must admit—Binance is harming the crypto circle, devouring the hopes of countless people.

This harm is based on trust; we abandoned the perilous on-chain world and turned to the cozy nest prepared for us by Binance, only to find the cost a bit heavy, with big teeth soothing our emotions, ensuring the meat is tender.

We need a new force that can replace Binance; even a centralized Hyperliquid is far superior to the pseudo-decentralized Binance by ten or even nine points.

No matter how many fabricated KOLs there are, they cannot surpass the voices of the masses; each of us is a source of volume. Today, if you can wave the banner of "Binance dies, the crypto circle lives," tomorrow the crypto circle will still be the only upward channel for grassroots in this turbulent world! Defend your hope!

Binance dies, the crypto circle lives.

References:

- Crypto Is Illegal in China. Binance Does $90 Billion of Business There Anyway.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。