Written by: Josh Solesbury (ParaFi Investor)

Translated by: Azuma, Odaily Planet Daily

Catalyzed by Stripe's acquisition of Bridge and the progress of the "GENIUS Act," the past six months have seen an explosive growth in headlines related to stablecoins. From CEOs of major banks to product managers at payment companies and high-level government officials, key decision-makers are increasingly mentioning stablecoins and promoting their advantages.

Stablecoins are built on four core pillars:

- Instant settlement (T +0, significantly reducing working capital requirements);

- Extremely low transaction costs (especially compared to the SWIFT system);

- Global accessibility (available year-round, requiring only an internet connection);

- Programmability (currency driven by extended coding logic).

These pillars perfectly illustrate the advantages of stablecoins as promoted in various headlines, blog posts, and interviews. Therefore, the argument for "why we need stablecoins" is easy to understand, but "how to apply stablecoins" is much more complex—whether for product managers at fintech companies or bank CEOs, there is currently very little content that specifically explains how to integrate stablecoins into existing business models.

Based on this, we decided to write this advanced guide to provide a starting point for non-crypto businesses exploring the application of stablecoins. The following text will be divided into four independent chapters, each corresponding to different business models. Each chapter will analyze in detail: where stablecoins can create value, what the specific implementation path is, and a schematic diagram of the restructured product architecture.

Ultimately, while headlines are important, what we truly pursue is the large-scale application of stablecoins—enabling real business scenarios to achieve the scaled use of stablecoins. We hope this article can serve as a small cornerstone for realizing this vision. Now, let’s delve into how non-crypto businesses can utilize stablecoins.

To C Fintech Banks

For consumer-facing digital banks, the key to enhancing enterprise value lies in optimizing the following three levers: user scale, average revenue per user (ARPU), and user churn rate. Stablecoins can currently directly support the first two metrics—by integrating partners' infrastructures, digital banks can launch stablecoin-based remittance services, reaching new user groups while also adding revenue streams for existing customers.

In the context of ongoing trends in digital connectivity and globalization, today’s fintech target markets often have multinational characteristics. Some digital banks position themselves as providers of cross-border financial services (like Revolut or DolarApp), while others treat it as a functional module to enhance ARPU (like Nubank or Lemon). For fintech startups focusing on expatriates and specific ethnic groups (like Felix Pago or Abound), remittance services are a necessity in their target markets. All these types of digital banks will (or already have) benefited from stablecoin remittances.

Compared to traditional remittance services (like Western Union), stablecoins can achieve faster (instant arrival vs. 2-5 days or more) and cheaper (as low as 30 basis points vs. over 300 basis points) settlements. For example, DolarApp charges only $3 to send dollars to Mexico, with real-time arrival. This explains why in certain remittance corridors (like the US-Mexico corridor), the penetration rate of stablecoin payments has reached 10-20%, with continued growth momentum.

In addition to creating new revenue, stablecoins can also optimize costs and user experience, especially as internal settlement tools. Many practitioners are well aware of the pain points of weekend settlements: bank closures lead to delays of two days. Digital banks pursuing real-time services and exceptional experiences have to fill the gap by providing working capital credit, which incurs opportunity costs (especially heavy in the current interest rate environment) and may force companies to seek additional financing. The instant settlement and global accessibility of stablecoins completely resolve this issue. One typical case is Robinhood, one of the largest fintech platforms globally, whose CEO Vlad Tenev stated in the February 2025 earnings call: "We are using stablecoins to handle a large volume of weekend settlement business, and the application scale continues to expand."

Therefore, it is not surprising that consumer-facing fintech companies like Revolut and Robinhood are actively engaging with stablecoins. So, if you work at a consumer bank or fintech company, how can you utilize stablecoins?

After introducing stablecoins into this business model, the practical solutions are as follows.

Real-time 24/7 Settlement

Utilize stablecoins like USDC, USDT, USDG for instant settlement (including holidays);

Integrate wallet service providers/coordinators (like Fireblocks or Bridge) to connect the bank system with blockchain for dollar/stablecoin flows;

Connect with fiat channel service providers in specific regions (like Yellow Card in Africa) to enable B2B/B2B2C exchanges between stablecoins and fiat currencies;

Filling the Fiat Settlement Gap

Use stablecoins as a temporary substitute for fiat during weekends, completing reconciliations once the bank system restarts;

Collaborate with suppliers like Paxos to build internal stablecoin settlement loops between customer accounts and businesses;

Instant Availability of Counterparty Funds

By using the above solutions or liquidity partners, bypass ACH/wire processes to quickly allocate funds to exchanges/partners;

Automated Rebalancing for Multinational Entities

When fiat channels are closed, achieve fund allocation between business units/subsidiaries through on-chain stablecoin transfers;

Headquarters can establish an automated, scalable global fund management system;

Beyond these basic functions, one can envision a new generation of banks entirely based on the concept of "always-on, instant, composable finance." Remittances and settlements are just the starting point, with subsequent scenarios including programmable payments, cross-border asset management, and stock tokenization. Such enterprises will win the market with exceptional user experiences, a rich product matrix, and a lower cost structure.

Commercial Banks and Enterprise Services (B2B)

Currently, business owners in markets like Nigeria, Indonesia, and Brazil face numerous obstacles when trying to open dollar accounts at local banks. Typically, only businesses with large transaction volumes or special relationships can qualify—this is contingent on the bank having sufficient dollar liquidity. Meanwhile, local currency accounts force entrepreneurs to bear both bank risks and government credit risks, making them constantly vigilant about exchange rate fluctuations to maintain operating capital. When making payments to overseas suppliers, business owners also incur high fees for converting local currency to dollars or other mainstream currencies.

Stablecoins can significantly alleviate these frictions, and forward-thinking commercial banks will play a key role in their application. Through a compliant digital dollar (like USDC or USDG) platform managed by banks, businesses can achieve:

- Holding multiple currency balances without establishing multiple banking relationships;

- Cross-border invoice settlements in seconds (bypassing traditional correspondent banking networks);

- Earning interest on stablecoin deposits;

Commercial banks can upgrade basic checking accounts to global multi-currency fund management solutions, offering speed, transparency, and financial resilience unmatched by traditional accounts.

After introducing stablecoins into this business model, the practical solutions are as follows.

Global Dollar/Multi-Currency Account Services

Banks manage stablecoins for businesses through partners like Fireblocks or Stripe-Bridge;

Reduce startup and operational costs (like reducing licensing requirements, exempting FBO accounts);

High-Yield Products Backed by Quality US Treasuries

Banks can offer yields at the level of the federal funds rate (around 4%), with credit risk significantly lower than local banks (US-regulated money market funds vs. local banks);

Need to connect with interest-bearing stablecoin suppliers (like Paxos) or tokenized treasury partners (like Superstate/Securitize).

Real-time 24/7 Settlement

See the previous section on consumer finance solutions.

Global Application Scenarios We Are Optimistic About (Stablecoin Platforms/Commercial Banks Can Solve)

Importers make instant payments in dollars, and overseas exporters release goods immediately;

Corporate CFOs allocate funds in real-time across multiple countries, freeing themselves from delays in the correspondent banking system, making bank services for large multinational groups possible;

Business owners in high-inflation countries anchor their balance sheets in dollars.

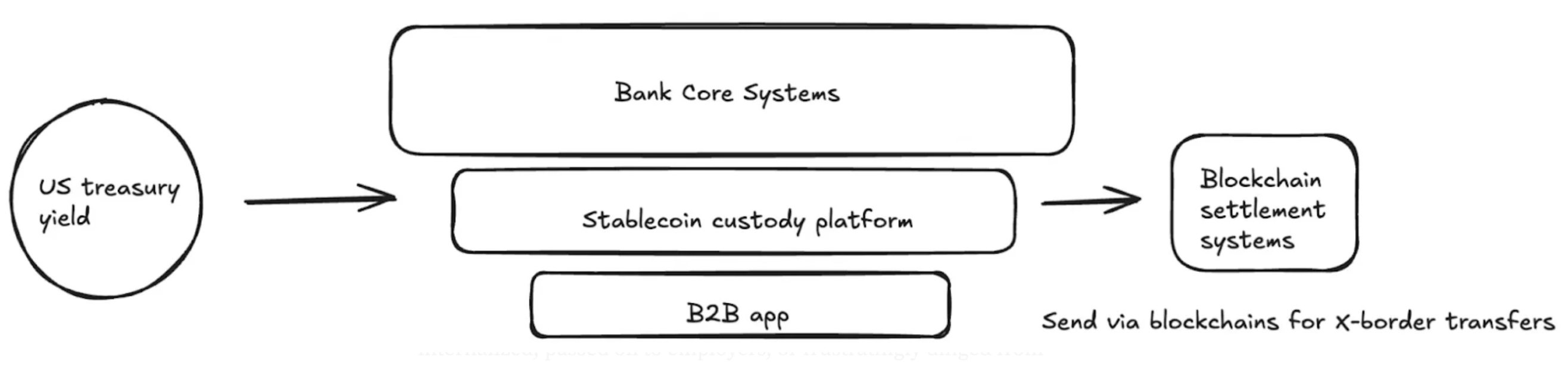

Product Architecture Example (Stablecoin-Based Commercial Banking Services)

Payroll Service Providers

For payroll platforms, the greatest value of stablecoins lies in serving employers who need to pay employees in emerging markets. Cross-border payments or payments in countries with underdeveloped financial infrastructure can impose significant costs on payroll platforms—these costs may be absorbed by the platform, passed on to employers, or reluctantly deducted from contractor payments. For payroll service providers, the easiest opportunity to realize is to open stablecoin payment channels.

As mentioned in previous sections, cross-border stablecoin transfers from the US financial system to contractors' digital wallets are almost cost-free and arrive instantly (depending on the fiat entry configuration). Although contractors may still need to convert fiat themselves (which incurs fees), they can receive payments anchored in the world's strongest fiat currency instantly. Multiple pieces of evidence indicate that demand for stablecoins in emerging markets is surging:

- Users are willing to pay an average premium of about 4.7% to obtain dollar stablecoins;

- In countries like Argentina, this premium can be as high as 30%;

- Stablecoins are becoming increasingly popular among contractors and freelancers in regions like Latin America;

- Applications focused on freelancers, such as Airtm, are experiencing exponential growth in stablecoin usage and user growth;

- More importantly, a user base has already formed: over the past 12 months, more than 250 million digital wallets have actively used stablecoins, with more people willing to accept stablecoin payments.

In addition to speed and cost savings for end users, stablecoins also offer numerous benefits to enterprise clients (i.e., paying clients) using payroll services. First, stablecoins are significantly more transparent and customizable. According to a recent fintech survey, 66% of payroll professionals lack tools to understand their actual costs with banks and payment partners. Fees are often opaque, and processes can be confusing. Second, the current payroll payment process often involves a lot of manual operations, consuming resources in the finance department. Beyond the payment execution itself, there are a series of other considerations, from accounting to tax to bank reconciliation, and stablecoins are programmable, with built-in ledgers (blockchain), significantly enhancing automation capabilities (like batch scheduled payments) and accounting capabilities (like automatic smart contract calculations, withholding, and record-keeping systems).

Given this, how should payroll platforms enable stablecoin payment functionality?

Real-time 24/7 Settlement

Related content has been covered earlier.

Closed-loop Payments

Collaborate with stablecoin-based card issuance platforms (like Rain) to allow end users to directly spend stablecoins, fully inheriting their speed and cost advantages;

Partner with wallet providers to offer stablecoin savings and earning opportunities.

Accounting and Tax Reconciliation

Utilize the immutable ledger characteristics of blockchain to automatically sync transaction records to accounting and tax systems via API data interfaces, achieving automation of withholding, bookkeeping, and reconciliation processes.

Programmable Payments and Embedded Finance

Use smart contracts to enable automatic batch payments and programmable payments based on specific conditions (like bonuses). Collaborate with platforms like Airtm or directly use smart contracts.

Connecting DeFi foundational protocols to provide wage-based financing services in an affordable and globally accessible manner. In certain countries/regions, it is possible to bypass the typically cumbersome, closed, and expensive local banking partners. Applications like Glim (and indirectly Lemon) are working to provide these functionalities.

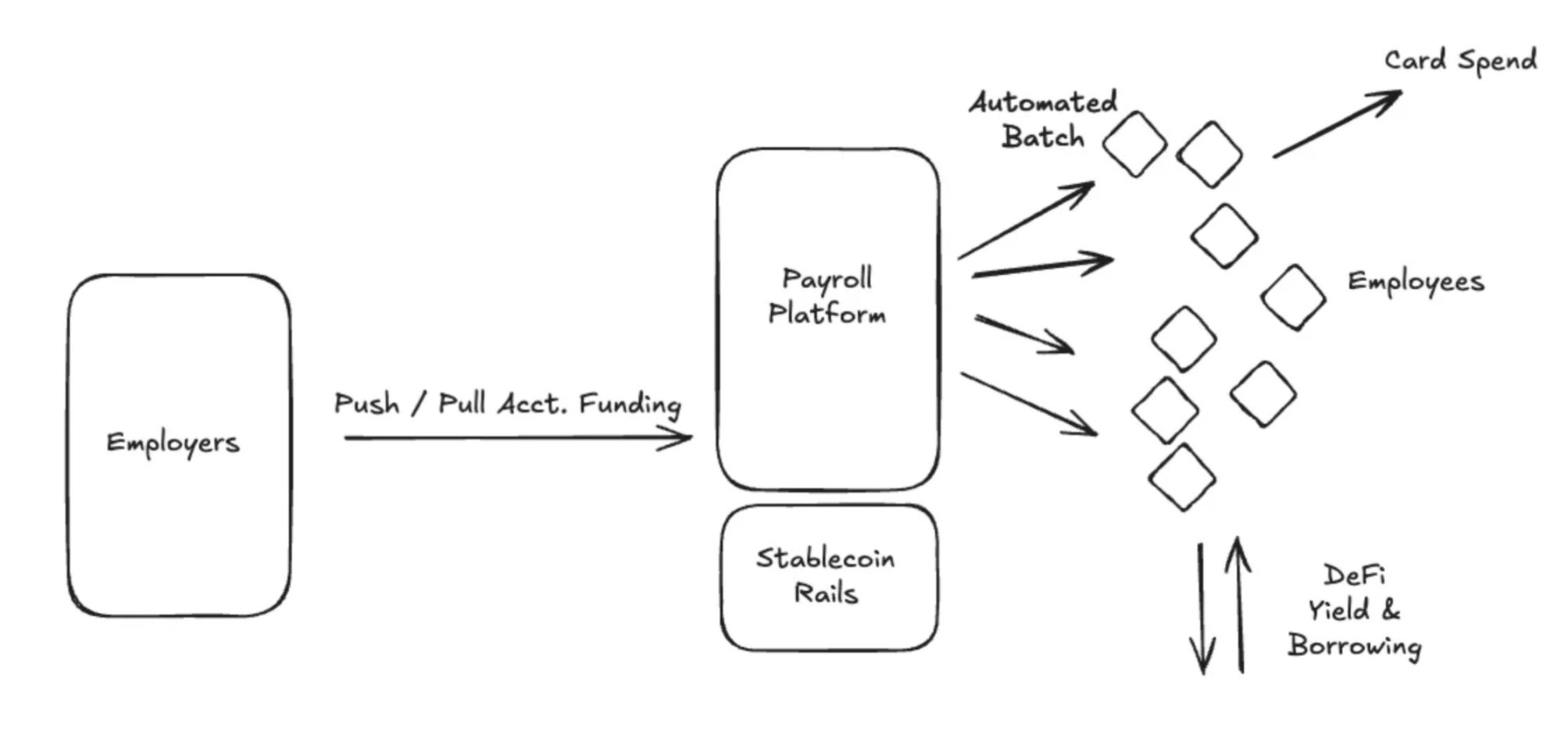

Based on the above plan, let’s further elaborate on the specific implementation methods:

Payroll processing platforms that support stablecoins collaborate with US fiat entry points (such as Bridge, Circle, Beam) to connect bank accounts with stablecoins. Before the payment date, funds are transferred from the client company’s account to an on-chain stablecoin account (these accounts can be hosted by the aforementioned companies or institutions like Fireblocks). Payments are fully automated and broadcast in bulk to all global contractors. Contractors receive US dollar stablecoins instantly, which they can spend using stablecoin-supported Visa cards (like Rain) or save through tokenized government bonds in on-chain accounts (like USTB or BUIDL). With this new architecture, the overall system costs significantly decrease, the coverage of contractors expands greatly, and the level of system automation is greatly enhanced.

Issuing Institutions

Currently, many companies are generating core revenue through card issuance. For example, Chime, which just went public on June 12, achieved over $1 billion in annual revenue in the US market solely through transaction fees. Although Chime has established a large business in the US, its partnerships with Visa, banking relationships, and technical architecture offer little assistance for expansion into overseas markets.

Traditional card issuance requires applying for direct licenses from institutions like Visa on a country-by-country basis or collaborating with local banks. This cumbersome process severely hinders companies' cross-regional expansion. Taking the publicly listed company Nubank as an example, it took nearly three years after operating for over a decade to begin overseas expansion.

Additionally, issuing institutions must pay deposits to card organizations like Visa to mitigate default risks. Card organizations use this to assure merchants like Walmart that even if a bank or fintech company goes bankrupt, cardholder payments will still be honored. Card organizations review transaction volumes from the last 4-7 days to calculate the deposit amount that the issuer must pay. This poses a heavy burden on banks/fintech companies, creating a significant barrier to entry in the industry.

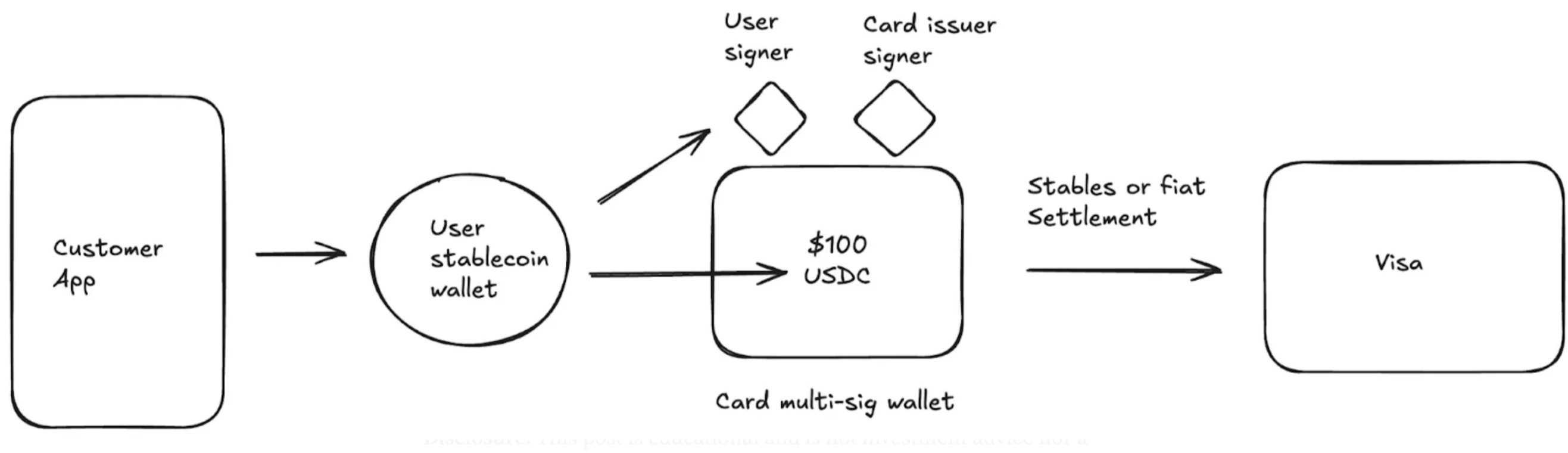

Stablecoins fundamentally change the possibilities for card issuance. First, stablecoins are fostering a new class of issuing platforms, such as Rain, where companies can leverage their primary membership with Visa to provide global issuance services through stablecoins. Examples include enabling fintech companies to issue cards simultaneously in Colombia, Mexico, the US, Bolivia, and many other countries. Furthermore, due to the 24/7 settlement capability of stablecoins, a new class of issuing partners can now settle on weekends. Weekend settlements greatly reduce partner risks, effectively lowering collateral requirements and freeing up capital. Finally, the on-chain verifiability and composability of stablecoins create a more efficient collateral management system, reducing the working capital requirements for issuing institutions.

After introducing stablecoins into this business model, the practical solutions are as follows.

Collaborate with Visa and card issuers to launch a global issuance program priced in US dollars;

Flexible card network settlement options;

Directly settle using stablecoins (enabling weekend and overnight settlements);

- The card network generates daily settlement reports containing bank account and routing numbers, which will display stablecoin addresses when using stablecoins;

- It is also possible to choose to convert stablecoins back to fiat before settling with the card network;

- Lower collateral requirements (thanks to 24/7 settlement capabilities).

- Below is an example process of a global card product architecture that supports stablecoins:

Conclusion

Today, stablecoins are no longer a future promise that requires strenuous imagination—they have become practical technologies with exponential growth in usage. The question now is not "whether" to adopt them, but "when" and "how" to adopt them. From banks to fintech companies to payment processors, formulating a stablecoin strategy has become inevitable.

Those companies that move beyond the proof-of-concept stage and truly integrate and deploy stablecoin solutions will far surpass their competitors in cost savings, revenue enhancement, and market expansion. It is worth mentioning that the actual benefits mentioned above are supported by numerous existing integration partners and upcoming legislative clarity, both of which will significantly reduce execution risks. Now is the best time to build stablecoin solutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。