The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and reject any market smoke screens!

At ten minutes past midnight the day before yesterday, there was another wave of ups and downs. With Trump calling for a ceasefire, a plethora of positive news emerged. First, Texas officially announced it would invest 10 million into Bitcoin. Secondly, Russia will expand its mining operations and update on Ethereum's progress. The development team finally released concrete information, stating that a formal update will occur by the end of the 26th, reducing the response time between blocks by half, from 12 seconds to 6 seconds. Coupled with the recent information, Trump once again urged Powell to lower interest rates by at least 2-3 percentage points, which would effectively reduce annual spending for Americans by 800 billion dollars. I believe many friends are paying attention to the Federal Reserve's hawkish statements; even if the data performs well in July, there is still a possibility of interest rate cuts. All these positive signals seem to indicate that the market is about to return to normal. However, it's time for Lao Cui to pour cold water on things; you can check the 24-hour spot inflow status, and surprisingly, Bitcoin is showing a net outflow, so everyone needs to be cautious!

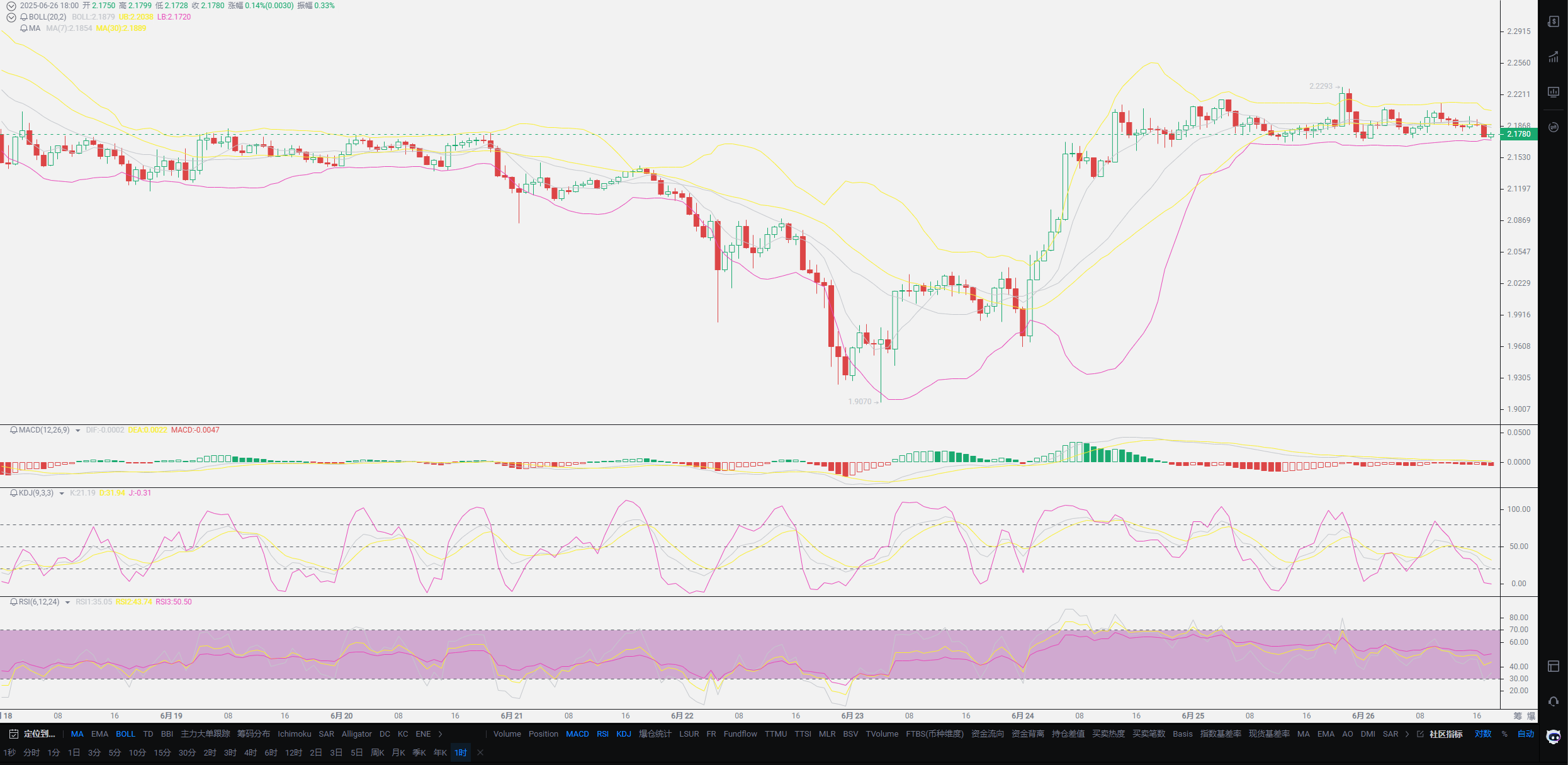

Although the positive news seems very strong, the actual news on the ground may only indicate a temporary easing of military conflict. Almost all positive news is about future developments. Under this premise, while there may be some short-term changes in trends, the help for the medium-term is not significant. If there is no actual capital support in the short term, the market may decline again. For everyone, do not hold too high expectations; even if there are interest rate cuts in July, it will only show a trend by the end of the month. Circle's valuation has surpassed 60 billion, and another heavyweight news that attracts Lao Cui's attention is that Metaplanet plans to inject another 5 billion dollars into its parent company in the U.S., planning to buy all Bitcoin reserves. This news may delay the arrival of bears; of course, these issues are not what we can consider at the moment. The focus should still be on the actual implementation effects. Due to the poor effect of capital injection, today's Bitcoin is still moving around to repair the trend, and the main focus should be on observing the evening's movements.

Returning to the issues everyone is concerned about, some friends always look at the U.S. spot ETF to make trend operations, which is something everyone needs to be cautious about. What is a spot ETF? In essence, it is quite different from spot trading. A Bitcoin Exchange-Traded Fund (ETF) allows investors to gain exposure to Bitcoin price fluctuations without directly holding or managing Bitcoin. This exposure method is favored by some investors. A Bitcoin spot ETF is an exchange-traded fund that directly holds Bitcoin as its underlying asset. This means that the performance of the spot ETF is directly related to the real-time value of the Bitcoin it holds. When investors buy shares of a spot ETF, they are essentially buying Bitcoin, but they do not personally hold Bitcoin. What does this mean? It's simple: if the platform holds Bitcoin, the costs are shared among everyone, and this creates a phenomenon of over-issuance.

What is over-issuance? If the trading platform only holds one Bitcoin, but you purchase an index fund that has ten. This fundamentally contradicts the principle of suppressing inflation in the crypto world, leading to a bubble in index funds. In other words, as long as you can hold Bitcoin and obtain a U.S. ETF license, you can also issue index funds; this is merely a fundraising venue. The actual investment may not be as strong as the data you see. In reality, how much capital can flow into the crypto world is an unknown. Those who have survived in the old A market surely have doubts about such operations. Therefore, when this operation is viewed in the crypto world, many friends see things that are completely opposite to the trends; during a significant drop, there is a large inflow of funds into the spot ETF. From a traditional financial perspective, this should not lead to a bearish market. Remember, you are always buying a fund, and the fund institution will reassess the crypto market; not all funds will necessarily flow into the Bitcoin market. The fund institution only needs to ensure your profits, not necessarily through Bitcoin!

The data you need to analyze is merely on-chain data and the liquidity of the spot market, along with the comparison of long and short entry points in contracts. The combination of these three can provide you with some hints on trends. Many friends see the accumulation of funds in the short term and choose to rush in, unaware that the positions of the market makers are lurking at very low levels. The moment you see the real data flow is precisely when they are ready to net. The recent focus of observation is also on the stablecoin concept stocks in Hong Kong and the U.S., which are steadily advancing. For the stablecoin concept, you only need to think about one question: how many stablecoin institutions will choose to invest in the crypto world? Most institutions that choose stablecoins are aiming for asset legalization, so the actual capital volume that truly favors the crypto world may not be too much. At most, it will only have a significant impact on the market value of the crypto world; through these capital accumulation methods, if large coins can maintain their market value, that is already considered qualified.

Lao Cui summarizes: In the past two days, Lao Cui has been focusing on explaining to users in hand. The greater the market fluctuations, the more emphasis is placed on what is in hand, and I apologize for not being able to share trends with everyone in time. Based on the current capital aggregation situation, the entire Bitcoin trend has almost completed a wave of repair. Whether it is speculation about interest rate cuts or the emergence of regulations in various places, overall, it does not represent actual capital injection. Therefore, in terms of trends, Lao Cui does not feel that there has been a change; there is a high probability that there will still be downward space. Do not think that the possibility of interest rate cuts in July is very high; as of now, there is only a 20% chance of a rate cut, and as we approach July, this probability will not decrease. If July is missed, the next opportunity for a rate cut will only be in September. By September, the capital volume will face a test, and the crypto world will inevitably experience a significant correction. For those who want to short or have already entered short positions, look again in half a month; you need to be patient. Lao Cui will intervene from the perspective of short positions; this price is indeed an opportunity for Lao Cui, and those who want to short can also give it a try. The focus remains on the news of interest rate cuts in July; positive news will still lead to some rebounds. Overall, in Lao Cui's analysis, there will definitely be a drop below the 100,000 mark before the interest rate cuts. Currently, users who are trapped in short positions are not yet at the time to break free; this rebound is an opportunity for long positions to break free, and the downward time will come soon.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or positions, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。