Selected News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

ANOMA: Due to recent integration with KaitoAI, ANOMA has garnered widespread attention on X (formerly Twitter). The project announced that 1% of its token supply will be used to reward the most active speakers and Kaito ecosystem users. ANOMA focuses on an "intention-driven" blockchain platform, allowing users to complete interactions by simply expressing their desired outcomes without worrying about execution details. This innovative design, coupled with a Multi-Asset Privacy Pool (MASP) and interoperability without cross-chain bridges, positions it as a promising dark horse project in the Web3 space. ANOMA has raised over $60 million, with investors including well-known institutions like Polychain and CMCC, and is seen as a potential game-changer in reshaping the decentralized application landscape.

MOONBERG: Discussions about MOONBERG mainly focus on the launch of its new product "MOONBERG Terminal" and the accompanying airdrop "Stimmy." This airdrop is distributed based on users' social media activity, with many users pleasantly surprised to find they qualify for rewards, which will be officially distributed at the Token Generation Event (TGE). While some are optimistic about the value of the rewards, others remain cautious, comparing it to past airdrops that generated much hype but little substance. The discussion's heat primarily stems from the novelty of the "play-to-earn" mechanism and its ease of operation.

ARB: Today's discussions about ARB center on its growing influence in the crypto ecosystem. Key points include the launch of Arbitrum's crypto collateral loan feature, the introduction of the DIA oracle funding program, and the excitement generated by the integration of the Yapyo leaderboard system with Arbitrum. Many users are hopeful that Yapyo, supported by Arbitrum, can replicate the success of previous InfoFi projects. Additionally, Arbitrum's ongoing progress in cross-chain trading and user growth has become a focal point of discussion.

KAITO: Today's discussions about KAITO focus on its collaboration with Anoma: Anoma will allocate 1% of its token supply for rewards, with 0.7% going to the most active speakers and 0.3% to the Kaito ecosystem. This collaboration has sparked significant community interest and further strengthened Kaito's influence as an InfoFi platform, particularly in encouraging content creation and community interaction. Furthermore, the Turtle-Kaito super combination has drawn attention to the concept of "liquidity and attention alignment," while KAITO's leaderboard mechanism continues to stimulate community engagement.

SUGARTOWN: Today's discussions about SUGARTOWN center on the newly launched "Abstract Badge" system. Users can obtain this badge by destroying Low or Energy cards on the platform, leading to active participation and discussion among users. Meanwhile, the excitement surrounding the WSOA poker qualifiers hosted by Sugartown remains high, with many players hoping to advance to the finals. The collaboration with AbstractChain and the ongoing release of new badge series have further fueled community interaction.

Selected Articles

The author analyzes the recent market fluctuations of Circle's market cap, USDC's yield structure, and partnerships. The context of writing is the renewed market focus on stablecoins following the passage of the GENIUS Act, with Circle's market cap briefly surpassing $63 billion, exceeding the total value of USDC issued. The author dissects Circle's current revenue structure, its partnership with Coinbase, and cost structure using on-chain data and public documents, pointing out the sustainability pressures and growth concerns behind its high valuation, especially in the context of declining interest rates and increasing competition, warning and forecasting the diversification of its business model.

Recently, Kalshi announced the completion of a $185 million Series C funding round led by Paradigm, with a valuation soaring to $2 billion; at the same time, Polymarket is preparing to complete a nearly $200 million funding round, with a valuation exceeding $1 billion. The frequent funding news in the prediction platform sector inevitably evokes thoughts of the underlying competition and tension between platforms, as a silent showdown over future information pricing power unfolds.

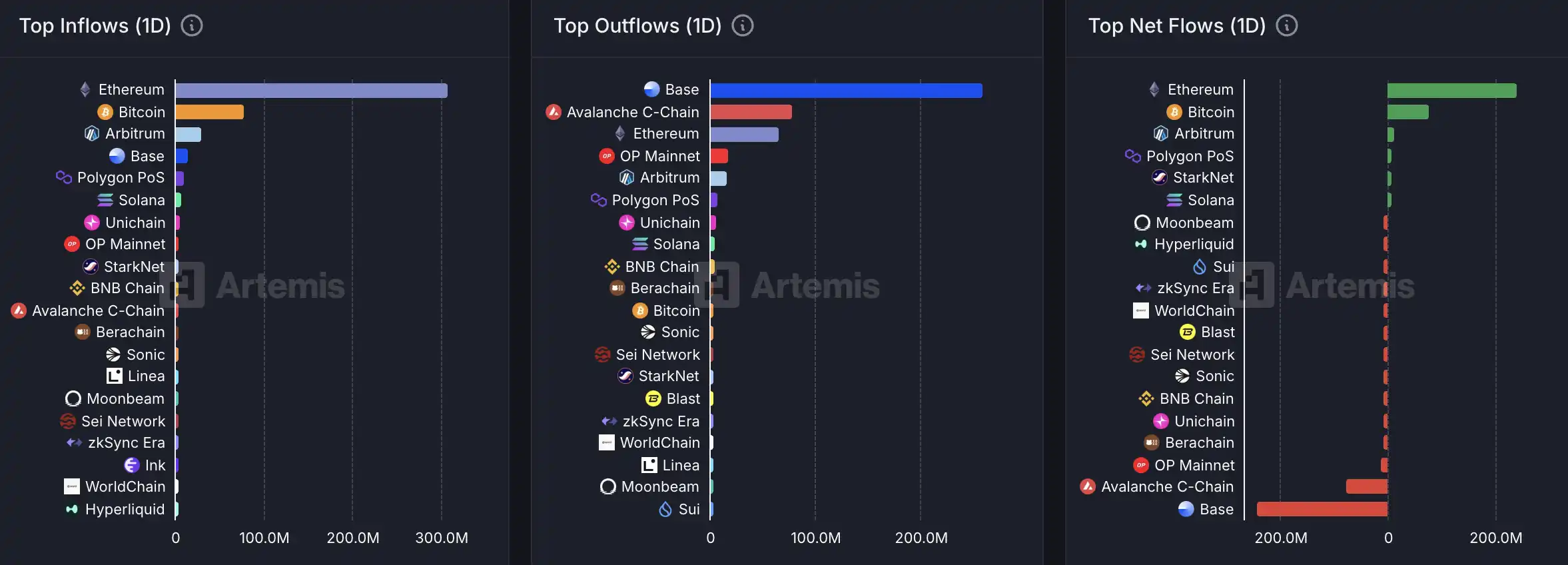

On-chain Data

On-chain fund flow situation for the week of June 26

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。