Grove Receives $1 Billion Investment from Sky: Will It Bring Wealth Effects Like Spark?

Written by: Alex Liu, Foresight News

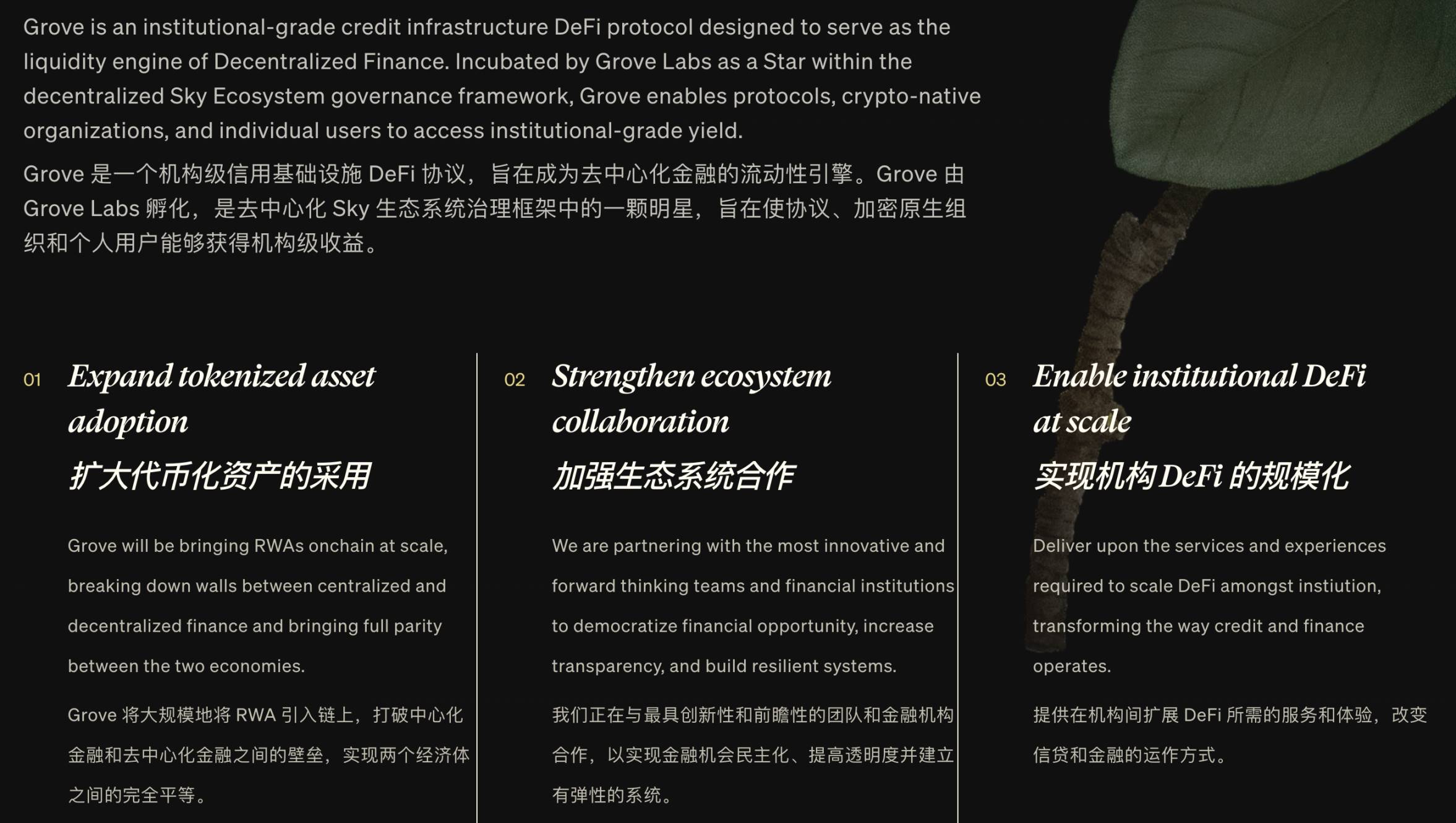

Sky Ecosystem (formerly MakerDAO) launched a brand new decentralized finance protocol Grove Finance on June 25, backed by an initial funding allocation of $1 billion from the Sky Ecosystem to promote investments in tokenized credit assets (primarily collateralized loan obligations, CLOs).

Grove is incubated by Grove Labs, a blockchain institution under Steakhouse Financial, with co-founders including Mark Phillips, Kevin Chan, and Sam Paderewski. The core team has extensive backgrounds in traditional finance and DeFi, having worked at institutions such as Deloitte, Citigroup, BlockTower, and Hildene.

Steakhouse Financial has previously played a key role in bringing real-world assets (RWA) into the Sky Ecosystem, making Grove's launch another significant attempt by Sky to connect more traditional credit markets to DeFi.

Product Positioning and Technical Architecture of Grove

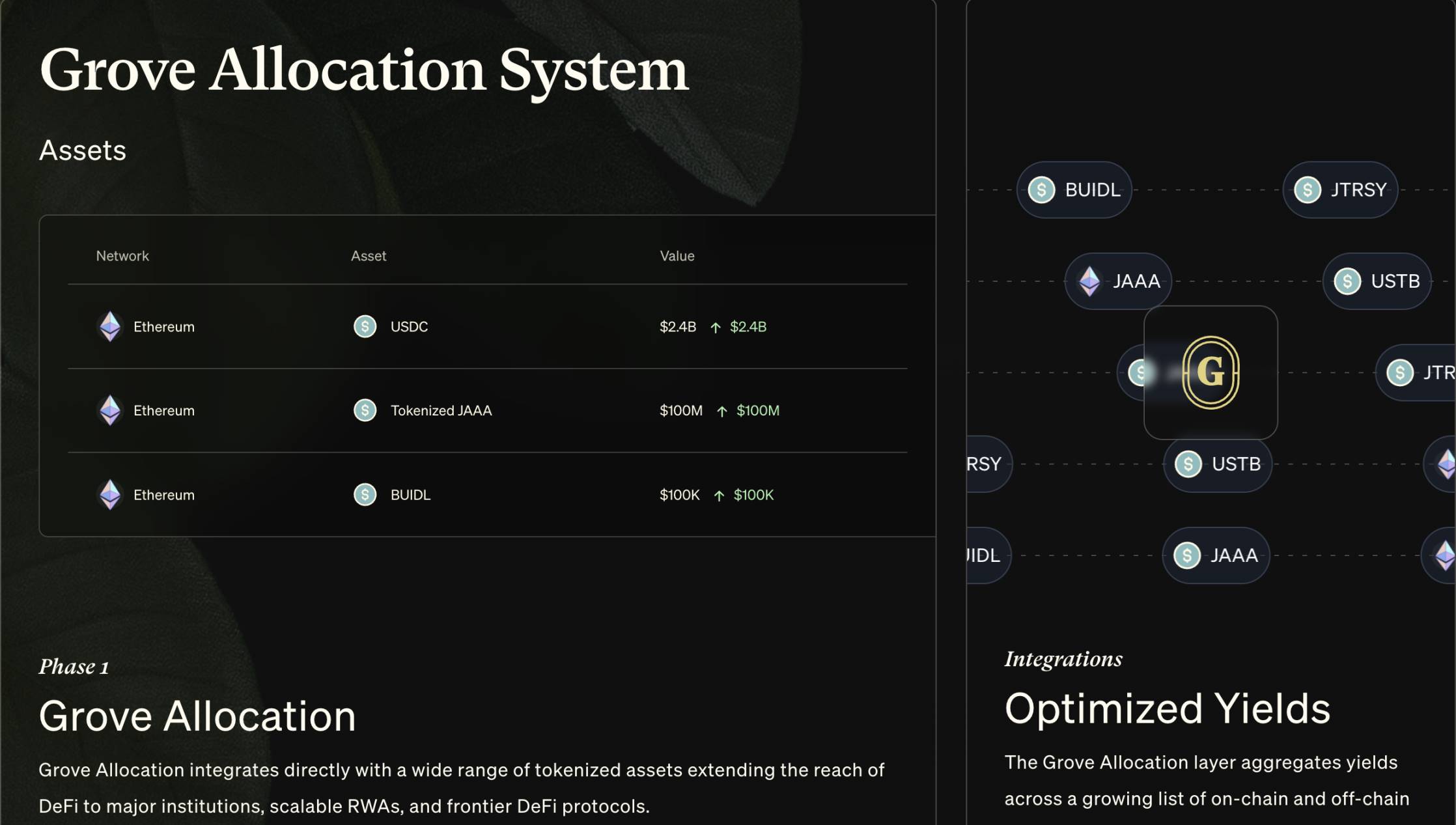

Grove aims to build "institutional-grade credit infrastructure," functionally bridging decentralized finance with regulated traditional credit asset markets. The protocol allows DeFi projects and asset management institutions to route idle funds through on-chain governance, investing in rigorously compliant credit products (currently focusing on AAA-rated CLO strategies) to achieve returns independent of cryptocurrency market fluctuations.

Reports indicate that the Sky Ecosystem will invest the initial funds into the Anemoy AAA-rated CLO strategy fund (JAAA) managed by Janus Henderson (Aberdeen Standard Investments), which is launched in collaboration with the Centrifuge platform and is the first AAA-rated CLO strategy that can be traded on-chain.

The Grove protocol operates in an open-source, non-custodial manner, aiming to create a "DeFi–traditional finance capital channel" to enhance capital efficiency, reduce transaction friction, and provide programmable, diversified funding allocation capabilities for asset managers and DeFi protocols. Official materials indicate that Grove can establish new global distribution channels for asset management companies, provide high-end on-chain capital partnerships for various protocols/DAOs, and enhance the credibility and sustainability of the entire DeFi ecosystem.

In short, Grove's technical architecture revolves around on-chain governance and automated fund routing, transforming stablecoins or other idle capital held by crypto protocols into institutional-grade credit asset investments, thereby optimizing returns and risks.

Similarities and Differences Between Grove and Spark

Grove and the Spark protocol within the Sky Ecosystem both belong to the MakerDAO (Sky) "Endgame" transformation plan as autonomous sub-units (subDAOs, also known as "Stars"), but they have distinct positioning and mechanisms.

Spark was launched in 2023 and is the first Star of the Sky Ecosystem, focusing on a yield engine of "stablecoins + RWAs." Spark leverages the DAI/USDS stablecoin reserves issued by Sky to launch products such as SparkLend, Spark Savings, and Spark Liquidity Layer (SLL). Users can deposit USDS, USDC, or DAI to participate in lending or farming yields, and through a dynamic risk engine, allocate funds to asset pools including DeFi lending, CeFi lending, and tokenized government bonds, thus obtaining relatively stable returns.

Spark is deployed across multiple chains, currently managing over $3.5 billion in stablecoin liquidity, and has launched a native governance token SPK (which was airdropped to the community). Users can earn additional rewards by staking SPK, participating in governance, and community incentives (Community Boost). The Spark team emphasizes transparency and auditability, aiming for yield levels slightly above U.S. Treasuries to meet the demand for risk-adjusted returns.

In contrast, Grove focuses more on large institutional-grade credit. Its initial deployment of $1 billion is aimed at connecting to Aberdeen's AAA-rated CLO fund, indicating that Grove targets users with larger capital scales and higher demands for yield stability (such as asset management companies and DeFi protocols). Currently, Grove has just launched, and it is too early to introduce a governance token; its incentive mechanism primarily focuses on enabling DeFi projects to "activate idle reserves and obtain higher quality asset yields."

In simple terms, Spark can be seen as a yield product for ordinary stablecoin holders within the Sky Ecosystem, while Grove serves as an infrastructure protocol for building on-chain credit channels for large projects and institutions. Both are part of the Sky Ecosystem's "Endgame" strategy, focusing on bringing real assets on-chain: Spark enriches stablecoin yields with government bonds and other RWAs, while Grove enriches DeFi asset allocation with credit assets like collateralized loans.

Thus, it is evident that Grove is filling in the institutional credit puzzle outside of the Spark system in the RWA track.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。