Schiavone believes that in a world shaped by beliefs, accelerated by imagination, and made unstable by repeated monetary interventions, the wisest investment is not certainty (bonds), but the power to shape the future.

Written by: Li Xiaoyin, Wall Street Journal

Goldman Sachs' top macro trader has thrown out a heavy viewpoint, stating that the "trend-following" strategy is no longer effective, and one must learn to interpret "macro turning points" in real-time.

Recently, Goldman Sachs senior macro trader Paolo Schiavone stated that the market has transitioned from the crisis phase in April to the "response phase" to the Federal Reserve's impending interest rate cuts. This macro backdrop is driving a significant upward revaluation of risk assets. He believes that the core driving force of the market is no longer trends, valuations, or mere liquidity, but rather a keen insight into changes in the macro environment.

He noted that especially when investor positioning remains defensive, the "most painful path" for the market will be a short squeeze to the upside, with the S&P 500 index expected to reach the "Goldilocks" range of 6400-6700 points.

This Goldman Sachs trader pointed out that the dominance of systematic macro strategies is waning, with assets under management declining by about one-third from their peak. Market behavior has become more reliant on subjective judgment and position allocation rather than programmatic trend following.

According to Schiavone, as we move deeper into 2025, the market is shedding old scripts and entering a new era dominated by policy shifts, event-driven dynamics, and psychological games.

Macro Environment Shift: From Crisis to Response Phase

Since the stellar performance of systematic macro funds in 2021-2022, the market landscape has undergone profound changes.

Schiavone pointed out that April marked the crisis phase, accompanied by economic slowdown and vulnerabilities in asset classes, while the current phase has entered the "response phase." Global central bank policy shifts are accelerating, with the Federal Reserve moving from a "wait-and-see" stance in 2024 to adaptive adjustments. The market expects a near-certain interest rate cut in September, with discussions about a cut in July as well.

This has led to a significant easing of financial conditions, reflected in declining long-term yields, tightening credit spreads, a weaker dollar, and improving dynamics in real wages.

Schiavone stated that this backdrop supports the upward revaluation of risk assets, with the stock market approaching historical highs, volatility compressing, and high-yield bonds and speculative sectors (such as biotech and laggards in artificial intelligence) showing vitality.

Despite soft housing and some labor data, the easing financial conditions have temporarily overwhelmed these headwinds.

Market Signal Shift: From Trend Following to Contextual Interpretation

During the past era of quantitative easing (QE), liquidity overwhelmed fundamentals, and trend-following strategies reigned supreme, with price movements explaining almost everything.

However, Schiavone emphasized that liquidity is no longer the sole dominant force; fiscal policy, geopolitical factors, and the Federal Reserve's response mechanisms have re-emerged as core driving factors. Market narratives are changing rapidly, price movements are more deceptive, and traders need to shift from automation to real-time interpretation of macro turning points.

The change in market psychology is also reflected in the redefinition of bull and bear markets.

Traditionally, bull and bear markets are defined by price movements of 20%, but now the focus should be on the market's response function: when good news lifts the market and bad news is ignored, it is a bull market; conversely, it is a bear market. Current price signals indicate a bullish tone, but this needs to be interpreted in context rather than purely on momentum.

This psychological shift poses new challenges for investors—traders who previously relied on technical signals and volatility filtering must now adapt to an event-driven macro market.

Schiavone warned that the biggest returns may not come from smooth trends but from capturing changes in central bank positions, inflation turning points, or shifts in consumer confidence early.

The Wisest Investment is Not Certainty, but the Power to Shape the Future

In this new environment, Schiavone pointed out that the influence of systematic macro funds is diminishing.

It is estimated that their capital has declined by about one-third from its peak and no longer dominates market flows. Instead, there is an interaction between policy and narrative, as well as a game of positions and unexpected events.

He listed the UK, artificial intelligence, China, biotechnology, the Brazilian real, and Bitcoin as investment "elephants," particularly betting on technologies like Bitcoin, which he believes represent a profound expression of the new era.

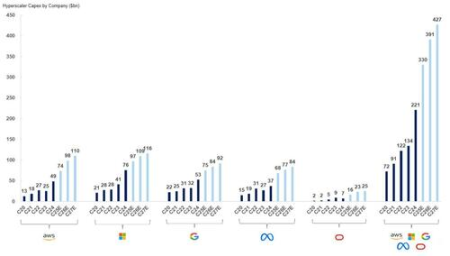

The field related to artificial intelligence is also showing strong momentum. According to Schiavone's estimates, total capital expenditures for U.S. hyperscale data center operators are expected to reach approximately $477 billion in the 2022-2024 fiscal years, and are projected to increase to $1.15 trillion in the 2025-2027 fiscal years, highlighting a strong confidence in future technologies.

For investors, the current bull market is not driven by euphoria but by a "comfort" in loose policies.

Schiavone emphasized that in this era shaped by beliefs, accelerated by imagination, and made unstable by repeated monetary interventions, the wisest investment is not certainty (bonds), but the power to shape the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。