CEX's push for the expansion of on-chain services is not just a defensive strategy; it reflects a positive bet on the future of the crypto ecosystem.

Authors: Chi Anh and Ryan Yoon

Translation: Deep Tide TechFlow

This report written by Tiger Research analyzes why major centralized exchanges (CEX) like Bybit, Binance, and Coinbase are entering the DeFi space and their strategies.

Summary

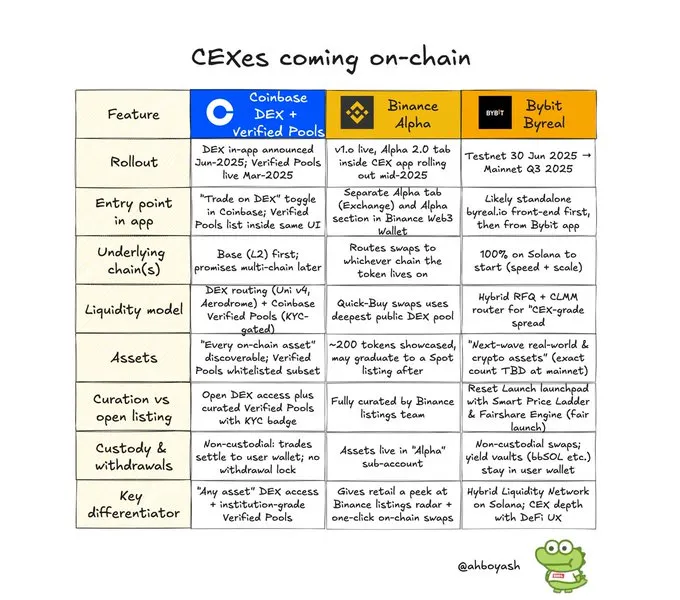

Strategic Differentiation: Binance offers retail-focused on-chain services aimed at lowering the entry barrier to Web3. Bybit launched an independent platform, ByReal, to provide CEX-level liquidity on-chain. Coinbase adopts a dual-track model targeting both retail and institutional users.

Why CEX is Turning to On-Chain: As early tokens increasingly debut on decentralized exchanges (DEX), centralized exchanges face listing delays due to regulatory scrutiny—losing trading volume and revenue. On-chain services allow them to participate in early token liquidity and retain users without formal listings.

The Future of CeDeFi: Platform boundaries are blurring. Exchange tokens are evolving from fee discount tools to core assets connecting centralized and decentralized ecosystems. Some DeFi protocols may be absorbed into larger CEX-dominated networks, accelerating the formation of an integrated hybrid market.

1. An Unmissable Opportunity: CEX's Shift to On-Chain

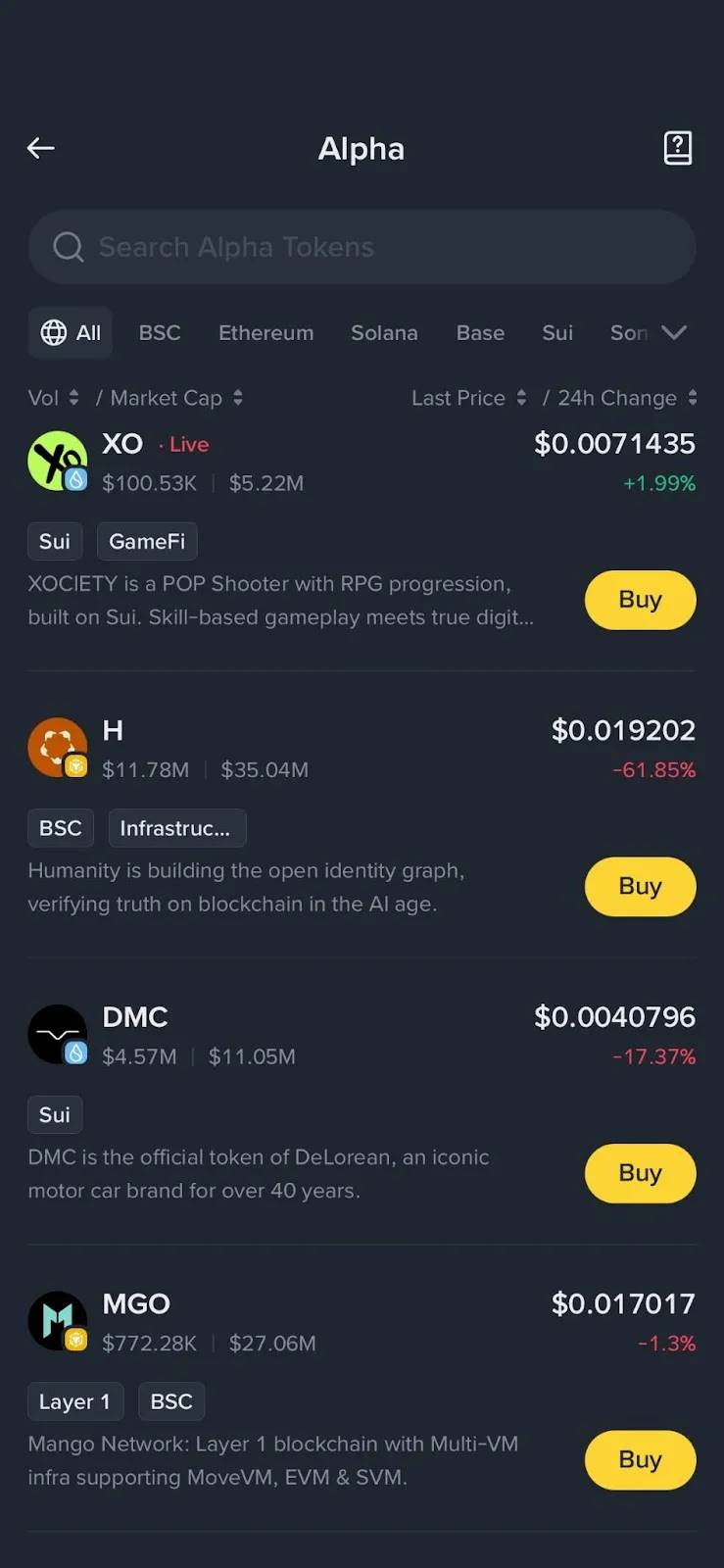

Binance's recent initiative, Binance Alpha, has become the focus of the market. Operated by the Binance team, Alpha serves as a DeFi-based listing platform, enabling retail users to access early tokens faster than through traditional exchange channels. This significantly enhances token accessibility and participation, especially through mechanisms like Alpha Points, which facilitate targeted airdrops to users.

However, this model is not without controversy. Several tokens listed through Alpha saw sharp price declines shortly after launch, sparking debates about the structure and intentions of the program. Despite mixed reviews, one trend is clear: centralized exchanges are no longer bystanders in the DeFi ecosystem—they are now active participants.

This shift is not limited to Binance. Other major platforms are also turning to on-chain. For instance, Bybit recently announced ByReal, a Solana-based DeFi platform. Coinbase has also revealed plans to directly integrate on-chain services into its app. These developments indicate that the exchange industry is undergoing a broader structural transformation.

The key question is: Why would centralized exchanges, which have long relied on stable, revenue-generating business models, enter the inherently volatile DeFi market? This report analyzes the strategic rationale behind this shift and examines the market dynamics driving this evolution.

2. The Current State of CEX Entering DeFi: What Are They Building?

Before analyzing the strategic motivations behind centralized exchanges entering the DeFi space, it is essential to clarify what they are actually building. While these efforts are often categorized under the broad trend of "CeDeFi" (centralized-decentralized finance), the implementation across platforms varies significantly.

Bybit, Coinbase, and Binance each take different approaches—there are differences in architecture, asset custody models, and user experience. Understanding these differences is crucial for assessing their respective strategies.

2.1. Bybit's ByReal: Providing CEX-Level Liquidity Through an Independent DEX

ByReal's first announcement. Source: @byreal_io

On June 14, Bybit announced ByReal as an on-chain extension of its exchange infrastructure. The primary goal is clear: to replicate CEX-level liquidity in an on-chain environment. To achieve this, Bybit employs a hybrid design that combines a Request for Quote (RFQ) system with a Centralized Liquidity Market Maker (CLMM) model.

The RFQ mechanism allows users to request quotes from multiple brokers before executing trades, optimizing prices through professional market makers. The CLMM model concentrates liquidity within active trading price ranges, enhancing capital efficiency and reducing slippage—key factors in approximating a CEX trading experience on-chain.

At the same time, ByReal maintains decentralization at the user level. Assets are self-custodied through Web3 wallets like Phantom, and the platform includes a token launch platform for new projects. It also offers yield generation features through its Revive Vault, including Solana staking products like $bbSOL.

Bybit's strategic intent with ByReal is to create a parallel liquidity layer for early tokens that may not meet its primary exchange listing standards, allowing these tokens to thrive in a more open, community-driven environment. While structurally similar to Binance Alpha, ByReal distinguishes itself by integrating launch platform features and yield products into a more comprehensive service.

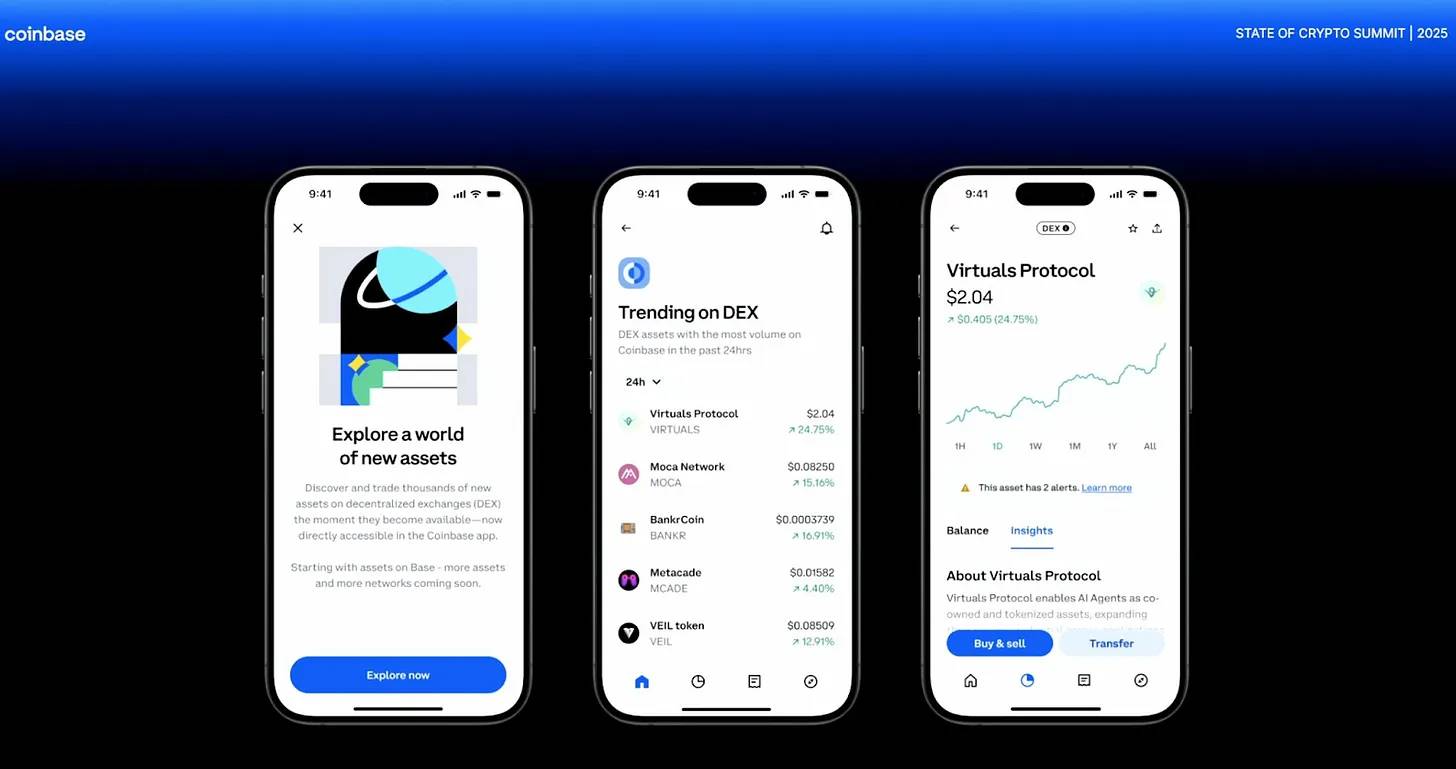

2.2. Coinbase: A Dual-Track Strategy for Retail and Institutional Users

Source: Coinbase

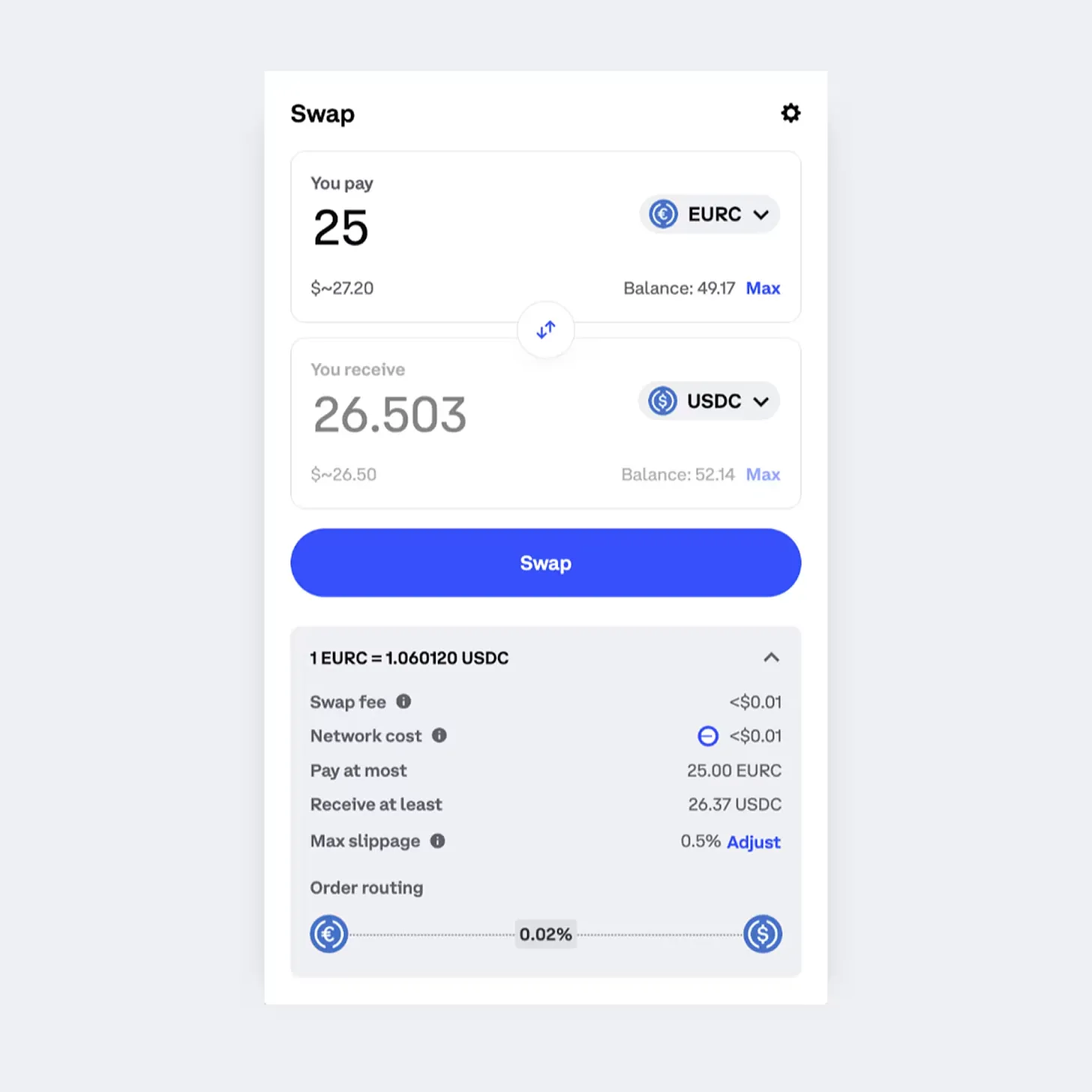

At the 2025 Crypto Summit, Coinbase announced plans to directly integrate DeFi trading into its main app, rather than through a separate wallet. The core of this strategy is to provide a seamless user experience. By enabling DEX trading within the core app, users can access and trade thousands of tokens from the moment they are minted, without leaving the Coinbase interface.

Source: Coinbase

Although DeFi can already be accessed through the standalone Coinbase Wallet, the company has introduced a key differentiating feature: Verified Pools. These pools are only open to institutional participants who have undergone KYC (Know Your Customer) verification, providing a secure and compliant environment for entities with regulatory obligations.

Ultimately, Coinbase has formed a complex dual-track strategy: providing seamless, integrated on-chain access for retail users while offering a regulated, high-security liquidity venue for institutional users. This allows the company to cover both user groups while balancing user experience and compliance.

2.3 Binance Alpha: A Retail-Oriented Strategy to Lower Web3 Barriers

Among the three major exchanges, Binance Alpha is the most retail-oriented product. Unlike other platforms that focus on decentralization, Binance prioritizes ease of use. Alpha can be accessed directly through a tab in the main Binance app, allowing users to trade without leaving the familiar interface.

Although all transactions are processed on-chain, users interact with Alpha through their existing Binance accounts, eliminating the need to set up a separate wallet or manage seed phrases, significantly lowering the entry barrier for Web3 newcomers.

While all three platforms are moving towards a CeDeFi model, their paths differ significantly. Bybit targets DeFi-native users with a fully decentralized architecture and advanced liquidity mechanisms; Coinbase adopts a dual-track strategy to serve both retail and institutional clients through differentiated infrastructure; while Binance focuses on driving mass adoption by simplifying Web3 complexities.

Each exchange is exploring its own trade-offs in asset custody, product planning, and integration depth, collectively shaping the diverse entry points of this evolving CeDeFi ecosystem.

3. Strategic Drivers of Centralized Exchanges (CEX) Turning to DeFi

3.1 Seizing Early Token Opportunities and Avoiding Listing Risks

The first reason is straightforward: CEX wants priority access to popular tokens, but they cannot list these tokens quickly enough.

Most new tokens are now issued directly on decentralized exchanges (DEX), where permissionless listing mechanisms and widespread attention drive rapid trading volume growth. However, due to legal reviews, risk management, or regional compliance issues, even when CEX clearly sees user demand, they often cannot list these tokens immediately.

This delay brings real opportunity costs. Trading volume flows to decentralized platforms like Uniswap, and CEX loses listing fee revenue. More importantly, users begin to associate token discovery and innovation with DEX rather than CEX.

By launching their own on-chain products, CEX creates a compromise solution. Platforms like ByReal and Binance Alpha serve as semi-sandboxed venues: tokens can be traded without going through formal listing channels, yet still remain in a controlled and brand-safe environment. This allows exchanges to monetize user activity early through exchange fees or token issuance mechanisms while maintaining legal distance. Exchanges provide access channels but do not directly custody or endorse these assets.

This structure offers CEX a pathway to participate in token discovery while avoiding triggering regulatory liabilities. They can capture liquidity, generate revenue, and guide activity back to their own ecosystems—while waiting for formal listing review processes to catch up.

3.2 Keeping Users On-Chain to Avoid Churn

The second driving factor stems from user behavior. Although DeFi is at the forefront of token innovation and capital efficiency, mainstream users still find it challenging to access easily. Most users are reluctant to manually transfer assets across chains, manage wallets, approve smart contracts, or pay unpredictable gas fees. Despite these barriers, the most attractive opportunities (such as new token listings and yield strategies) are increasingly occurring on-chain.

CEX (centralized exchanges) have identified this gap and responded by embedding DeFi access directly into their platforms. All the aforementioned CEXs allow users to interact with on-chain liquidity through familiar CEX interfaces. In many cases, exchanges completely abstract away wallet management and gas costs, enabling users to access DeFi as easily as using Web2 applications.

This approach achieves two goals. First, it prevents user churn. Traders who might turn to DEX (decentralized exchanges) can now remain within the CEX ecosystem even when using DeFi products. Second, it enhances the platform's defensive capabilities. By controlling the access layer and gradually mastering the liquidity layer, CEX builds network effects that extend beyond spot trading.

Over time, this approach will translate into user lock-in effects for the platform. As users become more sophisticated, many will seek cross-chain routing, yield products, and trading strategies. If CEX has its own DEX infrastructure, Launchpad layer, or even proprietary chains (like Coinbase's Base), it can ensure that users, developers, and liquidity are firmly bound within its ecosystem. User activity will be tracked, monetized, and recycled without flowing to third-party protocols.

In fact, on-chain capabilities enable CEX to control the complete lifecycle of user funds: from fiat deposits to DeFi exploration, and finally to token listings and exits—all within a unified and revenue-generating system.

4. The Future Path of CeDeFi

The expansion of major centralized exchanges (CEX) into on-chain services marks a significant turning point in the evolution of the crypto industry. CEX no longer views DeFi as an external phenomenon but is beginning to build its own infrastructure or at least ensure direct access points for users.

4.1 Blurring Boundaries: The Rise of a New Trading Paradigm

As CEX integrates on-chain services, the boundaries between "exchanges" and "protocols" are becoming increasingly blurred from the user's perspective. A user trading on-chain tokens via Bybit may not even realize they are interacting with a decentralized protocol or a centralized interface. This integration could significantly reshape the liquidity architecture, product design, and user flows across the entire industry.

Institutional behavior will also be a key observation point, but a full influx of capital in the short term is unlikely. Institutions remain cautious, primarily due to unresolved risks: regulatory uncertainty, smart contract vulnerabilities, token price manipulation, and opaque governance mechanisms.

The launch of on-chain services by exchanges does not eliminate these structural risks. In fact, some institutions may view the mediated access to DeFi through exchanges as a new layer of intermediary risk. Realistically, early attempts may primarily come from hedge funds and proprietary trading firms that deploy small-scale capital for experimentation. More conservative participants, such as pension funds or insurance companies, are expected to remain on the sidelines for the next few years. Even if they participate, they may adopt extremely cautious allocation strategies—typically not exceeding 1-3% of their portfolios.

In this context, predictions of "billions of dollars in capital inflow" seem overly optimistic. A more realistic outlook is gradual testing in the hundreds of millions. However, even these modest capital inflows could enhance market depth and mitigate volatility to some extent.

4.2 The Evolving Role of Exchange Tokens

As exchanges continue to expand their on-chain services, the functions of native exchange tokens will also evolve. Holding a certain amount of these tokens may provide users with discounts on on-chain transaction fees or unlock yield opportunities through staking and liquidity incentives. These changes could introduce new utility for exchange tokens while also bringing new volatility.

Currently, Binance is the only major platform that provides clear and sustained utility for its native token (BNB), which plays an active role across multiple services. Most other exchange tokens still have functions limited to basic fee discounts.

As CeDeFi infrastructure matures, this status quo will change. When exchanges operate integrated on-chain and off-chain platforms, their native tokens will become the link connecting these two realms. Users may need to hold exchange tokens to participate in staking, Launchpool, or gain early access to newly listed projects—whether centralized or decentralized.

This functional expansion elevates exchange tokens beyond mere utility assets; they will become core assets within vertically integrated ecosystems. Exchanges with existing tokens may significantly enhance the utility of their tokens, while those without may consider launching new tokens to support DeFi-related services. This possibility is especially likely for platforms developing their own blockchains or differentiated DeFi layers.

In short, exchange tokens are evolving from simple fee tools into strategic assets that will play a key role in user retention, protocol integration, and cross-platform capital flows.

4.3 The Ongoing Integration: A New Competitive Landscape

CEX's push for the expansion of on-chain services is not just a defensive strategy; it reflects a positive bet on the future of the crypto ecosystem. Exchanges no longer view DeFi as a threat but as a neighboring domain that can be integrated or even absorbed.

The most likely scenario is integration. Major exchanges will increasingly operate semi-decentralized networks, while independent DeFi protocols may find themselves relying on these ever-expanding ecosystems, or even being integrated within them. This could ultimately lead to a redistribution of power and liquidity, with CEX-dominated platforms becoming the focal points of DeFi activity.

This trend may foster a more unified market structure, allowing for the free flow of liquidity between centralized and decentralized environments. Users will be able to choose a combination of trust, transparency, and convenience based on their preferences. The competitive landscape is changing, and Bybit's launch of ByReal may be an early signal of this hybrid future gradually taking shape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。