Author: Coinbase

Translation: Baihua Blockchain

The second half of 2025 is about to begin, and Coinbase has provided a rather positive forecast for the entire cryptocurrency market in its recent report, with the following key points:

- The outlook for the cryptocurrency market in the second half of 2025 is positive, driven by better-than-expected economic growth, corporate cryptocurrency adoption, and improved regulatory clarity.

- Corporate leverage financing for purchasing cryptocurrencies may pose systemic risks, involving forced or spontaneous sell-offs, but we believe this issue is not significant in the short term.

- Changes in the U.S. regulatory environment support cryptocurrencies, with progress in stablecoin legislation and discussions on cryptocurrency market structure legislation.

The following is the main text:

Our constructive outlook for the cryptocurrency market in the second half of 2025 is driven by several key factors: a more optimistic expectation for U.S. economic growth, potential Federal Reserve interest rate cuts, increased corporate treasury adoption of cryptocurrencies, and progress in regulatory clarity in the U.S. Despite potential risks, such as a steepening U.S. Treasury yield curve and the possibility of forced sell-off pressures on publicly traded cryptocurrency instruments, we believe these risks are manageable in the short term.

We identify three key themes in the cryptocurrency market. First, the macroeconomic outlook is more favorable than previously expected. The shadow of recession has faded, and the U.S. economy shows stronger growth signs. While an economic slowdown is still possible, market conditions are unlikely to lead asset prices back to 2024 levels. Second, corporate treasury adoption of cryptocurrencies is an important source of demand, but there are reasonable concerns about potential systemic risks in the medium to long term. Third, significant regulatory progress is being made in stablecoin and cryptocurrency market structure legislation, which could significantly shape the U.S. cryptocurrency landscape.

Despite the risks, we expect the upward trend of Bitcoin to continue, but the performance of altcoins may depend more on their specific factors. For example, the SEC is handling numerous ETF applications, which may involve decisions on physical creation and redemption, staking inclusion, multi-asset funds, and single altcoin ETFs, expected to be made by the end of 2025. These pending proposals and their related decisions may affect market dynamics.

01 Constructive Outlook for the Second Half of 2025

We maintain a constructive outlook for the market in 2025. A few months ago, we stated that the cryptocurrency market would bottom out in the first half of 2025 and reach new historical highs in the second half. We still believe in this prediction, despite a rebound in Bitcoin prices at the end of May. That said, we believe there is still upside potential in the next 3-6 months.

In our view, the peak of macro disturbances caused by tariff issues has passed. Looking ahead, risk sentiment should generally benefit from the U.S. government's shift to more market-friendly policies, with new legislative fiscal plans expected to be completed by the end of summer.

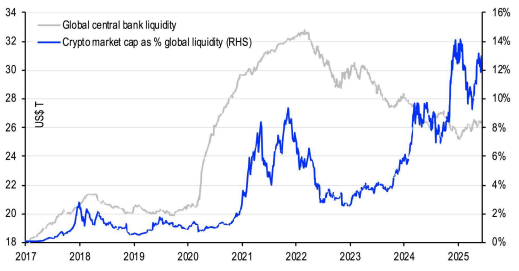

Chart 1. The proportion of the total market capitalization of the cryptocurrency market to global liquidity is rising

Note: The total market capitalization of the cryptocurrency market does not include stablecoins. G6 central bank liquidity includes the Federal Reserve, European Central Bank, Bank of Japan, Bank of Canada, Bank of England, and People's Bank of China. Source: Bloomberg, Coinbase.

However, an important risk to our view is that the passage of government spending bills may lead to a steepening of the U.S. Treasury yield curve, particularly in the 10-30 year bond sector. In fact, due to concerns about the U.S. deficit, the yield on 30-year U.S. Treasuries reached 5.15% in May, the highest in twenty years. This could lead to financial conditions tightening beyond expectations, increasing borrowing costs for businesses and consumers, and potentially undermining the growth that supports our market optimism. If long-term yields rise too quickly, it could trigger volatility in the stock and credit markets, especially if investors begin to doubt the U.S.'s ability to maintain high deficits without adverse consequences.

Such developments could challenge the widespread expectation of fiscal expansion and may lead to a reassessment of risk assets before long-term fiscal risks fully materialize, particularly if economic data or Federal Reserve policies fail to meet market expectations for growth. On the other hand, we believe this situation could improve the outlook for value storage assets like gold and Bitcoin, while the performance of altcoins may be weaker as Bitcoin continues to benefit from the decline of the dollar's dominance.

Overall, we believe the cryptocurrency market in the second half of 2025 will have the following three themes:

The macro outlook for the remainder of 2025 is more optimistic than before, particularly regarding U.S. growth expectations.

Corporate treasury adoption of cryptocurrencies is an important source of demand, but investors may be concerned about potential systemic risks.

Regulatory barriers for cryptocurrencies in the U.S. have eased, but what will the future path look like?

02 The Shadow of Recession Fades

Trade disruptions at the beginning of 2025 initially raised concerns about a potential technical recession in the U.S. this year, especially after a 0.2% annualized contraction in economic activity in the first quarter. (Refer to headlines from The Economist and The Wall Street Journal, such as "Trump's Trade War Threatens Global Recession" and "Trump's Reciprocal Tariffs Could Trigger U.S. Recession.") A technical recession is defined as two consecutive quarters of negative real GDP growth.

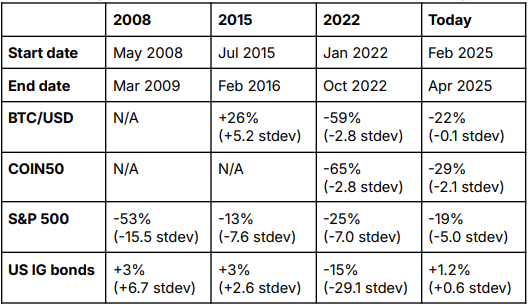

However, we maintained a constructive view for the second half of 2025 at that time because we believed the severity of the recession was crucial. While a technical recession could weaken investor confidence, it would not necessarily become a significant disruptive event for the market unless negative macro momentum intensified. In fact, the impact of the real recession in 2008 (with a 53% drop in the U.S. stock market) was significantly different compared to the relatively mild situations in 2015 and 2022 (see Table 1). Additionally, the Atlanta Federal Reserve's GDPNow estimate recently surged from 1.0% (seasonally adjusted) in early May to 3.8% on June 5, reflecting a significant shift in economic data.

Therefore, we believe the worst-case scenario this year may be an economic slowdown or mild recession—possibly even avoiding a recession altogether—rather than a severe recession or stagflation scenario. In the case of a slowdown, the market impact may be milder, with potential damage in specific industries rather than a broad-based significant decline across all asset classes. However, given the rise in liquidity indicators such as the U.S. M2 money supply and the general expansion of global central bank balance sheets, we believe market conditions are unlikely to lead asset prices back to 2024 levels, suggesting that the upward trend of Bitcoin may continue. Furthermore, we may have passed the peak of tariff impacts, indicating that the market has entered a new normal, although investors may still remain tense before July 9 (the deadline for most countries to suspend reciprocal tariffs, with August 12 for China).

Table 1. Performance Changes of Various Assets (from Peak to Trough)

Note: Standard deviation is based on the average of the previous 180 days. U.S. investment-grade bonds are measured by the unhedged Bloomberg U.S. Aggregate Bond Index. Source: Bloomberg, CoinMetrics, Coinbase.

03 Adoption… Are Imitators Coming?

Globally, about 228 publicly traded companies hold a total of 820,000 Bitcoins on their balance sheets. According to Galaxy Digital, around 20 of these companies have adopted the leverage financing method pioneered by Strategy (formerly MicroStrategy) for Bitcoin, Ethereum, Solana, and XRP. We believe that many companies have recently begun to adopt this method, partly due to the cryptocurrency accounting rules that will take effect on December 15, 2024. Previously, under U.S. Generally Accepted Accounting Principles (GAAP), the Financial Accounting Standards Board (FASB) only allowed companies to record impairment losses on cryptocurrency holdings. However, in December 2023, the FASB updated its guidance to allow companies to report their digital asset holdings at fair market value.

In simple terms, the previous FASB rules prevented many companies from adopting cryptocurrencies because these rules only allowed for the recording of losses and did not allow for gains to be reflected until the assets were sold. The revised FASB guidelines eliminate much of the accounting complexity faced by many CFOs and auditors by providing a clearer picture of financial conditions.

While this explains why more companies have announced cryptocurrency holdings this year, an increasingly growing trend is the focus on cryptocurrency accumulation by publicly traded companies. Early adopters like Strategy and Tesla initially viewed Bitcoin as an investment outside their core business, while these emerging entities aim to accumulate Bitcoin or other cryptocurrency assets as their primary goal. They fund acquisitions by issuing equity and debt (often convertible bonds), with many companies trading above their net asset values.

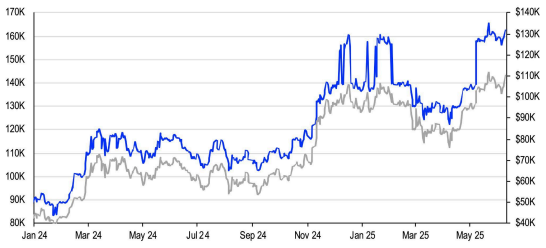

Chart 2. The number of Bitcoin wallets with balances ≥ $1 million has surged

Source: Glassnode, Coinbase.

The rise of publicly traded cryptocurrency vehicles (PTCVs) has significant implications for the market, involving both potential demand for cryptocurrencies and systemic risks within the crypto ecosystem. Systemic risks can be divided into two parts: (1) forced sell-off pressure and (2) spontaneous sell-offs.

Forced sell-off pressure: Many PTCVs raise low-cost funds to purchase crypto assets by issuing convertible bonds. If a company's stock price rises due to the appreciation of cryptocurrencies, bondholders may profit. If things go poorly, the company may need to repay its debt and could be forced to sell its cryptocurrency holdings, potentially leading to losses. Unless refinancing is possible, this collective sell-off could trigger market liquidations and broader cryptocurrency sell-offs.

Spontaneous sell-offs: A more subtle risk is that such situations may shake investor confidence in the crypto ecosystem. For example, if one or more entities suddenly sell part of their cryptocurrency holdings due to regular cash flow management or business operations, it could trigger a sudden price drop and market liquidation. If prices begin to fall, other entities may rush to sell out of concern for reduced exit opportunities, thereby undermining market stability before debt repayment issues arise.

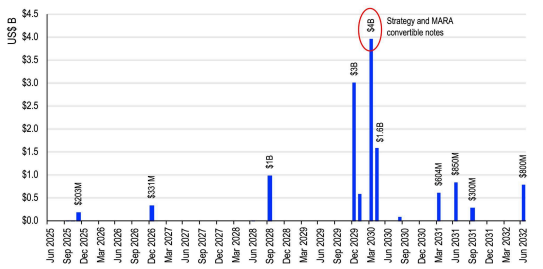

Chart 3. Distribution of outstanding debt of certain companies by final maturity date

Includes debt issued by Classover, Gamestop, H100, Janover, MARA Holdings, Metaplanet, Riot, Semler Scientific, and Strategy. Source: SEC filings, CoinDesk, CoinTelegraph, Nasdaq, press releases, Coinbase.

Nevertheless, we believe that the downward pressure caused by these two risks is unlikely to replicate the consequences of certain failed cryptocurrency projects in the past. First, based on our review of the outstanding debt of nine entities, most of the debt is set to mature between the end of 2029 and early 2030, indicating that forced sell-off pressure is not an issue in the short term. (Note: Strategy's $3 billion convertible bonds mature in December 2029, with an optional early redemption date in December 2026.) See Chart 3. Furthermore, as long as the loan-to-value (LTV) ratio remains reasonable, the largest companies may have refinancing options to avoid liquidating their reserve assets.

Of course, as debts mature or more companies adopt these strategies, our assessment may change depending on the risk levels and repayment timelines. Currently, there is no consistency in the financing methods of PTCVs, making it difficult to track capital structures. Clearly, Strategy's pioneering efforts have caught the attention of other corporate executives interested in cryptocurrencies, who may wish to further explore its investment logic. We believe the market has not yet reached saturation, and the trend of corporate accumulation in the second half of 2025 may continue.

04 Opening New Regulatory Pathways

The U.S. regulatory environment underwent unprecedented changes in the first half of 2025, laying the groundwork for what could be the most transformative period for digital asset policy. This stands in stark contrast to the previous administration's "regulation by enforcement" approach. We believe that the second half of 2025 is poised to redefine the U.S. position as a global cryptocurrency hub, supported by the White House's decisive shift towards cryptocurrency-friendly policies and Congress's urgent efforts to establish a comprehensive framework for this asset class.

We believe that stablecoin legislation is the most likely candidate to become the first major cryptocurrency-related legislation in the U.S., receiving strong bipartisan support. Both the House and Senate have shown significant progress, with the House advancing the STABLE Act and the Senate pushing forward the GENIUS Act. The Senate has fully approved the GENIUS Act, which has been sent to the House for consideration. Both bills outline reserve requirements for stablecoin issuers, anti-money laundering compliance parameters, and consumer protection and bankruptcy priority provisions for stablecoin holders.

The two main differences between the bills lie in how they treat non-U.S. stablecoin issuers and the scale thresholds for federal regulatory transitions, which congressional negotiators will need to resolve in the coming months. Government officials have expressed confidence in delivering a unified bill to President Trump for signing before Congress adjourns on August 4, 2025. This could pave the way for the development of a cryptocurrency market structure bill.

The cryptocurrency market structure bill could be the most significant long-term development this year, especially as the House Financial Services Committee introduced the bipartisan 2025 Digital Asset Market Clarity Act (CLARITY Act) on May 29. This bill would delineate the regulatory responsibilities of the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) based on whether digital assets are classified as "digital commodities" or "investment contract assets."

The bill builds on last year's passage of the 21st Century Financial Innovation and Technology Act (FIT21) in the House, but there are some key differences. Most importantly, the bill requires the CFTC and SEC to jointly define key terms such as "digital commodities" and to address gaps through future rulemaking, indicating that the precise boundaries of regulatory authority may continue to evolve. We believe the bill aims to provide a foundation for future bicameral discussions, but these negotiations may be much more complex than those surrounding the stablecoin legislation.

ETF Approval Timeline: The SEC faces a complex situation with approximately 80 cryptocurrency ETF applications in 2025, involving physical creation/redemption, staking features, index funds, and single altcoin ETFs:

Several ETF issuers (Bitwise, Franklin Templeton, Grayscale, Hashdex) have applied to track broad cryptocurrency indices with multi-asset funds. These funds are weighted 90% towards BTC and ETH, and the SEC already has a framework for cryptocurrency index ETFs, with decisions likely to be made before July 2.

Physical creation/redemption proposals are under formal review by the SEC. Physical creation/redemption can improve price consistency between share prices and net asset values (NAV), narrowing the price gap of ETFs. We believe decisions may be made in July 2025, but the SEC may extend this to October.

The SEC must decide on staking inclusion proposals before October, as there are pending issues regarding whether certain fund structures meet the definition of "investment companies." However, Bloomberg Intelligence suggests that the SEC may be compelled to act sooner due to the customized basket provisions and transparency standards of Rule 6c-11.

The final statutory deadline for single altcoin ETF applications is in October, and we believe the SEC may fully utilize the review time.

05 Summary

We have a constructive outlook for the cryptocurrency market in the third quarter of 2025, supported by relatively optimistic U.S. growth prospects, potential Federal Reserve interest rate cuts, increased corporate cryptocurrency adoption, and progress in regulatory clarity in the U.S. Despite the risks of a steepening yield curve and forced sell-off pressures on publicly traded cryptocurrency instruments, we believe these risks are manageable in the short term. While we are confident in Bitcoin's upward trajectory, we believe that only specific altcoins may perform well due to their unique circumstances.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。