Beyond the boom of stablecoins, equity tokenization is also becoming a new market narrative.

On June 27, Web3 startup Jarsy announced the completion of a $5 million Pre-seed financing led by Breyer Capital. More than the amount, what truly captured market attention was the problem they are trying to solve: why do the early growth dividends of top private companies always belong only to institutions and super-rich individuals? Jarsy’s answer is to reconstruct the participation model using blockchain technology—"minting" the private equity of unlisted companies into asset-backed tokens, allowing ordinary people to bet on the growth of star companies like SpaceX and Stripe with a threshold of just $10.

After the financing disclosure, the market immediately focused on the topic of "private equity tokenization"—an alternative asset class that originally existed only in VC boardrooms and high-net-worth circles is being packaged as blockchain assets, expanding its territory on-chain.

Private Equity Tokenization: The Next Stop for Asset On-Chain

If there are still financial opportunities in this era that have not been fully opened, the private market is undoubtedly the most representative asset island.

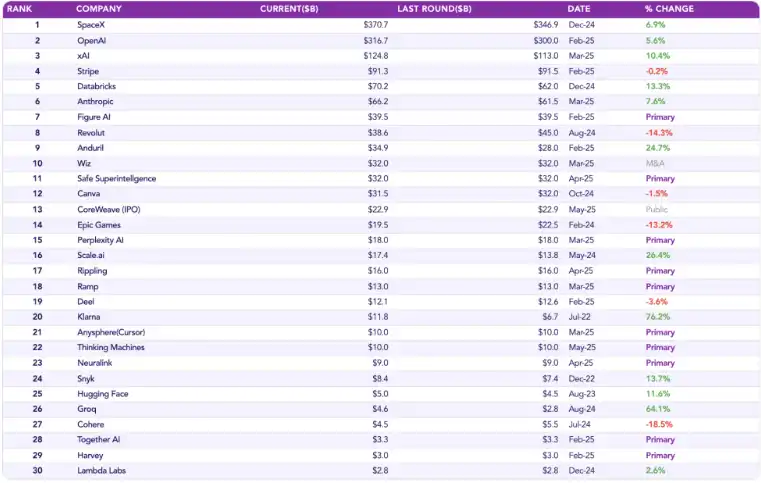

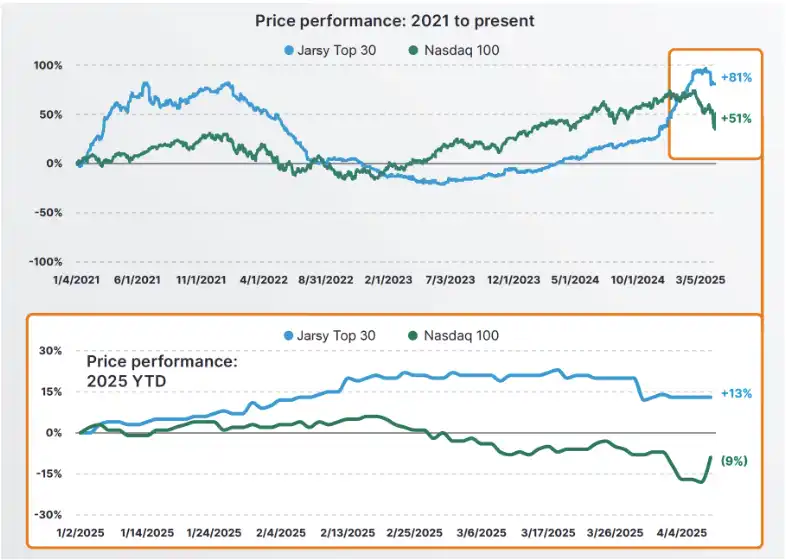

Jarsy has built a set of indicator systems covering the 30 largest and most active unlisted companies in the private market, known as the "Jarsy 30 Index," to measure the overall performance of top Pre-IPO companies. This index focuses on star companies like SpaceX and Stripe, representing the most imaginative and capital-attentive parts of the private market. Data shows that these companies have sufficiently attractive return rates.

From the beginning of 2021 to the first quarter of 2025, the Jarsy 30 Index has cumulatively risen by 81%, far exceeding the 51% increase of the Nasdaq 100 Index during the same period. Even in the context of an overall market downturn in the first quarter of 2025, with the Nasdaq falling by 9%, these leading unlisted companies still rose by 13% against the trend. This strong comparison not only affirms the fundamentals of the companies but also serves as a market vote on the growth potential before an IPO—these assets are still in a golden phase of significant value misalignment.

However, the problem is that this "value capture window" only belongs to a very small number of people. An average transaction size exceeding $3 million, with a complex structure (mostly requiring SPVs) and a lack of public liquidity, makes this asset market a complete "waiting area" for most retail investors.

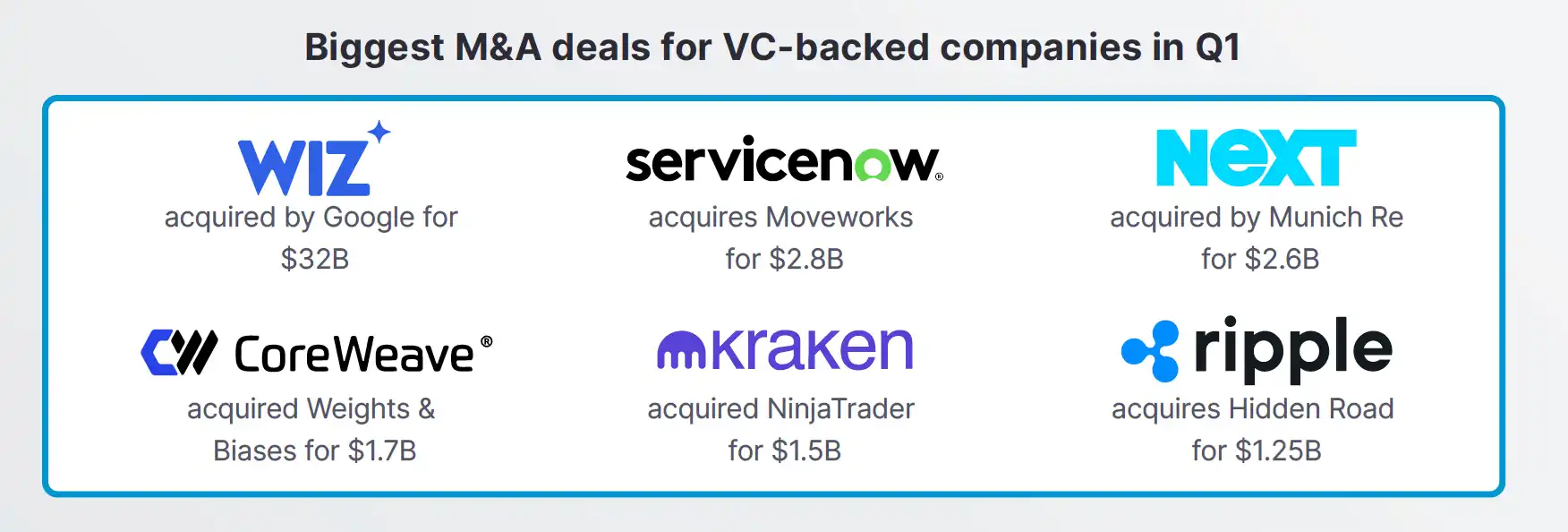

Moreover, the exit paths for these companies are often not limited to IPOs; mergers and acquisitions have become one of the more mainstream options, further raising the participation threshold for retail investors. In just the first quarter of 2025, the scale of mergers and acquisitions supported by venture capital reached a historic high of $54 billion, with Google's acquisition of cybersecurity unicorn Wiz alone accounting for $32 billion.

Thus, we see a typical traditional financial picture where the best growth assets are locked within the circles of high-net-worth individuals and institutions, while ordinary investors are excluded.

"Private equity tokenization" is breaking this structural inequality by dismantling the originally high-threshold, low-liquidity, complex and opaque private equity rights into on-chain native assets, lowering the entry threshold from $3 million to $10; transforming lengthy and complex SPV agreements into on-chain smart contracts; while also enhancing liquidity, allowing assets that were originally locked for long periods to have the possibility of real-time pricing.

Bringing the "capital feast" of the primary market into everyone's digital wallet.

Jarsy

As a blockchain-based asset tokenization platform, Jarsy aims to break down the walls of the traditional financial world, making Pre-IPO assets that were exclusively enjoyed by high-net-worth individuals accessible to users worldwide as public investment products. Its vision is clear: to eliminate restrictions on investment imposed by capital thresholds, geographical barriers, or regulatory labels, and to redistribute financial opportunities to the public.

Its operational mechanism is straightforward yet powerful. Jarsy first completes the actual equity acquisition of the target company through the platform, and then tokenizes this portion of equity on-chain in a 1:1 manner. This is not merely a mapping of securities but a substantive transfer of economic rights. More importantly, all information regarding the total issuance, circulation paths, and holdings of the tokens is transparently recorded on-chain, open for real-time verification by any user. The on-chain traceability and off-chain physical assets structurally achieve a technological reconstruction of the traditional SPV and fund systems.

At the same time, Jarsy does not push retail investors into the "deep waters" of professional and complex processes. The platform actively undertakes all "dirty work" such as due diligence, structural design, and legal custody, allowing users to build their own Pre-IPO investment portfolios at a low threshold starting from $10 using a credit card or USDC. The complex risk control and compliance processes behind the scenes are "invisible" to users.

In this model, the token price is highly tied to the company's valuation, and users' returns come from the real growth curve of the enterprise, rather than from the platform's empty narratives. This structure not only enhances the authenticity of the investment but also, at the mechanism level, opens up the long-controlled revenue channel between retail investors and the primary market.

Republic

On June 25, Republic, a veteran investment platform, announced the launch of a new product line—Mirror Tokens, with the first product rSpaceX using the Solana blockchain, attempting to "mirror" one of the world's most imaginative companies as a publicly available on-chain asset. Each rSpaceX token is tied to the expected value trajectory of SpaceX, a space unicorn valued at $350 billion, with a minimum investment threshold of just $50, and supports payments via Apple Pay and stablecoins. This opens the doors of the primary market's temple to global retail investors.

Unlike traditional private equity investments, Mirror Tokens do not grant you voting rights, but they have designed a unique "tracker" mechanism: the tokens issued by Republic are essentially a debt instrument dynamically linked to the valuation of the target company. When SpaceX goes public, is acquired, or experiences other "liquidity events," Republic will return corresponding stablecoin earnings to investors' wallets based on their token holdings, potentially including dividends. This is a new structure of "earning dividends without holding shares," maximizing the reduction of legal barriers while retaining core revenue exposure.

Of course, the mechanism is not without thresholds. All Mirror Tokens will be locked for 12 months after initial issuance before they can circulate in the secondary market. In terms of regulation, rSpaceX is sold under U.S. Regulation Crowdfunding rules, with no restrictions on investor identity, allowing global retail investors to participate, but specific qualifications will be dynamically screened based on local laws.

What’s even more exciting is that this is just the beginning. Republic has announced that it will subsequently launch Mirror Tokens anchored to star private companies like Figma, Anthropic, Epic Games, and xAI, and even open up user nominations for the next "unlisted unicorn" they want to bet on. From structural design to distribution mechanisms, Republic is building an on-chain private equity parallel market that does not require waiting for an IPO.

Tokeny

Tokeny, a provider of RWA asset tokenization solutions based in Luxembourg, has also begun to enter the private market securitization track. In June 2025, Tokeny partnered with local digital securities platform Kerdo, aiming to reshape the way professional investors participate in the private market (such as real estate, private equity, hedge funds, and private debt) using blockchain infrastructure.

Its core advantage lies in: standardized product structures, embedded compliance logic for issuance, and the ability to quickly replicate and expand across different jurisdictions using Tokeny’s white-label technology. Tokeny focuses on granting "institutional-level legitimacy" to the assets themselves—its use of the ERC-3643 standard allows tokens to embed KYC, transfer restrictions, and other control logic throughout the entire process from generation to transfer, ensuring that products are legally transparent and allowing investors to self-verify safety on-chain without relying on platform endorsements.

Against the backdrop of increasingly stringent regulatory frameworks like MiFID II, the demand for such "compliant on-chain assets" in the European market is accelerating. Tokeny is filling the trust vacuum between institutional investors and on-chain assets in a highly technical manner, reflecting a trend: the competition in the RWA track is no longer just about on-chain technical implementation, but about who can deeply cultivate a combination of regulations + standardized product structures + multi-jurisdictional issuance channels. The partnership between Tokeny and Kerdo is a typical example of this trend.

Conclusion

The rise of private equity tokenization signals that the primary market is entering a new stage of structural transformation driven by blockchain technology. However, this path is still fraught with real-world obstacles. It may reshape the entry rules, but it is difficult to break the deep-seated structural barriers between retail and institutional investors in one fell swoop. RWA is not a "magic key," but rather a long-term game about trust, transparency, and institutional reconstruction, and the real test is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。