Original | Odaily Planet Daily (@OdailyChina)

Author | jk

In the context of Bitcoin's ecosystem returning to the main stage and the accelerated evolution of modular blockchain architecture, Hemi is connecting the two core worlds of cryptocurrency assets—Bitcoin and Ethereum—in an unprecedented way. As a forward-looking modular Layer 2 network, Hemi not only aims to inherit Bitcoin's security but also embraces Ethereum's smart contract flexibility. Through its innovative hVM architecture and Proof-of-Proof consensus mechanism, it opens new pathways for inter-chain collaboration.

Since its launch, Hemi has attracted attention from top institutions such as YZi Labs (formerly Binance Labs) and Breyer Capital, accumulating over $100 million in Total Value Locked (TVL) in a short period, making it one of the most notable emerging L2s. This article will comprehensively outline Hemi's technical path, core team, ecological layout, and token progress, revealing its unique value proposition in the wave of modular blockchains.

Public Chain Overview

Hemi is a modular Layer 2 network focused on high scalability, security, and inter-chain interoperability. According to official sources, it views Bitcoin and Ethereum as core components of the same "super network," integrating the advantages of both public chains through a dual-drive architecture. With full EVM compatibility, developers can build applications that connect BTC and ETH in a one-stop manner.

One of Hemi's core technologies is the Hemi Virtual Machine (hVM)—which embeds a complete Bitcoin full node within the Ethereum Virtual Machine (EVM), allowing smart contracts to directly access Bitcoin's state. This architecture enables developers to build "Bitcoin-aware" dApps using familiar EVM tools, enhancing support for Bitcoin DeFi, lending, and MEV ecosystems.

At the same time, Hemi's Proof-of-Proof (PoP) consensus anchors L2 block states to the Bitcoin chain, packaging and publishing states to the Bitcoin network through special PoP miners, achieving "Bitcoin-level" security guarantees. Users running lightweight PoP miners can publish L2 block headers and earn token rewards. This process does not require Bitcoin miners' participation, and the network can reach Superfinality—exceeding Bitcoin's final confirmation capability—in about 90 minutes.

Hemi's "Tunnels" mechanism constitutes its trustless cross-chain bridge, allowing for the secure migration of assets between Bitcoin and Ethereum, breaking through the trust bottleneck of traditional bridging and providing infrastructure support for cross-chain asset movement and liquidity aggregation. Additionally, through hVM and the Hemi Bitcoin Kit, developers can call upon Bitcoin's native assets for on-chain deployment. Through this architecture, Hemi aims to bridge the vast value reserves of Bitcoin with the flexible smart contract ecosystem of Ethereum, establishing a high-performance bridge between the two.

Team Background

Hemi was created by a team with extensive experience in the cryptocurrency field, with core members having heavyweight backgrounds. Co-founder Jeff Garzik is an early legendary Bitcoin developer who worked with Satoshi Nakamoto and served as a core Bitcoin developer for five years. He is also the co-founder and CEO of blockchain infrastructure company Bloq. Another co-founder, Maxwell Sanchez, is a pioneer in blockchain security, having co-founded the PoP consensus mechanism and led the protocol's optimization design.

In addition to the two founders, the Hemi team currently consists of nearly 30 members, including several who have participated in the technical development of well-known projects (such as former Decred CTO Marco Peereboom).

Investment Situation

Since its establishment, the Hemi project has garnered interest from several well-known institutions. In September 2024, Hemi Labs announced the completion of a $15 million seed round of financing, led by YZi Labs (formerly Binance Labs). This financing was co-led by traditional Silicon Valley venture capital firm Breyer Capital (whose founder was an early investor in Facebook, Circle, etc.) and crypto fund Big Brain Holdings.

Additionally, the list of investors is impressive, including institutions such as Crypto.com Capital, HyperChain Capital, Alchemy Ventures, SNZ Holding, and industry figures like Bitmain founder Wu Jihan. The backgrounds of the investors encompass crypto exchanges, traditional VCs, and industrial capital, reflecting the market's recognition of Hemi's modular blockchain vision. It is reported that the funds from this round of financing will primarily be used to advance the development and mainnet launch of the Hemi network based on Bitcoin and Ethereum. After the rebranding of Binance's investment department, Hemi has become one of its key supported infrastructure projects.

On-Chain Data Performance

As an important indicator of on-chain ecosystem activity, Hemi's Total Value Locked (TVL) has grown rapidly since the mainnet launch. When the mainnet officially opened on March 12 of this year, Hemi attracted approximately $440 million in asset inflow, with about $270 million pouring in through Hemi's staking platform in the first three days of the mainnet launch to earn staking rewards for BTC, ETH, and others. As ecological projects gradually deploy and user growth continues, the TVL has continued to rise.

Currently, according to DeFiLlama data, Hemi's on-chain locked assets remain at around $300 million, excluding liquid staking assets.

On-Chain Ecosystem

While Hemi has attracted large-scale liquidity in a short time, its on-chain ecosystem landscape has also rapidly expanded. Currently, dozens of decentralized applications (dApps) have been deployed or announced support on Hemi, covering multiple fields such as DeFi, NFTs, and cross-chain communication. Over 50 protocols were onboarded as launch partners at the time of Hemi's mainnet launch.

Among them are several well-known cross-chain and DeFi protocols in the industry. For example, mainstream decentralized exchanges Uniswap and Sushi on Ethereum have launched on Hemi, providing users with token trading and market-making services; DODO exchange and the elastic concentrated liquidity protocol iZUMi are also on the initial support list. In terms of lending and yield, emerging LayerBank and ZeroLend provide on-chain lending markets, while protocols like Nucleus and Concrete have launched multi-strategy yield vaults.

Currently, Pell Network's TVL has reached $177 million, iZUMI's TVL has reached $61.44 million, while Uniswap follows closely with approximately $21.46 million.

Liquid staking tokens (LST) and liquidity re-staking tokens (LRT) derived from Bitcoin and Ethereum have also become a significant feature of the Hemi ecosystem, such as pumpBTC providing Bitcoin staking derivatives, and StakeStone supporting Ethereum staking derivative assets. In terms of on-chain oracles, Hemi has integrated high-performance oracle networks like RedStone and Pyth to provide on-chain price and data feeding services for DeFi protocols. The cross-chain communication protocol LayerZero has also joined Hemi as a key infrastructure, facilitating message and asset interoperability between Hemi and other chains.

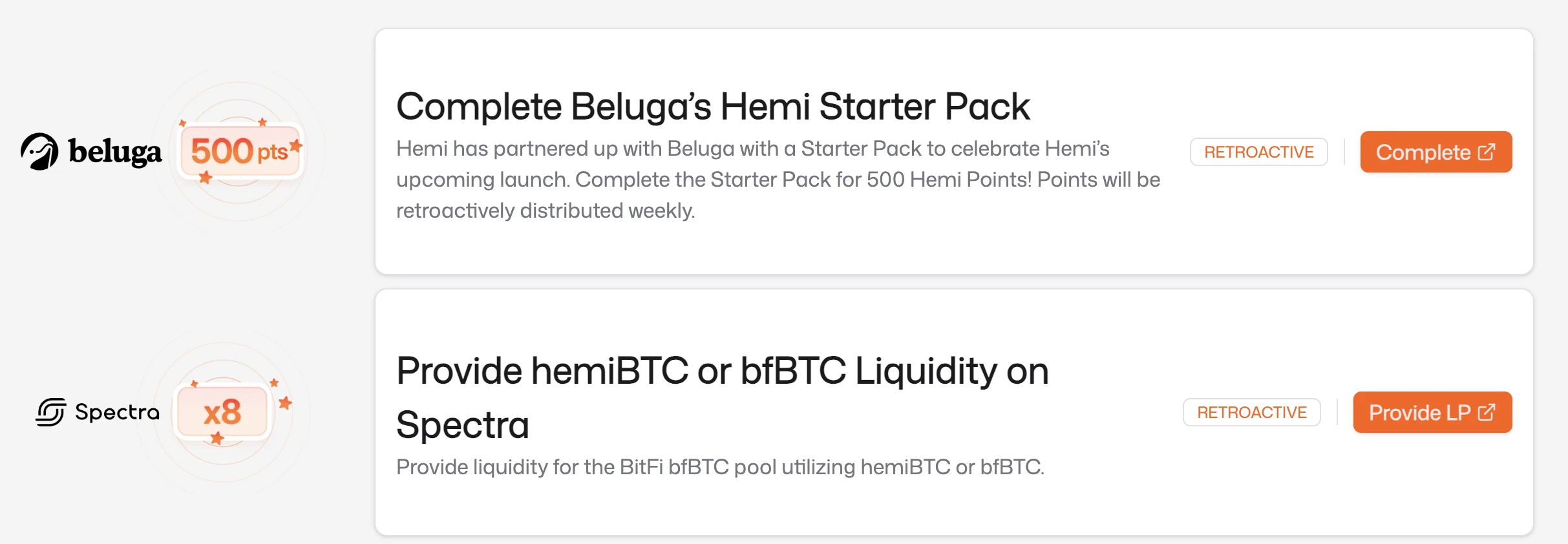

Currently, Hemi's mainnet activities are still ongoing, and users can accumulate points by completing tasks and collaborative missions.

Overall, the initial ecosystem projects on Hemi's mainnet include both the expansion deployment of mature platforms in the industry and several emerging protocols focused on Bitcoin DeFi scenarios, forming a preliminary prosperous ecological prototype centered around "Bitcoin + Ethereum DeFi."

Token Generation Event (TGE) Progress

The issuance plan for Hemi's native token (TGE, Token Generation Event) is a topic of high interest among the community and investors. As of now, the team has not officially announced a specific TGE date. However, according to earlier information disclosed by the official team, the token issuance for Hemi is likely to occur within a few weeks after the mainnet launch. Hemi co-founder Max mentioned in a community sharing session in February that the TGE is expected to take place about 4 to 6 weeks after the mainnet release. Based on the mid-March mainnet launch, the planned token generation event could potentially start as early as late April to May. However, due to project development pace and market conditions, the official team has been cautious about the timing of the issuance. Another possibility is that Hemi has already entered the TGE rhythm but has not yet entered the public eye.

The community generally anticipates the market performance of the token upon its launch. Given that Hemi has several hundred million dollars in on-chain assets and an active cross-chain ecosystem, many industry insiders predict that once its token is issued, its market capitalization and liquidity are likely to gain attention in the secondary market. Additionally, the background of YZi Labs, one of the lead investors, has sparked speculation—there is community anticipation that Hemi tokens may land on mainstream trading platforms in the future, further expanding their influence.

Overall, the Hemi team has adopted a prudent approach to token issuance: on one hand, prioritizing the consolidation of technology and ecosystem after the mainnet launch, and on the other hand, ensuring that true contributors benefit from the token economy's initiation through a points mechanism. As the mainnet stabilizes and the ecosystem matures, the launch of Hemi tokens is expected to be in the countdown stage, and Odaily will keep a close eye on this and continue to report.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。