🔥 #Sei is exploding! ETF, stablecoins, and institutional adoption are all blooming

As a long-time observer of new public chains, I have recently been amazed by the rhythm of #Sei. I initially thought it was just a high-performance L1, but now it has directly entered the main line of "institutional adoption," even starting to explode with keywords like ETF, stablecoins, and TVL.

📌 First, let's talk about the heavy news: ETFs and ETPs are promoting institutional entry into Sei

• In Europe, Valour has launched Sei's ETP. This team has previously created many ETP products for various chains and understands the rhythm well;

• In the United States, Canary Capital has also submitted an application for a Sei ETF, which basically means that institutions are officially starting to lay out their plans;

• Don't forget, BlackRock's Bitcoin ETF reached $70 billion in just over a year. The market's appetite for compliant and liquid crypto assets is growing, and #Sei is riding this tailwind.

🪙 #Sei + stablecoins = dual driving force

• The Wyoming state government has already named #Sei as one of its pilot chains for stablecoins, which is no longer just a grassroots initiative; it has government-level recognition;

• Additionally, #Circle's IPO documents directly state that Sei is one of its main investment targets. It's important to note that Circle is a core player behind USDC globally, and this kind of endorsement is not something just any project can obtain;

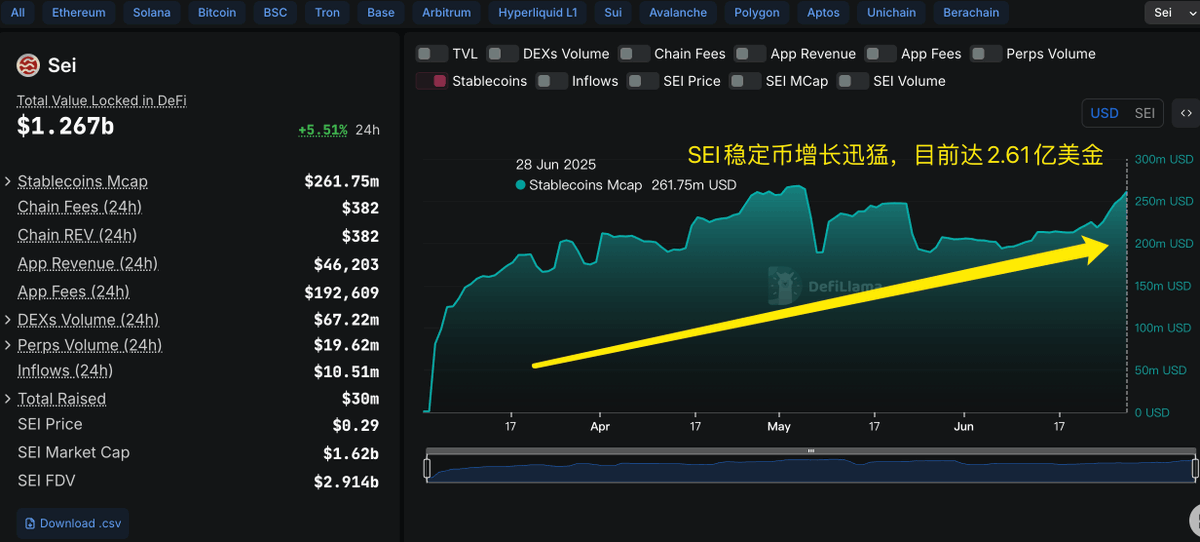

• The supply of stablecoins on #Sei has surged nearly 7 times in the past few months, which is a clear indication of capital and users voting with their feet.

📊 On-chain data is also ridiculously hot

• TVL has skyrocketed to over $1.267 billion, up from just over $400 million a few months ago (as shown in the image below);

• Daily trading volume on DEX has surpassed $94 million, with trading activity ranking among the top across all chains;

• Daily transaction count exceeds 5.1 million, with an average TPS of 78+, firmly establishing its position as a high-performance, high-throughput L1;

• The application layer is also impressive, with transaction fees approaching $300,000 per day, and several projects have already entered the top 100 in total chain revenue;

• Even in the gaming sector, #Sei has now directly claimed the top spot across all chains (according to #DappRadar data).

Currently, #Sei is no longer just our stereotypical "fast chain" impression; it is evolving from high-performance infrastructure to a truly financial-grade public chain that is being adopted by governments and institutions. Once such a public chain is "integrated into the system," the subsequent valuation and application space will likely support multiple zeros. Therefore, I believe that this combination of ETF + stablecoins + DeFi TVL + actual user volume is the most critical turning point for #Sei's rise. What we can do is to identify trends in advance and then get on board. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。