KraneShares ETF Aims to Track BTC, ETH, XRP & More

KraneShares Seeks SEC Approval for Coinbase 50 Index

KraneShares, an asset manager specializing in ETFs, is seeking to list a "Coinbase 50 Index ETF" that tracks the 50 largest digital assets by market capitalization. The company filed its registration application with the U.S. Securities and Exchange Commission. Nate Geraci, president of ETF Store, stated on X that he believes there will be a significant surge in applications for crypto Exchange Traded Fund s.

Source X

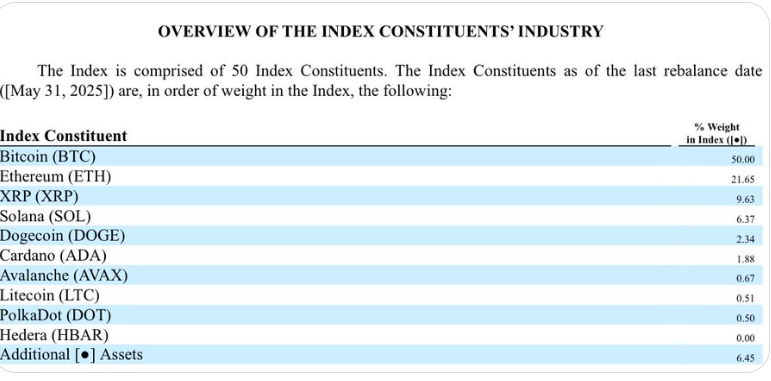

The ETF will track the 50 largest digital assets by market cap.

According to the Coinbase 50 Index, this Exchange Traded Fund would track the top 50 crypto currencies by market capitalization. Growing institutional interest in investment products linked to cryptocurrencies is reflected in the filing. Launched in late 2024, the Coinbase 50 is managed by the largest U.S. crypto exchange. The top positions currently consist of 50% Bitcoin, 21% ETH, 9% XRP and 6 Solana . The remaining portion of the index is made up of smaller cryptocurrency. As a result, investors would have diversified exposure to the biggest cryptocurrencies through the Exchange Traded Fund , which would track this same guide. This action shows that traditional financial markets are beginning to accept digital assets.

Source https://www.sec.gov/Archives/edgar/data/2073505/000182912625004735/kraneshares_s1.htm

Institutions Get Ready: Coinbase Index ETF May Be Game-Changer

With the Coinbase 50 Index, KraneShares hopes to attract more investors who are wary of investing in individual cryptocurrencies due to concerns about security, volatility, and regulatory risk. Conventional investors find it easier because the format offers a well-known and regulated investing option. This could encourage more people to adopt and accept cryptocurrency as a valid asset class. The move reflects the increased institutional demand for digital assets as well as the need for safe and transparent investment solutions in the bitcoin market.The launch of these has the potential to greatly enhance cryptocurrency adoption and mainstream acceptance.

How will the SEC's approval of the KraneShares ETF impact the broader cryptocurrency market and its adoption by mainstream investors?

If the SEC-approves KraneShares ETF has the potential to drive institutional interest in the cryptocurrency space, leading to increased adoption and price appreciation. This can drive increased liquidity, which can lead to improved financial dynamics.The SEC approval can also serve as a beneficial precedent for other crypto-related ETFs, allowing mainstream investors to enjoy a structured and safe investment environment. The diversified strategy of the ETF's, which covers obscure cryptocurrencies, may open up greater use of cryptocurrencies outside of Bitcoin and Ethereum. Previous SEC approvals of Exchange Traded Fund s on cryptocurrencies exhibited considerable forces, which resulted in higher asset prices as well as investor interest. Approval may mark a new direction for the cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。