According to a comprehensive report by Redstone, and co-authored by Gauntlet and rwa.xyz, the 85% year-over-year expansion reflects a decisive shift from experimental pilots to scaled institutional adoption. Major financial institutions like Blackrock, JPMorgan, and Franklin Templeton are now deploying production-grade solutions, with governments increasingly recognizing blockchain as critical infrastructure for modernizing legacy systems.

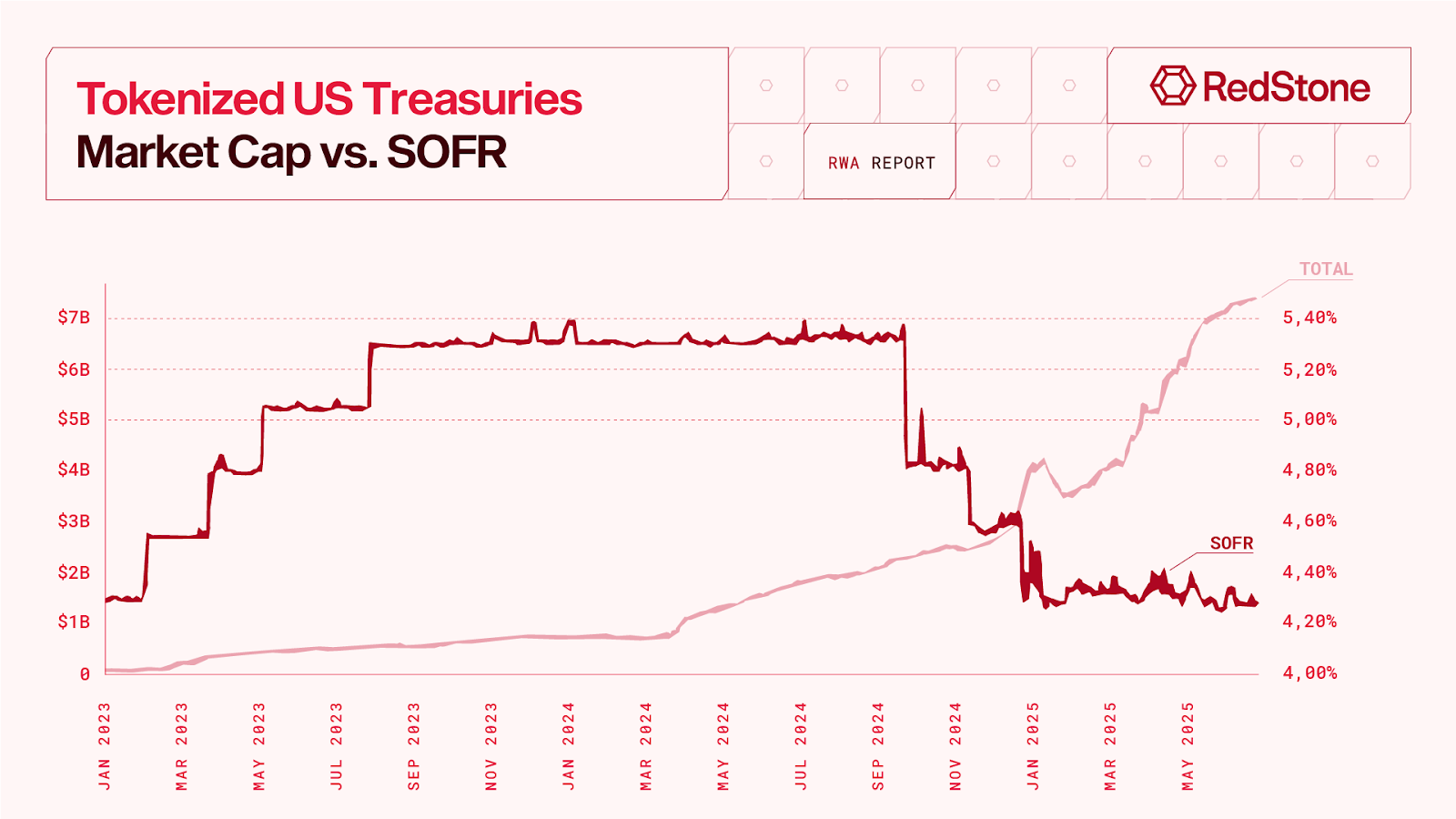

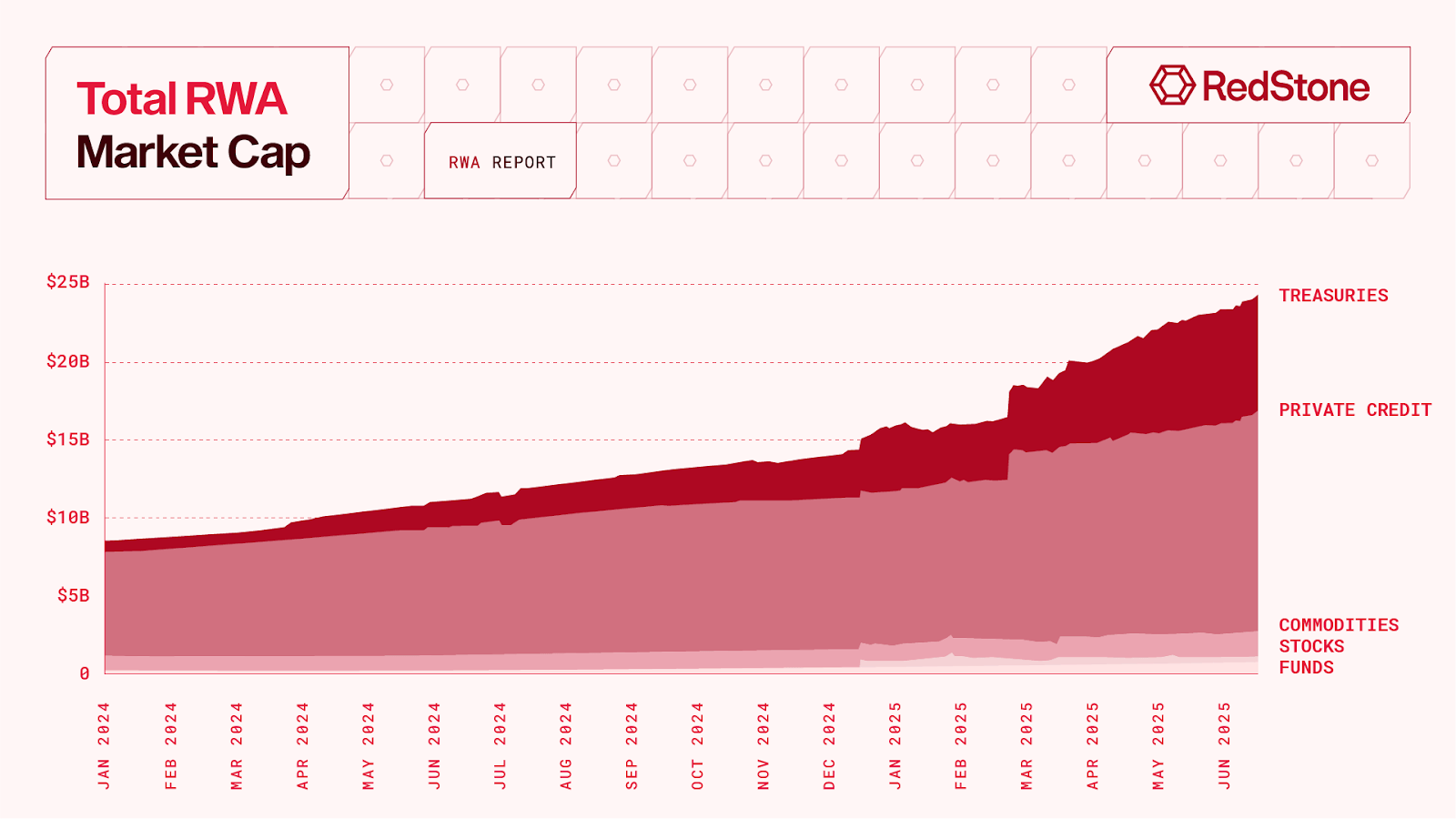

Tokenized U.S. Treasuries exemplify this institutional momentum, ballooning from $100 million in 2023 to $7.5 billion by mid-2025. Blackrock’s BUIDL fund issued by Securitize dominates this segment with $2.9 billion in assets. Private credit, however, is the largest RWA category at $14 billion, driven by platforms like Figure and Tradable that tokenize loans on Provenance and Zksync Era blockchains.

Commodities tokenization reached $1.6 billion, overwhelmingly led by gold-backed tokens PAXG ($851M) from Paxos and Tether’s XAUT ($679M). Equity tokenization, while nascent at $365 million, gained traction through partnerships like Exodus-Securities’ $900 million Algorand-based offering.

The integration of RWAs into decentralized finance (DeFi) is unlocking new use cases. Platforms like Securitize’s sToken framework enable regulated assets to function as DeFi collateral, while Morpho v2 offers fixed-rate loans tailored for institutions. Spark Protocol and Pendle Citadels further bridge traditional finance (TradFi) with onchain yield strategies.

Specialized blockchain oracles, such as Redstone’s RWA pricing solutions, address unique challenges like net asset value (NAV) calculations and illiquidity adjustments. In 2025, the blockchain protocol Ethereum remains the dominant RWA chain ($7.5B), followed by Zksync Era ($2.2B) and Solana ($351M).

Industry projections suggest 10-30% of global assets could be tokenized by 2030–2034, potentially bridging over $400 trillion in TradFi value to onchain ecosystems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。